Thomas De Wever/iStock Editorial via Getty Images

Thesis: Time To Buy

InvenTrust Properties (NYSE:IVT) is a retail real estate investment trust (“REIT”) that owns 63 shopping centers primarily in the Sunbelt region of the United States.

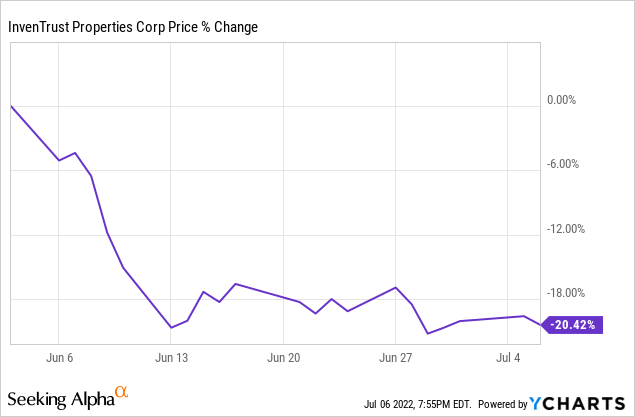

Since going public in its current form in the Fall of 2021, IVT has garnered a nice premium valuation from the market. But in the last month, IVT has sold off by 20%, reducing its valuation and bringing its stock price back near its IPO level.

Based on 2021 core FFO per share of $1.40, IVT currently trades at a price to core FFO of 18.5x. Based on 2022 core FFO per share guidance of $1.51 to $1.56, however, the price to core FFO drops to 17x. The flipside of that equation is IVT’s core FFO yield is about 5.8%.

Even after a 20% selloff, IVT is by no means cheap on an absolute level.

Why is that? It is due to a combination of IVT’s particularly conservative portfolio of high-quality, mostly grocery-anchored shopping centers that are overwhelmingly concentrated in fast-growing Sunbelt states along with the REIT’s strong balance sheet that recently garnered an investment grade credit rating.

IVT is certainly not a fast grower, and it will not turn into a fast grower anytime soon. But it is a conservative and reliable dividend grower that one would do well to include in a diversified income-oriented investment portfolio.

Those looking for high total returns or rapid dividend growth may be disappointed in IVT, but those looking for stability and reliability are sure to find it in this small-cap Sunbelt retail REIT.

High-Quality Sunbelt Retail Portfolio

As a resident of Austin, Texas myself, I can attest to the rapidity with which the Sunbelt city has grown in the last few years. Admittedly, I’m part of the problem. My wife and I moved here in 2021, along with tens of thousands of others, and have been contributing to the traffic congestion ever since.

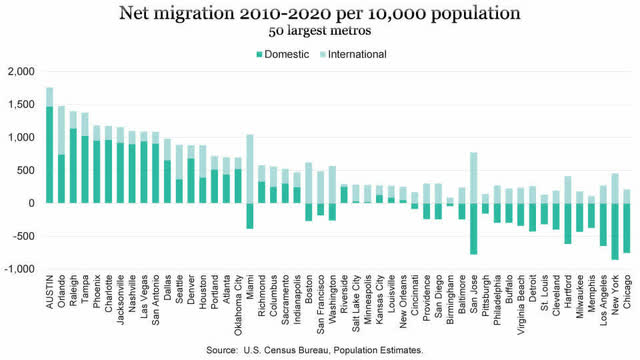

Austin, Texas isn’t an isolated case of fast population growth in the Sunbelt. The trend has been present for the entire region for years now and only accelerated during the pandemic. For instance, consider that 12 of the 15 fastest-growing large metros in the country are located in the Sunbelt.

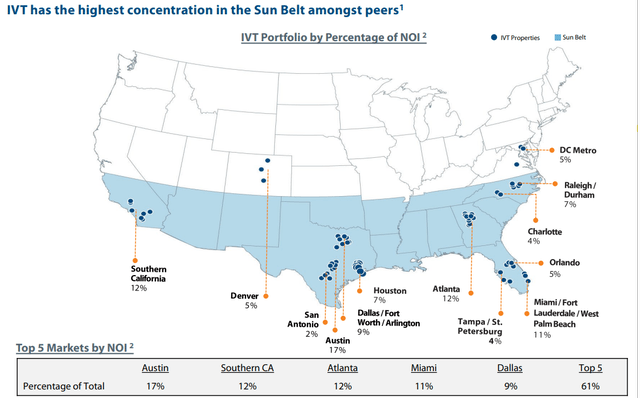

I highlight Austin, Texas not only because it is my own city but also because it is IVT’s top market by net operating income (17% of the total).

Orlando, which enjoyed the second-highest net migration among large metros from 2010-2020, accounts for 5% of IVT’s NOI. Raleigh/Durham, which had the third-highest net migration in the 2010s, makes up 7% of NOI. Tampa, boasting the fourth-highest net migration, makes up 4%.

Around 90% of the portfolio is located in Sunbelt markets.

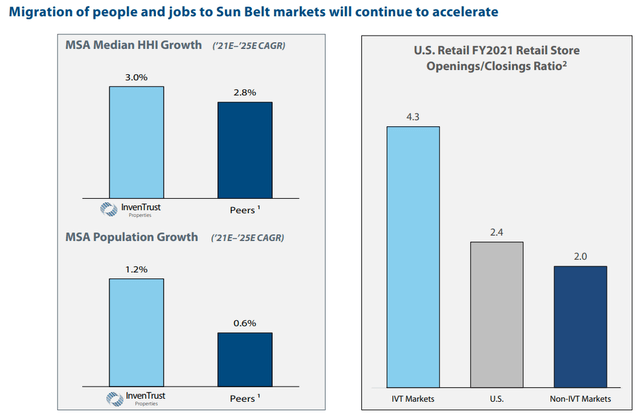

This may be a backward-looking measurement. But forward projections do not show above-average population, job, and income growth slowing in these Sunbelt markets anytime soon.

According to one projection, the median household income growth in IVT’s particular mix of markets should outpace its retail REIT peers in the next several years. And population growth in its markets should be double that of peers.

As IVT’s management is happy to point out, the retail store openings to closings ratio is significantly higher in its markets than across the country as a whole.

The REIT’s portfolio occupancy sits at 94.4%, leaving some room for further lease-up (mainly in the small-shop spaces).

About 86% of the portfolio is grocery-anchored or “shadow-anchored” (the grocery store is on the premises but owned as a separate property by a third party). This property was already considered the most conservative among all types of shopping centers before the pandemic, but COVID-19 solidified grocery-anchored centers as the defensive play in retail.

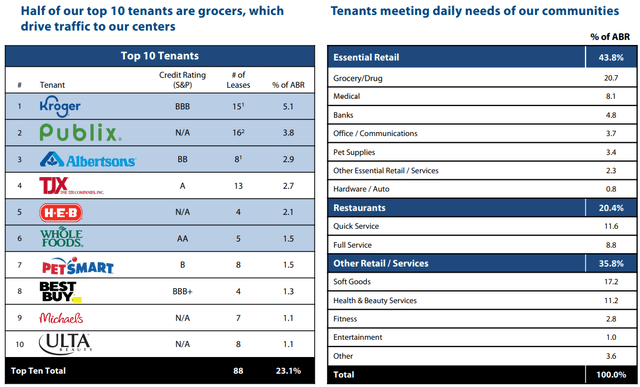

Half of IVT’s top tenants are grocers, and nearly 21% of annual base rent derives from grocery or drug stores.

Notice that ~44% of the tenant base is in essential retail, while a mere 1% is in entertainment. This signifies that IVT’s portfolio is overwhelmingly weighted toward the “essential” or “necessity” side rather than the discretionary side that is more likely to see disruptions during a pandemic.

Balance Sheet

IVT recently secured its first credit rating from Fitch, starting at BBB-. This investment grade rating put a rating agency’s stamp of approval on a strong balance sheet, but one could have also garnered that information by observing IVT’s weighted average interest rate of 2.56% in Q1 2022.

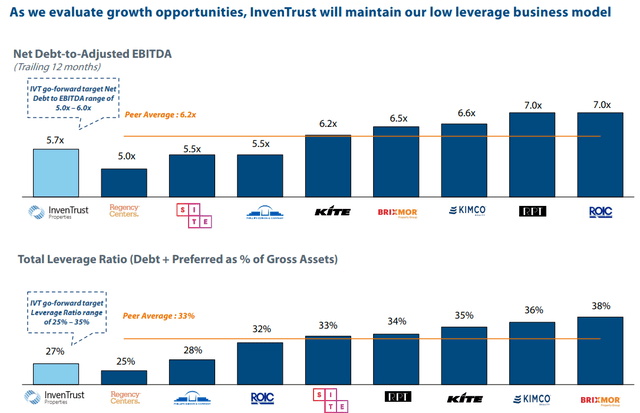

When IVT first went public in Fall 2021, the REIT had very low debt, illustrated by its net debt to EBITDA of 3.6x. Today, after issuing some low-cost debt, the REIT’s net debt to EBITDA has risen to 5.7x, but IVT’s liquidity and net acquisition guidance has also risen with it.

This net leverage ratio is a big jump from the level where this metric sat at IVT’s IPO, but it is still on the low end compared to IVT’s peers.

Adding in preferred equity (IVT doesn’t have any), IVT’s total leverage ratio is the second-lowest in its peer group.

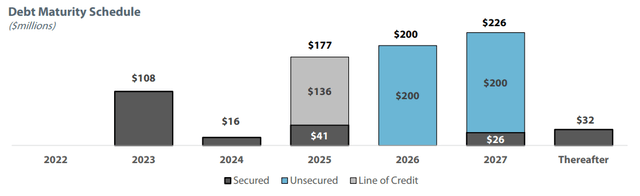

In terms of debt laddering, IVT’s debt maturities do not set off any alarm bells. There is some debt maturing next year, and it may or may not be refinanced at higher rates.

But the good news is that rent rates are climbing, offsetting any rise in interest expenses in the coming years.

As of the end of the first quarter, IVT’s weighted average remaining debt maturity stood at 4.3 years. While somewhat short, this average debt maturity should be compared to the typically 3-5 year leases that are constantly rolling over at higher rent rates. In other words, rental revenue should continue to grow alongside interest expenses.

The REIT’s average interest rate has surely already risen, as the company announced in June a private placement of $250 million of debt at a weighted average interest rate of 5.1%. Fortunately, though, this new debt lengthens IVT’s weighted average debt maturity, because the average maturity of the private placement debt is 8.2 years.

The Dividend

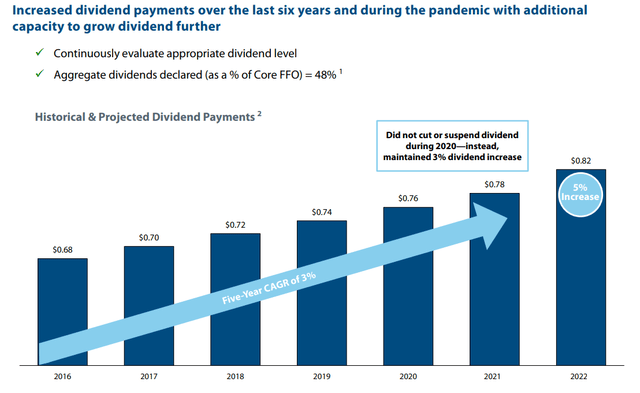

At the present moment, IVT pays an annualized dividend of $0.82, which (based on a stock price of nearly $27) represents a dividend yield of slightly over 3.0%.

Meanwhile, based on 2022 core FFO guidance of $1.51 to $1.56, the payout ratio is a range of 50-55%. The exact payout ratio will depend on where IVT ends up delivering its full-year core FFO per share.

Unlike most of IVT’s peers, the REIT did not need to cut its dividend during the pandemic in 2020. Instead, IVT hiked its dividend that year by 2.7% in continuation of a multi-year streak.

The ultra-low payout ratio (for a REIT) of just over 50% tells us two things:

- IVT is retaining a lot of cash for organic growth purposes.

- The dividend, while low yielding, enjoys a wide margin of safety and is highly unlikely to be cut.

Bottom Line

IVT’s guidance for 2022 projects core FFO per share growth of 8-11% and same-property NOI growth between 3.75% and 5.25%. That is after turning in a very strong 12.2% SPNOI growth number in Q1 2022. Blended lease-over-lease rent growth for new and renewal leases signed in Q1 was 5.0%.

Combining this with management’s expectation of investing $210 million on net into portfolio expansion, we find that IVT should enjoy solid growth from both organic and external sources this year.

In short, IVT’s primarily grocery-anchored, Sunbelt retail portfolio is a strong combination of defensiveness, decent yield, and moderate growth. Of course, 8-11% core FFO per share growth is quite strong for a retail REIT, but it will not likely last multiple years. Instead, I expect mid-single-digit growth beyond this year.

When adding that growth rate to the 3% dividend yield and the likely valuation upside, IVT offers total returns of 10-12% from its current price.

Be the first to comment