ayhan turan/iStock via Getty Images

The post-summer rally blues

I wrote an article on July 12th, where I suggested that Invesco QQQ ETF (NASDAQ:QQQ) is potentially ripe for the summer rally, pending the technical breakout above the 50dma, supported with the falling CPI inflation thesis:

QQQ is at the important resistance, and the break above the 50dma is likely to propel the index towards to 200dma…given the correction in oil prices, as well as prices of other commodities, it is likely that the headline CPI could surprise to the downside – which could be the trigger to push the QQQ over 50dma and propel the summer rally. Thus, at this point, I recommend the hold on QQQ, but the 50dma breakout with the downside surprise in the headline CPI on July 13 will trigger the tactical buy. Will update accordingly.

I never updated the QQQ summer rally call because I specifically focused on SPY, where I issued the buy rating on July 18th, with the key bullish argument that “the liquidity risk is receding because we are (finally) past the peak Fed hawkishness.”

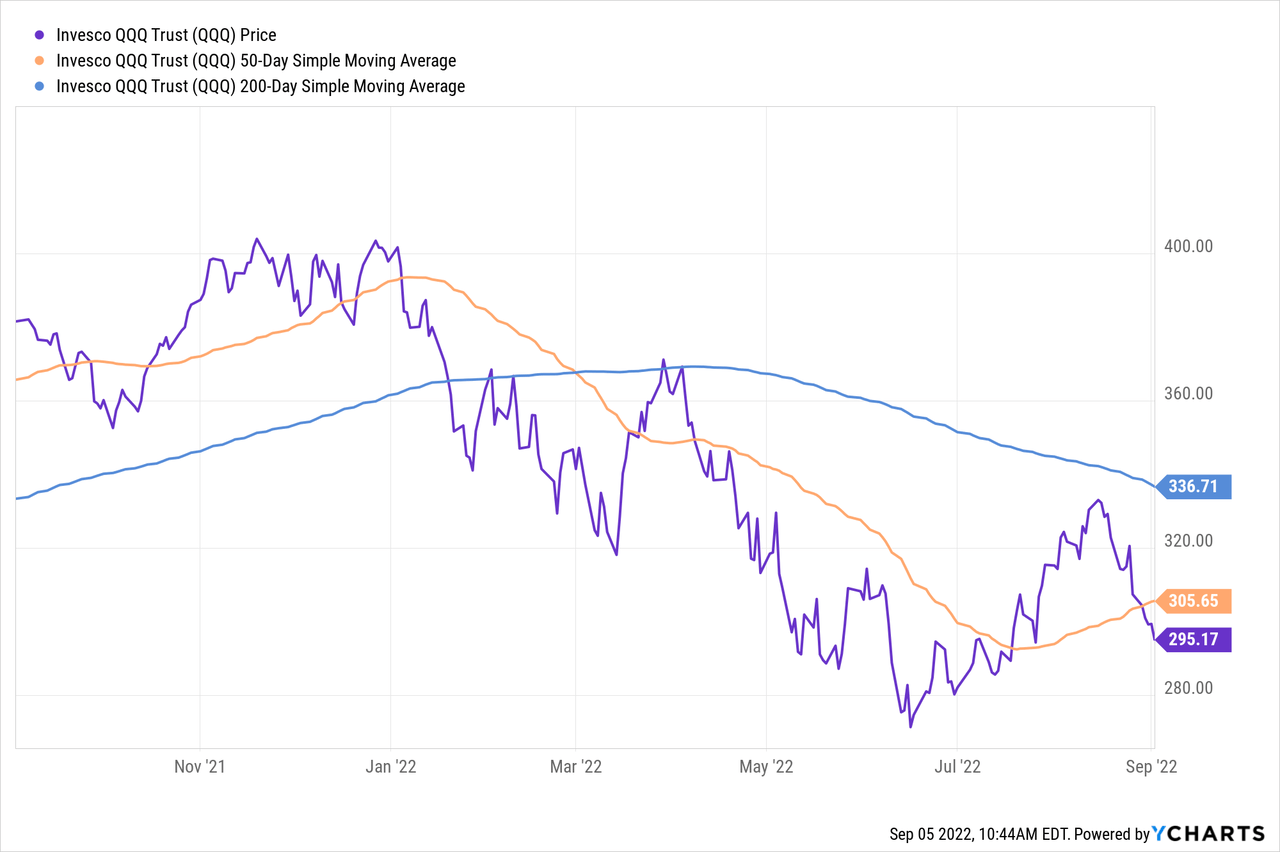

However, QQQ did break the 50dma resistance, which triggered my bullish scenario, and subsequently sharply rose towards the 200dma – a move that will be known as the summer rally of 2022. Here is the QQQ chart that shows the 50dma breakout in late July:

The chart above also shows that the summer rally faded near the 200dma resistance and reversed. In fact, the peak of the summer rally coincides with SPY reaching the 200dma resistance, which is why I focused on SPY rather than QQQ analysis.

In fact, I reversed my bullish call for SPY summer rally on Aug 15th, and re-rated it as a sell, citing several fundamental issues facing the stock market in September (the doubling of the QT, the likely inversion of the 10y-3mo curve, and potentially higher CPI reading).

The “growth recession policy” stops the music

However, the key negative fundamental trigger for stock market came on August 26th with the Fed Chair Powell speech at the Jackson Hole Economic Symposium (emphasis added):

Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy. Committee participants’ most recent individual projections from the June SEP showed the median federal funds rate running slightly below 4 percent through the end of 2023. Participants will update their projections at the September meeting.

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

The Fed Chair Powell indicated that the Fed changed the initial policy of soft-landing (whereby the Fed would possibly pause the hiking cycle to evaluate the effect of past interest rate hikes on the real economy) to something defined as a growth recession.

The term “growth recession” was first mentioned in 1972 by Solomon Fabricant, a professor at New York University. It is basically defined as “a prolonged period (more than one quarter) of significantly below trend real GDP growth.”

Essentially, this apparent hawkish turn rules out the Fed’s dovish pivot until the inflation expectations significantly decrease, which will require some pain (increase in unemployment rate). Thus, the bullish soft-landing theme (based on the Fed’s dovish turn) is now dead and replaced with a much more bearish growth recession theme.

Consequently, I have already reiterated my sell rating on SPDR S&P 500 Trust ETF (SPY). But it seems like the growth recession policy will particularly negatively affect the growth stocks heavily weighted in Nasdaq 100, which is closely tracked by the QQQ ETF. Thus, I am now specifically recommending a sell on QQQ.

Sell growth stocks

Growth stocks listed in QQQ are particularly vulnerable in the growth recession environment because QQQ is still overvalued. Based on the Wall Street Journal data, the trailing 12-month P/E ratio for QQQ is near 25, which is very high based on historical standards, while the 12-month forward P/E ratio at above 22 is also still very high. This valuation multiple will have to contracts, and also account to the downgrade of earnings expectations.

- The growth recession policy and the associated “pain to consumers and households” will require the downgrade of corporate earnings expectations. This will particularly hit hard the cyclical technology sector (XLK), which is 48% of the QQQ, as well as the cyclical consumer discretionary (XLY) and the communication (XLC) sectors, which represent about 16% of QQQ each. These 3 cyclical sectors represent around 80% of QQQ, and the “pain” promised by Powell will negatively affect the expected profits of the associated growth companies.

- Furthermore, even after accounting for lower earnings, the valuation multiple will have to contract to reflect a slower growth for extended period of time.

- Additionally, the “restricted level” of monetary policy also includes the doubling of QT, which started in September. The effect of a more aggressive QT program is reflected in higher real interest rates, as thus, higher nominal long term interest rates, which also negatively affects the valuation of the long-duration assets as such technology stocks.

Implications

The growth stocks most widely followed with the QQQ ETF are likely to significantly decrease in value, as long the Fed continues to favor the “growth recession” policy.

More importantly, the risk is skewed to the downside – the Fed is more likely to overtighten and cause the real recession, which would prolong the QQQ selloff. The probability of recession will reach the almost-certainty level if the Fed deeply inverts the 10Y-3mo spread – and we are near the 0% level now, even before the upcoming September Fed meeting. So, buckle up.

Be the first to comment