ribeirorocha/iStock via Getty Images

A Quick Take On iPower

iPower (NASDAQ:IPW) went public in May 2021, raising nearly $17 million in gross proceeds in an IPO that was priced at $5.00 per share, below its expected range.

The firm sells branded and in-house hydroponic farming products to businesses and consumers.

While risk-on investors may see IPW as a potential bargain buying opportunity at just .8x EV/Revenue multiple, I’m more conservative and am uncertain about its growth prospects from here.

I’m on Hold for IPW for the near term.

iPower Overview

Duarte, California-based iPower was founded to build and market an ecommerce presence selling over products via its website as well as through third-party distribution channels such as Walmart, eBay and Amazon.

Management is headed by co-founder Chairman, CEO and President, Lawrence Tan, who was previously a senior software engineer at various companies.

The company’s product offerings include:

-

iPower and Simple Deluxe private label products

-

HVAC exhaust blowers

-

CFM duct inline fans

-

Grow light systems

-

Trimming machines

-

Pumps

-

Hydroponic-related items

The firm primarily sells its products through its own website – www.zenhydro.com – as well as through third-party ecommerce sites.

Market & Competition

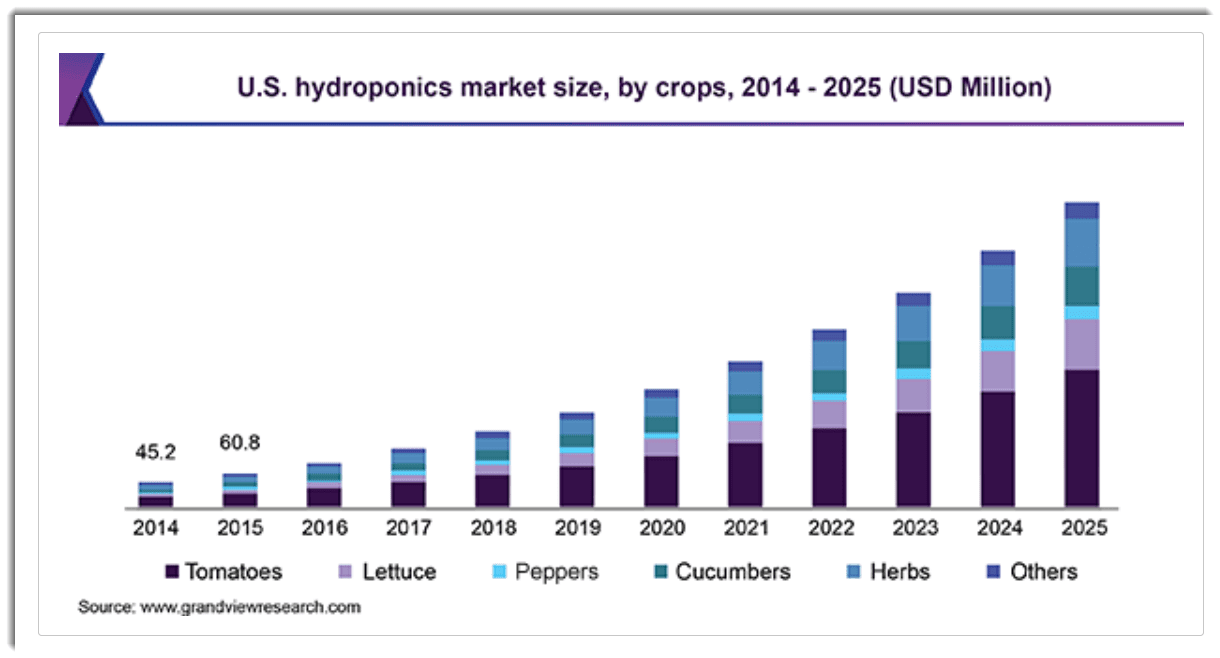

According to a 2020 market research report by Grand View Research, the global market for vertical farming was an estimated $1.33 billion in 2018 and is expected to reach $96 billion by 2025.

This represents a forecast very impressive CAGR of 22.5% from 2019 to 2025.

The main drivers for this expected growth are a growing legalization of marijuana in various states of the U.S. and increasing awareness by consumers of the need for naturally grown products.

Also, the use of hydroponics reduces the risk of disease caused by soil organisms and produces a higher yield due to tighter control over nutrients.

U.S. Hydroponics Market (Grand View Research)

Major competitive or other industry participants include:

-

Aerofarms

-

Argus Control Systems

-

Freight Farms

-

Green Sense Farms

-

LumiGrow

-

Numerous others selling their products direct to users

iPower’s Recent Financial Performance

-

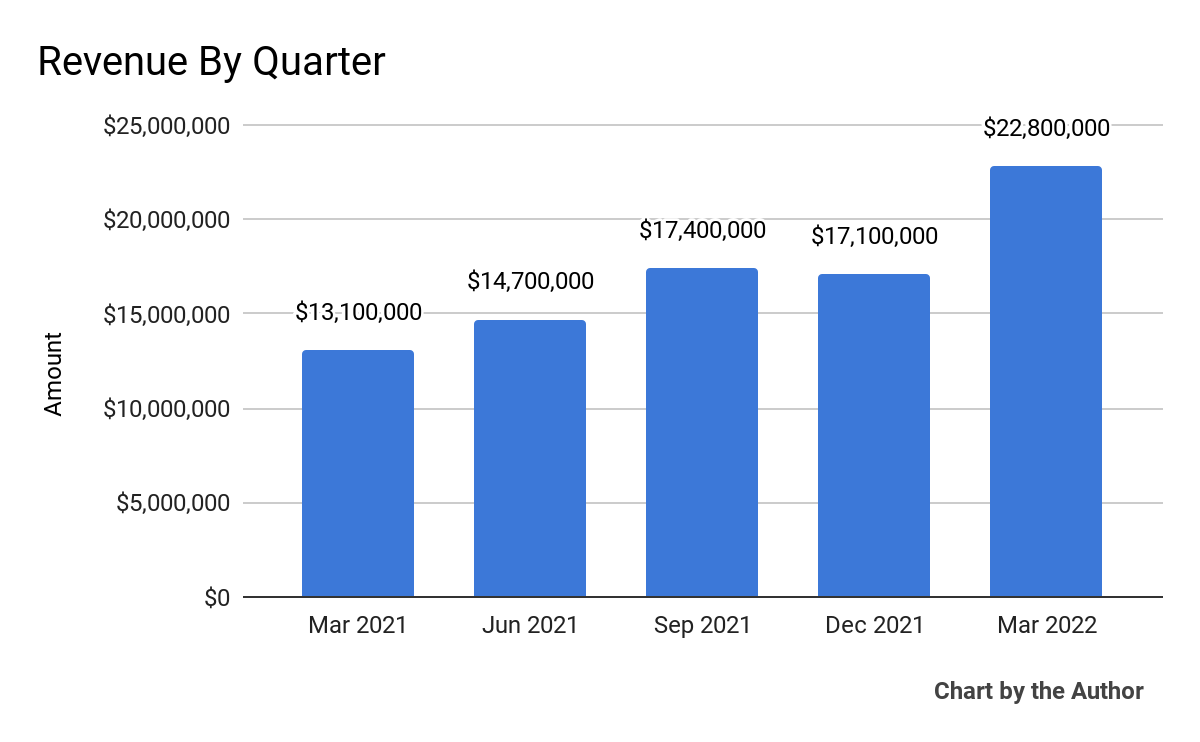

Total revenue by quarter has grown notably over the past 5 quarterly reporting periods:

5 Quarter Total Revenue (Seeking Alpha)

-

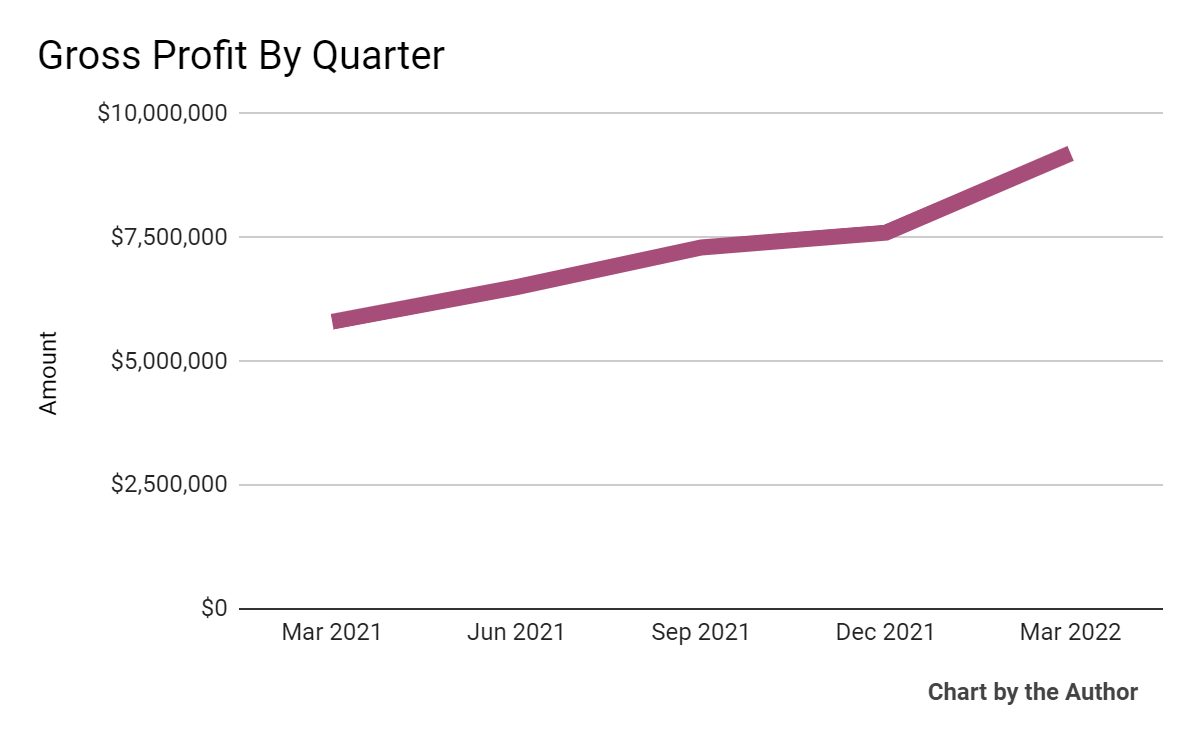

Gross profit by quarter has grown materially in the past 5 quarters:

5 Quarter Gross Profit (Seeking Alpha)

-

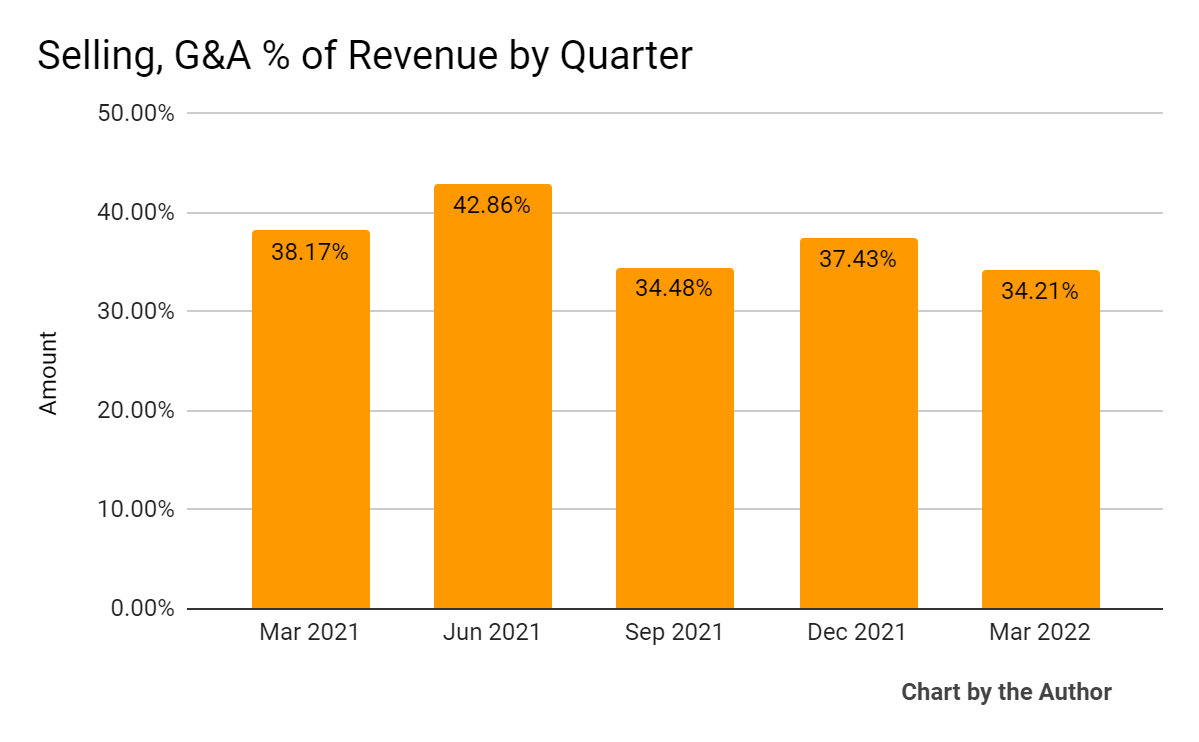

Selling, G&A expenses as a percentage of total revenue by quarter have largely remained within range:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

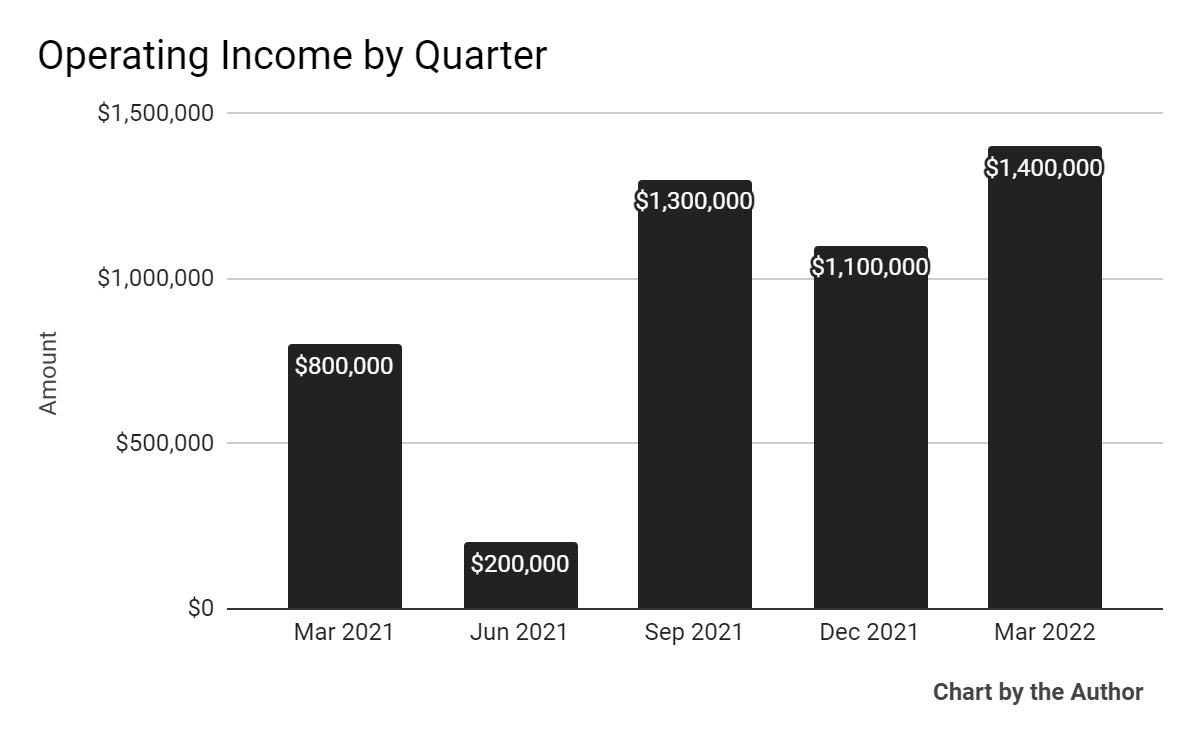

Operating income by quarter has grown markedly in recent purporting periods:

5 Quarter Operating Income (Seeking Alpha)

-

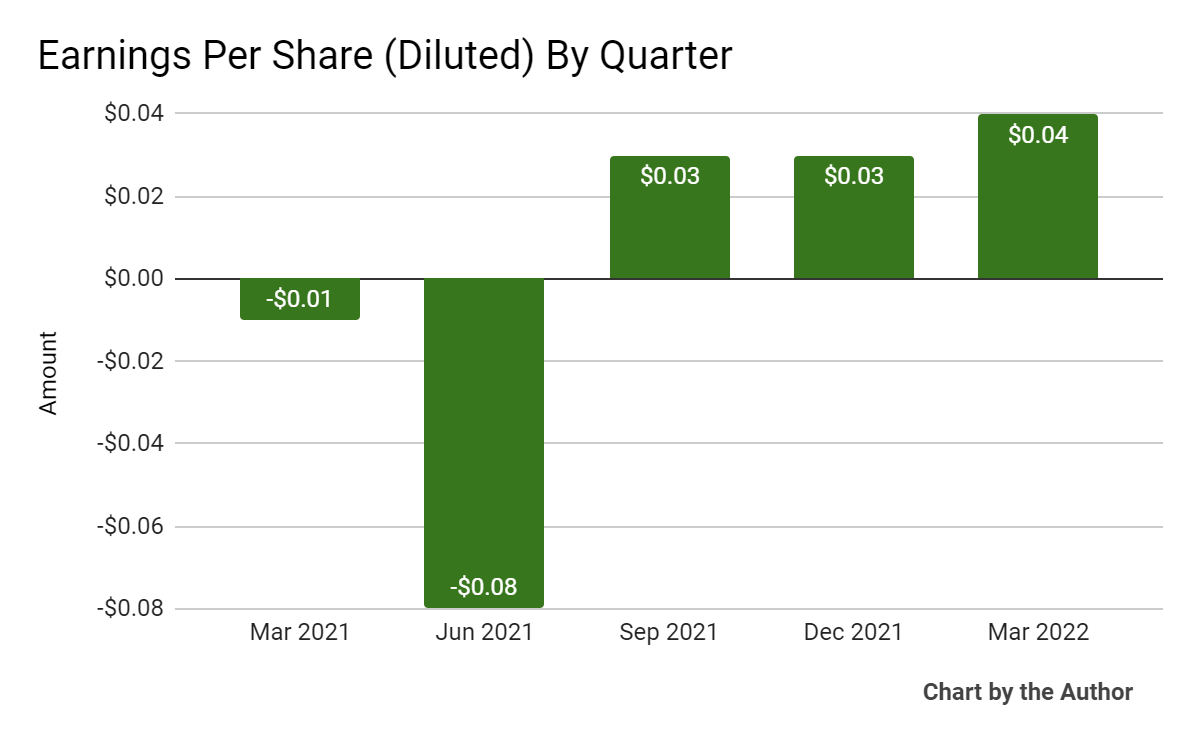

Earnings per share (Diluted) have improved significantly over the past 5 quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

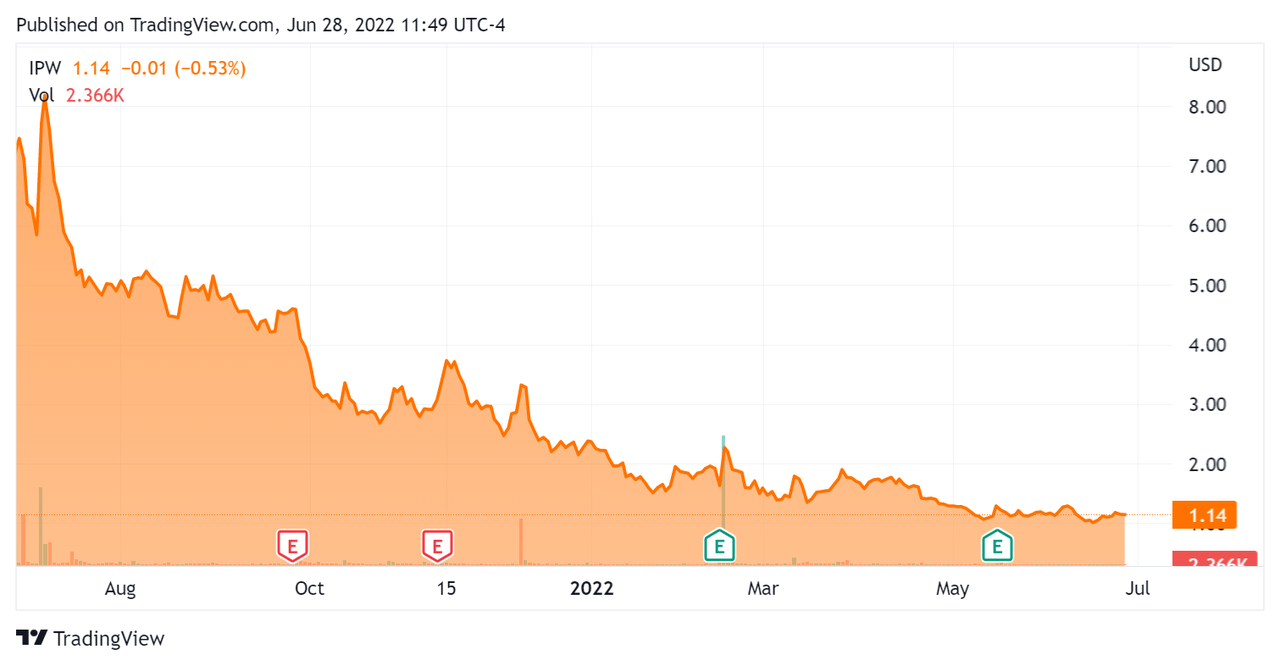

In the past 12 months, IPW’s stock price has fallen 84.1 percent vs. the U.S. S&P 500 Index’s drop of around 10 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For iPower

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$34,900,000 |

|

Enterprise Value |

$55,980,000 |

|

Price/Sales (TTM) |

0.40 |

|

Enterprise Value/Sales (TTM) |

0.78 |

|

Operating Cash Flow (TTM) |

-$22,730,000 |

|

Revenue Growth Rate (TTM) |

33.37% |

|

Earnings Per Share |

$0.02 |

(Source – Seeking Alpha)

Commentary On iPower

In its last earnings call (Source – Seeking Alpha), covering FQ3 2022’s results, management highlighted the high contribution from the sale of the firm’s in-house products, now approximately 82% of total revenue.

The company is also continuing to expand into Europe and the UK and believes that these markets ‘present a significant medium to long-term opportunity’ for IPW.

Management also detailed its expansion into areas outside of its core hydroponics business, including what it calls eCommerce value chain services via a joint venture with Box Harmony.

Leadership believes the business is complementary due to its experience and capacities in the logistics space. Time will tell if this becomes a profitable segment or more of a distraction.

As to its financial results, FQ3 2022’s revenue rose 74% year-over-year as the firm prioritized selling its in-house brands.

Gross profit rose, but gross margin dropped from 43.9% to 40.3%, driven by a change in product mix and record-high transportation inflation.

Notably, operating expenses as a percentage of revenue dropped from 37.9% in 2021 to 34.3% in 2022, driven by its direct import program the firm has with one of its channel partners.

Looking ahead, management continues to focus on its consumer channel opportunities, seeking to cut deals with big box retailers. Those deals will probably not materialize until at least the new fiscal year.

Regarding valuation, the market has punished IPW’s stock valuation, pushing it down to an EV/Revenue multiple of around .8x on trailing twelve-month revenues.

The primary risks to the company’s outlook are continued high transportation inflation and slow deal progress on major retailers for its consumer channel.

Potential upside catalysts would be lower inflation costs and a successful company rebrand, with both likely not happening for some time.

It is interesting that management is choosing to diversify from the hydroponics business into eCommerce logistics, as it speaks volumes about their opinion of the hydroponics business as a standalone opportunity.

I’m generally not a fan of businesses that stray from their core business as they tend, over time, to become a ‘jack of all trades and master of none.’

While risk-on investors may see IPW as a potential bargain buying opportunity at just .8x EV/Revenue multiple, I’m more conservative and am uncertain about its growth prospects from here.

I’m on Hold for IPW for the near term.

Be the first to comment