Irina Nedikova

Foreword

As supplement to this article, please note that Kiplinger has published an on-line slide-show detailing the latest 2022 65 S&P Dividend Aristocrats. The article, entitled 65 Best Dividend Stocks You Can Count On, is by Dan Burrows, a contributing editor.

Most of this collection of 65 S&P 500 Dividend Aristocrats is too pricey to justify their skinny dividends. However, three of the top ten, live up to the dogcatcher ideal of paying annual dividends (from a $1K investment) exceeding their single share prices and one more outside the top ten does too.

Three top ten Aristos show annual yields (from $1K invested) meeting or exceeding their single-share prices at this time. They are Leggett & Platt Inc (LEG), Walgreens Boots Alliance (WBA), Franklin Resources Inc (BEN). Then, one more outside the top ten Amcor PLC (AMCR) keeps the average up. One more could soon join the ideal four, VF Corp (VFC) was within $0.05 of making the team as of 7/5/22.

As we are now four months beyond two-years removed from the anniversary of the 2020 Ides of March dip, the time to snap up these four lingering top yield Aristocrat dogs is at hand… unless another big bearish drop in price looms ahead. (At which time your strategy would be to add to your position in any of those you then hold.)

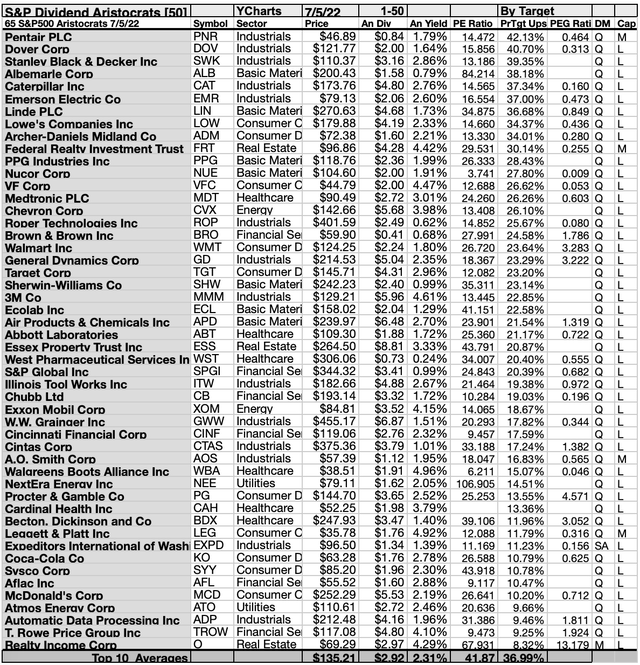

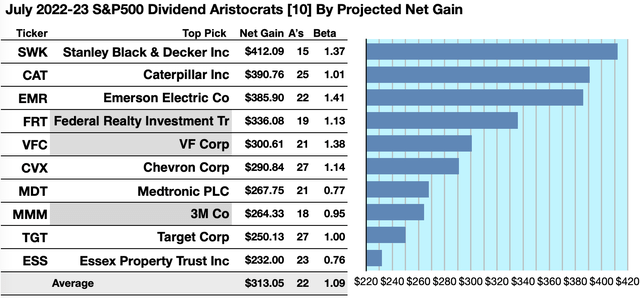

Actionable Conclusions (1-10): Analysts Predict 23.2% To 41.21% Top Ten Aristocrat Net Gains To July 2023

Three of the ten top Aristocrats by yield were verified as being among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below.) Thus, this yield-based July 5 forecast for Aristocrats (as graded by Brokers) was 30% accurate.

Estimated dividend-returns from $1000 invested in each of these highest-yielding stocks and their aggregate one-year analyst median target prices, as reported by YCharts, produced the 2022-23 data points for the projections below. Note: target prices from lone-analysts were not used. Ten probable profit-generating trades projected to July 5, 2023 were:

Stanley Black & Decker Inc (SWK) was projected to net $412.09, based on the median of target price estimates from fifteen analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 37% greater than the market as a whole.

Caterpillar Inc (CAT) was projected to net $390.76, based on the median of target price estimates from twenty-five analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 1% greater than the market as a whole.

Emerson Electric Co (EMR) was projected to net $336.08, based on dividends, plus the median of target price estimates from nineteen analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 13% greater than the market as a whole.

Federal Realty Investment Trust (FRT) was projected to net $336.08, based on a median of target estimates from nineteen analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 13% greater than the market as a whole.

V.F. Corp. (VFC) was projected to net $152.88, based on dividends, plus the median of target price estimates from twenty-one analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 38% greater than the market as a whole.

Chevron Corp (CVX) was projected to net $290.84, based on dividends, plus the median of target price estimates from twenty-seven analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 14% greater than the market as a whole.

Medtronic PLC (MDT) netted $267.75 based on a median target price estimate from twenty-one analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 23% less than the market as a whole.

3M Co (MMM) was projected to net $264.33, based on the median of target price estimates from eighteen analysts, plus the estimated annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 5% less than the market as a whole.

Target Corp (TGT) was projected to net $250.13 based on dividends, plus the median of target price estimates from twenty-seven analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility equal to the market as a whole.

Essex Property Trust Inc (ESS) was projected to net $232.00 based on target price estimates from twenty-three analysts, plus annual dividend, less broker fees. The Beta number showed this estimate is subject to risk/volatility 24% less than the market as a whole.

The average net gain in dividend and price was estimated to be 31.31% on $10k invested as $1k in each of these ten stocks. The average Beta ranking showed these estimates subject to risk/volatility 9% less than the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs”, even if they are “Aristocrats.”

Top 50 Dividend Aristocrats By Broker Targets

Source: us.spindices/YCharts.com

This scale of broker-estimated upside (or downside) for stock prices provides a measure of market popularity. Note: no broker coverage or single broker coverage produced a zero score on the above scale. These broker estimates can be seen as the emotional component (as opposed to the strictly monetary and objective dividend/price yield-driven report below). As noted above, these scores may also be regarded as contrarian.

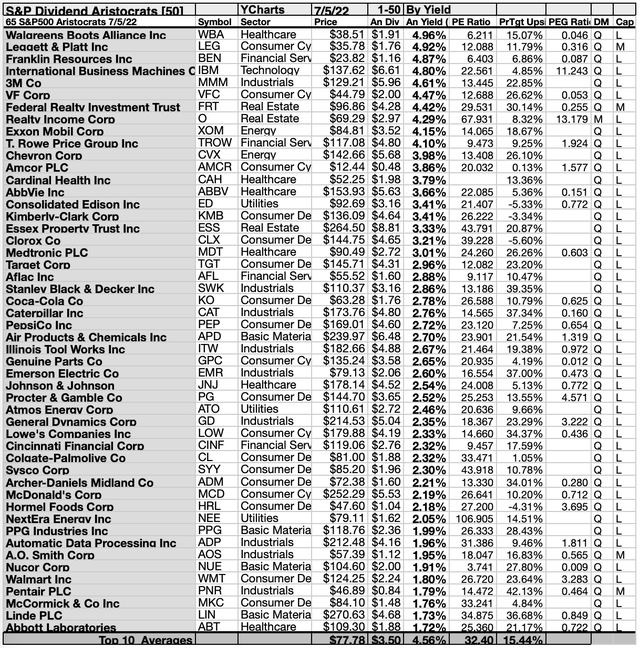

Top 50 Dividend Aristocrats By Yield

Source: us.spindices/YCharts.com

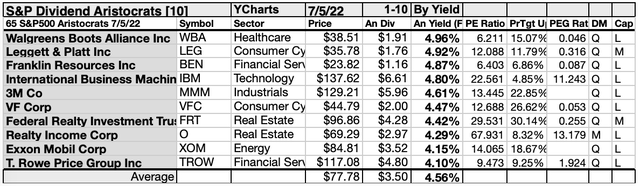

Actionable Conclusions (11-20): Ten Top Stocks By Yield Are The July Dogs of The Dividend Aristocrats

Top ten Aristocrats Dogs selected 7/5/22 by yield represented seven of eleven Morningstar sectors. In first place was the healthcare representative in the top ten, Walgreens Boots Alliance [1].

Two consumer cyclical representatives took the second, and fifth places, Leggett & Platt Inc [2], and VF Corp [5].

Thereafter, two financial services firms placed third, and tenth, Franklin Resources Inc [3] and T. Rowe Price Group Inc (TROW)[10].

In fourth place was the technology sector Aristocrat, International Business Machines Corp (IBM) [4.]. Then, one industrials representative, placed fifth, 3M Co [5].

Two real estate representatives took the seventh and eighth slots, Federal Realty Income Trust [7], and Realty Income Corp (O) [8].

Finally, the energy representative placed ninth, Exxon Mobil Corp (XOM) [9]. This completed the July S&P500 Dividend Aristocrats top-ten, by yield.

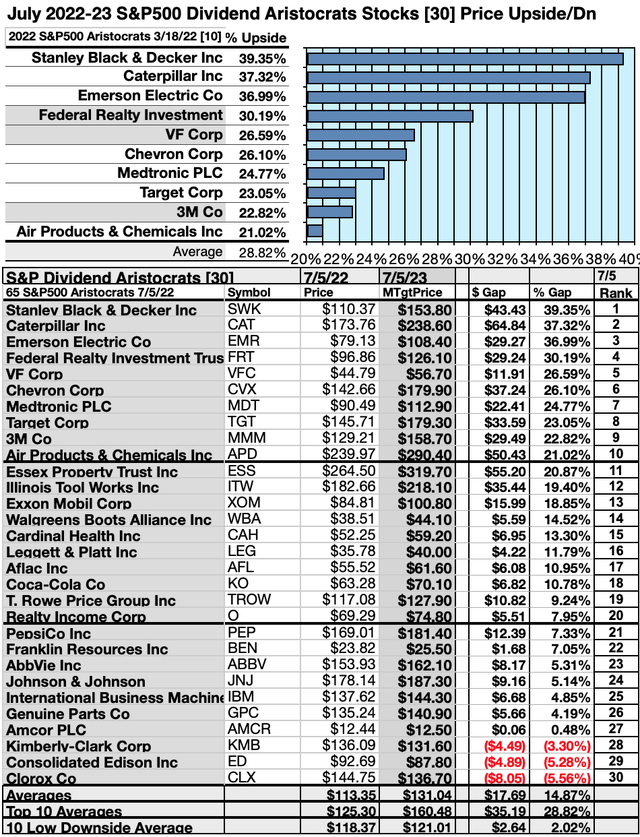

Actionable Conclusions: (21-30) Ten Aristocrats Showed 21.02% To 39.35% Upsides To July, 2023; (31) On The Downside Were Three -3.3% to -5.56% Losers

To quantify top-yield rankings, analyst median-price target estimates provided a “market sentiment” measure of upside potential. Added to the simple high-yield metrics, analyst median price-target-estimates became another tool to dig-out bargains.

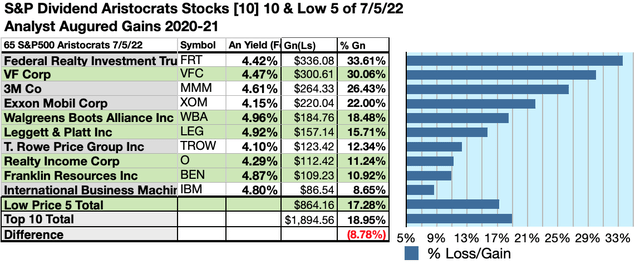

Analysts Estimated An 8.78% Disadvantage For 5 Highest-Yield, Lowest-Priced, of Top Ten Dividend Aristocrats To July, 2023

Ten top Aristocrats were culled by yield for their monthly update. Yield (dividend/price) results, verified by YCharts, did the ranking.

As noted above, top ten Aristocrats selected 7/5/22 represented even of eleven sectors in the Morningstar sector scheme.

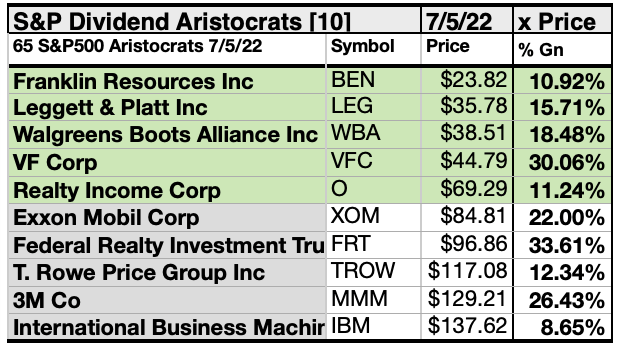

Actionable Conclusions: Analysts Estimated 5 Lowest-Priced Of Ten Highest-Yield Dividend Aristocrats (32) Delivering 17.28% Vs. (33) 18.95% Net Gains by All Ten, Come July 2023

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten Dividend Aristocrats kennel by yield were predicted (by analyst 1-year targets) to deliver 8.78% LESS gain than $5,000 invested as $.5k in all ten. The fourth lowest-priced Aristocrats top-yield stock, VF Corp, was projected to deliver the best net gain of 30.06%.

Source: YCharts.com

The five lowest-priced top-yield Aristocrats as of July 5 were: Franklin Resources; Leggett & Platt Inc; Walgreens Boots Alliance Inc; VF Corp; Realty Income Corp, with prices ranging from $23.82 to $69.29

The five higher-priced top-yield Aristocrats as of July 5 were: Exxon Mobil Corp; Federal Realty Investment Trust; T. Rowe Price Group Inc; 3M Co; International Business Machines Corp, whose prices ranged from $84.81 to $137.62.

This distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, however, since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

Afterword

If somehow you missed the suggestion of the four stocks ripe for picking at the start of the article, here is a repeat of the list at the end:

The following 4 (as of 7/5/22) realized the ideal of offering annual dividends from a $1K investment exceeding their single share prices: Franklin Resources Inc, Leggett & Platt Inc, Walgreens Boots Alliance, and Amcor PLC.

Price Drops or Dividend Increases Could Get All Ten Top Aristocrat Dogs Back to “Fair Price” Rates For Investors

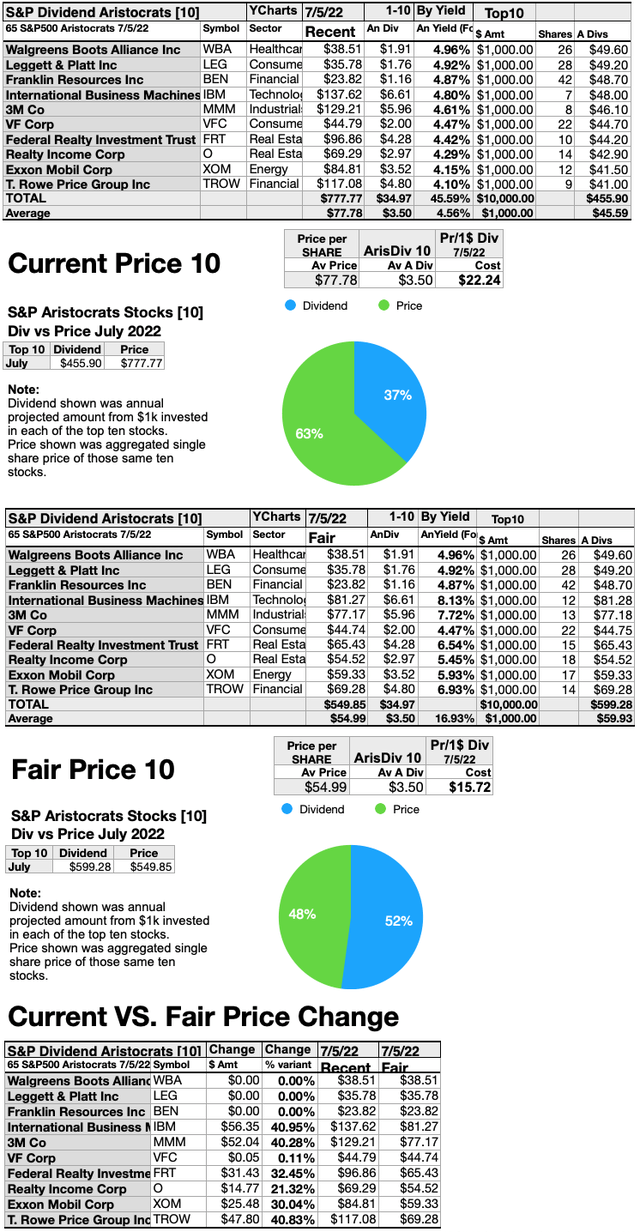

Since three of the top ten Aristocrats shares are now priced less than the annual dividends paid out from a $1K investment, the following charts compare those three plus seven at current prices. Fair pricing, when all ten top dogs conform to the ideal, is displayed in the middle chart. Finally, the dollar and percentage differences between current and fair prices are documented in the bottom chart.

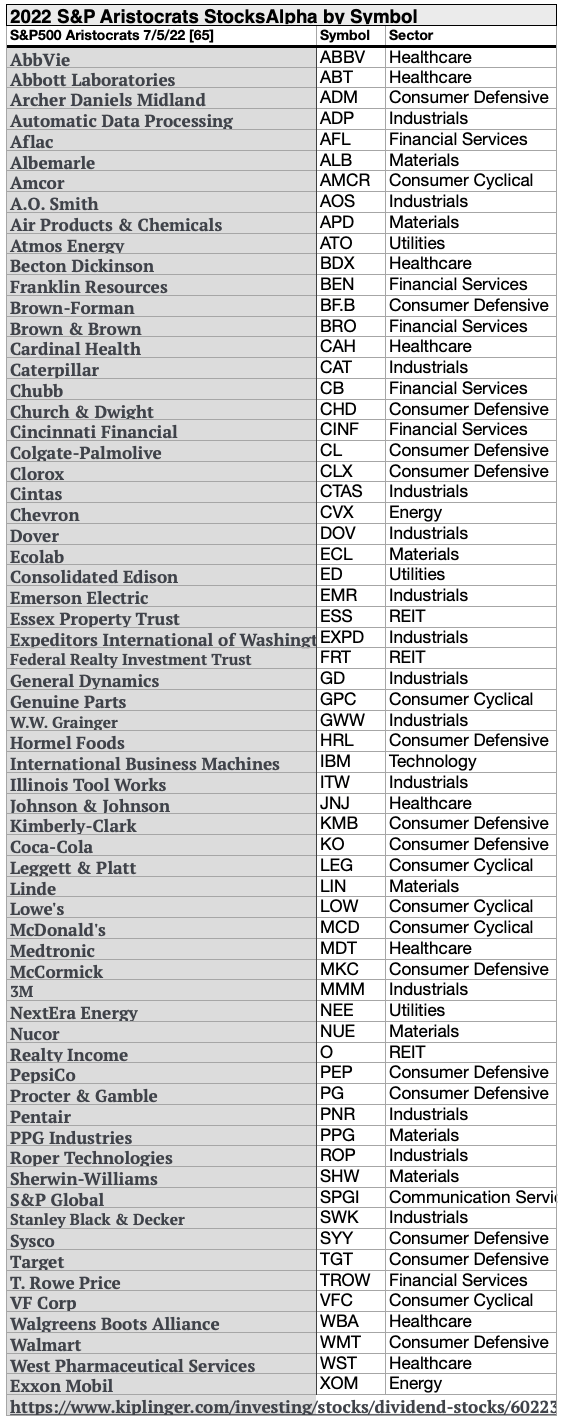

S&P 500 Aristocrats Alphabetically by Ticker Symbol

Source: S&P Dow Jones Indices

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your Dividend Aristocrats dog stock purchase or sale research process. These were not recommendations.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexarb.com; YCharts.com; finance.yahoo.com; analyst mean target price by YCharts. Dog art: Open source dog art from dividenddogcatcher.com

Be the first to comment