KanawatTH

MicroStrategy (NASDAQ:MSTR) reported a typically mediocre operating quarter at the beginning of November and a catastrophically bad investment quarter. The bad news for MSTR shareholders (and some bondholders) is that the core operating business does not matter much at this point. The crypto market bloodbath has overwhelmed everything else tied to this company. If the price of Bitcoin (BTC-USD) does not improve markedly over the next few years, shareholders (and some bondholders) will likely be impaired.

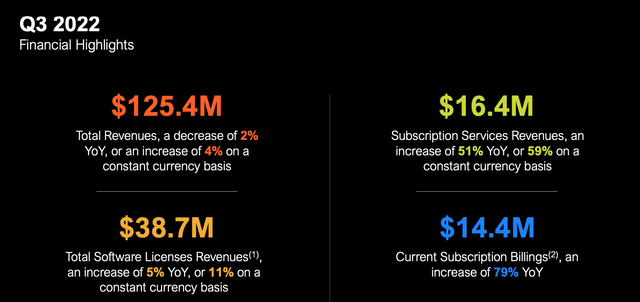

As a brief reminder, MSTR has a moribund software business that has not shown much if any growth for years. The company likes to tout its conversion to a subscription model but you can see from the numbers below, they barely matter in the grand scheme of overall revenues.

MicroStrategy Revenue Breakdown (Q3 MicroStrategy Earnings Presentation)

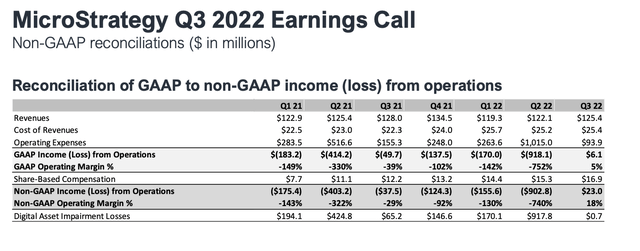

Moreover, since it is subscale with anemic growth, its margins are weak for a software company, where healthy operating margins are normally well north of 20%. Even using non-GAAP numbers, MSTR operating results stink versus scaled software providers.

MicroStrategy GAAP and non-GAAP Profit Breakdown (Q3 MicroStrategy Earnings Presentation)

The Bitcoin Bet

As I wrote previously about this company, Chairman Michael Saylor (with the approval of a Board of Directors with a high risk-tolerance) has made an enormous leveraged bet on Bitcoin–$4 billion worth using $2.4 billion of debt, including $500 million of first lien secured bonds and another $205 million of secured loans. This debt, particularly the secured debt has quickly become a major problem for MSTR shareholders.

For starters, at a Bitcoin price of $16,500, the 130,000 Bitcoin the company bought at an average price of about $31,000 are worth only about $2.14 billion, so less than the company’s debt load. Remember from my last write up, the company’s enterprise value before the Bitcoin purchases was only $600 million. With ~$250 million of debt net of the Bitcoin, this company would only have a market cap of about $370 million if we’re just valuing the software business, which I showed above is likely not more valuable now.

| Market Cap (9.7mm shares at $118) | $1.150 billion |

| Debt | $0 |

| Cash and Short-Term Investments | $532 million |

| Enterprise Value | $618 million |

| EV/TTM EBITDA ($119 million) | 5.19x |

| EV/Sales ($475 million) | 1.3x |

But the company has more shares now after the equity issued to purchase the Bitcoin. 11.3 million instead of 9.7 million. So going back to a $370 million market cap would mean a value of ~$32/share, down over 80%.

Unfortunately, that’s not even the worst news for shareholders. The secured bonds are issued by MicroStrategy Inc. They were issued after the company had already issued $1.7 billion of convertible bonds (unsecured) and were specifically used to buy Bitcoin. Since the company already had a sizeable debt load, these bonds had to be backed by all of the operating assets of MicroStrategy in addition to a specific claim on 14,800 Bitcoin. Therefore, in a distressed scenario, these secured bonds would lay claim to those Bitcoin and if that did not satisfy them, they would get first dibs on the operating business.

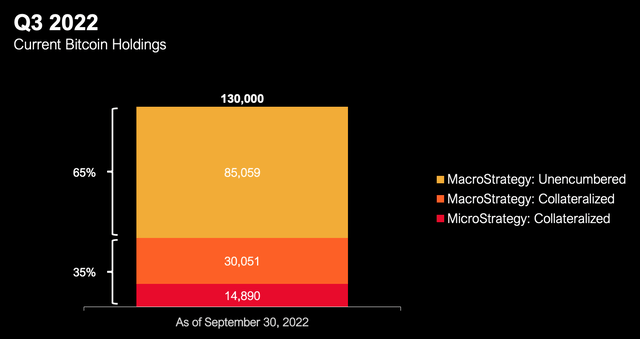

The loans were issued earlier this year by an entity called MacroStrategy LLC, with a specific claim on $30,051 Bitcoin. The rub is that the MacroStrategy loan is effectively a margin loan, one that can only be about 50% of the value of the Bitcoin pledged to it. Right now, at a Bitcoin price of $16,500, that loan is collateralized. Should the price drop below $13,600, more Bitcoin would have to be pledged.

MicroStrategy Bitcoin Holdings by Claim (Q3 presentation)

What I find particularly galling is that Michael Saylor had a huge, if improbable win on his hands for a little while. It should be fairly obvious to everyone, including Saylor, that the core software business is unlikely to ever garner much value. So Saylor threw what I believe is a hail Mary pass with the Bitcoin bet and it worked! He had billions in gains with Bitcoin at over $60,000. He could have monetized them, paid off his debts and walked away with a huge cash cushion that he could have distributed to shareholders. Instead, he kept pressing the bet. Now, not only are shareholders massively underwater unless Bitcoin recovers, he will struggle to refinance his debts as they come due. Worse yet, if Bitcoin keeps falling, all shareholders (and some bondholders) will be wiped out or impaired. In my opinion, the taking on of leverage for a risky bet and then not monetizing the win is horrendous risk-taking with shareholder money.

The Only Good News From MicroStrategy

The only credit I give this management team is they issued convertible bonds with low coupons. The interest costs on that debt are not horrible and first bonds don’t mature until 2025. The market is not too sanguine on ultimate recovery as the 2025 convertible bonds are trading at $63, which is about a 16.5% yield to workout. The 2026 convertible bonds are in the 30’s. A lot can happen in three years. Maybe some miracle comes along and Bitcoin gets back to breakeven. I wouldn’t count on it, but what do I know.

Conclusion

As far as I can tell, the only thing holding up this stock price is short covering and some investors who still believe that Michael Saylor will somehow create value for them with his leveraged bet on Bitcoin. I really don’t understand the latter. If you want to invest in Bitcoin, there are many other avenues to do so without the leveraged risk and currently underwater nature of the bet embedded in MSTR. Then again, given the awful headlines at FTX, one should be VERY careful where you deposit any hard cash to invest in this asset class.

Be the first to comment