Imagesrouges/iStock via Getty Images

Introduction

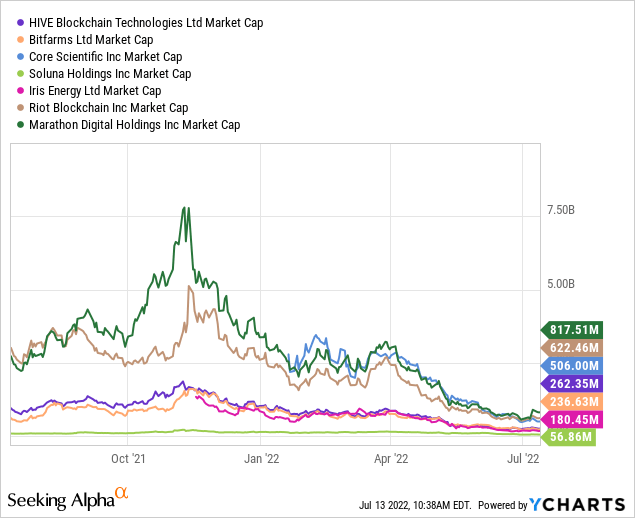

We’ve been in the market searching for crypto mining companies that can provide alpha. We’ve covered the likes of Riot Blockchain (RIOT), Marathon Digital (MARA), Iris Energy (IREN), Soluna Holdings (SLNH), Core Scientific (CORZ), and Bitfarms (BITF).

Our prerequisites for a crypto mining company to be investable is to be 100% powered by renewable energies. By this standard, only IREN and SLNH made the cut. IREN’s investment proposition is centered around being priced near the value of its total hard assets (cash, land, and grid-connected power facilities). The problem with IREN is that its total mining cost isn’t as efficient as other miners. On the other hand, not only SLNH’s mining cost is inefficient, it is limited to the availability of curtailed renewable energy. Since we expect the curtailed renewable energy to shrink over time, SLNH’s business prospects will also be limited.

BITF’s mining operation is much more efficient than IREN and SLNH. Unfortunately, BITF’s Bitcoin mining operations in Argentina are powered by natural gas. Hence, it is disqualified from being 100% powered by renewable energy. The same goes for RIOT and MARA for being only carbon-neutral and not 100% powered by renewables yet.

What we want to find out in this article is whether HIVE Blockchain (NASDAQ:HIVE) can fill in the gap and offer IREN-level sufficient margin of safety with leading mining efficiency.

HIVE is Strategically On Point

The first thing investors can see on HIVE’s homepage is the following statement:

… The company uses 100% green energy to mine both Bitcoin and Ethereum, with a committed ESG strategy since day one. HIVE strives to create long-term shareholder value with its unique HODL strategy…

This statement has 2 very big implications for us. It confirms that HIVE aligns with our view of what makes a crypto mining company investable.

Firstly, the first statement affirms that the company is aware of ESG risks from day one. The ESG risk is a material one. Core Scientific acknowledges it in its official fillings:

Increasing scrutiny and changing expectations from investors, lenders, customers, government regulators and other market participants with respect to our Environmental, Social and Governance (“ESG”) policies may impose additional costs on us or expose us to additional risks.

To our knowledge, one way to be ESG-compliant is to be carbon neutral. For crypto miners to be carbon neutral means to absorb the same amount of carbon emitted throughout mining operation. If the carbon cannot be absorbed locally, it can be offset in another region through methods such as afforestation (e.g., buying plots of land to plant trees).

The problem with carbon offsets is the method of measuring how much carbon is absorbed. Any changes in the measurement technique could risk the company’s ESG compliance.

Therefore, HIVE’s 100% green energy strategy is on point.

Secondly, crypto mining companies act as proxies for the underlying asset mined. Crypto mining companies should maximize asset retention. The more the crypto mining companies hold the assets in reserve, the more valuable they are. In fact, it is one of the key metrics in our valuation framework.

Based on these 2 aspects, HIVE is indeed strategically on point for us. HIVE met our prerequisites and resonates with us.

Good Margin of Safety and Best-in-Class Efficiency

As per HIVE’s latest quarter report (CY2021Q4), HIVE managed to mine 1220 equivalent Bitcoins (697 Bitcoins and 7,126 Ethereum). HIVE’s all-in business cost which consists of Operation and Maintenance, Depreciation, General and Administrative Expenses, Shared-based Compensation, and Financial Expenses totaled $27.4mil. This implies that HIVE’s total all-in business cost per BTC-equivalent mined is only $22,500 (Table 1). If non-cash expenses (depreciation and share-based compensation) are excluded, HIVE’s total all-in business cash cost per BTC equivalent is only $8,900.

To put this into perspective, HIVE’s all-in cost remains the lowest when compared to the 7 other crypto mining companies we’ve covered so far (Table 1). HIVE’s total all-in business cost per BTC equivalent is also consistently low over the past 2 other quarters (CY2021Q3 and CY2021Q2) at $17,842 and $23,468 respectively (Table 2). The same goes for HIVE’s total all-in business cash cost per BTC equivalent in CY2021Q3 and CY2021Q2 at $8,856 and $11,475 respectively.

We seldom deem a crypto mining business cost as low. This is the lowest we’ve seen.

Table 1. All-in Business Cost per BTC Equivalent mined

Source: Author, HIVE

*Excluding Hosting, Range Depending on how shared costs are pro-rated between hosting and self-mining (proprietary)

Table 2. HIVE’s Mining Business Costs

| QR(CY) | BTC-Equivalent Mined | Total Mining Cost ($mil) | Operating and Maintenance ($mil) | Depreciation ($mil) | General and Admin ($mil) | Share-based comps ($mil) | Financials ($mil) |

| 2021Q4 | 1220 | 27.4 | 6.526 | 15 | 2.862 | 1.672 | 1.338 |

| 2021Q3 | 1233 | 22 | 7.6 | 9.6 | 2.63 | 1.48 | 0.305 |

| 2021Q2 | 767 | 18 | 6.2 | 6.9 | 2.3 | 2.3 | 0.3 |

Source: Author, HIVE

In terms of margin of safety, HIVE has $63mil cash and $203mil worth of deposits and equipment. HIVE’s reserve also has 3,239 BTC and 7,667 ETH as per the June 2022 update and is worth $70.5mil as of the time of writing. Hence, these assets are worth about $330mil. These assets in excess of total liabilities ($55.1mil) are worth $280mil.

HIVE’s market cap as of the time of writing is $260mil, which is about 10% lower than HIVE’s assets (cash + reserves + deposits + equipment) in excess of total liabilities. Comparatively, BITF is traded at around a similar metric while IREN is trading around 55% lower than the similar metric.

Hence, IREN’s margin of safety remains the best. That being said, HIVE’s margin of margin is good and acceptable.

The Catch

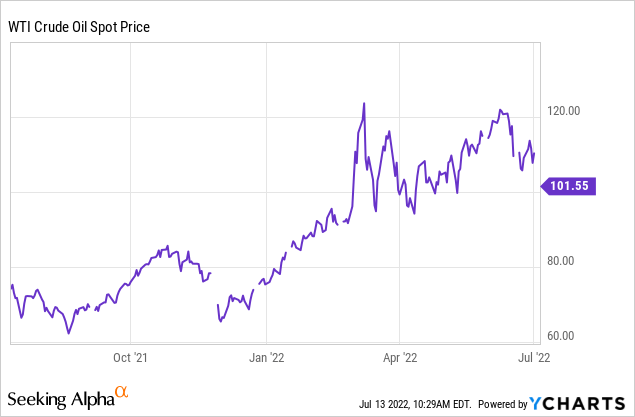

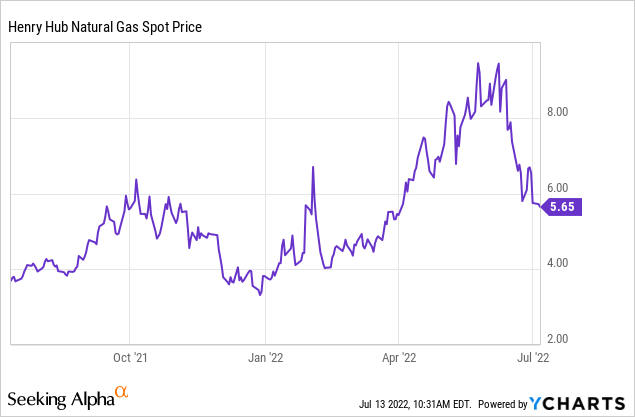

The catch mentioned in the title of this article is the date. HIVE’s data is based on 2021Q4 while other miners mentioned in Table 1 are based on 2022Q1. This catch is significant because the crude oil price jumped from about $77 to nearly $130 per barrel while the natural gas price increased from $4 to nearly $6 in 2022Q1.

However, we have reasons to believe that this cost will be maintained. By referring to Table 2, we can see that the only cost that materially increased is depreciation, while all other costs such as operating and maintenance, general and administrative, share-based compensations, and financials remain relatively consistent. Furthermore, HIVE is 100% renewable energy.

Hence, we do not expect HIVE to incur materially higher costs in 2022Q1 and 2022Q2.

Valuation

HIVE is priced relatively closer to BITF and IREN. So let’s use BITF and IREN as comps.

HIVE’s expected near future capacity is about 38% to 60% lower than IREN’s (depending on early or end of 2023), but is priced 40% higher. This premium might be contributed from HIVE’s 3x higher built-up capacity (meaning less execution risk), and 50% lower total all-in business cost per BTC. Only time will tell whether IREN’s cost can reach economic of scale. Contrary to popular belief, we explained why crypto mining companies might not achieve economies of scale in our previous coverage on BITF.

Nevertheless, we think that IREN provide investors with better upside opportunity if investors are willing to undertake more risk. To our knowledge, IREN has not proven its ability to retain its Bitcoins mined as IREN does not have Bitcoin reserves yet while HIVE has a good track record to prove its ability. Moreover, we showed that a crypto mining company’s capacity growth is somewhat similar across the sector at 8.5% or 0.4 EH/s -1 EH/s per quarter. By this standard IREN might be able to achieve its targeted capacity of 10 EH/s from the current 1 EH/s. Hence the risk.

On the other hand, HIVE is priced about 10% higher than BITF despite having similar built-up capacity and expected capacity of 6 EH/s in 2023. Given that HIVE is 100% powered by renewable energy and HIVE’s all-in business cost is 35% lower than BITF, this 10% premium is well justified. Just remember that the catch mentioned in the previous section.

Furthermore, HIVE shareholders suffered less dilution than BITF shareholders despite HIVE’s $100mil ATM Equity Program. HIVE shareholders only suffered 11% dilution in 2021 while BITF shareholders suffered 33%. In terms on potentially dilutive securities, HIVE only has 6% potential dilution while BITF has more than 15% (from outstanding stock options and warrants). Comparatively, CORZ has 66% potential dilution from potentially dilutive securities. This further justifies HIVE’s 10% premium over BITF.

Table 3. Built-up and Expected Near Future Capacities of Mining Companies

| Company | Built-up Capacity | Near Future Expected Capacity |

| Hive Blockchain (HIVE) | 3.2* | 6 |

| Bitfarms (BITF) | 3.3 | 8 |

| Core Scientific (CORZ) | 8.3 | ~16 |

| Soluna Holdings (SLNH) | 1 | 4 |

| Iris Energy (IREN) | 1.1 | 10 |

| Riot Blockchain (RIOT) | 4.3 | 12.8 |

| Marathon Digital (MARA) | 3.9 | 23.3 |

Source: Author

* Including BTC-equivalent capacity for Ethereum

Verdict

Aside from the recent notice of deficiency from NASDAQ, we only have good things to say about HIVE. HIVE has lesser ESG compliance risk (powered by 100% renewable energy), growing Bitcoin reserves, acceptable margin of safety in terms of price to hard assets excess of total liabilities ratio, and significantly lower all-in business cost per BTC by sector standards.

Although HIVE’s near future expected capacity isn’t a wow factor like IREN’s, HIVE’s expectation is closer to the realistic historic sector growth rate.

That being said, we think that it is still early to get into HIVE as Bitcoin is expected to decline further to $10,000 by end of 2022. This has been our stance since May 2021 and is evident by Bitcoin’s decade-old halving cycle as well as current economic fundamentals.

When Bitcoin shows signs of recovery by then, we expect HIVE to be our current prime go-to crypto mining company to invest in.

Be the first to comment