Amy Sussman

Investment Thesis

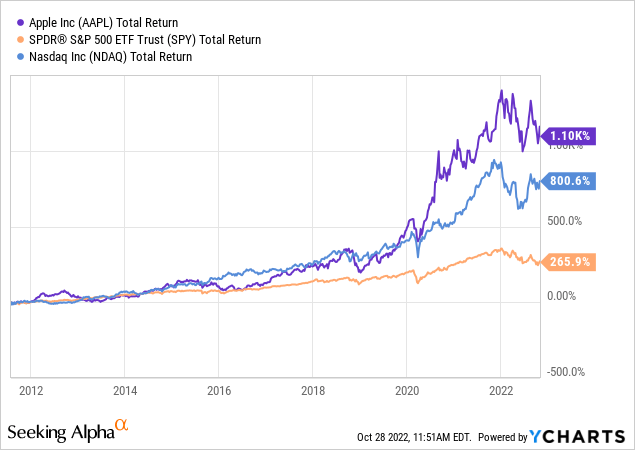

Apple (NASDAQ:AAPL) has absolutely dominated the smartphone market over the past decade, particularly in the western world, and in doing so it has created a formidable ecosystem that competitors are finding tough to crack. The design prowess of Steve Jobs laid the foundations for the current ecosystem of hardware and software created by Tim Cook’s Apple, and investors have enjoyed great returns since he took the helm in August 2011.

The company released its Q4’22 results on Thursday, in an earnings season where plenty of big tech businesses got slammed after weaker-than-expected reports. I also wrote an article earlier this week previewing Apple’s results, urging investors to be cautious due to the numerous risks that could impact this business.

So, did Apple make me look like a fool?

Yes, yes it did.

Apple Earnings Overview

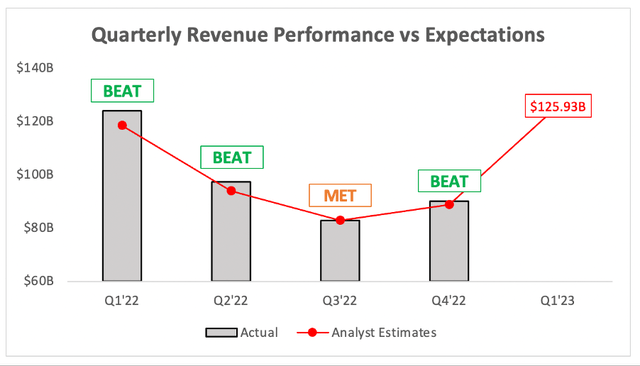

Starting from the top, Apple’s Q4 revenue grew 8.1% YoY to $90.1B, coming in ahead of analysts’ estimates of $88.8B. This is perhaps even more impressive considering the exchange rate headwinds that have hampered many US-based global businesses; on a constant currency basis, YoY growth would have been 14%.

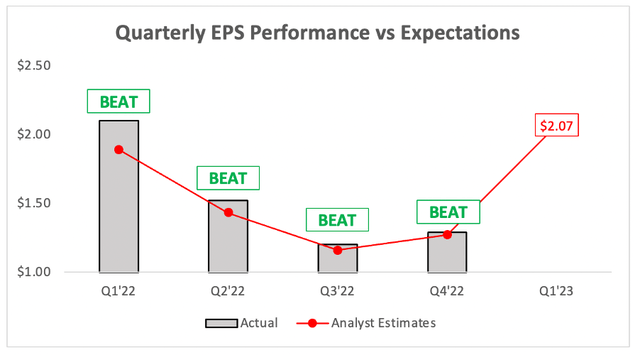

Moving onto the bottom line, and it was another story of success for Apple. The company posted EPS of $1.29, which came in ahead of analysts’ estimates of $1.27.

Hats off to Apple; it delivered a very strong quarter in an earnings season where the likes of Meta (META) and Amazon (AMZN) fell 20% following the announcement of their results. All of these companies are facing the same headwinds, namely inflation and a strong US dollar, but Apple so far has coped the best out of all the big tech firms.

Plenty Of Highlights For Shareholders

Despite the difficult macroeconomic environment, this earnings call must have delighted Apple shareholders; it was full of great news, records being broken, and I think I would be feeling pretty smug as a shareholder right now – on the contrary, I’m feeling slightly sheepish after being proven quite wrong by this brilliant company.

Let’s take a look at some of the highlights from Apple’s Q3 earnings call, that I think show reason for optimism in the future – starting with the following gem from CEO Tim Cook:

We reached another record on our installed base of active devices, thanks to a quarterly record of upgraders and double-digit growth in switchers on iPhone. Across nearly every geographic segment, we reached a new revenue record for the quarter. And we continue to perform incredibly well in emerging markets with very strong double-digit growth in India, Southeast Asia and Latin America.

With the growth of Apple’s services business and the attractive gross margins that it brings in, shareholders should be delighted to see a new record for Apple’s installed base of devices. Furthermore, the records reached and strong performance in emerging markets show that, despite being an already huge and dominant business, Apple still has several growth levers it can pull.

I said in my previous article that the sales of Apple’s new iPhone 14 would be a key item to watch, and the company gave a strong performance once again. Taking another snippet from Cook:

iPhone grew 10% in the Q4 timeframe to $42.6 billion. Customer demand was strong and better than we anticipated that it would be. And keep in mind that this is on top of a fiscal year of 2021 that had iPhone revenue grow by 39%, and so it’s a tough compare as well. And so we were happy with it.

In terms of the new products, the 14 and the 14 Pro and Pro Max, the — it’s still very early. But since the beginning, we’ve been constrained on the 14 Pro and the 14 Pro Max and we continue to be constrained today.

There were talks of Apple having to cut back its production for the new iPhones, and I saw this as a cause for concern – well, that’s a lesson learned for me. Apple saw stronger-than-expected demand for its new iPhones, and the constraints were in fact on the production side. It looks to me like another successful launch for the next generation of iPhones, and this behemoth keeps marching on.

Services Continue To Deliver

Apple’s services could well be the basis of any investment thesis for the company, as it has the potential to grow rapidly, and it also offers up much higher gross profit margins. Anyone who did base their investment in Apple at least in part on its services revenue would’ve been pleased with this quarter, as CFO Luca Maestri put it:

Moving to Services, as I mentioned, we set a September quarter record in aggregate and in most geographic segments, generating $19.2 billion in revenue in spite of very large foreign exchange headwinds.

I’m starting to find it funny how, in spite of all the global macroeconomic difficulty, Apple seems to keep posting record results; in fact, the word ‘record’ was used a staggering 37 times in the Q4 earnings call.

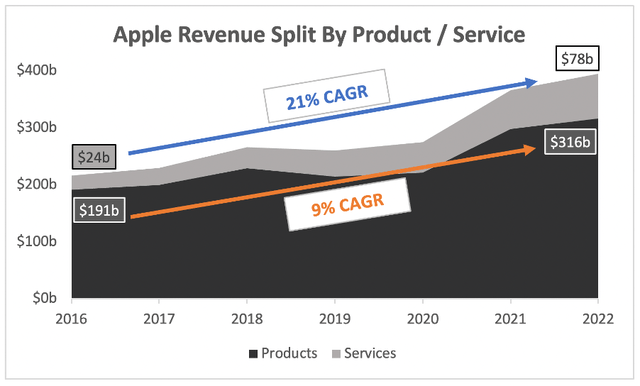

The revenue growth of Apple’s services continues to outpace the growth of its products, growing 14% YoY compared to 6% YoY for products. It now makes up 19.8% of Apple’s total revenue, compared to 18.7% in 2021. As the graph below shows, it has consistently outpaced product growth.

Why does that matter? Two reasons.

First, there are only a limited number of people that Apple can sell their high-end devices to. It already has a smartphone market share of 48% in the United States, albeit there are still growth opportunities both at home and abroad. Yet the replacement cycle for smartphones is getting longer, so it is great news for shareholders that Apple has another growth lever it can pull. Plus, the more people who have devices in their hands, the more revenue Apple can generate due to the broader reach of its services.

Secondly, the margins on Apple’s service revenues are significantly stronger than its margins for products; and, these margins have been growing over time.

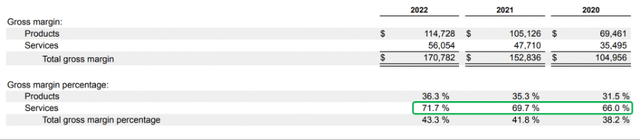

Gross profit margins in FY22 for Apple’s services was 71.7%, up from 66.0% in 2020. This compares to the gross profit margins for products, which were 36.3% in 2022 – these were also up, but it demonstrates exactly how much profit Apple’s services can bring into the business as it becomes a larger portion of overall revenues.

Quick Take: Global Headwinds

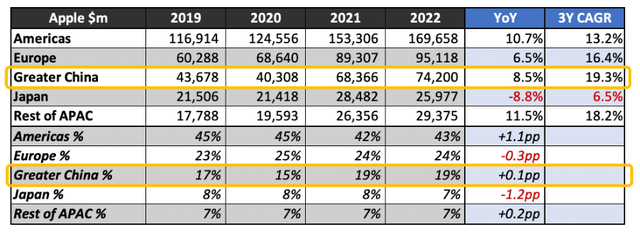

I also want to briefly touch on Apple’s geographical revenue split, now that its financial year has come to an end. As per the below chart, it’s clear to see that Apple saw a substantial slowdown in several regions this year compared to its three-year CAGR; perhaps the most concerning is China, as the economy slowed in this former high-growth region, and geopolitical tensions continue to concern investors.

There is also the risk of an economic slowdown in Europe. As someone from the UK, this country in particular is feeling the pinch of rising interest rates and soaring energy prices, resulting in some economic difficulties and, ultimately, less money in the consumers’ pocket.

Whilst this is something to be aware of, I believe Apple has demonstrated enough strength in this quarter to show investors that management can be trusted to deal with the most difficult of situations. I’m sure long-term Apple investors will be reading this and thinking “yeah, duh, that’s what we’ve been saying for ages”; all I can do is hold my hands up and admit that I should’ve seen it sooner.

AAPL Stock Valuation

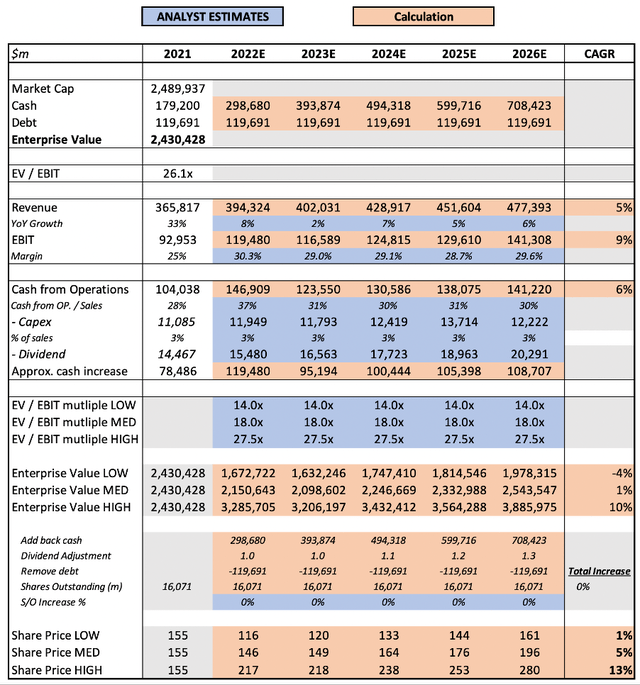

I normally look to invest in high-growth, disruptive companies where valuation is tough. At least with Apple, I feel like I have something a bit more stable and predictable – so, a bit of a treat for me. When a company is more stable like Apple, I do think valuation is substantially more important than it is for a high-growth disruptor. With that said, onto my valuation model:

I have decided to use analysts’ estimates for my model, as Apple is such a large business that it is difficult for myself and my limited data to fully analyse the future outlook. I have also allowed for slightly higher and lower multiples in order to demonstrate potential additional upside and downside.

Put all that together, and I can see Apple shares achieving a CAGR through to 2026 of 1%, 5%, and 13% in my respective bear, base, and bull case scenarios. I do also believe that services could meaningfully expand this EBIT margin over time, and so perhaps the return will be closer to the bull case of 13%.

Bottom Line

I was not particularly optimistic about Apple’s Q4 results, but boy did this company prove me wrong. When all other big tech stocks were getting crushed, Apple somehow delivered another strong set of results, in spite of the broader macroeconomic headwinds.

It’s fair to say that this quarter has done enough to convert me; as such, I am changing my rating on Apple shares from a ‘Hold’ to a ‘Buy’. I would still be cautious, and I do think there will be more attractive prices in the future, but Q4 showed that this is a reliably brilliant (or brilliantly reliable?) business that would be a solid addition to any portfolio.

Be the first to comment