luza studios

Iris Energy (NASDAQ:IREN) is one of the smaller market cap Bitcoin (BTC-USD) miners in the equity market at just $246 million market cap. Iris is smaller than many of the other publicly traded miners despite similar levels of installed exahash:

| Company | Ticker | EH/s | Market Cap |

|---|---|---|---|

| Bitfarms | (BITF) | 3.9 | $336 million |

| Iris Energy | IREN | 3.7 | $246 million |

| CleanSpark | (CLSK) | 3.4 | $219 million |

| Marathon Digital | (MARA) | 3.2 | $2.2 billion |

| Hut 8 Mining | (HUT) | 3.0 | $397 million |

Sources: Iris Energy, Seeking Alpha as of 9/15/22

In my last coverage of Iris Energy, my article focus was on property ownership, institutional holdings, and miner profitability broadly in the industry. In this article, we’ll look at Iris’s annual update, the current balance sheet, production/exahash trends, and the regulator risk facing North American mining operations.

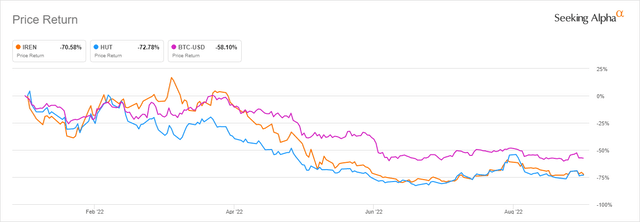

Miners still move in tandem

What’s fascinating about the publicly traded miners is how different the models can be. For instance, Marathon Digital and Riot Blockchain (RIOT) are among the largest Bitcoin mining operations yet they have drastically different infrastructure models with one vertically integrating and the other relying on hosting. Despite those difference, both companies are performing similarly in the stock market. Iris Energy and Hut 8 Mining (HUT) are similarly priced from a capitalization standpoint but they have drastically different treasury strategies. Despite these large differences, all of these equities move in tandem with each and with Bitcoin.

In the case of Iris and Hut 8, the performance since Bitcoin’s recent cycle low on June 18th is nearly identical. Iris is down 71% while Hut is down 73%. Each of these equities is lagging Bitcoin’s performance but the only one that probably should be lagging this badly is Hut 8. Iris sells its production each month while Hut 8 takes the “HODL” approach. Because of this, Hut 8 should theoretically outperform most peers when Bitcoin’s price is increasing. Hut 8 should theoretically underperform most peers when Bitcoin’s price is decreasing; as it is now. Since the market largely treats all of these equities as equals, I believe it presents an opportunity to allocate to Iris Energy more heavily if you believe Bitcoin’s price won’t drastically increase in the short term.

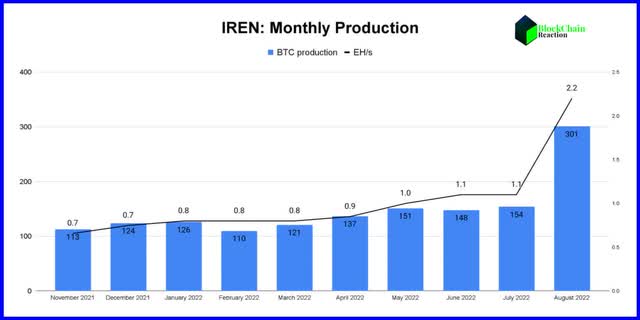

Annual Update/Production

In the last few days, investors have received Iris Energy’s latest quarterly earnings figures and August production results. On the company’s conference call, CEO Daniel Roberts shared that a cumulative figure of 3.7 EH/s had been energized as of the end of August thanks to the Prince George location coming online. For the month of August average, Iris’s energized production came in at 2.2 EH/s – a massive increase over the average EH/s for the previous months.

Given the large boost to EH/s, it’s no surprise that the BTC production from Iris was also up significantly over July with 301 BTC mined vs 154 in the month prior. Because of the additional EH/s that we can expect to see in September, monthly BTC production for Iris should eclipse 500 BTC for the current month given the efficiency that we’ve seen so far from Iris’ mining operation.

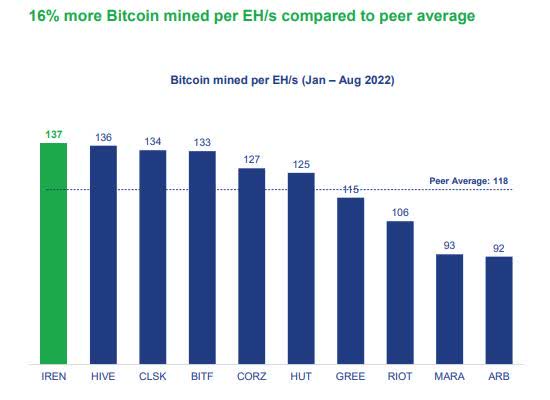

Iris Energy

The company claims 137 BTC produced per EH/s. That would make it the most efficient miner in the industry. While these figures are really impressive and show strong execution from the company, I do want to point out that despite efficiencies vs peers, the company’s average cost per BTC has been trending a bit higher than it was last year.

| Quarter Average | BTC Energy Cost |

|---|---|

| Q4-21 | $7,194 |

| Q1-22 | $8,119 |

| Q2-22 | $9,012 |

| Q3-22* | $8,465 |

Source: Company announcements. *Just two of three months complete in Q3

While Q3 is seeing a decline so far in the energy expense needed to produce a Bitcoin, it must be mentioned that this general trend has been higher even while the price of the coin itself has come down drastically. This is bad news for margins and something to pay attention to going forward. Especially if electricity costs continue to be a problem more broadly.

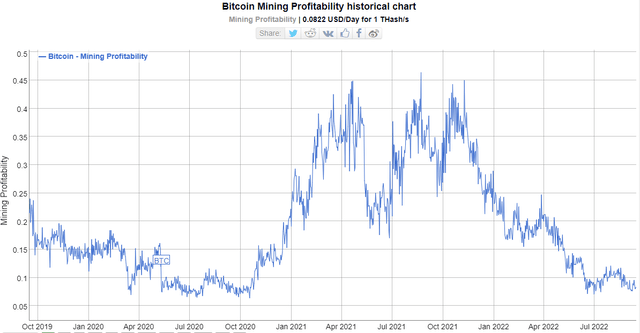

Mining profitability in the space is still near two year lows. That said, combining Iris’ higher efficiency production compared to peers and the strategy of selling monthly production rather than holding in treasury, Iris is unlikely to have to turn off machines unless there is a larger push from regulators to stop PoW mining entirely.

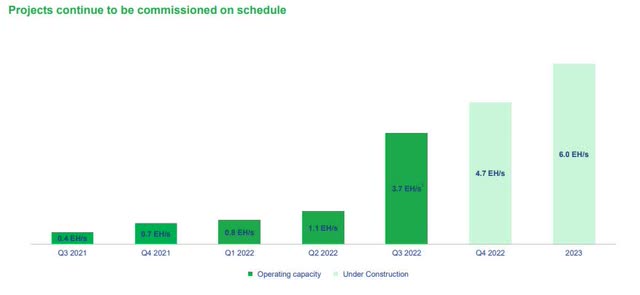

Forward Exahash Guidance

While the gains in energized mining footprint within the company have been strong over the last month, the company is guiding for even more capacity online in the months ahead. Iris Energy is guiding for 4.7 EH/s by the end of Q4 – that’s up from the original guidance of 4.2 EH/s. The company also sees 6 EH/s in 2023.

If the company can execute on that goal, it will be able to mine over 800 Bitcoin per month in 2023 when 6 EH/s is achieved. This would make it one of the largest producers in the industry and would realize a very fast buildout of that production.

Financial Performance/Balance Sheet

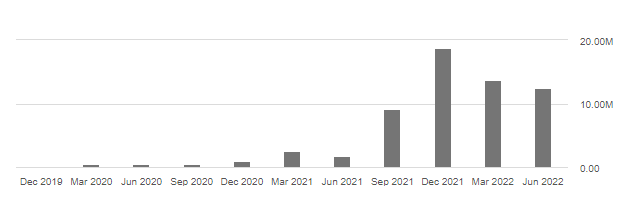

With the decline in Bitcoin’s price year to date, we’re now seeing two sequential decreases in quarterly revenue. At the end of Q2, Iris booked $16.2 million in revenue at a production cost of $3.8 million. Though that is still a terrific margin, it does show the second consecutive quarterly decline in gross profit:

Gross Profit (Seeking Alpha)

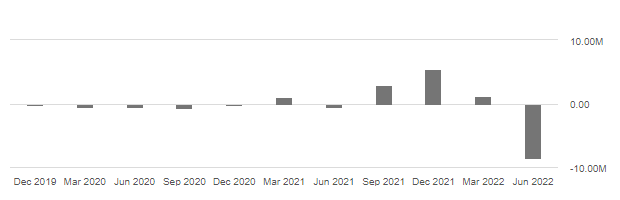

Notably, there was a rather large increase in admin expenses quarter over quarter from $3.8 million to $7.0 million. Depreciation moved up from $2.3 million last quarter to $3.8. After a quarterly decline from Q4 to Q1 in total op-ex, Q2 saw a rise from $12.5 million to $21.1 million. This resulted in a deeply negative operating income of $8.6 million.

Operating Income (Seeking Alpha)

While those expenses jump off the page a bit, Roberts said on the conference call that the corporate overhead is more attributable to building out the growth of the company’s operation. Balance sheet-wise, I think things look pretty good at the end of Q2:

| Balance Sheet | Q1-22 | Q2-22 |

|---|---|---|

| Cash/Investments | $157.7 | $110.0 |

| Total Current Assets | $201.5 | $160.3 |

| Total Assets | $556.2 | $570.5 |

| Current Liabilities | $53.9 | $85.1 |

| Total Liabilities | $97.9 | $133.1 |

Source: Seeking Alpha, millions

As of quarter end, the company has $110 million in cash – $76 million of which will be used to get to 6 EH/s. But again, that exahash capacity will be used to realize returns from production rather than holding the BTC on balance sheet. There should be strong cash flow from that operation provided Bitcoin’s price doesn’t completely collapse.

Risks

Aside from a Bitcoin’s price moving down near or below mining cost, I think the biggest risk to Iris Energy’s success is regulatory. I believe Ethereum’s (ETH-USD) successful move from proof-of-work to proof-of-stake is going to put quite a bit of pressure on Bitcoin developers to due the same given the narrative that Bitcoin mining isn’t environmentally friendly.

Since Bitcoin is now 94% of the proof-of-work mining market, BTC mining is going to be in the cross hairs and we’re already seeing sentiment from the White House’s Office of Science and Technology Policy that the administration is paying attention to the environmental impact of PoW mining. While Iris Energy would certainly make the case the company is a green-friendly operation, nuance can sometimes be ignored in favor of politics when it comes to regulators. Mining restrictions in Iris Energy’s North American mining footprint could theoretically come under fire if the United States and fellow G7 nations decide to ban or heavily restrict crypto mining.

Summary

Those who have been following my work or who are active subscribers to the Blockchain Reaction service likely know where I stand on Hut 8 Mining. It’s part of my portfolio because I think it will do very well if Bitcoin is grinding higher. But I also like Iris Energy quite a bit because the company’s approach to treasury is the exact opposite. I believe exposure to both ideas is the right way to play the Bitcoin mining space. Especially in a Bitcoin bear market.

I think it makes quite a bit of sense to buy the miners that are efficient and less obligated to a treasury strategy that might not be working. The miners that are using production to fund operations and that have low mining costs are theoretically the last ones to turn off machines if the bear market gets worse. So far, Iris Energy has shown strong execution and over delivery on guidance. Even though it’s being treated like all of the other miner equities so far, the longer the bear lasts, the more time is on Iris Energy’s side if it can keep producing while peers go bust or dilute. IREN is a ticker that I’m scaling into during crypto winter.

Be the first to comment