Spencer Platt

Overview

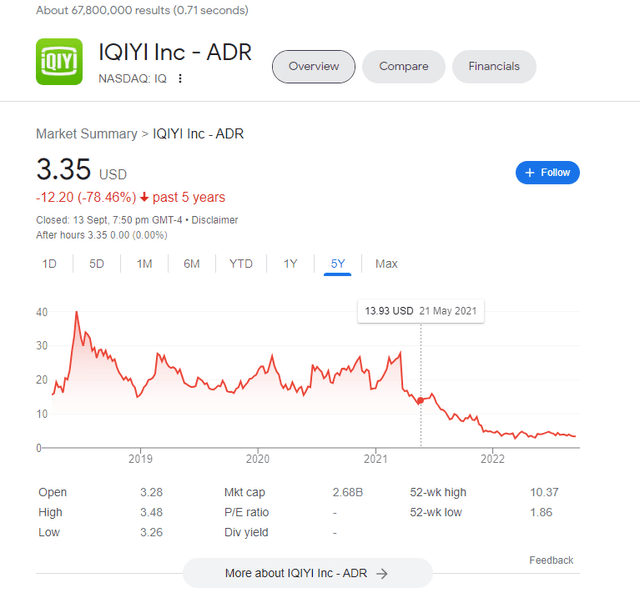

iQIYI (NASDAQ:NASDAQ:IQ) is currently significantly undervalued. I believe that IQ’s true value will be realized as it continues to gain subscribers in a growing market and shows investors that it can generate healthy cash flow. The current valuation gives investors a chance to take advantage of this deep mispricing.

Business description

IQ is an over-the-top (OTT) media content provider. The IQ platform offers a selection of premium video content, with an emphasis on IQ original dramas and shows (IQ also has licensed content on its platform). IQ has a large and growing user and subscriber base. In 2Q22, it had an average daily number of total subscribing members of 98.3 million and a monthly average revenue per membership (ARM) of RMB14.69.

IQ generates revenue mainly through membership, online advertising, and content distribution. Its monetization model fosters an environment for high-quality content production and effective content distribution on its platform, which in turn expands its user base and increases user engagement, creating a virtuous cycle.

Investments thesis

IQ has exposure to a very large TAM in China

The TAM is enormous, giving IQ a very long runway to continue adding subscribers. With 1.4 billion people, China has twice the population of the US and EU combined. Video streaming will be a big market, as evidenced by billions of dollars invested in the Western world by Netflix (NFLX), Disney (DIS), Apple (AAPL), Amazon (AMZN), and others, as well as strong consumer demand. There is no reason for China to be any different, as evidenced by Tencent’s (OTCPK:TCEHY) and Youku’s investments.

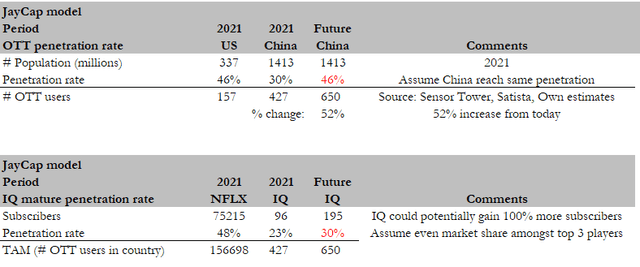

IQ profit pool potential is a function of two things: 1) OTT user penetration as a percentage of the total population and 2) IQ market share of total OTT user penetration. To illustrate this potential, I benchmarked China against a more mature country and peer: the U.S. and NFLX, respectively.

As of 2021, OTT in the US has a 46% penetration rate, whereas China has 30%. I believe the gap will close as the trend towards consuming content on-demand is significant. If 46% is the mature figure and China eventually reaches the same level, there will be an additional 123 million potential subscribers available.

As for market share, I do not think IQ can reach the same level as NFLX, given that it did not have a strong head start like NFLX. To illustrate the potential gain in number of subscribers, I assume the market is split between 3 key players (90% divided by 3) at maturity (China’s total OTT penetration reaches 46%). IQ could easily double its number of subscribers (as of FY21).

Significant pricing power to increase ARPU

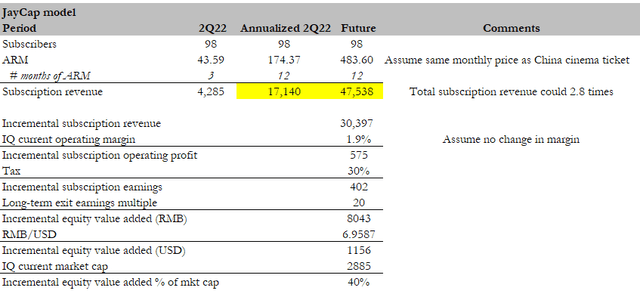

IQ has a great deal of room to raise its current subscription fee of RMB14.69 (US$2.12). The present subscription fee is a lot less than RMB40.3, the average price of a cinema ticket in China, whereas NFLX’s subscription fee is equivalent to the average price of a movie ticket in the United States. If IQ eventually raises its prices to a level comparable to NFLX, the impact on revenue and equity value is massive, as shown below.

My model suggests that if IQ raised prices to the same level as an average cinema ticket in China, it could easily increase equity value by 40%. Note that this number could be a lot higher since I didn’t count on the operating margin going up.

The structural shift in consumer demand and GDP/capita in China is what enables IQ to raise prices to levels that are competitive with NFLX.

China, once a haven for pirated sites, has evolved into a market where consumers are increasingly willing to pay for online video content. Paying for online content has become more affordable as disposable income has increased. The Chinese government also played a role, launching a piracy crackdown that resulted in the closure of hundreds of sites that offered pirated streaming or downloading. The rapid rise in copyright-related infringement cases is another sign that pirated websites are being shut down more and more quickly.

Paying for video streaming used to be a bad deal for consumers because they could easily access the content on piracy websites, but as in other parts of the world, the tastes of the growing middle class are quickly changing. They now have the money to pay for the newest, most exclusive programming, free of interruptions from commercials, so they can watch it whenever they want.

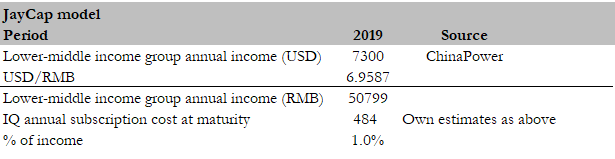

I believe that at maturity, when IQ’s prices are the same as the average price of a movie ticket, IQ’s annual subscription would still be a very small part of the annual income of China’s lower-middle income group and even less for China’s richer people.

Author’s estimates

Industry is rationalizing to improve profitability

IQ will benefit financially as the industry rationalizes its focus on profitability rather than revenue growth through aggressive promotions and content acquisition. This development is likely due to the rising interest rate environment (i.e., no longer a supply of cheap money) and the increasing pressure to generate profits as market sentiments shift from “growth at any cost” to “generate cash flow.” This phenomenon is not confined to IQ and its Chinese counterparts. In the Western world, NFLX and DIS are also moderating on content spending, and key players in the food delivery industry, such as TKWY, DHER, and ROO, are all focusing on profits as shareholders put pressure on the company to generate profits. Aside from cutting costs, China’s OTT content players (Tencent Video, Youku) are also increasing prices to increase profitability.

The combination of rising ARM, lower customer acquisition cost (CAC), and reduced content spend is a clear margin expansion story for IQ. This story is already beginning to play out in recent quarterly filings. In 2Q22, gross margin increased to an all-time high of 21.16%, while operating margin reached an all-time high of 1.89% for the first time since the IPO. This is a very positive development for IQ because shareholders have been waiting a long time for it to turn a profit. Moving forward, as the industry continues to rationalize, IQ margins should improve at a faster rate as the company scales off from its fixed cost base.

On another note, which has already been in play for a while now, IQ’s ongoing focus on shifting from licensed-based to producing original content (IQ 4Q21 earnings call) also helps to improve margins in the long run. Original content can command a 30% to 50% higher margin than licensed-based content (NFLX MoffettNathanson Media & Communication Summit Aug’18), so I see this shift as very positive.

Partnership with Douyin should improve profitability and increase web

The partnership with Douyin should benefit IQ in terms of profitability and traffic. In July 2022, IQ announced the signing of a definitive agreement with Douyin (China’s largest short video platform), under which IQ will license selected premium longform video to Douyin for editing and distribution in short-form video format. While the exact financial terms are unknown, I anticipate that this deal will benefit IQ in two ways:

1) Monetization possibilities: IQ could charge sublicensing fees when Douyin uses IQ’s content, or IQ could impose a revenue-sharing model (from advertisements) with Douyin.

2) Increase traffic to IQ: popular short films with commentary on Douyin frequently encourage users to watch entire films (similar to what people outside of China see on Reels and FB videos), thereby directing traffic to the IQ platform.

This agreement also reinforces the notion that Douyin will not enter the long-form video market directly through heavy investment in self-developed content.

Forecast

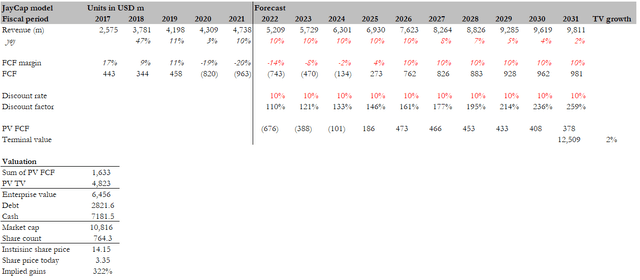

Based on my investment thesis, I expect IQ to continue growing by acquiring more subscribers as OTT penetration rates increase in China and by increasing prices. My DCF model is separated into 2 periods:

- First period: FY22 to FY26. Subscriber growth and price increases (for subscriptions and advertising fees) will keep revenue growing at the same rate as in the past.

- Second period: FY27 to FY31, I expect growth to slow to the long-term inflation level.

I expect IQ to slowly grow from current levels to 10% FCF margin. I used NFLX’s current net margin (16.42%) and assumed that would be IQ net margin in the out years. I also assumed that IQ would still need to continue investing in huge content CAPEX moving forward, and hence, net margin to FCF conversion would be less than most mature companies. Given how the market is right now and how IR is going up, I would need a discount rate of 10% before I would even think about investing in IQ.

Assuming the aforementioned assumptions and a 2% terminal growth rate, I calculated an intrinsic value of $14.15, almost 3 times the current share price of $3.35. The price target may seem high at face value, but we need to note that IQ was trading at that level just less than 2 years ago.

Red flags

Liquidity issue

IQ had a net debt of RMB13 billion as of 2Q22. Owners of IQ convertible bonds have the option to redeem bonds worth US$1.2 billion (RMB7.8 billion) and US$0.8 billion (RMB5.2 billion) in April 2023 and August 2024, respectively. Despite the fact that IQ was able to secure additional financing, its outstanding liabilities continue to pose a potential liquidity risk.

Competition in the online advertising market

If advertisers continue to shift ad budgets from the long-form video market to the short-form video market, IQ’s future advertising outlook will be uncertain. I believe IQ’s recent collaboration with Douyin, as well as the launch of additional app products, will support IQ’s advertising revenue.

Competition from other OTT players

The most significant risk to IQ is that it operates in a competitive market where its competitors, Youku and Tencent Video, may have more capital to finance the production of original content. There is no assurance that we will not see the same price war again.

Conclusion

IQ has a very simple business model that rides on a long-term tailwind of increased consumer income and preference for on-demand content. On top of these, it has levers to pull to increase profitability, such as raising prices and rationalizing content spend (produce vs license). I believe IQ is well positioned to continue growing its business and its financial profile should improve dramatically over the years to come, just like NFLX did.

Be the first to comment