Joe Raedle/Getty Images News

A Quick Take On TXO Energy Partners

TXO Energy Partners (TXO) has filed to raise $100 million in gross proceeds from the sale of its common units of limited partner interests in an IPO, according to an amended registration statement.

The firm acquires and operates conventional oil and gas extraction sites in the Permian and San Juan Basins in the United States.

Given the firm’s prospects and positioning as well as its proposed IPO price, my outlook on the IPO is a BUY at up to $20.00 per common unit.

TXO Energy Overview

Fort Worth, Texas-based TXO Energy Partners, L.P. was founded as MorningStar Partners, L.P. to acquire, develop and produce oil & gas products from conventional formations in the Permian and San Juan Basin areas of the U.S.

Management is headed by MorningStar Oil & Gas, LLC Chairman and CEO Bob R. Simpson, who was previously Chairman of Southland and Chairman and CEO of XTO until it merged with Exxon for $41 billion.

As of September 30, 2022, TXO has booked fair market value investment of $549.5 million from investors including Global Endowment Management and Luther King Capital Management.

According to a 2022 market research report by GlobalData, the USA Permian Basin crude oil and condensate production capacity is an estimated 5 million barrels per day and natural gas capacity is approximately 19.9 million cubic feet per day.

It is the largest oil-producing basin in the U.S. and is primarily located in the state of Texas.

Also, management aims to focus its exploration efforts on low-risk, low-decline rate formations funded by cash flow from operating activities.

The firm expects its annual development budget to be approximately $30 million for 2022 and 2023.

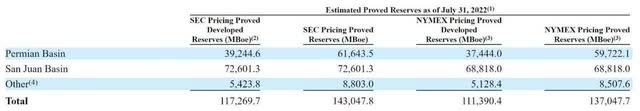

Below are the firm’s estimated oil and natural gas reserve metrics:

Major competitive or other industry participants include:

-

Chevron (CVX)

-

Exxon Mobil (XOM)

-

Occidental Petroleum (OXY)

-

ConocoPhillips (COP)

-

Pioneer Natural Resources (PXD)

-

Chesapeake Energy (CHK)

-

Devon Energy (DVN)

-

EOG Resources (EOG)

-

Endeavor Energy Resources

-

Marathon Oil (MRO)

-

Coterra Energy (CTRA)

-

Continental Resources

-

Laredo Petroleum

TXO Energy Partners Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Variable gross profit and gross margin

-

Fluctuating operating profit

-

Growing cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Nine Mos. Ended September 30, 2022 |

$ 204,038,000 |

46.9% |

|

2021 |

$ 228,344,000 |

109.9% |

|

2020 |

$ 108,764,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Nine Mos. Ended September 30, 2022 |

$ 110,077,000 |

18.2% |

|

2021 |

$ 159,088,000 |

166.8% |

|

2020 |

$ 59,618,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Nine Mos. Ended September 30, 2022 |

53.95% |

|

|

2021 |

69.67% |

|

|

2020 |

54.81% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended September 30, 2022 |

$ 1,394,000 |

0.7% |

|

2021 |

$ 44,190,000 |

19.4% |

|

2020 |

$ (155,300,000) |

-142.8% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Nine Mos. Ended September 30, 2022 |

$ 14,613,000 |

7.2% |

|

2021 |

$ 52,475,000 |

25.7% |

|

2020 |

$ (163,238,000) |

-80.0% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended September 30, 2022 |

$ 103,668,000 |

|

|

2021 |

$ 73,726,000 |

|

|

2020 |

$ 18,964,000 |

|

(Source – SEC)

As of September 30, 2022, TXO had $11.1 million in cash and $352.4 million in total liabilities.

Free cash flow during the twelve months ended September 30, 2022, was $121.8 million.

TXO Energy Partners’ IPO Details

TXO intends to sell 5 million common units representing limited partner interests at a proposed midpoint price of $20.00 per common unit for gross proceeds of approximately $100 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing common units at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $633 million.

The float to outstanding units ratio (excluding underwriter options) will be approximately 16.7%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

to repay a portion of the amounts outstanding under our revolving credit facility

(Source – SEC)

Management’s presentation of the company roadshow is available here until the IPO is completed.

Regarding legal proceedings, management says ‘it is remote that pending or threatened legal matters will have a material adverse impact on our financial condition.’

Listed underwriters of the IPO are Raymond James, Stifel, Janney Montgomery Scott and Capital One Securities.

Valuation Metrics For TXO Energy

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$600,000,000 |

|

Enterprise Value |

$632,952,000 |

|

Price / Sales |

2.04 |

|

EV / Revenue |

2.16 |

|

EV / EBITDA |

24.61 |

|

Earnings Per Unit |

$1.36 |

|

Operating Margin |

8.77% |

|

Net Margin |

14.25% |

|

Float To Outstanding Units Ratio |

16.67% |

|

Proposed IPO Midpoint Price per Unit |

$20.00 |

|

Net Free Cash Flow |

$121,803,000 |

|

Free Cash Flow Yield Per Unit |

20.30% |

|

Debt / EBITDA Multiple |

1.71 |

|

CapEx Ratio |

15.18 |

|

Revenue Growth Rate |

46.86% |

(Source – SEC)

Commentary About TXO Energy Partners

TXO is seeking U.S. public capital market investment to pay down its credit facility debt.

The firm’s financials have generated increasing topline revenue, fluctuating gross profit and gross margin, variable operating profit and higher cash flow from operations.

Free cash flow for the twelve months ended September 30, 2022, was $121.8 million.

The firm currently plans to pay cash distributions to unitholders on a quarterly basis and provided the following distribution history information in its S-1:

Pro forma cash available for distribution generated during the year ended December 31, 2021, and the twelve month period ended September 30, 2022, was approximately $89.6 million and $133.0 million, respectively.

The company’s trailing twelve-month CapEx Ratio was 15.2, which indicates it has spent a relatively low amount on capital expenditures as a percentage of its operating cash flow.

The market opportunity for conventional production from the Permian and San Juan Basins is substantial owing to the large and still-untapped resource pools contained in those formations.

Raymond James is the lead underwriter, and there is no performance data on IPOs led by the firm over the last 12-month period.

The primary risk to the company’s outlook as a public company is the recently volatile pricing environment for oil & gas products as a result of the COVID-19 pandemic followed by the war in Ukraine.

Additionally, the regulatory environment for oil & gas production in the U.S. has been uncertain and subject to changing political efforts.

TXO will essentially be a limited partnership dividend distribution play for investors interested in receiving dividends out of its operational profits.

The current free cash flow yield per unit of 20.3% over the trailing twelve-month period is quite impressive and likely due in large part to the strong rise in oil & gas prices as a result of the Ukraine war.

As for valuation, given the high degree of volatility in energy prices in recent years, it is difficult to determine a valuation based on pricing assumptions.

The firm is currently generating a free cash flow yield of 20.3%, given current volume and pricing assumptions.

Going forward, it is anyone’s guess as to whether these assumptions will be met.

However, the prospect of a ‘China reopening’ after its government scrapped failing ‘Zero-COVID’ policies and the increasing potential for a ‘soft landing’ in the U.S. suggests that prices for oil & gas products may rise in the quarters ahead.

Given the firm’s prospects and positioning as well as its proposed IPO price, my outlook on the IPO is a BUY at up to $20.00 per common unit.

Expected IPO Pricing Date: January 26, 2023.

Be the first to comment