Zephyr18/iStock via Getty Images

There are now stories out there about retailers suddenly being “overstocked,” and the shortages having turned into gluts, and suddenly folks are already seeing that the supply chains got fixed miraculously or whatever. But overall inventories at retailers remain very low, and at the biggest category of retailers – auto dealers – inventories are desperately low, and they’re low at other retailer categories, but general merchandise retailers, such as Walmart and Target, are suddenly awash in some types of merchandise.

What happened at these general merchandise retailers, and some others, is that eternally long lead-times and snags and chaos have delayed goods, and when they finally got there, the consumers had moved on to other things. And these retailers ran out of the stuff the consumers had moved onto, and were overstocked with the stuff consumers were no longer interested in.

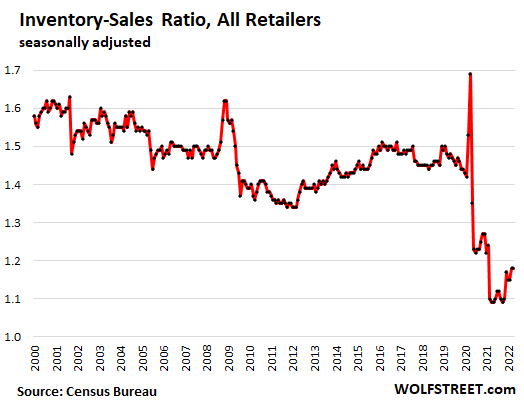

Overall retailer inventories, in terms of months’ supply, are still near historic lows.

Having the wrong inventory on hand is a classic retailer problem. To minimize that risk, retailers have shortened their supply chains, and they delay major product decisions until the last moment. And then the pandemic hit, and that solution became a huge problem, and retailers had to adjust on the fly. And some retailer categories got caught wrong-footed and are overstocked, while many other retailer categories have very tight inventories or shortages, including the largest category of retailer — auto dealers — which are still out of inventory. The overall inventory-sales ratio – or months’ supply – at retailers has improved only slightly to 1.18 months’ supply:

Inventories in dollars = raging cost inflation, not rising inventories.

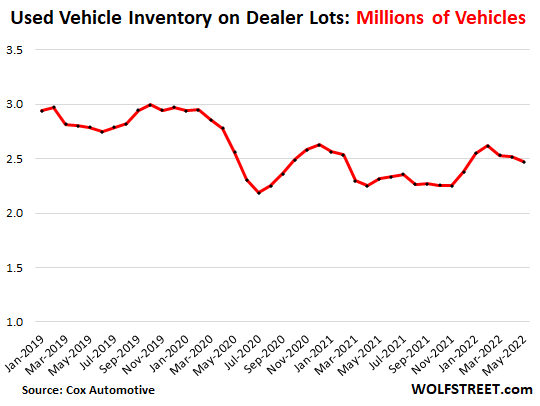

Inflation in goods – which is what retailers sell – has been far higher than overall CPI. For example, used vehicles wholesale prices, which become the cost in inventory for dealers, spiked by 35% to 45% year-over-year between October last year and February this year. These cost increases have ballooned the inventories in dollars, though used vehicle inventories in terms of vehicles remain tight and actually declined over the past three months.

What matters: months’ supply.

To exclude the impact of the surging costs of goods, and to get a feel for what actual inventory levels are in relationship to sales, we look at the “inventory-sales ratio,” which is a classic industry metric that shows how many months it takes to sell the inventory on hand at the end of the month at the current rate of sales.

Last week, the Census Bureau released the retail inventory data through April. The end of April is also when the fiscal Q1 of most retailers ends, including Walmart and Target.

We’re going to look at it by category of retailer, because they’re big differences.

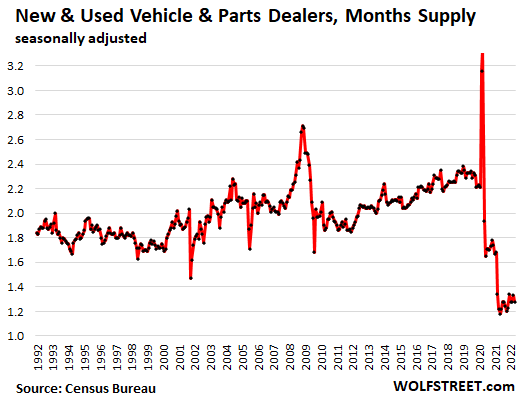

At auto dealers, the largest category of retailer, which in normal times account for over 35% of total retail inventories, inventories remain desperately low, at 1.28 months’ supply, down from roughly 2.2 to 2.4 months’ supply before the pandemic. And they have hardly made any progress at all:

Auto dealers are now struggling with another issue: Pickup trucks and large SUVs were all the rage in 2020 and 2021 and earlier in 2022, and no one had any in stock due to the semiconductor shortages. Automakers prioritized production of these vehicles because they’re far more expensive and profitable than smaller vehicles, and if they can build only a limited number of vehicles due to the semiconductor shortages, they’d build the most expensive and most profitable ones to maximize their revenues and profits – which they did.

Then gasoline prices began to spike earlier this year, and suddenly consumers were chasing down more economical cars and compact SUVs and hybrids, and now dealers are out of them, they’re just about all gone from inventories, while pickup trucks are starting to accumulate at some brands. But overall, new vehicle inventories remain desperately low.

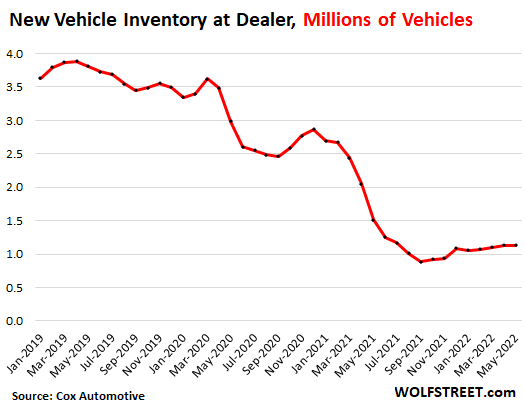

The number of new vehicles at dealer lots, according to data from Cox Automotive, has plunged by 70% from 2019, to just 1.13 million vehicles at the end of May. Many models, especially now more economical vehicles, have essentially vanished from inventory.

The number of used vehicles at dealer lots, at 2.47 million vehicles is tight and below pre-pandemic levels, but there is sufficient supply for the lower sales rates currently, which are kept down by a partial buyers’ strike against these sky-high prices:

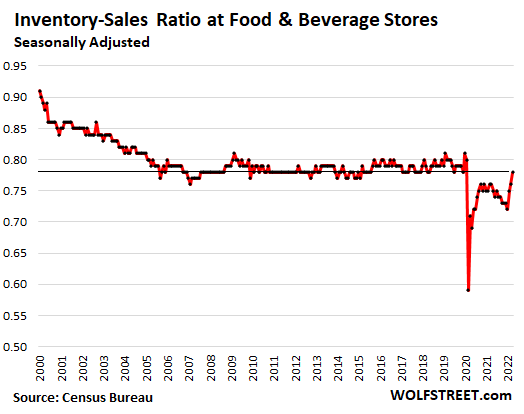

At food and beverage stores, supply is nearly back to pre-pandemic levels, at 0.78 months, which is a good thing:

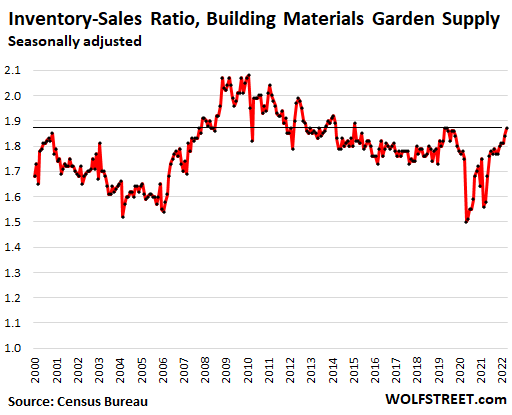

At building materials and garden supply retailers, supply is now back at the upper end of the pre-pandemic normal range, at 1.87 months, same as in April and May 2019:

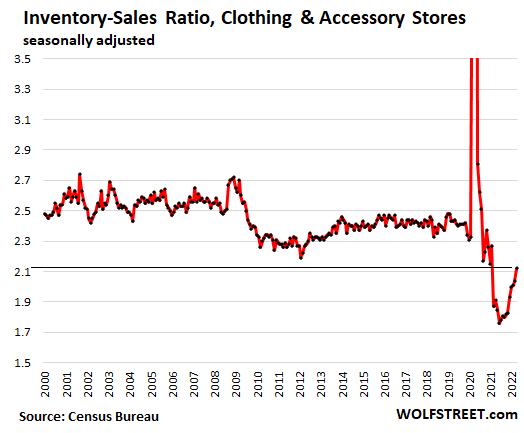

At clothing and accessory stores, inventory has been improving from the desperate levels last year. The current supply of 2.12 months is about 13% below where it had been during the same period in 2019:

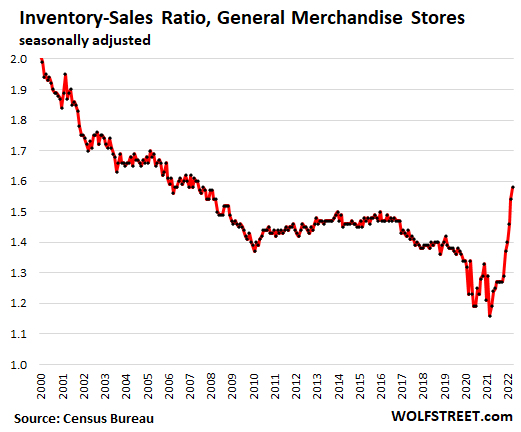

At general merchandise stores, which account for about 12% of total retail inventory and include Walmart and Target, inventories have risen sharply, as their merchandise has finally arrived. Meanwhile, consumers shifted their spending to services such as travel and dentists and entertainment events, and to items that those stores were suddenly out of, and so now there are rich levels of supply, but some of it is the wrong stuff, with shortages in the right stuff. The supply of 1.58 months was the highest since 2007:

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment