IvelinRadkov/iStock via Getty Images

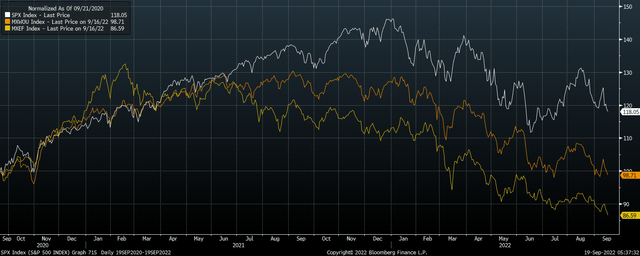

With two lower highs in place on the SPX since the peak in January the bull market now appears to have ended. I noted in my previous update on the SPX that U.S. stocks were the last shoe to drop among the world’s major markets, which have all been in bear markets for over a year (see SPX: Bear Market Rally On Borrowed Time). The SPX looks increasingly likely to follow the path of international benchmarks until some signs of capitulation occur.

SPX, MSCI World Ex-US, and MSCI Emerging Markets (Bloomberg)

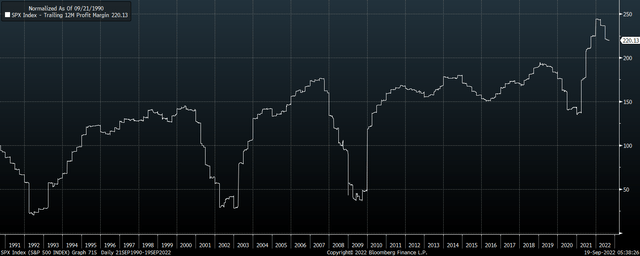

Even at current profit margins the SPX is still historically expensive, and in the absence of falling equity prices these valuations are likely to rise as earnings fall. During the initial stages of market peaks, valuations can look attractive as profit margins remain elevated. However, it is often the case that profit margins, and typically actual profits themselves, peak after the initial stage of the bear market, and there are reasons to expect profits to fall sharply over the coming quarters.

Profit Margins At Risk From A Rise In Precautionary Savings

SPX profit margins remain near their most extreme levels in history, and the consensus appears to expect them to be sustained over the long term. However, when we look at what determines profit margins from a macroeconomic perspective, we can see how unsustainable they are.

SPX Profit Margins (Bloomberg)

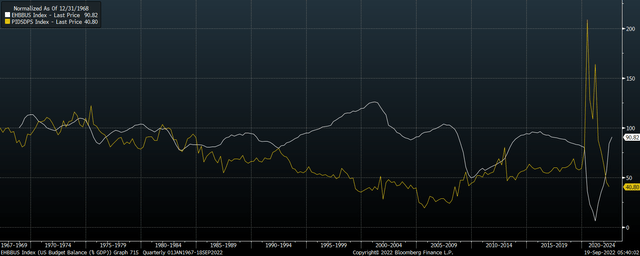

Corporate profits rise when revenues rise relative to wage and salary payments. In the absence of any fiscal deficits or surpluses, for any given level of wages, if the personal savings rate declines, then corporate profits will rise as falling savings will feed through into corporate revenues via higher sales. When the government runs a fiscal deficit, it spends more money than it takes in and this money either finds its way into the savings of individuals or corporations. In response to the Covid pandemic the U.S. government ran huge fiscal deficits which allowed consumers to build up savings and corporates to continue posting record profits.

Fiscal Deficit and Personal Savings Rate (Bloomberg)

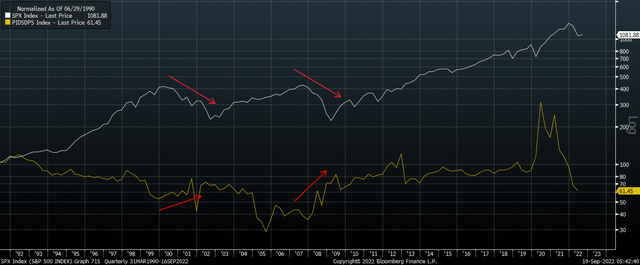

With the fiscal deficit having fallen back to just 3% from a peak of 17%, corporate profit margins have managed to remain at all-time highs due to the willingness of individuals to draw down their savings, with the personal savings rate falling to its lowest level since 2008. When asset prices are rising and the economy is growing consumers tend to be willing to save a small share of their income, but things often change once asset prices decline. As the chart below shows, this has been the trend throughout recent U.S. market history.

Personal Savings Rate Vs SPX (Bloomberg)

Multiples Are Already High And Free Cash Flows Are Lagging

This dynamic goes some way to explaining why profit margins decline after markets decline, which tends to leave investors who bought on the strength of backward-looking earnings full of regret. After a 20% decline from October 2007 to January 2008, the SPX traded at a 16x trailing PE ratio and 13x forward PE ratio, yet stocks went on to fall almost 50% more before bottoming out for good. Today, those figures are 19x and 17x, on profit margins that are almost 50% higher than they were then.

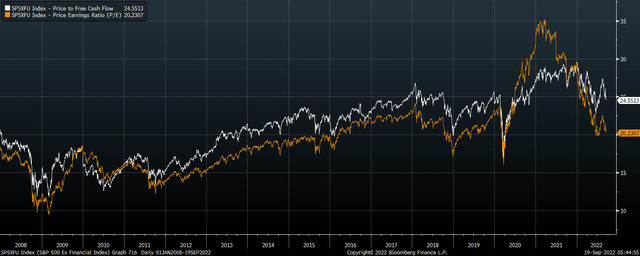

SPX Ex-Financials PE and P/FCF Ratios (Bloomberg)

If we look at free cash flow metrics, U.S. stocks are even more expensive. The SPX ex financials trade at a price-to-free cash flow ratio of almost 25x, as free cash flows have significantly lagged earnings over the past year. This is typical of high inflation periods as depreciation costs, which are based on assets purchased many years ago, tend to be far lower than capital expenditure in the present. Free cash flows are ultimately what matter, and a 4x free cash flow yield seems far too low considering the risks facing profitability and the increasingly attractive opportunities available in international markets and fixed income.

Be the first to comment