Alex Wong

Buy wonderful businesses at good prices. That sounds like a great idea, and indeed it is. Wonderful businesses are often thought of as profitable firms. They’re large and robust enough to resist the vicissitudes of the market. They’re prudent enough to invest conservatively, and they frequently recognize their shareholders through dividend distributions. As Warren Buffett himself says, time is the friend of a wonderful business. If you hold onto wonderful businesses for long enough, they’ll compound many times over and reward you handsomely.

The Invesco S&P 500 High Dividend Low Volatility ETF (NYSEARCA:SPHD) contains a number of firms that Buffett himself personally invests Berkshire money into. Chevron (CVX), Kraft Heinz (KHC), Coca-Cola (KO), U.S. Bancorp (USB), and Verizon (VZ) are a few well-known names. Dividend growth investors will also notice Altria (MO), AbbVie (ABBV), IBM (IBM), and many other companies within SPHD. It may be tempting to set aside part of your paycheck every month, buy all of these wonderful businesses via this ETF, and let time do the work for you – for a small fee.

If this game plan sounds too good to be true, well, that’s probably because it is. SPHD is not the market’s hidden secret, and it may not even deserve a spot in your portfolio.

What Is Inside SPHD?

SPHD is an index fund. That’s already quite a departure from classical value investing and “buying what you know”. You’re tracking the S&P 500 Low Volatility High Dividend Index, which contains 50 of the highest dividend-payers in the S&P 500. You’re putting a lot of trust into S&P to do your active management for you. But, Standard & Poor’s is reliable, Invesco is a behemoth in the index fund industry, and your money is being invested into name-brand companies. You’re not likely to lose money in the long run. Good start.

You’d be paying 0.30% in fees, which seems a bit high for 50 stocks, but you could be doing a lot worse with a typical actively managed fund. Annual portfolio turnover is 28%, but I would not expect costs to be material considering everything in the S&P 500 is liquid.

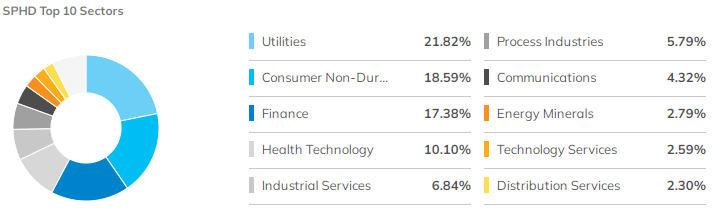

SPHD prefers boring but profitable sectors like utilities and finance. Still, its sector diversification is reasonable. We can expect this diversification in the long term because by the underlying index’s own rules, no one sector can represent over 25% of the portfolio.

SPHD’s sector diversification is acceptable. (ETF.com)

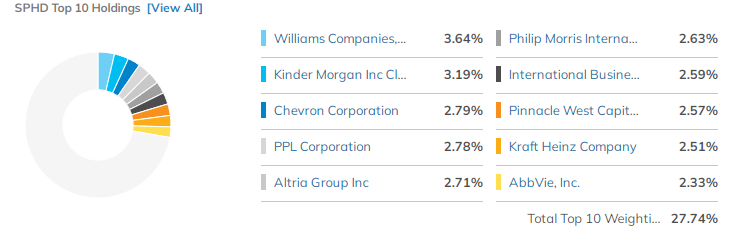

Weights of individual securities are determined by their trailing-twelve-month dividend yield. For the most part, though, I think it’s easier to visualize SPHD as an equal-weight ETF. In an equal-weight portfolio, we’d expect the top 10 of 50 stocks to constitute 20% of the portfolio. In SPHD’s case, it’s around 28%.

SPHD is not concentrated in any one security. (ETF.com)

Lastly, I want to talk about academic risk factors. Asset pricing models have been developed to explain the differences in returns between diversified portfolios. The statistics behind factor science is a hotly debated topic and can be quite mathematically dense. Nevertheless, I believe that factor regressions are useful to intuitively understand what a fund is doing.

Investors like to think of Buffett’s portfolio as consisting of large, profitable companies. These stocks are cheap. “Quality” is a word that gets thrown around a lot in value investing. We see all of these traits in factor regressions in the form of their academic definitions.

A 2018 paper suggests that Buffett’s returns are largely due to excess exposure to the “quality” and “bet against beta” factors. Basically, they’re coming from robust companies that don’t fluctuate with the market. We’d hope to see similar traits in SPHD, and as expected, we do.

Portfolio Visualizer’s AQR factor regression for SPHD covers nearly 10 years of data. SPHD does appear to invest in quality companies that bet against beta, but interestingly, SPHD is slightly short momentum. I think this might be attributable to some large cap firms finding their way into the index after a period of underperformance.

Even in light of momentum, SPHD’s factor exposure is impressive and sets up the fund for long-term outperformance relative to the S&P 500. Everything else looks fine as well. I still don’t like SPHD, though.

My Problems With SPHD

S&P is clear that their index is meant for income-seekers. They say so on their website.

“The index is designed to serve as a benchmark for income-seeking investors in the U.S. equity market.”

SPHD gives the illusion of passive indexing, but there is a lot of active management behind the scenes. According to S&P, the 50 lowest share price volatility stocks of the top 75 dividend payers from the S&P are selected for the index. In effect, this is a quant screen, and I don’t think it’s a particularly good one. Using 50 and 75 as your numbers are convenient, but they’re ultimately arbitrary. Also, dividends are prioritized over volatility, which strikes me as an odd choice. Many income seekers prefer low volatility over high dividends, and they won’t find that with SPHD.

I also argue that 50 stocks are far too concentrated to guarantee investment results. William Bernstein provides a compelling argument in his article “The 15-Stock Diversification Myth”. While you are able to reduce your volatility by owning a small number of stocks, your returns are not assured. Invesco is not making any effort at all to ensure your total return, and S&P wasn’t trying to ensure your total return from the very beginning. While we expect high returns from our factor analysis, whether or not this plays out in practice is largely up to chance. After all, the promising factor results are in part due to the less promising portfolio’s concentration. Investors looking at this fund for total return would risk not having one of Bernstein’s super compounders, which decreases the reliability of their investment outcome. This does not seem attractive to a fixed-income investor.

Your dividend is also inconsistent. It depends on whatever corporate America feels like doing with their dividends. Since the fund’s inception, the average yield has been close to 4%. However, there is nothing stopping that yield from dropping below 4%.

Should You Buy SPHD?

Not really. In addition to my other gripes with SPHD, I don’t like the idea of restricting low volatility stocks to only dividend payers. There are many amazing low volatility stocks that don’t pay dividends – Berkshire Hathaway (BRK.A) is the obvious example. Limiting your opportunity set to just 50 businesses feels unnecessary.

SPHD, as well as its underlying index, comes off as a sly marketing trick to get dividend investors to pay for Invesco’s mutual fund fees.

To be clear, SPHD is not a bad fund. It’s not likely to blow up your retirement account. That’s pretty high praise for something that hails from the dark alleys of Wall Street. But, Wall Street knows that people love high dividends with low volatility. Invesco is happy to track an index (to keep their own costs low) but charge you 0.30% for something you probably don’t need.

If you’re a factor investor, then there are more intelligent ways to target factors. If you’re an index investor, then there are more diversified and lower cost index funds to choose from. If you’re a dividend investor, then you can find higher dividend yields or lower volatility elsewhere. If you’re a value investor, then you’d want to do your own fundamental analysis. SPHD doesn’t fit any of these niches.

When you think about low volatility, most people think about low risk. They don’t think about the systematic uncorrelation between empirical academic risk factors. They also don’t think about competitive advantages like moats. While standard deviation is the most apparent measure of risk we have, it has limitations. For complicated risk stories like with SPHD, understanding the many dimensions of risk is all the more important. I question whether income-seeking investors really want to jump into an investment that has so many hidden strings attached.

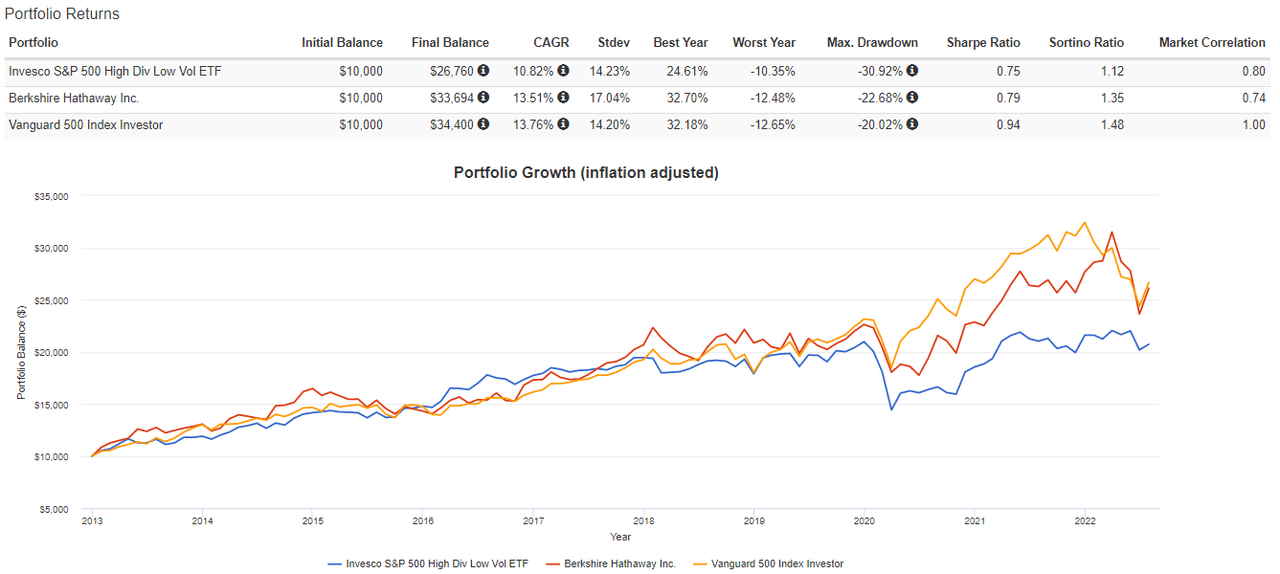

SPHD does not even always do what it says on the box. In fact, SPHD suffered a larger max drawdown over the last 10 years than the S&P 500 did. Ironically, you would have been better off avoiding “low volatility” during the 2020 flash crash. By comparison, Buffett’s investments over at Berkshire did just fine. Possibly, this is because Buffett didn’t rely on a quant screen when betting against beta, and instead created his own portfolio over decades of experience.

At least since inception, the fund advertised as low volatility had remarkably high volatility. This story does not help me sleep at night.

SPHD hasn’t been a low volatility ETF apart from its standard deviation. (Portfolio Visualizer)

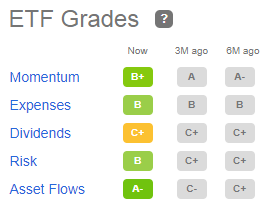

For what it’s worth, Seeking Alpha’s Quant gives SPHD a Buy rating. I’m giving it a Hold rating. Expenses are tolerable but not stellar, the risk is pretty low, and it pays a reasonable dividend. Asset flows into SPHD are on the rise, which can contribute to price momentum. I would guess this is because investors are fearing an upcoming recession and are flooding to large cap value stocks.

I mean, sure, now is a good time to buy if you want to benefit from some short-term price action, but this is largely immaterial to a buy-and-hold investor. I don’t advise making investment decisions based on what Quant says, even if I agree with Quant on the facts. Investors know thyself. I’m more passive of an investor than Quant is. You are also different from Quant in your own way.

Quant views SPHD favorably. (Seeking Alpha)

Find the Right Vehicle For You

Overall, I don’t think SPHD is a great investment for most people. If you want monthly cash flows, the safer option is to invest into Treasury bonds, covered call ETFs, or other income-producing investments that do a good job at producing income. If you want portfolio growth too, well, that’s the downside you accept as an income investor. There are no free lunches.

It is true that Buffett invests in some companies that are included in SPHD, but he does not invest in SPHD. If you want to invest like Warren Buffett, you may want to follow in his footsteps and become a value investor yourself. You’d read financial statements and do other value investor things. At worst, you can copy Buffett’s portfolio. This is actually not a bad idea.

If you want to invest like Warren Buffett but don’t want to put in the work, then SPHD is not the way to do it. Consider using a lazy ETF portfolio instead. I recommend the Buffett Portfolio: 90% S&P 500 index fund and 10% short-term Treasuries.

Be the first to comment