Sean Gallup/Getty Images News

Introduction

On February 24th of this year, I published an article titled “Apple & Alphabet Will Not Side-Step A Deep Bear Market“. In that article, I made the case that Alphabet’s (NASDAQ:GOOGL) earnings expectations were too high, and that after the ending of government stimulus, the stock price was likely to drop significantly. Here is what I had to say about Alphabet in that article:

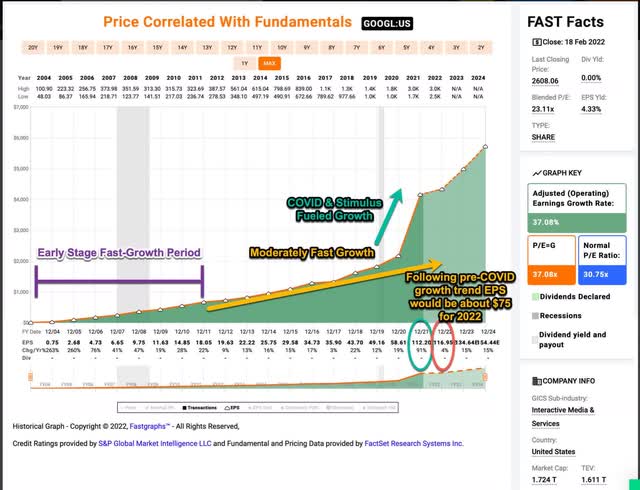

I estimate that without COVID stimulus Alphabet’s previous EPS trend would have had them earning about $75 per share in 2022, and right now analysts are expecting about $116 per share. As with Apple, these additional stimulus earnings will likely help adjust the previous trend upward a bit, and that money will continue to circulate in the economy for a while, so, perhaps EPS won’t fall all the way down to the previous trend line, but I think for analysts to expect $134 per share of earnings in 2023 is wildly optimistic.

An additional consideration for investors is that during the last recession of any length in 2008, Google managed to grow EPS at over 40% per year because they were then still a relatively small and fast-growing business. Now they are a $1.7 trillion company. Most of Alphabet’s revenue comes from advertising, and advertising has a long history as a cyclical industry. Investors should expect that EPS growth will be deeply negative during a “normal” recession. Now add on top of that a recession that is preceded by an advertising boom fueled by what is likely to be one-time stimulus money, and it sets up GOOGL stock for a potentially very steep decline. The stock price will almost certainly fall far enough to reach bear market territory, and I probably wouldn’t consider buying it until it was -40% or -50% off its highs.

And I went on to clarify in the comment section regarding the odds of various drawdown scenarios:

While I think a -50% drop is possible, and investors should know it’s possible, and while I think a -20% has an extremely high probability of occurring, I would say a -30% to -40% drop is probably the most likely scenario. It’s not that Apple and Google aren’t great businesses. It’s that the market expects them to be greater than great. Greater than great businesses rarely see EPS decline from one year to the next, and I think there is a high probability of that happening with both of these businesses within the next two years.

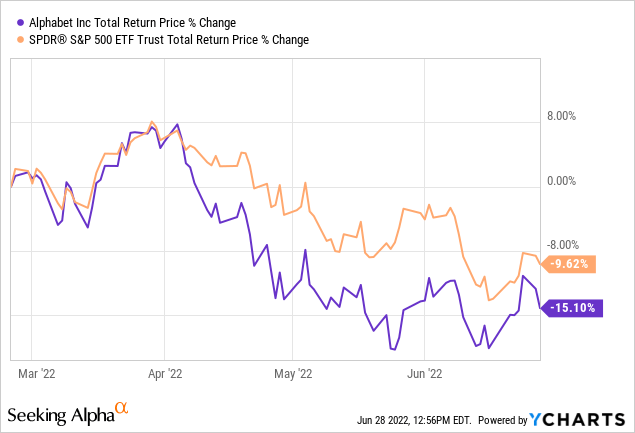

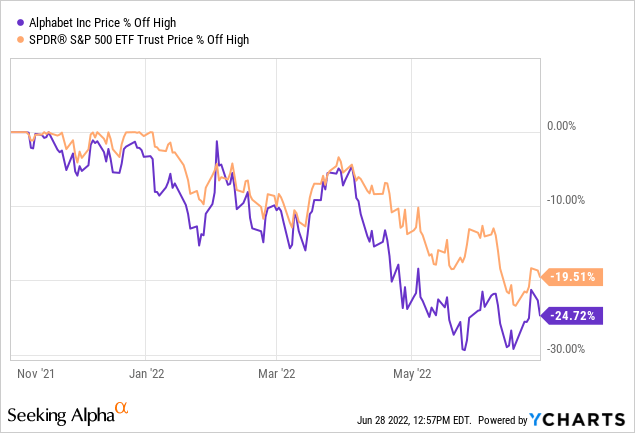

Here is how GOOGL has performed since my article:

At one point a couple of weeks ago, the price was more than -20% off its highs since the article and significantly underperforming the S&P 500.

In terms of how far off its highs GOOGL fell, it essentially bounced off the -30% drawdown level, which was the very low end of my expectation. Since then, the stock price has rallied to the upside, and now I think a question investors could rightfully consider is whether that was the bottom. This is the question I’ll consider in this article.

Earnings expectations are what will matter

Investing in the stock market is very different than most other things in life that immediately respond to what is happening at the moment. But, most of the time, current price movements in a stock’s price are based on earnings estimates that run far into the future. And then when we get to the future, those prices are based on estimates even farther into the future. This often causes confusion for investors who try to take today’s news, and apply it to daily stock price moves because sometimes (I would argue most of the time) items that are reported in the news, are not what actually move stock prices. If you follow the market long enough, you’ll notice this disconnect between news and immediate corresponding stock price movement because sometimes there is good news and the price goes down, and sometimes there is bad news and the price goes up. Yet, the financial media carries on each day, doing its thing, pretending like there is some actionable connection between what they report and how the stock price happens to be moving that day.

As good investors, it’s always important to understand just how far into the future you are projecting, and what sort of return on your investment you think you can achieve over that time period. This is really just common sense. However, what sometimes gets missed is that an investor also needs to estimate what time frame and expectations they think the market will be looking at in the future. When a company reports good earnings and the stock price drops, what that usually means is that the market was looking at the implications of the earnings over a different time period than just one quarter or the market was using some other factor (revenues, margins, users, etc.) as a proxy for future earnings, often many years from now into the future.

My experience has been that it’s pretty typical for the market to take four quarters’ worth of earnings from the past, and four quarters’ worth of earnings expectations in the future, and then extrapolate that out (sometimes for decades) in order to value a stock. Because of this, depending on how far into the future the bulk of investors are extrapolating, small changes in earnings expectations can have an outsized effect on the price of a stock, and I think Alphabet currently is particularly vulnerable to this sort of movement over the next year-and-a-half.

Google’s earnings expectations have fallen since February

Below is an annotated FAST Graph I shared in my original GOOGL article back in February:

There are two numbers I would like to focus on. The first is 2022’s expected earnings per share, and the second is 2023’s expected earnings per share. Four months ago, analysts expected $116.95 per share for 2022 and $134.64 per share for 2023. I was particularly skeptical and bearish on those $134.64 expectations in my previous article, with the central thesis being that Alphabet had a very high probability of missing those expectations because we would no longer have stimulus money entering into the economy.

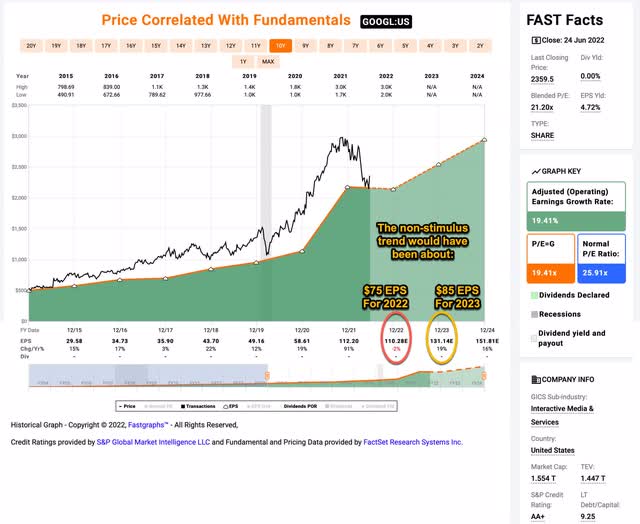

Let’s now take a look at how those earnings expectations for 2022 and 2023 have changed over the past four months.

Estimates for this year have fallen from $116.95 to $110.28, and estimates for 2023 have fallen from $134.64 to $131.14. Importantly, earnings growth estimates for this year are now negative for the first time in Google/Alphabet’s history. So we are just now starting to see my prediction of earnings misses occur. What is essential for investors to understand is that even though these expectations haven’t come down very much, yet, they only came down after the stock price fell nearly -30% off its high. Analysts are way, way, way behind the curve on this. As I noted in the chart above, if Alphabet’s previous earnings growth trend had continued without any stimulus from the government they would have been expected to earn roughly $85 per share in 2023 compared to analysts’ $131 expectation now. This gap is so incredibly wide, that it’s hard to see how the stock price doesn’t move lower if Alphabet’s earnings revert to anywhere close to the previous earnings trend.

So, perhaps the most important question to ask is how sticky are those stimulus earnings going to be? The simple fact is that there is much more money circulating in the economy than there was before the stimulus and that money doesn’t simply disappear from the economy when the spigot is turned off. At least some of it will come back to Alphabet again and again. For this reason, it’s likely that all other things equal, Alphabet will probably earn more than $85 per share in 2023. However, it’s hard for me to see how they earn over $100 per share, much less $131 per share without continued stimulus.

Not only will stimulus stop, it’s also about to reverse

Way back on January 26th of 2022 I wrote an article titled: “6 Financial Stocks I Recently Sold, And 2 I Will Hold For The Long Term” where I pointed out:

There were two types of direct stimulus to the American people in 2021, one type was quick “one-time” payments, of which, there were two: one in January and one in March. This was the equivalent of giving someone, say $4,000, twice, and then not giving them any more money. But there were two additional forms of ongoing fiscal stimulus that directly affected many Americans. The enhanced child tax credit, and the pause on student loan repayments. These were different in that they were ongoing forms of stimulus, that for the average family with two kids who have student loans, amounted to roughly $400 per month each. One of them, the child tax credit created money that flowed into a household in the form of increased income of about $400 per month, and the other prevented an approximate $400 outflow per month to pay back student loans. Combined, these two forms of stimulus are far more important, and underrated by the market than they should be. This is an amount roughly equal to 20% of the affected families’ take-home pay. One can only imagine the percentage of disposable income those two forms of stimulus accounted for in the second half of 2021. This stimulus was, without a doubt, a very, very high percentage of disposable income for many people in 2021.

Near the end of December, we got the news from Senator Joe Manchin that he would not support the bill that would extend the enhanced tax credit. Once that happened at the same time the Fed speakers dramatically turned into inflation hawks, I put my trailing stops on. Biden, soon after Manchin’s decision, extended the student loan pause until May, so that potential removal of stimulus was delayed, but we still don’t know how long the delay will last, and in May, it could be gone.

As far as I’m concerned, the potential for this fiscal stimulus boom/bust cycle is far, far, greater than any Fed interest rate decision. The Fed would have to hike short-term rates to double digits to have the same effect on working families and the economy as the removal of this stimulus will have. All that extra demand for goods from the stimulus that has been contributing to inflation will disappear in a few quarters if the tax credit isn’t extended and borrowers have to start paying back their students loans. Inflation will quickly be replaced by disinflation, a bear market, and probably a recession. This is the real danger to the price of these stocks (and many others).

All the focus in the financial media has been on the Federal Reserve, but in my view, the Fed raising rates has a much smaller impact on Alphabet’s earnings and price than the ending, and eventual reversing, of stimulus does. There are two important points I want to make about this. The first is that there will be a lag in the effects of ending stimulus from the time they end until the time the effects reach corporate earnings, and the second very important point is that students still haven’t started repaying their loans, yet. Student loan payment resumption, which is now set to begin in two months at the end of August, is going to be a huge, nearly 100% net negative for the economy and corporate earnings. And while we could always get a surprise this summer, Biden has shown little interest in any sort of substantial forgiveness program. Remember, student loan repayments, no matter how you feel about them politically, ethically, morally, whatever, are a nearly 100% net drag on the economy when they go into effect. And if they resume as planned without some positive economic catalyst balancing them out, we will almost certainly go into a recession, and corporate earnings almost across the board will miss, including Alphabet’s.

It’s difficult to predict how much they will miss earnings, but the distance between analysts’ expectations and the reality of the likely probabilities, particularly for 2023 after the effects of both stimulus and higher interest rates have worked their way into the economy, are so vast, that a much lower stock price seems relatively easy to predict. If I had to offer a range for an earnings estimate, I would say $90 to $100 per share for 2023 is what I would expect, but a bad recession might send EPS even lower. Alphabet has yet to experience a deep recession as a mature business, so it’s difficult to say.

So when would I buy Alphabet stock?

Even though I’ve been bearish on Alphabet stock since February, it is definitely a stock I would want to buy if I could get it at the right price. Readers who have been following me for a while and are familiar with my “full-cycle analysis” know that I typically have a P/E mean reversion element that is included in my valuation process. Because Alphabet had this unusual, and likely temporary, spike in earnings, current P/Es aren’t particularly helpful here because earnings are likely to drop, and we don’t really know by how much, yet.

Time will actually be an important factor to consider because I think we need some time to see how far Alphabet’s earnings decline, and then we need some time for analysts to reduce their forecasts down. My guess is that by Q1 of 2023 this will have at least started to happen, and by Q2 2023 I will know whether my thesis was roughly correct or not. Until then, I am assuming $75 per share of earnings for Alphabet for my valuation estimates for 2022, so if GOOGL’s price falls far enough that it would be a good value assuming $75 of earnings and about +13% long-term annual earnings growth, then I would be a buyer within the next 6-7 months.

This works out to a buy price for me at about $1,327 per share right now. It’s possible that if we get February 2023’s earnings report, and earnings aren’t as weak as I expect, I’ll raise my expectations for 2023 and raise my buy price at that point, but I plan to be pretty conservative until then. The thing is, we already see that Alphabet’s earnings growth is now expected to be negative by analysts. If it turns out they are more negative than expected, then investors will start to extrapolate that downward trend instead of the long-term upward trend. I mean, who wants to pay a 30 P/E for negative earnings growth? If that sentiment gets negative enough, all of the sudden my 13% earnings growth expectation starts to look optimistic, and I become the bull while most everyone else is negative. If you don’t think this can’t happen, just look at Meta (META) or Netflix (NFLX). Alphabet might fair better, but they won’t be immune if they disappoint.

Conclusion

Alphabet is such a great company we don’t really have to discuss the business much here. The problem with Alphabet stock isn’t the company as much as it is the unrealistic expectations the market has placed on it. Once Alphabet’s earnings normalize in a post-stimulus economy, I have high confidence they will grow at mid-teens levels for a long time. So, for those of us who like to get above-average returns from our investments, the question is how low Alphabet’s earnings might fall over the next 12-18 months. I think they are likely to fall far enough that it’s worth waiting 6-7 months to see what they fall to, and then hope that the market starts to overshoot to the downside so I can buy the stock with a margin of safety. And for current owners, there is likely enough downside potential to at least lighten up one’s position.

Be the first to comment