Pgiam/iStock via Getty Images

Wealth-Building Goals

To achieve financial goals and live the life I desire for me and my family, my long-term investing approach is to assemble a portfolio of high-quality, currently out-of-favor, low PE companies and wait for things to return to normal to earn market-beating returns over time.

Portfolio Principles for the Long Term

To achieve this goal, a written set of guiding principles can help maintain discipline and focus during rocky market conditions. Here are few for consideration:

1.Valuation always matters: maintain the discipline to identify what shares are worth compared to that company’s own history.

2. Avoid valuation mistakes: the idea is that a company returns to its normalized valuation over time. When an investor pays market prices well above historical norms, they are simply asking for trouble.

2. Monitor holdings: Be willing to rotate into new names if a stock becomes materially overvalued.

3. Be patient: measure holding periods in months and years, not days and weeks.

4. Earnings matter: do not be lulled into momentum, popular stocks that don’t earn profits.

The Thesis Here

Never cheap on a price-to-earnings basis, the thesis here is that J&J Snack Foods (NASDAQ:JJSF) is not especially attractive at current price levels. The current PE is well above historical norms, and there are risks of continued inflationary margin pressures.

Patient value investors — people who desire to build a portfolio on companies with stellar balance sheets and unblemished histories of earnings growth — should look elsewhere at these levels.

What to Expect from This Article

This article has three goals: 1) Summarize the company and recent performance relative to the stock market; 2) Describe company activities relevant to the thesis; 3) Provide a valuation estimate based on the company’s own historical performance.

Company Description

If you like soft pretzels, Minute Maid juice and Icees (along with a huge list of other name brand products), then you know the company.

J&J Snack Foods manufactures nutritional snack foods and distributes frozen carbonated and juice beverages mainly in the United States, Mexico and Canada. It sells to snack bars, food stands, fast food operators, stadiums, sports arenas, warehouse club stores, schools, colleges, movie theaters, and others. In addition, it sells various food products through a chain of specialty snack food retail outlets.

Relative Stock Price Performance

Over the past year, the company stock price has held up relatively favorably (key word here: relatively). One year ago the stock price was $153 per share, and today the stock price is around $139 per share.

JJSF 1-year Stock Performance (Yahoo! Finance)

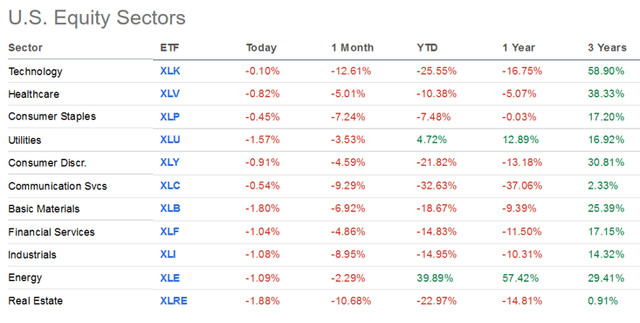

As a Consumer Defensive stock in the Packaged Foods sector, the stock has compared favorably to the one-year performance of the equity sectors.

Equity Sectors Performance (SeekingAlpha)

Reasons the Stock Price is Down

Anyone who has been to the grocery store during the past 6 months will understand why the company is experiencing margin pressure. Have you noticed the price of flour, meat, eggs, oils, and chocolates lately?

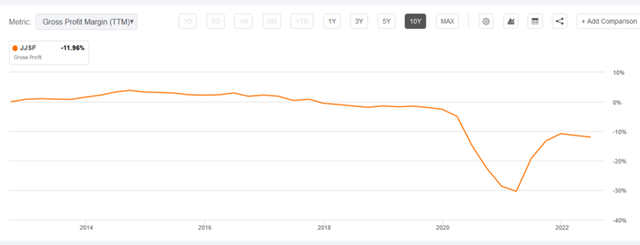

Turns out those are the primary ingredient raw materials for company products. While the company delivered decent top-line results recently, margins continues to feel significant pressure.

Note the recent margin performance compared to the past 10 years. No doubt this continued pressure has dampened investor enthusiasm – particularly since there is no clear signal inflationary pressures will be easing any time soon.

Gross Margin 10 year history (SeekingAlpha)

Catalysts for an Improved Outlook

While raw material inflationary impacts are headwinds for the coming quarters, the company is taking actions to improve the situation:

1.Pricing strategies to offset higher input costs. The company reports a number of efforts to adjust pricing across product lines. However, the positive impact will likely not reach the bottom line for several quarters.

2. Dippin’ Dots acquisition. The company bought the tasty treat company for $222 million, and the move is expected to be accretive to earnings over time.

A Look at Company Earnings and Stock Price

For patient value investors, the key question is valuation. The valuation measure I favor is based on a review of the price-to-earnings ratio relative to that company’s own historical norm.

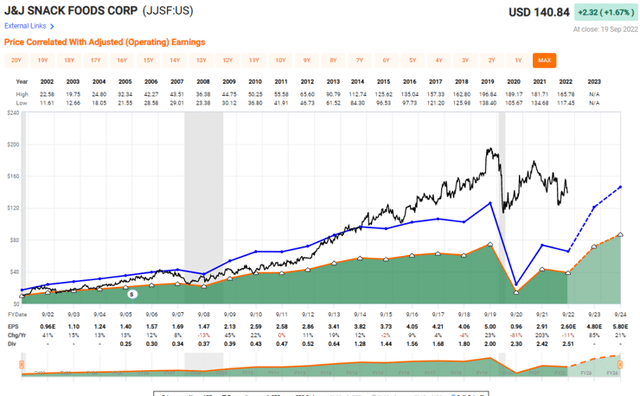

The basis of this valuation method is that a company needs a reasonably steady history of growing earnings over longer periods of time. Check out the graphic below.

The black line represents the stock price over time. The orange line represents earnings growth, and the blue line is the company’s own normal PE ratio for the time period.

Note how the stock price generally followed the earnings growth until around 2011-2012. The stock price then began to accelerate beyond earnings growth, resulting in PE expansion.

JJSF Long Term Earnings History (FastGraphs)

Never cheap with a long-term normalized PE of 25.23X (except the Covid washout), decreased earnings estimates suggest a current PE around 48X. This can be visualized by reviewing the relationship between the black line (stock price) and orange line (earnings) on the chart above.

So What Are Shares Worth?

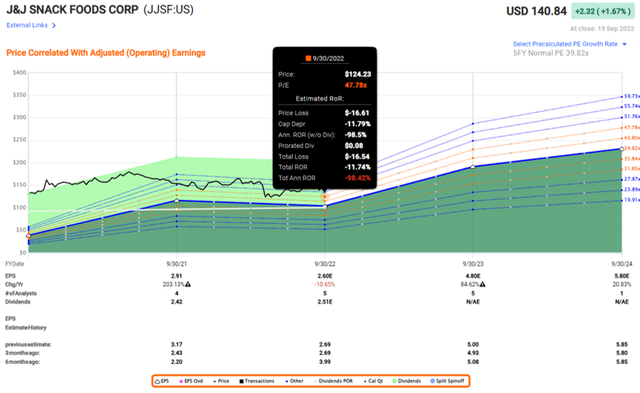

And therein lies one of the current challenges with J&J Snack Foods stock.

Not only is it a challenge to reasonably normalize earnings at this stage, it is difficult to ascertain what a normal multiple might be to arrive at a confident valuation.

Given the shorter-term inflationary pressures discussed above, analysts continue to expect margin pressure for the coming year or so. While top line growth will likely continue at moderate rates, margin compression is expected to result in lower earnings per share.

Remember, the idea is to derive a reasonable valuation by estimating earnings and applying the company’s own normal multiple.

With so many gives and takes, even applying a generous adjusted PE of 47X with expected earnings at $2.60 suggests a valuation of perhaps $124-$130.

To derive a valuation much higher than that requires confidence that the company will, in fact, restore earnings to previous levels over the next 12-24 months.

With all of the uncertainties in this inflationary environment, normalized EPS may be some time away.

Parting Thoughts

Of course the key question is whether earnings will be constrained to this level or if earnings will normalize faster than expected in the coming 1-3 years.

For what it is worth, for conservative patient value investor-types like me, I prefer to wait on the sidelines unless the situation is more obviously a sweet deal.

Sticking with my lame company-related food metaphor, at current pricing, given the earnings challenges and an abnormally high PE relative to historical norms, investors will likely feel salty if they initiate a position at these levels.

Thank you for reading this article.

Be the first to comment