piranka

The Chinese Fintech industry is forecasted to grow with the Digital Assets vertical expected to spearhead the charge with growth of a blistering 50.7% expected in 2023 alone. The People’s Bank of China has even released its Fintech Development Plan for 2022-2025. AMTD Digital (NYSE:HKD) is a fintech software, investing, and consultancy company that is poised to benefit from these trends across fintech growth and digital transformation in China. The company was founded in 2019 by Calvin Choi, an ex-UBS investment banker who is well-connected in the financial industry.

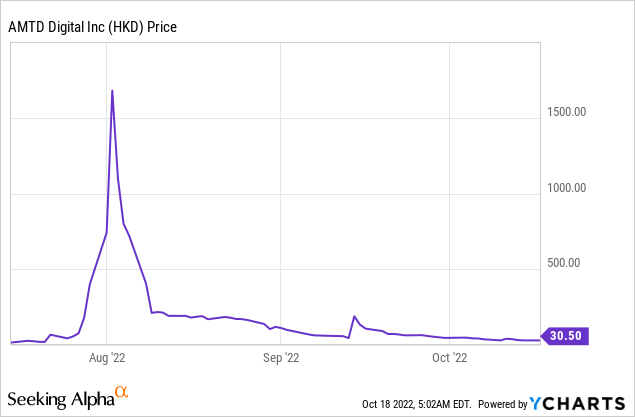

AMTD Digital has its IPO in July 2022, and the stock price surged by a blistering 21,000% by August. This gave the company a market capitalization of ~$300 billion which made it larger than companies such as Coca-Cola and Costco. With revenue of just $25 million, you can imagine this bubble didn’t last long and the stock price came crashing down. It was thought that currency traders may have confused the HKD ticker symbol with the Hong Kong Dollar. Despite this rollercoaster start the company is fairly unique and thus I’m going to break down the business model, financials and valuation. Let’s dive in.

Digital Business Model

AMTD Digital is a company that provides digital services to clients mostly in the financial industry. Its flagship software is called AMTD SpiderNet which it leverages across its four main services;

- Digital Financial Services

- Digital Media, Content & Marketing

- SpiderNet Ecosystem Solutions

- Digital Investments

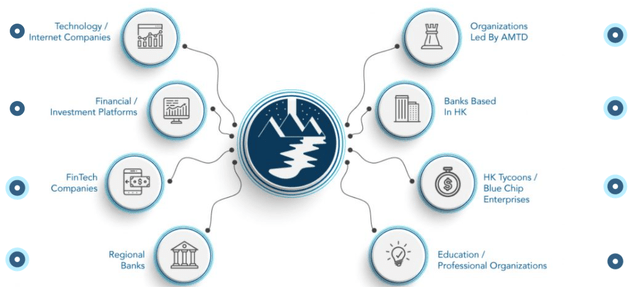

The company provides digital financial services to both retail and corporate clients. The bedrock of the business is its “SpiderNet” ecosystem which connects tech companies with Hong Kong-based banks and blue-chip enterprises. It has a range of digital financial licenses that it can leverage to help its clients. This can also be thought of as a competitive advantage as sometimes certain financial licenses in Asia can be scarce.

AMTD SpiderNet (Investor Relations)

Its SpiderNet ecosystem also acts as a “superconnector” that can connect entrepreneurs and corporate businesses with capital, technologies, and even mentorship. This service is vital for businesses that are going through a digital transformation and require consultancy.

The Digital Transformation industry is seeing a “quantum leap” in China. It is forecasted to grow at an 18.9% compounded annual growth rate between 2022 and 2025. Financial companies are spearheading this growth but companies in the manufacturing industry are forecasted to follow.

AMTD’s Digital Investment arm invests directly in businesses that can further complement the SpiderNet ecosystem. The business has established a S$50 million (Singapore dollar) fund with the Singapore FinTech Association.

Stable Financials

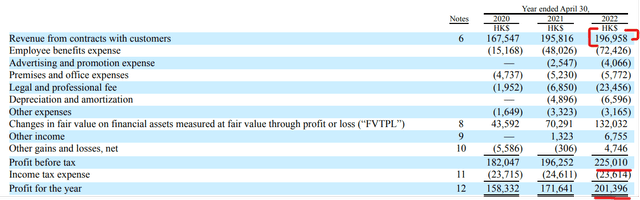

As a Chinese company that has had a relatively recent IPO with a complex structure, the financial data is fairly scarce. Its latest SEC filing is dated August 30th 2022, but this is for the year-end of April 2022. Therefore this is all we have to go on so far. Revenue from contracts with customers was HK$ 196,958 (Hong Kong Dollar in thousands) or $25.1 million (US Dollars). This was up a rapid 17% from the HK$ 167,547 (thousands) or $21.4 million generated in 2020. However, year-over-year revenue has been pretty much flat with only a slight increase.

Working our way down the income statement one of the largest expenses is an employee benefits expense of HK$72.4 million, which is fairly substantial. There is also a fairly high amount of legal and professional fee expenses HK$ 23.5 million. The good news is the company benefited from a substantial boost in the fair value of its financial asset investments. This resulted in a jump from HK$70.3 million in 2021 to HK$132 million by 2022, up a rapid 88% year over year. This looks to have been a key fact in driving business profit for the year of 2022 HK$ 201.4 million ($25.7 million) which was up a rapid 17% from HK$172 million ($21.9 million) in 2021. Amazingly this was higher than the business’s entire revenue from contracts which was $25.1 million.

AMTD Digital had a solid balance sheet with $53 million in cash and cash equivalents and $396 million in total net assets by April 2022. With virtually no interest-bearing debt.

Post-IPO, the umbrella holding company AMTD IDEA Group (AMTD) announced the “injection” of AMTD Assets into AMTD Digital. This business has a portfolio of properties with a fair value of approximately $500 million. Therefore AMTD Digital now has a total net asset position of approximately $660 million.

Valuation?

As the financial data is fairly limited at the moment and the business model is fairly unique, we will only look at a few simple measures of valuation. As Billionaire Investor Warren Buffett would say “I would rather be approximately right than precisely wrong”.

Here is what we can estimate if the business has net assets of $660 million and a market capitalization of $5.64 billion. We can estimate its Enterprise Value [EV] is ~$5 billion ($4.98b). Usually, when calculating Enterprise Value we just plus debt and minus cash but in this case, I will use net assets.

Therefore we can reason that the business is trading at an EV/Sales = $4.98 Billion/$25.1 million = 262, which isn’t exactly “cheap” by any measure. However, as the business generated earnings before tax of $28.7 million (as its investment portfolio increased) we can assume its EV/EBIT = $4.98 billion/$28.7 million = 173 which is better but still not cheap.

Even if we assume that the business generated slightly higher profits +17% again in the year so far, this would still not materially impact the valuation.

Risks

Lack of Disclosure

A lack of full financial disclosure is not uncommon among Chinese companies listed in the USA. I don’t believe the business is hiding anything personally but we just don’t have the full financial data to truly value the business. Looking at the data we do have the stock is egregiously overvalued. But the business could have a few tricks up its sleeve through investment portfolio companies so I wouldn’t rule them completely out.

China Risk/Delisting

It really does seem strange for the company to IPO on the New York Stock Exchange, when we are currently going through a time when the SEC has announced plans to boot Chinese companies off the exchange if they don’t comply with US accounting standards.

Final Thoughts

AMTD Digital has a strong brand, best-in-class technology, and many connections across China’s financial services industry. However, there is still a lack of full information from a financial perspective on the business and the data we do have says the stock is overvalued.

Be the first to comment