Sean Hannon

I thought would write a quick note on Warren Buffett‘s acquisition spree in shares of Occidental Petroleum (NYSE:OXY) during 2022. Berkshire Hathaway (BRK.A) (BRK.B) now owns 18.6% of outstanding shares with warrants to purchase another 8% of the company at $59.62. Wall Street analysts are speculating he is trying to move over 20% ownership to allow some accounting of OXY profits in Berkshire’s official financial statements.

I wrote a bearish Occidental article at $57 a share back in March here, explaining why Buffett was taking on enormous risk, gambling crude oil and natural gas prices would remain high all year long. Despite the stock quote barely budging off my sell suggestion level, prices for these two important energy inputs have indeed traded higher for longer than I expected. However, I am still questioning the timing of his purchases and the likelihood fossil fuel prices have already peaked, as a U.S. recession appears to have begun. I believe rampant speculation by bulls that Berkshire may acquire 100% of the company is unlikely and does fit his past mode of operation with mega-cap investments.

Recession Odds Nearing 100%

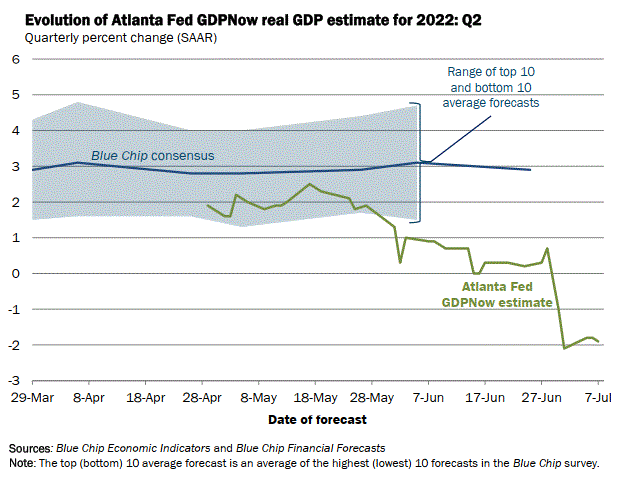

The Atlanta Fed’s GDPNow has a decent track record of forecasting actual GDP reports months in advance. Today, it is projecting a second straight quarter of contracting economic output. A -2% real GDP print for the 3-month period ending in June would be on top of the -1.6% number from Q1 2022.

Atlanta Fed – GDPNow Forecast – July 7, 2022

Respected Wharton economist Jeremy Siegel explained to a CNBC audience yesterday that we have slipped into recession, and a deep/severe contraction is possible if the Federal Reserve does not slow interest rate hikes. He pointed to the robust U.S. dollar exchange rate in 2022 as a warning signal the Fed needs to start worrying about being too aggressive in tightening. Mr. Siegel has been increasingly concerned in interviews since the middle of June that economic demand may crash soon (his words not mine).

Occidental Hates Recession

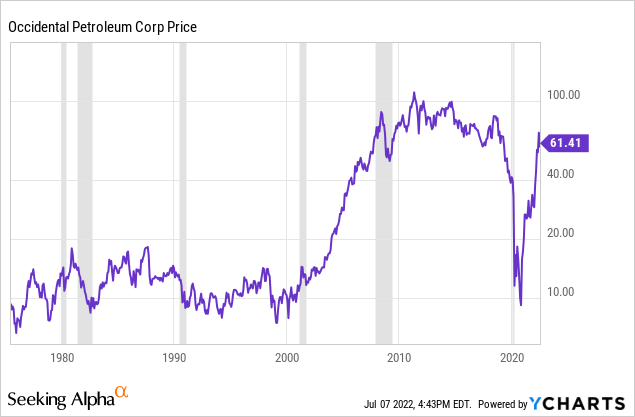

So, how has OXY performed for shareholders the last 6 recession since 1975? If has been a rotten investment 100% of the time. As you can review below, the worst timing of all to purchase shares in Occidental (or any oil/gas name statistically speaking) is right before a recession hits. That’s exactly the point in the energy cycle Mr. Buffett has decided to exchange $10+ billion in cash for a peaking oil asset? Why didn’t he buy the whole company in the $20s a few years ago at the clear cycle bottom? I was writing article after article on the bust valuations to buy in the sector during 2020-21.

OXY Price since 1975, Recessions Shaded – YCharts

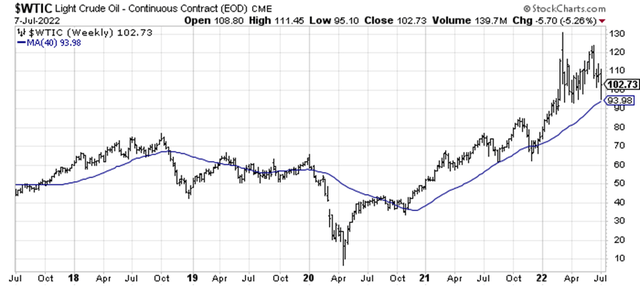

What is Mr. Buffett’s rush? If a recession is our new reality, crude oil and natural gas prices could tumble. I explained how commodities in general, and crude oil in particular, are almost always horrible investments during recession in an article posted this week here. My growing worry is we may be repeating the 2008 experience, where industrial commodities spiked markedly in the first half of the year, then crashed as the Great Recession real estate bust and banking crisis destroyed confidence and demand into 2009. Crude oil fell from $140 per barrel in the summer of 2008 to $40 less than a year later.

In all probability, Berkshire may be able to acquire OXY shares closer to $40 by early next year, with $70 per barrel crude oil and $4 per MMBtu natural gas prices. Both of these numbers are well above the cost of production globally, but nowhere near the $100 and $6 pricing of today respectively. My unchanged bearish view for OXY is substantial downside risk may play out as economic demand deteriorates throughout 2022.

5-Year Crude Oil Chart, StockCharts.com 5-Year Natural Gas Chart, StockCharts.com

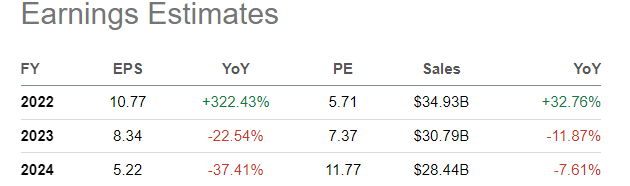

Peaking Operating Results

Wall Street is today forecasting peak earnings for the oil sector in 2022, without anticipating a period of rapid demand destruction is about to drop oil/gas quotes off a cliff. Below is a graph of expected EPS for OXY into 2024, which I will argue is completely inflated vs. our future recession reality.

Seeking Alpha Table – Wall Street Consensus Forecast – July 7, 2022

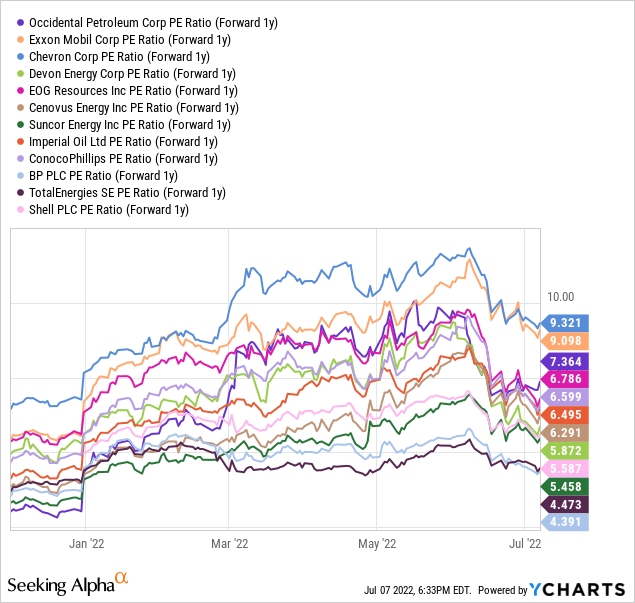

Berkshire’s buying has pushed Occidental from a lower than industry-norm valuation in late 2021 to a higher than typical setting in early 2022. You can review this idea on the basic forward 1-year EPS forecast plot below. Major oil/gas peers and competitors in America, Canada and Europe are included.

YCharts

Trading Momentum Fading Fast

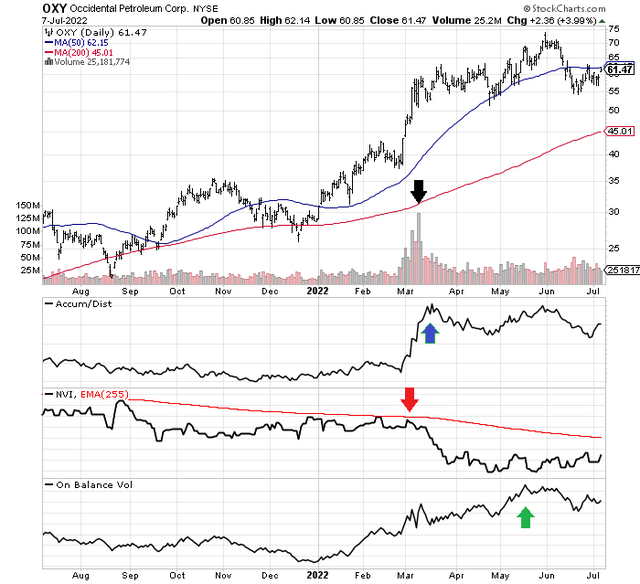

Another reason to be a little skittish about owning OXY is trading momentum has faded quickly since Buffett’s first open market purchases were announced in March. The late May peak in price in the low-$70s was not “confirmed” by the vast majority of momentum stats I review in a variety of quant-sorting formulas.

On the 1-year chart below of daily price and volume changes, I have drawn a number of the indicators I track. Volume buying peaked in early March, highlighted with the black arrow. The Accumulation/Distribution Line topped in March, the blue arrow. The Negative Volume Index has been sliding for the past 12 months, but has expanded its weakness since March, the red arrow. Plus, On Balance Volume topped out in early May, the green arrow. Taking the sliding momentum signals in combination, and contemplating price has traded below its 50-day moving average for three weeks, technical trading risk is now rising daily.

OXY 1-Year Chart with Author Reference Points, StockCharts.com

Final Thoughts

What could keep the OXY price high? Really, the only scenario involves a crushing supply problem, likely from Russia expanding the Ukraine invasion into NATO-held territory, or a major new war erupting between Middle Eastern OPEC producers. Neither of these shortage-creators can be discounted out of hand. However, I would argue $100 crude oil is, in fact, encouraging new supplies to market, albeit at slower rates than consumers would prefer (global production stats rose almost 1 million barrels in Q1). In addition, millions of barrels in daily production are available from Iran for worldwide supply, if international sanctions were dropped.

Unfortunately for Berkshire shareholders, the company may be top ticking Occidental’s price for this cycle. It reminds of the large-scale buys of oil services NOV (NOV) in the 2012-13 period. Mr. Buffett nearly bought at the exact top in this stock that has lasted ever since, a good decade running.

NOV 13-Year Chart with Author Reference Points, StockCharts.com

Other energy picks have survived better, including the integrated Chevron (CVX) stake he is adding to and refiner Phillips 66 (PSX), which he has slowly been getting rid of since 2019. My point is Warren’s energy cycle calls are no better than anyone else. And, the Occidental purchase of 2022 could turn into a monster mistake for Berkshire a year or two down the road, especially if a deep recession is just beginning.

My view is Berkshire will not materially benefit from its aggressive oil/gas buying in a looming and lurking recession. The company and stakeholders may wish it had kept the billions in spent cash to buy OXY on the balance sheet. If petroleum prices implode, holding Occidental shares at a cost in the middle-$50s will look incredibly ill-timed. The crude oil market is notoriously cyclical. You buy related assets after a multi-year decline, when everyone hates energy investments. After several years of dramatic gains (with investor sentiment overly excessive) and a recession beginning, now is a smart time to sell oil/gas assets and run for cover elsewhere.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment