Baloncici/iStock Editorial via Getty Images

Before commenting on the just released Capital Markets Day from Dufry (OTCPK:DUFRY), we should report that the company held an extraordinary General Meeting for the merger with Autogrill (OTCPK:ATGSF; OTCPK:ATGSY). The go-ahead from Dufry shareholders represents the key step of the entire operation, which will now have to wait for the green light from the regulators including the Antitrust Authority. In detail, Dufry shareholders, including the private equity fund Advent (11%) and Alibaba (6%), have approved all the items on the agenda including the future governance. According to the management, the offer will take place in the second half of 2023, probably already in Q1. This process will lead to the delisting of Autogrill from Euronext Milan, and the new Dufry will remain listed on the Zurich Exchange. As for governance, based on the agreement, once the integration is completed, three members of Edizione will be appointed to the board of directors. In particular, the honorary president will be Alessandro Benetton – whose entry into the Dufry board of directors was approved almost unanimously by the shareholders of the Swiss group with a percentage of more than 99% of the quorum present.

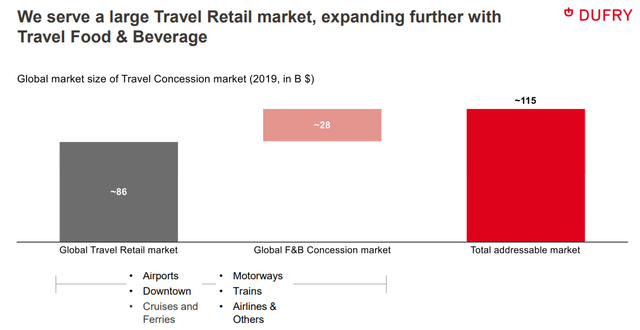

As we already mentioned, the merger combination will create a global player in the catering and retail services sector with a strong presence in the United States and Europe and a significant base in the Asian markets. The new group will operate in a potential market worth around €105 billion. The merger has the dual objective: 1) developing a new range of products & services and 2) improving travelers’ customer experience.

CMD details and financial implications

Meeting the needs of new travelers and continuing to lead the Travel Experience are Dufry’s strategic long-term goals. To achieve them, the Swiss group has developed a new strategy called “Destination 2027” which will rely on four pillars:

- A better travel experience for customers with a more personalized offer and new industrial collaboration;

- Geographical presence diversification. Thus, Dufry will invest to enter into fast-growing markets and protect itself from economic cycles and regional shocks;

- The third pillar aims to promote a culture of operational improvement to enhance the company’s profitability and accelerate cash flow generation to reinvest for growth opportunities.

- More ESG investments.

Dufry four pillars plan (Dufry CDM)

Looking at the numbers, the “Destination 2027” plan will have a strong impact on Dufry’s accounts. The company expects annual revenue growth of 5%-7% over the period 2025-2027 as well as improvements in the gross yearly core EBITDA margin from 30 to 40 basis points for the combined entity. On the other hand, the years 2023-2024 are considered for transition and could see an annual increase in turnover of just 7%-10%. In addition, the company aims at a conversion of FCF to core EBITDA of more than 20% in 2023-2024. A figure that could rise over 30% in the following period.

Conclusion and Valuation

Today, Dufry’s stock price is in negative territory, and Wall Street analysts’ consensus was forecasting a higher growth rate in the short term (numbers in hand, on average, they were expecting a growth of 21% in top-line sales in 2023). Looking at the negative comments, the current international macroeconomic context is characterized by high fuel prices that will have negative impacts on the travel and leisure sector. A higher addressable market with a new strategic plan for the two combined entities coupled with a strong recovery from travel demand is the recipe for a share rebound. After the half-year results comment, our internal team was already ahead of Wall Street analysts’ estimates, so we decide to leave unchanged our target price at CHF 50 per share (based on a 3-stage Discount Cash Flow model with a WACC of 8% and a long-term growth rate of 2%). In our initiation of coverage, we would like to report the following consideration – if we normalized the pre-COVID-19 cash generation and adjusted the operating cash flow margin at 13% with the structural saving guided by the management, the derived target price should be even higher.

Be the first to comment