spooh

After the market closes on August 3rd, the management team at midstream company and pipeline operator Energy Transfer (NYSE:ET) is due to report financial performance covering the second quarter of the company’s 2022 fiscal year. Heading into that report, there seems to be a lot at stake. Shares of the company have risen in recent months, driven by a general optimism in the fundamental condition of the enterprise. However, that does not change the fact that shares are incredibly cheap at this moment, both on an absolute basis and relative to similar firms. More likely than not, management reports some rather favorable results for the business. But nothing is guaranteed and, as with any investment, the quality of the opportunity can change from quarter to quarter. In preparation for that quarterly release, I have outlined a few important things that investors should keep a close eye on. These are metrics or aspects of the company that will go a long way toward determining its investment worthiness moving forward.

Keep an eye on Energy Transfer’s guidance

The biggest thing, in my opinion, that investors should keep a close eye on when it comes to the company’s impending earnings release is the guidance that management anticipates for the 2022 fiscal year. Although as a pipeline operator, Energy Transfer is exposed to a steady stream of income, it can be impacted both positively and negatively by issues such as weather, the timing of the completion of projects, energy prices and production levels to some degree, and more. We already saw the company change guidance expectations earlier this year when they reported first-quarter 2022 results. Previously, management had forecasted EBITDA this year of $12 billion at the midpoint of expectations. That number has now been increased to $12.4 billion, with a range of between $12.2 billion and $12.6 billion.

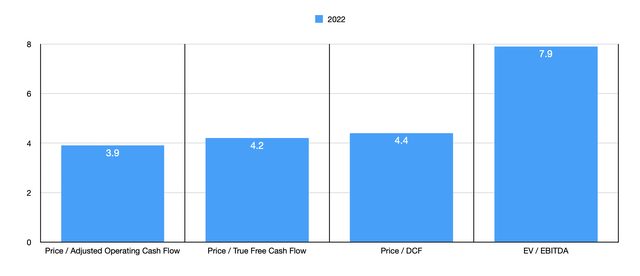

There are other profitability metrics that investors should also pay attention to. And these are ones that are heavily tied to EBITDA. One that I see as being particularly important is adjusted operating cash flow. I define this as operating cash flow minus non-controlling interests and preferred distributions. Based on my calculations in a prior article, this metric should come in at around $9.06 billion. My personal favorite metric, meanwhile, is what I refer to as ‘true free cash flow’. This is the adjusted operating cash flow figure minus sustaining capital expenditures, with sustaining capital expenditures being those in the capital budget that are required in order to keep current operations running as they have been. My current forecast is for this to come in at $8.38 billion for the year. And finally, we also have DCF, or distributable cash flow. This should come in at around $7.96 billion for the year.

What management reports on this front will be incredibly important when it comes to determining how much upside potential, if any, shares of the business currently offer. The beautiful thing about this particular opportunity, however, is that shares are already very cheap and it would be difficult to justify further downside. Using our forward estimates, the company is trading at a price to operating cash flow multiple of 3.9 and at an EV to EBITDA multiple of 7.9. To put this in perspective, when I looked at five similar firms, their price to operating cash flow multiples ranged between 7.4 and 10.1, while their EV to EBITDA multiples were between 9.7 and 11.2. If Energy Transfer were to trade at just the average of what these five firms traded for, the price to operating cash flow approach would imply upside of 120.7%, while the EV to EBITDA approach would warrant upside of 138.7%.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Energy Transfer | 3.9 | 7.9 |

| MPLX (MPLX) | 7.9 | 9.7 |

| ONEOK (OKE) | 10.1 | 11.2 |

| Kinder Morgan (KMI) | 8.1 | 9.8 |

| Williams Companies (WMB) | 9.0 | 10.7 |

| Cheniere Energy Partners (CQP) | 7.4 | 9.8 |

Watch for cash flow and debt

Although management should be explicit about what kind of guidance to expect for the year, investors should still pay attention to quarterly performance data as it comes in. In particular, it would be wise to keep a close eye on operating cash flow and the company’s other profitability metrics that I highlighted previously. In the first quarter of the year, operating cash flow is $2.37 billion. And in the second quarter of the 2021 fiscal year, this metric was $2.01 billion. Not only will this prove to be a barometer of the company’s success so far, it will also go a long way to determining the debt picture for the business.

You see, net debt has been rather volatile in recent quarters, bouncing around in a fairly narrow range. In the first quarter of 2021, this metric was $51.07 billion. It fell over the next two quarters to $45.16 billion before spiking to $49.37 billion in the final quarter of the company’s 2021 fiscal year. Despite that pain, the metric did decline some in the first quarter of this year thanks to strong cash flow, with it ultimately dropping to $48.37 billion. Although this seems like a great deal of money, it’s worth noting that management’s goal, in the long run, is to keep the net leverage ratio of the firm between 4 and 4.5. If management is correct about guidance for the current fiscal year, that has already been achieved, with the forward net leverage ratio coming in at 3.9.

ET’s dividend news is bullish

The leverage picture of the company can change from quarter to quarter. But so long as the leverage is within the range or below the range that management wants, investors can be sure that the company will continue to ratchet up its distribution. Their current goal is to eventually get the annual payout to $1.22 per share. Given the company’s current share price, this would translate to a forward distribution of 10.8%. That’s quite a return on top of the potential upside associated with shares rising in value as the market comes to realize just how undervalued the company is.

So far, management is making good progress in this direction, which is likely a further testament to their comfort with the current debt load. On July 26th, for instance, the management team at the firm raised the distribution to $0.23 per quarter, working out to $0.92 per year. That implies a distribution moving forward of 8.1%. By comparison, the distribution just one quarter earlier was $0.20 per share, or $0.80 per year. And in the second quarter of the firm’s 2021 fiscal year, it was as low as $0.1525 per quarter, or $0.61 per year. So between the improved financial condition of the company and management’s own optimism, the distribution for shareholders has risen by 50.8% over the past 12 months.

Takeaway

Although there’s virtually no such thing as a guaranteed outcome in the investment space, it’s difficult to imagine things turning out poorly for shareholders in Energy Transfer. So long as management does not have any big negative surprises when it comes to the items that I mentioned throughout this piece, such as guidance for the year, cash flow and debt, and its payouts, the overall trajectory for investors should be higher. This is especially true when you consider how cheap shares are and how much upside potential they seem to offer compared to other similar businesses. For these reasons, I continue to retain my ‘strong buy’ rating on the company as we near its earnings release.

Be the first to comment