Coupa Software (COUP) is a cloud-based software provider in the Business Spending Management market segment. The company’s platform allows businesses to have greater visibility and control of their expenses, helping them make cuts and increase profit margins. Since going public in 2016, the stock has outperformed the Nasdaq 100 and the software sector. That performance had a great correlation with the growth in revenue during the period. Considering the strong position in the market segment that Coupa has enjoyed for some time, its cash pile, and a recent acceleration in revenue growth, the stock may continue to outperform the tech sector and its software peers. The recent quarterly results indicate that the growth story is intact, while the company also is achieving strong profitability margins for its stage of growth. Moreover, the COVID-19 outbreak may not have a material impact on the company, and could even have positive implications. On valuation, the revenue multiple is higher than those of peers, but the free cash flow multiple is lower, so the price is somehow fair. The company has an edge on profitability over its closest peers. Recently, the stock has been rebounding, and may join the list of stocks that are not supposed to be affected by the COVID-19 outbreak, such as Zoom Communications (ZM) and Everbridge (EVBG).

Strong Stock Performance

One of the reasons I like Coupa is for its past stock performance. The stock has outperformed the Nasdaq 100 index and the iShares Expanded Tech-Software ETF (IGV) in the last one- and three-year periods, and ever since going public in October 2016 (charts below). Keep in mind that past outperformers are good candidates for future outperformers, unless the investment thesis changes in a meaningful way.

(Full time chart, YCHARTS)

(3-year chart, YCHARTS)

(1-year chart, YCHARTS)

Yes, past performance is not indicative of the future, but a strong one suggests that investors liked the way the company performed in the past, and that somehow, they have confidence in its opportunities ahead. But not only that, Coupa has managed to grow its quarterly revenue from subscriptions to its platform (core revenue) from $27.8 million in Q2 2017 when the IPO date to $98.6 million in Q4 2020, according to the latest quarterly results released on Monday. That means a cumulative growth rate of 255%, or a CAGR of 43.6%, for three years and two quarters. In turn, the stock has returned 312% as of this writing, with a CAGR of 51.3% for three years and five months.

The performance of core revenue over these years suggests that the performance of the shares is somehow justified. Therefore, if the company is able to keep growing revenues above 30% and improving profitability as it has done so far, for the next three years, then the stock could follow suit. And I think that the company will deliver going forward, backed by its emerging leadership position in its market segment.

A Leader In Its Market

Coupa was the top leader in the latest publication of Gartner’s Magic Quadrant for Procure-to-Pay (P2P) Suites. The company has been a leader on this quadrant since its first publication in 2015, but this is the first time it appears as the top leader, even above SAP (SAP), which is a better-known vendor in this space.

(Gartner)

Gartner selected Coupa as a leader for the following reasons:

- Strong innovation

- Deep market understanding

- Strong product

- Strong customer experience

In fact, it praised the company citing that “Coupa is well suited to organizations seeking an innovative P2P solution that is easy to use.”

Moreover, the company is often recognized as a leader by research firms such as Forrester Research and IDC, among others.

Being a leader in the P2P space has allowed Coupa to perform well in recent years.

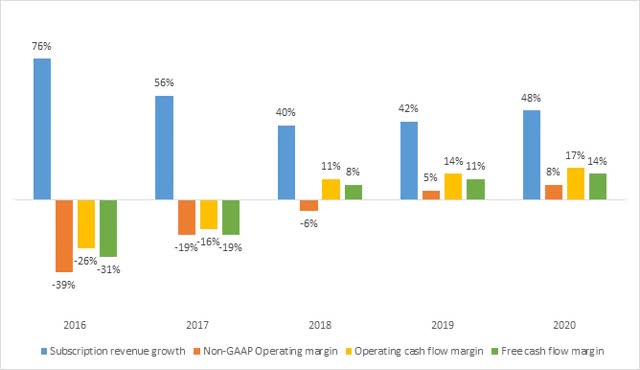

(Author)

As you can see from the chart above, most performance metrics have done well in recent times. Revenue growth is not above 50% as it was by the time of the IPO, but has been steady in the 40% region, with a little bit of acceleration thanks to acquisitions that have broadened the company’s platform.

On the profitability side, it could not have been better. There were improvements in the operating margin, and the margins of operating cash flow and free cash flow, with the last two metrics being positive for the last three years, and still expanding.

But that’s not the end of the story. Other important metrics indicate sustained strength over these years.

For example, the growth in billings has been above 40% in the last four years, the growth in the number of customers has been above 30% in the last three years, and the growth in remaining performance obligations, which, in my opinion, is the most reliable indicator of future performance, was 45% in fiscal 2020 relative to fiscal 2019.

Coupa has been able to show such a strong performance thanks to continuous innovation through in-house research and development and acquisitions. The company is constantly adding tens of capabilities, and sometimes new products, to its platform in every of its major updates, which are carried out nearly every quarter.

The result is a sticky platform with only ~5% in customer churn, and customers annually expanding their use of the it by more than 10% on the most recent periods. Yes, 110% in net retention rate for a SaaS company is industry average, but the churn rate is not, it’s ~200 bps lower than the average. A low churn rate and a high efficiency in the company’s sales efforts (above 100% in sales efficiency for fiscal 2020) have made the platform have one of the strongest unit economics in the SaaS sector with an LTV/CAC of ~7.7. That figure puts the company above well-known names such as Slack (WORK), Alteryx (AYX) and Okta (OKTA), to name a few.

Going forward, I expect Coupa to keep a strong performance and to outperform its peers in the foreseeable future. Reasons? Its recognition as a leader by several market research firms, its cash balance of $767 million to spend in organic growth and acquisitions, and a strong momentum as its revenue growth has been accelerating for the last two years. Also, the latest quarterly report of the company suggests that the thesis is still intact.

Quarterly Highlights

As I said before, the company generated $98.6 million in subscription revenue, growing 46% on a year-over-year basis. Growth may appear to be decelerating as previous quarters showed higher readings. But, as the company mentioned on the earnings call, Q4 2019 was favored by the Hiperos acquisition. As in previous years, the company may acquire two or three new businesses that will help maintain 40%-plus revenue growth. Also, billings growth for the quarter was 43%, which as I mentioned before, continues to be above 40%.

Beyond growth, I think investors must be happy with the progress in profitability for the quarter. Although the non-GAAP gross margin is barely expanding from 72.5% in Q4 2019 to 73% in the past quarter, the non-GAAP operating margin increased from 3% to 12%. This helped non-GAAP earnings per share to be four times those of Q4 2019 ($0.21 vs $0.05). On a cash flow basis, the operating cash flow and the free cash flow margins were 20% and 18%, respectively. The free cash flow margin was up 9% from the same figure of Q4 2019.

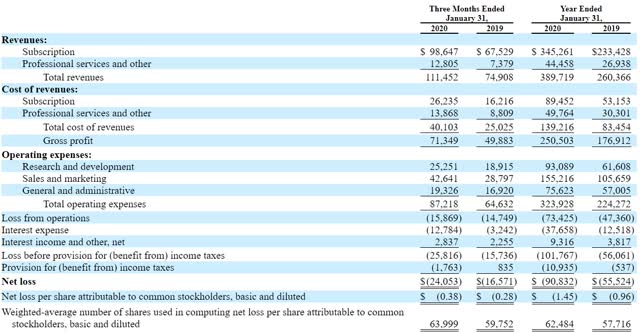

Here’s a look at the details from the income statement.

(Earnings Release)

The company saw strong customer growth, finishing the fiscal year with more than 1,300 customers, up more than 30% from Q4 2019. During the quarter, Coupa signed important customers such as AstraZeneca, American Signature and Fox Corporation, among others:

(Investor Presentation)

On the earnings call, the management commented on the progress of Coupa Pay, one the latest products of the company, and the increased adoption of Community Intelligence. A payments solution could significantly expand the total addressable market of Coupa as it enters the digital payment space, which is experiencing strong secular growth. Community Intelligence is a feature that leverages the data from customers’ spending activity to give insights on best spending practices. It has been a reason for customers to buy Coupa’s products, and also is a differentiation factor in the marketplace, according to Gartner.

Lastly, the guidance, which suggests mid 20% growth in fiscal 2021, should not be a reason to believe these are actual expectations. In fact, this is the same growth that the management expected in the Q4 2019 earnings report (there was no COVID-19 in sight), and the actual growth was twice the expected growth (actual: 50%, estimated: 26%). So, it is the same story, nothing changes.

The main issue this time is the COVID-19. So, there’s a high probability that the actual performance be closer to the guidance than in the past. On the earnings call, management cited that the company is doing business as usual, and that the COVID-19 issue may turn to be positive to the company. Here’s an excerpt from an answer that the CEO gave to an analyst when asked about changes to the growth strategy:

Alex, I would say that’s a wait and see on that. We will see if we shift our strategy there. At the moment it’s business as usual. We haven’t – we don’t have any statistically-significant signs in front of us. The suggest we can continue exactly the way we’ve been doing with logo acquisition as well as organic expansion into the core.

In fact, I think this is not a bad time to tell you that in terms of the core, and frankly, given the situation that’s out there now, we’re looking at ways to help folks particularly suppliers that don’t have a great deal of cash flow may need cash flow. So what we’re offering now is our customers’ ability to ease Coupa digital checks at no charge through April 20. So we think these small supply cash flows could be an issue. We have speed of payments may be critical at this time. And as you know with millions of suppliers that our customers interface with, we believe it’s our responsibility to try to make an impact here.

So we’ve actually made that public at coupa.com/payments. So that’s just an example of really the power of having over 100 customers transacting millions of suppliers around the world managing their business spending in our opportunity to get into that environment and drive more and more value, whether it’s free in this case to support cause or whether it’s needed for us to continue to grow our business via an alternate strategy that presents itself.

(Earnings Call)

My opinion on that piece of commentary is simple. Firstly, if the company ends up having a bad year because of the COVID-19, it does not matter because it will recover and continue the outperformance in the years ahead. Secondly, I do not expect the company to be materially affected by the outbreak. Coupa sells “cost efficiency” and that’s in need right now. With the reduction in business for most companies, the need to cut costs increases, so the appeal of Coupa’s solutions increases as well. Yes, selling those solutions will become difficult as the activity would have to be done by phone instead of on the field (face to face). This is something hard to forecast, but I see some kind of balance between the increased interest in Coupa’s solutions and the difficulty of selling them by phone.

Valuation And Takeaway

Even with the recent turmoil in the stock market, buying COUP is not an easy option. While other SaaS stocks has lost near 40% of their value in the COVID-19 sell-off, COUP has barely lost 19%. Of course, it has been recovering since its last quarterly report – it also was down in the 40% region.

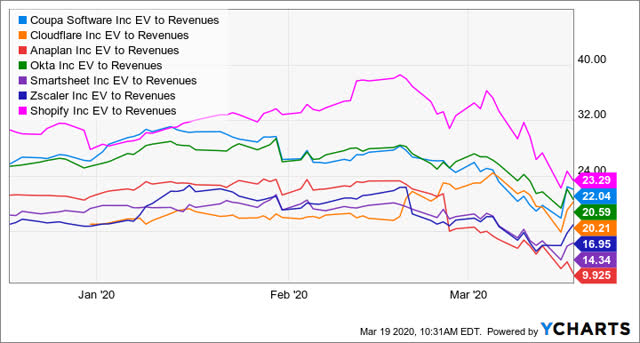

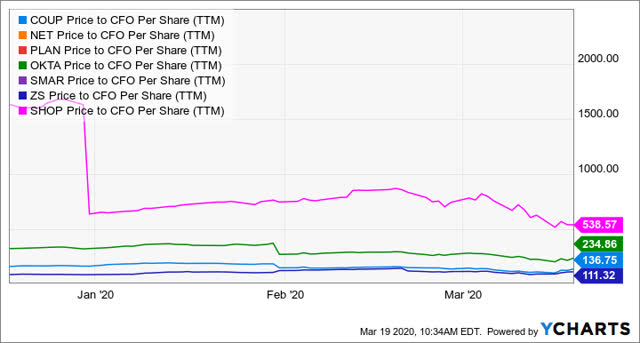

So, comparing COUP against other SaaS stocks with similar trailing revenue growth, I see that it is not cheap, but it’s not the most expensive as well. Somehow I consider this valuation to be fair or reasonable (on a relative basis). You will see.

(YCHARTS)

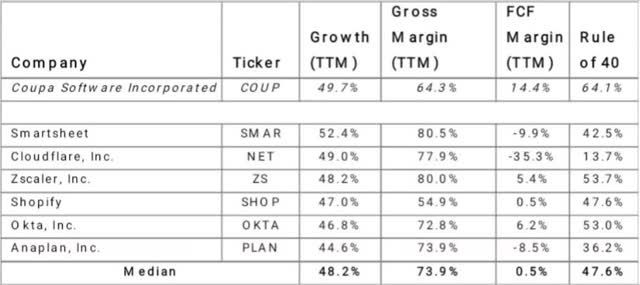

The main difference between COUP and these stocks is profitability. Some of these names have negative free cash flows, and the margins of those who are in positive territory do not match that of COUP. Also, COUP has a superior Rule of 40 of 64% (Rule of 40 = FCF Margin + Revenue Growth). The only point against it is gross margin, which may grow in the future as it has done in the past. Check out the table below.

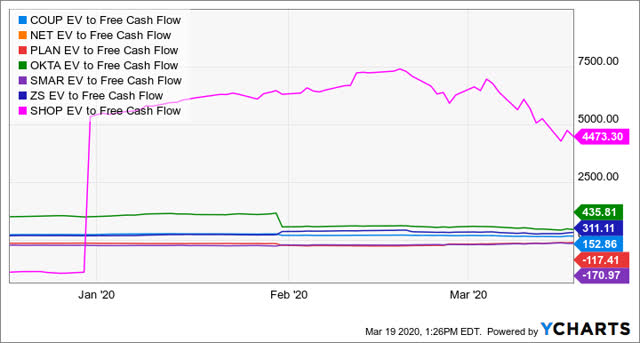

Away from revenue multiples, COUP’s valuation from a cash flow perspective reflects another story. Look at the chart below. COUP is relatively undervalued on price/cash flow from operations and EV/free cash flow.

(YCHARTS)

(YCHARTS)

My conclusion is that the current price is fair enough to a company that has been able to maintain and accelerate growth rates, but at the same time is significantly expanding profitability margins. At these prices, and with the recent momentum that the stock is enjoying, I would buy COUP. Of course, the risks are there. There’s no way to forecast how COVID-19 will actually affect this company. A decrease in the growth in customers as it gets difficult to reach them could strongly affect top line growth – as the company has only an average net retention rate, it needs to keep adding customers at a rapid pace to keep growth rates in the 40% region. Also, a change in the competitive environment such as a decrease in prices from the competition (mainly SAP), could have negative implications for COUP.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in COUP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment