franckreporter

While screening for high-yielding funds, I came across the Simplify Volatility Premium ETF (NYSEARCA:SVOL) that is managed by noted market guru, Michael Green. Michael Green, or Professor Plum, as he’s known on Twitter, often opines on market structure and volatility, so I decided to dig a little deeper into the fund to see if it’s worth considering.

I believe the SVOL ETF is an interesting fund that investors who are bullish the markets (bearish on volatility) can consider adding to their portfolio. It offers a high distribution yield that is generally uncorrelated to other income-yielding assets such as bonds and REITs. Unlike prior iterations of short volatility ETFs that blew up in 2018, SVOL appears to be hedged for left tail risks by owning calls on long VIX products.

Overview

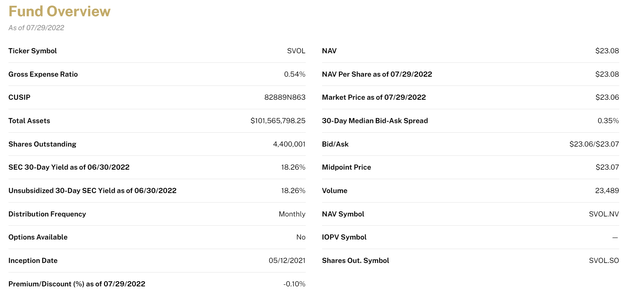

The Simplify Volatility Premium ETF is a fund that seeks to provide investment returns that correspond to 0.2x to 0.3x the inverse of the S&P 500 VIX short-term futures index while hedging extreme events. In other words, the fund profits when volatility is low but has hedges against Armageddon. As of July 29th, SVOL has $102 million in assets (Figure 1).

Figure 1 – SVOL Fund overview (Simplify ETFs)

Strategy

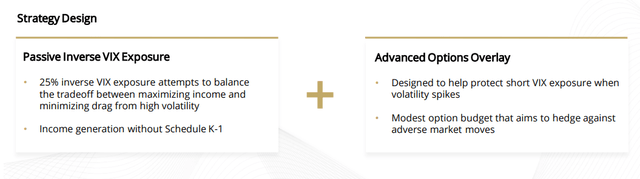

SVOL is designed to provide an income stream that is different from traditional income sources. The fund achieves its objective by shorting VIX futures while owning VIX calls to protect against adverse moves in VIX (Figure 2).

Figure 2 – Strategy Overview (SVOL Factsheet)

Fees

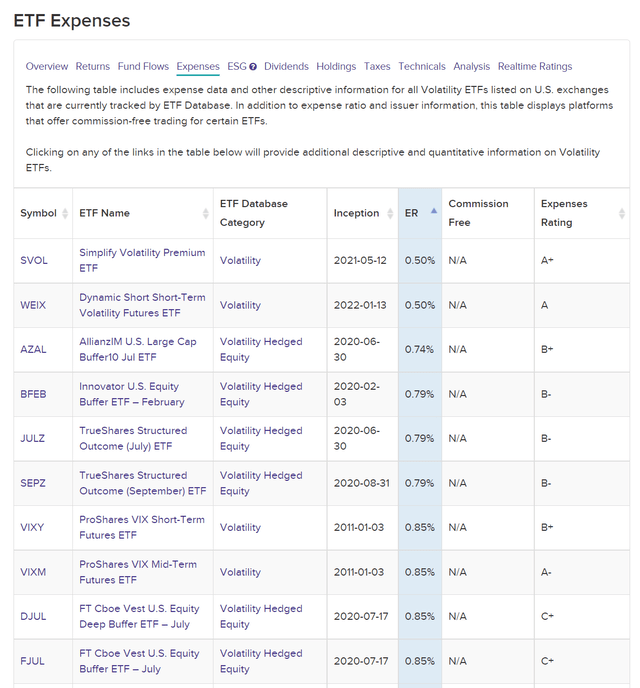

The Simplify Volatility Premium ETF is a relatively inexpensive fund, charging management fees of 0.5%, one of the lowest management fee rates in the Volatility asset class. VettaFi gives it an expenses rating of A+ (Figure 3). Along with other fund fees and expenses, the estimated total fund operating expenses is 0.54%.

Figure 3 – SVOL has lowest management fee of volatility ETFs. (etfdb.com)

Dividend & Yield

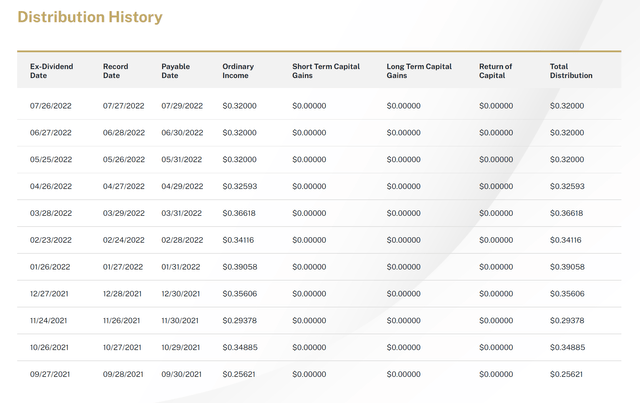

SVOL is a high-yielding fund, with an SEC 30-day yield of 18.3%. It has paid a monthly distribution since September 2021, with the most recent monthly distribution of $0.32 per share payable on July 29th, equating to 16.6% annualized. Note the monthly distribution is variable and is dependent on the income earned by the fund. Cumulatively, the fund has paid $3.64 in distributions since September of 2021 (Figure 4).

One point to note is that the distributions paid are considered Ordinary Income. Also, SVOL generates income without a Schedule K-1. Investors should consult a tax expert to determine how SVOL distributions will impact their individual tax situation.

Figure 4 – SVOL distribution history (Simplify ETFs)

Portfolio Composition

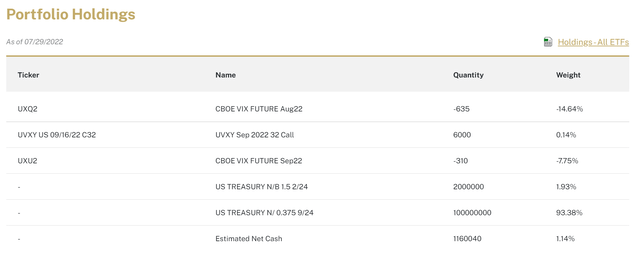

As mentioned above, the SVOL ETF achieves its objective by shorting VIX futures and owning calls on VIX products as hedges. It aims to benefit from range-bound markets and takes advantage of declining volatility.

As of July 29th, SVOL holds a -14.6% short position in August VIX futures and -7.8% position in September VIX futures. It also holds a 0.14% position in UVXY September calls with 32 strike (UVXY is currently trading at $10.32, so these are DEEP out of the money calls).

Figure 5 – SVOL Portfolio composition (Simplify ETFs)

Fund Returns

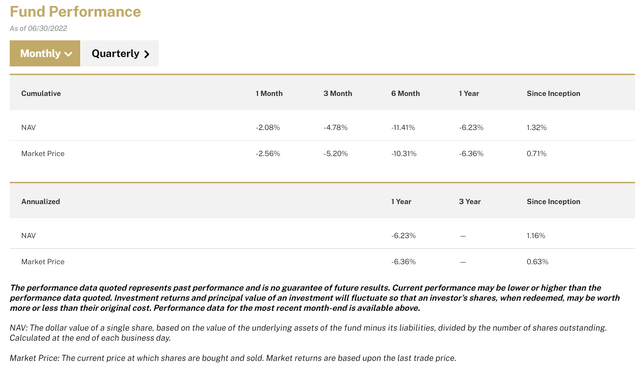

Figure 6 shows SVOL’s performance. It has generated cumulative returns of 0.7% since inception (May 12, 2021) on a market price basis, and 1.3% on a NAV basis. This compares to the S&P 500 Total Return Index, which has returned 3.5% in the same time frame.

Figure 6 – SVOL Fund performance (Simplify ETFs)

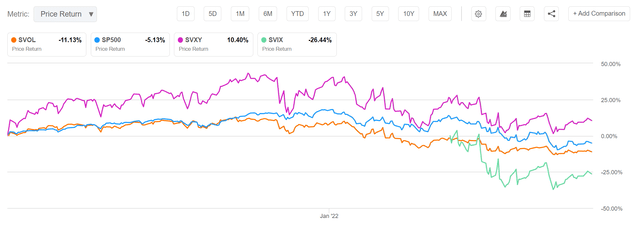

Investors should note that a significant part of the fund’s return is from its high distribution yield. On a price return basis, it has returned -11.1% since inception versus the S&P 500 at -5.1% (Figure 7).

Figure 7 – SVOL vs. S&P 500 (Price) (Seeking Alpha)

Fund Peers

SVOL is broadly grouped into the U.S. Volatility segment, which includes many different funds and strategies. For example, the largest fund in the segment is the iPath Series B S&P 500 VIX Short-Term Futures (VXX) with $500 million in assets and goes long short-dated VIX futures on a bet in rising volatility.

Other funds that go short VIX include the ProShares Short VIX Short-Term Futures ETF (SVXY) which aims to provide -0.5x VIX, and the recently launched -1x Short VIX Futures ETF (SVIX), which aims to provide -1x VIX.

Since inception, on a price basis, SVOL has underperformed SVXY (Figure 8). However, this figure is misleading as SVXY has paid no distribution. Also, note the differing levels of ‘shortness’, as SVXY is -0.5x VIX, and 2021 was a good time to be short VIX due to low volatility and rising markets.

Figure 8 – SVOL vs. short vol peers (Seeking Alpha)

Key Risks

Short volatility is generally a riskier strategy with some comparing it to picking up nickels in front of a steamroller. In the worst-case scenario, all the cumulative premiums / gains one makes from shorting the VIX can be wiped out in a very short period of time. A good example is the 2018 ‘Volmageddon’ event when the VIX doubled overnight and wiped out many investors, including the VelocityShares Daily Inverse VIX Short-Term ETN (“XIV”).

SVOL appears to be designed with this risk in mind with its small allocation to deep OTM calls on UVXY. However, as SVOL is a young fund (less than 2 years of operating history), it is unclear whether this small allocation to UVXY calls will be enough to protect the overall portfolio in a Volmageddon scenario.

Conclusion

In conclusion, I think SVOL is an interesting ETF that investors who are bullish the markets (bearish on volatility) can consider adding to their portfolio. It offers a high distribution yield that is generally uncorrelated to other income-yielding assets such as bonds and REITs. Unlike prior iterations of short volatility ETFs that blew up in 2018, SVOL appears to be hedged for left tail risks.

Be the first to comment