jetcityimage/iStock Editorial via Getty Images

Introduction

This is the fourth episode of a series that I introduced in my article: “Learning From Buffett About Investing In Railroads: The BNSF Case Study”.

I highly recommend reading it because it explains thoroughly what I have found out about the way Warren Buffett thinks about the railroad Berkshire owns. I have outlined the general mind-frame of the Oracle of Omaha and what we can learn from him as we assess the publicly traded railroad companies.

This series is attempting to look at railroads exactly from the perspective of Warren Buffett, which, as we are seeing, takes into account a certain number of factors that are not always the first ones to think about.

For those interested in reading the previous episodes, here are the links:

- Looking At Railroads As Mr. Buffett Does: Canadian National Railway

- Looking At Railroads As Mr. Buffett Does: Canadian Pacific

- Looking At Railroads As Mr. Buffett Does: Norfolk Southern

For this third episode, we will move to the East Coast and we will consider CSX Corporation (NASDAQ:CSX).

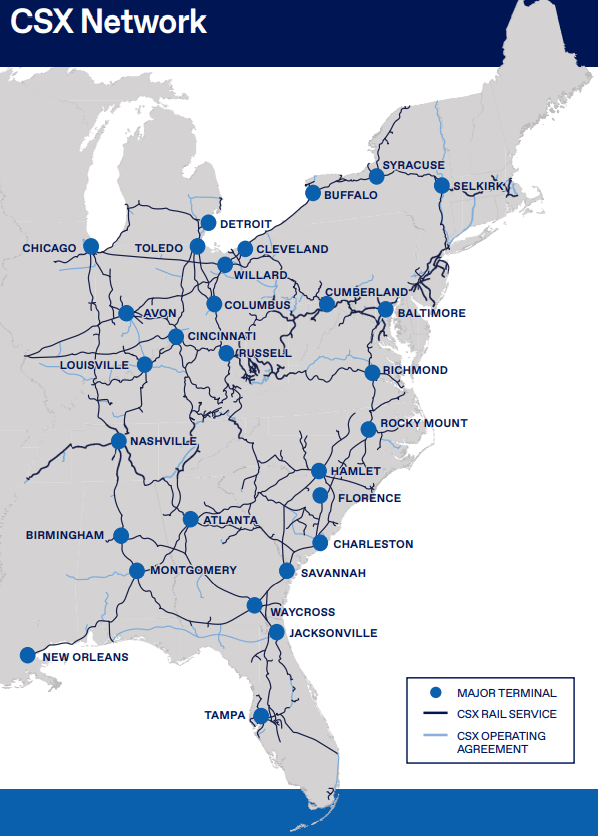

The company

CSX Corporation is one of US’s leading transportation suppliers, providing rail-based transportation services, including traditional rail service and the transport of intermodal containers and trailers. Its rail network encompasses approximately 19,500 miles of track and connects 23 states, the District of Columbia, and the Canadian provinces of Ontario and Quebec. A very important fact is that CSX serves some of the largest population centers in the nation, with nearly two-thirds of Americans living within its territory, as we can see from the map below.

CSX 2021 Annual Report

CSX and Norfolk Southern (NSC) make up the duopoly that controls rail traffic between the east coast and the Mississippi River. However, CSC has an advantage over Norfolk provided by its network in Florida, where Norfolk reaches only Jacksonville. Florida is the fourth largest economy in the U.S., as a consequence, CSX has a significant advantage over its peer by being the only railroad that serves the whole state. Another difference between the two networks is that CSX’s is closer to the coast, thus reaching better some ports. On the other hand, Norfolk has a network that runs closer to the Appalachian Mountains connecting more directly the route that goes from Atlanta to Richmond.

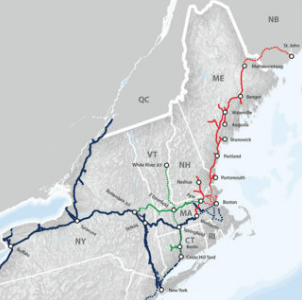

The company just expanded north its network, with the $601 million acquisition of Pan Am Systems that was approved in April and completed in June. Through this operation, CSX strengthens its network in New York, Connecticut and Massachusetts, while adding Vermont, New Hampshire and Maine to its network, as shown in this map.

Railway Age website

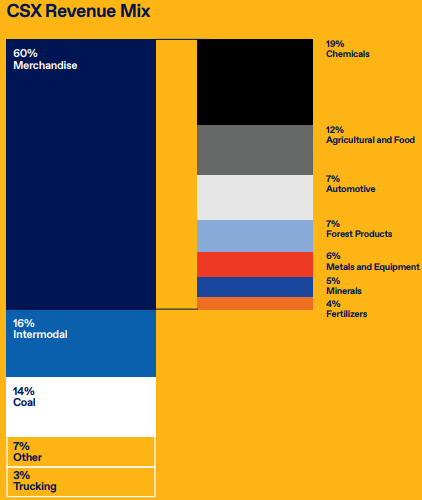

Let’s move on to the revenue mix. At the end of 2021, CSX reported a revenue of $12.52 billion. As we can see from the revenue breakdown below, CSX, too, is exposed to coal, which accounts for 14% of total revenues. This is higher than Norfolk. Both railroads have similar sources of revenues, with CSX being a bit more exposed to chemicals and to agriculture, forest and fertilizers, which, summed up together, make up 23% of CSX’s revenue versus 19% of Norfolk. On the other hand, Norfolk is a bit more exposed to metals and constructions (13% of revenue versus 6% for CSX).

CSX is focusing on chemicals and its acquisition of Quality Carriers, the largest liquid bulk chemicals trucking carrier in North America that operates over 2,500 trucks and 6,400 trailers, enabled it to offer shippers the first integrated intermodal chemical transportation solution of its kind.

A bigger difference can be found for intermodal. While this has a 30% weight on Norfolk’s revenue, it makes up only 16% for CSX. It would be interesting to know in the comments how SA readers view this point since there are opposite views on intermodal volume.

CSX 2021 Annual Report

In the first six months of 2022, the largest change in the revenue mix came from coal, whose revenue increased 47% from $807 million to $1.18 billion. This made coal’s weight on the total revenues of $7.23 billion equal to 16.4%. On the other hand, chemicals’ volume decreased due to lower shipments of crude oil, while its revenue did increase 8% but reduced their weight on total revenues, moving down to 17%. Intermodal remained pretty much flat at 15.6%.

Earning Power

Railroads are capital intensive businesses. While Buffett was young he used to keep away from these businesses. However, he came to understand that this is not per se a problem, if the company has enough earning power. What does Buffett mean with this? He wants to be sure that the company is able to earn enough money to cover its interest requirements in any economic condition. How is interest coverage calculated? The answer is quite simple: it is the ratio of pre-tax earnings/interest. Pre-tax earnings is calculated by subtracting the operating and interest costs from the gross profit. For CSX this number was $4.5 billion in 2021. With an interest expense of $722 million, the ratio is 6.2, which is in line with Canadian Pacific (CP) and Norfolk Southern. So far, we have seen that Canadian National (CNI) is the best performer with a ratio of 10.4. However, we do have to say that even a 6 is not worrisome at all since it allows the company to have an 83% drop in earnings before becoming unable to cover its interest expense. Of course, such a drop would be a huge disaster, but it is unlikely to happen even during a recession, given the growing need for freight and transportation.

However, over the past six months the company doubled YoY the cash it used to repurchase shares from $1.25 billion in 2021 to $2.52 billion this year. This caused a significant drop in free cash flow at the end of the six months compared to the first six months of 2021. The average cost per share repurchased seems to me a bit high at $33.15. While I really like share buybacks, I am watchful when they take place when the stock trades near its ATHs. However, we do have to acknowledge that, unlike Norfolk Southern, CSX is not using debt to fund its buybacks, because it has actually been paying down its debt in the past quarters.

Efficiency

Railroads are businesses that have a long history, reaching back almost 200 years for some companies. This is an industry that moves at a slow pace, with a lot of investments but a considerable moat. Furthermore, it has been able to go through very different economic environments without being wiped out. Mr. Buffett stress this a lot, writing more than once in his shareholder letters that his BNSF will be here 100 years from now. This consideration leads us to think about investing in railroads as a long-term investment. Thus, when we analyze a railroad, we have to consider its results over a long period of time to get the grasp of how the company behaves and performs. Mr. Buffett’s thought process ends up in assessing a company’s efficiency in order to understand whether it can compound well or not. This is why we will look at some metrics over a ten year time frame.

The key metric here is the operating ratio. The lower, the better. CSX reported an operating ratio of 55.4% in Q2 2022, while it was at 55.3% at the end of 2021. Its main competitor Norfolk Southern performs worse with a 60.1% operating ratio, close to Canadian Pacific’s 59.5% and Canadian National’s 59.3%.

In the recent months, fuel costs grew a lot for railroads, hurting margins and free cash flow. However, many analysts expect to see from Q3 the benefit of fuel surcharges. To state the truth, CSX seems ahead of some of its peers regarding fuel surcharge revenue which more than doubled YoY from $260 million in 2021 to $635 million this year. This increase was able to cover almost completely the total locomotive fuel expense of $651 million, leaving uncovered the $126 million of non-locomotive fuel expense.

I think one of the strategies CSX adopted to save on fuel was to reduce train velocity, which was decreased 15% from 17.9 mph in 2021 to 15.3 mph this year. This also leads us to fuel efficiency. It barely increased from 0.96 US gallon per 1,000 GTMs to 0.97. Here CSX is in line with Canadian Pacific, and performs better than Norfolk’s reported 1.11 gallon per 1,000 GTMs. The leader remains Canadian National with its 0.84.

The company owns more than 3,500 locomotives that have an average age of 22 years, better than Norfolk’s 26.7 years. This is a key metric to understand that, so far, CSX has invested more than Norfolk in renewing its equipment, thus obtaining a better efficiency.

Use of capital: return on investments and shareholder return

Warren Buffett has stressed it many times that a company needs to be able to earn a decent return on the capital employed. Unlike its Canadian peers, both Norfolk Southern and CSX do not disclose their ROIC. However, if I calculate it using the formula (NOPAT/invested capital) I get a 15.4% for CSX, which is above Norfolk’s 14% and Canadian National’s 14.1% while it is below Canadian Pacific’s 16.7% (prior to the Kansas City Southern acquisition, which brought the ROIC down to 8.2%). A 15.4% ROIC is good and this is positive for this company and its investors.

We also know the company targets at keeping capex around $2 billion, which is around 15% of the forecasted revenue for 2022. This ratio is quite acceptable and it is aligned with the industry.

Present and future cash flows

While CSX revenues have been somewhat flat over the past decade, with the exception of 2022 which is forecasted to gross above $14 billion, the gross profit has steadily increased at a CAGR of 3.92%. The operating income has grown more rapidly at a CAGR of 4.19% and the net income has seen a CAGR of 7.33% from 2012 to 2021. This shows that the company has become more and more efficient. The result can be seen in its growing free cash flow which moved up from $629 million in 2012 to $3.17 billion at the end of last year which translated into a 17.55% CAGR. This translates into a free cash flow yield of 6% that has clearly fostered cash distributions where the payout ratio has remained low (it currently is at 22.15%). With a dividend yield of 1.24%, there is ample room for the company to increase without damaging its financials.

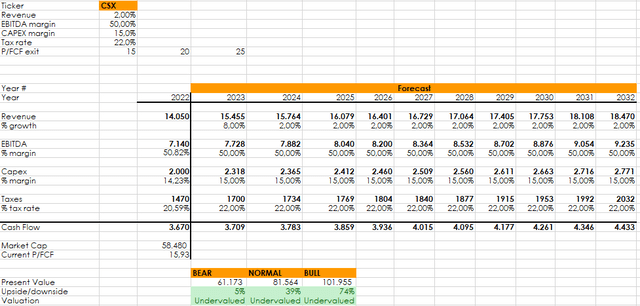

As we learned from Mr. Buffett, we have to give a valuation of the company based on its future cash flows. Here below is a simple discounted cash flow model that projects the future cash flows of CSX and sets three possible scenarios based on price/free cash flow multiple exits.

I plugged in the numbers I am expecting for this year based on the 1H results and the management’s guidance. I have also assumed that next year’s revenues will grow more thanks to the new 500 employees in training, the surge in coal and the acquisitions the company completed. Afterwards, I assume a constant revenue growth of 2% which may actually seem a bit generous given the past decade.

The EBITDA margin is assumed to be at 50%, in line with the industry average, while I chose a 15% capex on revenue according to the current data available from the company.

Based on the three possible exit multiple, the company is undervalued. It is pretty similar to the result we had for Norfolk Southern. However, I warned about this company that this model stretches into the future the metrics the company has gotten us used to in the past decade where it has been focused on free cash flow while reducing other expenditures. It was to be seen if the choices taken by Norfolk Southern will make the company more profitable over the long term. On the other hand, CSX has proven to be more reliable as per investments, efficiency and financials, making it a more interesting investment, in my opinion, over its peer. This is why I rate the stock as the one to buy to gain exposure to the East Coast.

Be the first to comment