AlbertPego

Several Seeking Alpha articles have already discussed how low the current market price is compared to Vonovia’s (OTCPK:VNNVF) book value, so just a quick recap. (All figures are in EUR, with B for billions and M for millions. The data I use are from public company materials, mainly the 2Q2022 presentation and the 2Q2022 report.)

- Vonovia carries their properties at 100B on their books. Most of them have current market values about 30% higher.

- Net debt is 43.5B, so net tangible assets (EPRA NTA) are about 50B (so ~63 per share).

- Current market cap is under 20B, thus less than 40% of NTA.

That definitely looks attractive. However, the gross rental yield on properties at book value is just 3.5%, and at market value is about 2.8%. That’s shockingly low, but in line with the zero interest rate policies of the last decade (Vonovia’s avg. interest rate on its debt is only 1.2%). There are two other major factors at play:

- Very high current construction costs. For instance, Vonovia’s avg. book value per square meter (m2) in Berlin is ~3200, but market values of older properties are around 5000 and for newly built apartments are over 7000. The construction costs alone (not including developer margins) are over 3500 eur/m2. The market value of older properties is driven up by higher prices for new properties.

- Low rents. There are various regulation frameworks for rent control (e.g. the Mietspiegel described in more detail in the Q2 presentation), but basically no landlord can raise rents at will, most rents are below market, and it will take more than 5 years for the vast majority of rents to catch up with the current inflation. On the other hand, I think it safe to assume that rents will increase at least 2% p.a. on average. With high inflation, it could be much more, as CEOs of German rental companies claim.

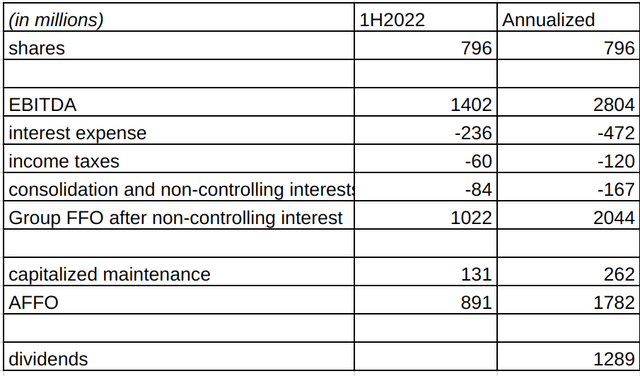

Let’s look at some other financial data. The problem here is that Vonovia has been a serial acquirer over the last decade, so the financial statements change quite a lot, including a major change from the acquisition of Deutsche Wohnen in 2021. So I will take the 1H2022 numbers and multiply them by 2 to get an annual run-rate.

(source: the author, based on Q2 financials)

The reported EBITDA does not include net income from fair value gains on properties, so it reflects recurring cash flows reasonably well. (Vonovia is also a big property developer, but 80% of EBITDA comes from the rental segment.) The interest expense calculation is fairly complicated due to interest rate derivatives and some other stuff (see p. 17 in the Q2 presentation). Expensed maintenance is included in EBITDA, but capitalized maintenance is not, so instead of FFO, I’d rather look at AFFO (FFO minus capitalized maintenance). The dividend policy is 70% of FFO; currently dividends are about 72% of AFFO.

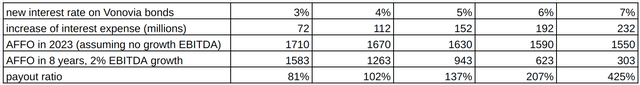

Over the next 8 years, about 4B of debt will come due every year. Since the debt structure is quite complex with all the interest rate hedges etc., I cannot determine the actual interest rates on bonds being refinanced in a particular year. Therefore, I assume that all the outstanding bonds have an interest rate of 1.2%. The following table shows the annual increase in interest expense vs. the new interest rate at which the bond is refinanced.

(source: author’s calculations)

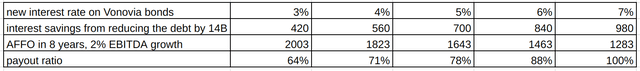

We can see that the current dividend would only be sustainable up to a 3-4% interest rate. My very rough estimate of the risk premium for Vonovia bonds is around 2%, and since 10-year Germany government bonds are at 1.7% already, it is obvious something has to be done. Management plans to sell properties worth 13B. With a loan-to-value ratio of 45%, we can expect the result will be about 7B in debt reduction and about 7B in equity proceeds. Let’s see what happens if all of this was used to repay the debt due in 2023 and 2024.

(source: author’s calculations)

So implementing this plan results in the dividend being sustainable for rates up to 5-6%. If the 7B of equity proceeds were instead used to repurchase shares, it would buy about 1/3 of the company (at 25 eur/share), reducing dividends paid out by a third, i.e. 400M, which can be used to pay higher interest. This would lead to a sustainable dividend for rates up to 5-6%. This suggests that there is indeed room for buybacks at current interest rates – they have a similar impact on the cash flow (or dividend sustainability) as debt repayments. (Selling apartments at 1.3x NAV and repurchasing shares at 0.4x NAV is also very likely to result in hefty gains.)

However, the 6% interest rate on Vonovia bonds corresponds to only something like a 4% risk-free rate. While one can reasonably assume that rates higher than that will only come with higher inflation, which will be reflected in higher rents over time, I am glad that the management is exploring further options to reduce debt: they want to create joint ventures that would allow them to extract cash from their assets in a tax-free way.

Other risks

Energy costs are rising across Europe and that could be a problem for some tenants. But it’s a problem for everyone, not just apartment renters. The strict regulations imposed on apartment renting indicate that governments are very concerned about affordable housing, so I can’t imagine they would not do something about exorbitant heating and electricity prices.

While some people might switch to co-renting to save on costs, apartments are in short supply in most cities, so Vonovia or its competitors won’t be much affected.

An unpleasant risk to keep in mind is a possible takeover. Vonovia is large, so this is less likely than for some of its smaller competitors. But I find the following scenario quite plausible: you buy shares for 25 eur/share, then the price temporarily declines to, say, 10 while the overall market goes down just 20%, and then some big alternative manager comes with an offer of “above-market” 15 eur/share and takes Vonovia private (for less than 15B). Just look at what happened to STORE (STOR).

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment