diegograndi/iStock Editorial via Getty Images

Looking for steady niche high yield income? You may want to climb aboard KNOT Offshore Partners LP (NYSE:KNOP), a leader in the niche industry of offshore shuttle tankers.

This tiny industry is less than 1% of the world’s total shipping fleet.

It may be a tiny industry, but shuttle tankers perform a vital service for offshore oil producers, who utilize them to get their product to the mainland. Shuttle tankers service a growing proportion of all offshore production, recently surpassing 90% in Brazil. KNOP’s management estimates that there are ~12 customers and ~3 suppliers in this sub-industry.

These are specialized vessels that take 2.5-3 years to build, which helps support KNOP’s re-contracting efforts, as its customers often utilize the extension options on these vessels.

These vessels have a lifespan of ~25 years. KNOP’s fleet utilization has typically been steady and strong, with an average of ~99.5% since KNOP’s 2013 IPO, which has resulted in steady revenues.

Recently, however, KNOP’s fleet utilization has been lower, due to several off-hires – in Q3 ’21 the fleet operated with 91.9% utilization for scheduled operations.

Fleet:

KNOP has 17 vessels in its fleet, with an average age of 7.8 years. The main challenge facing management in 2022 is that there are several vessels with charters ending in 2022.

The average remaining charter period is ~2 years. KNOP’s customers have options to extend these charters by a further 2.7 years on average.

This has prompted some debate about the possibility of a future dividend cut, if KNOP has to recharter these vessels at much lower rates:

The Tordis, Vigda, and Lena are all off-hire in 2022, and not commencing new charters until Q2-Q4 2023.

The Bodil’s charter extension starts in Q2 2022, but doesn’t have a new charter until 2024. However, parent Knutsen NYK is employing the Bodil under a rolling time charter contract, with the vessel being used in Knutsen NYK’s North Sea business. An extension to the charter has been agreed for a further 3 months on the same commercial terms, with 3 further one-month extensions of the charter as option, potentially taking the vessel’s fixed employment to June 2022.

The Tordis Knutsen started its 1st planned 5-year special survey drydocking in mid-December 2021, with off-hire expected to be from for ~ 60-days.

KNOP has five other vessels undertaking scheduled drydocks in 2022.

The Hilda’s charter runs through Q3 ’22, with a 3-year extension available to ENI, its charterer.

The Brazil and the Anna both have charters ending in 2022, with 6-year extensions available:

Dropdown Inventory:

KNOP’s parent Knutsen NYK has been supportive through the years – it retains at least 25% of the limited partner interest in KNOP through both direct investment and ownership of the general partner. This company pioneered the shuttle tanker business.

Knutsen has 6 vessels available for dropdown to KNOP, all with multi-year contracts. KNOP’s last dropdown was in 2020, when it acquired the Tove Knutsen for $117.8M, less $93.1M of outstanding indebtedness. It was financed on a non-dilutive basis using cash on hand and borrowings under KNOP’s existing revolving credit facility.

Management is reviewing potential dropdowns in 2022. With investors still hankering for preferred high yield stocks, one way to help finance a dropdown would be to issue a new preferred series at a much lower rate than the common units’ current 12%-plus yield. Of course, refinancing rates would be even lower than that. Management should be able to refinance the 2023 debt maturity at a lower rate.

Potential Tailwinds:

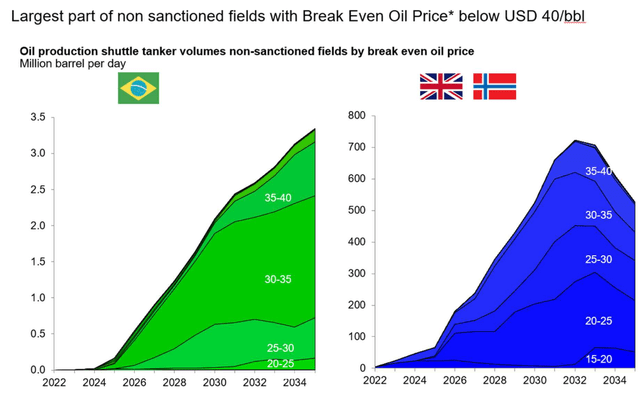

Management sees ongoing demand growth for shuttle tankers in Brazil, the UK and Norway, its areas of operation, from a combo of producing fields, fields under development, and non-sanctioned fields.

Brazil shows the most growth potential for 2021-2031, at 63%, with the UK and Norway at 27%

Another support is that the non-sanctioned fields should have a breakeven below ~$40/barrel, with a majority having a breakeven of just over $35/bbl:

Earnings:

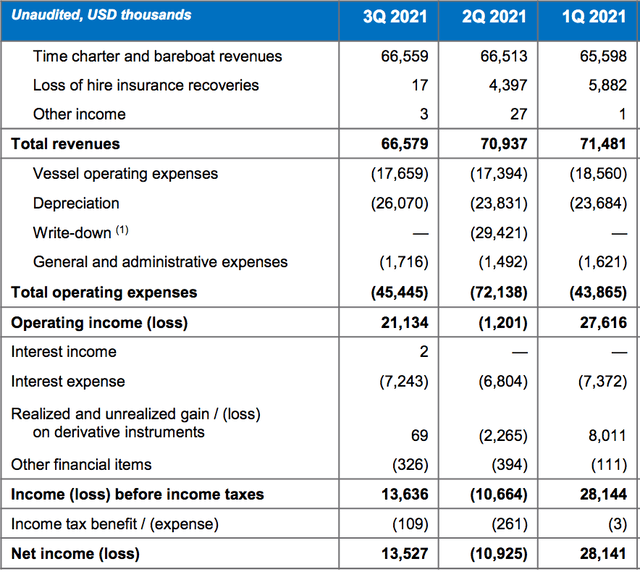

Q3 ’21 revenues were slightly lower than the second quarter due to several vessels experiencing temporary technical issues or transitioning between charters. Net Income went from a -$10.9M loss in Q2 ’21, to a $13.5M gain, due to a $29.4M non-cash write-down in Q2 ’21 on the Windsor Knutsen vessel, which had to be converted to a shuttle tanker. Without the writedown, Q2 ’21 Net Income would’ve been ~$19M.

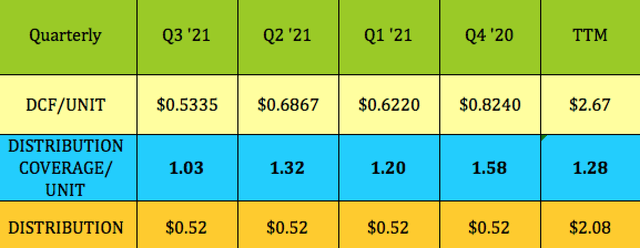

DCF, which adds back non-cash items, was $18.64M in Q3 ’21, vs. $23.97M, and Adjusted EBITDA was $47.2M in Q3 ’21, vs. $52M in Q2 ’21.

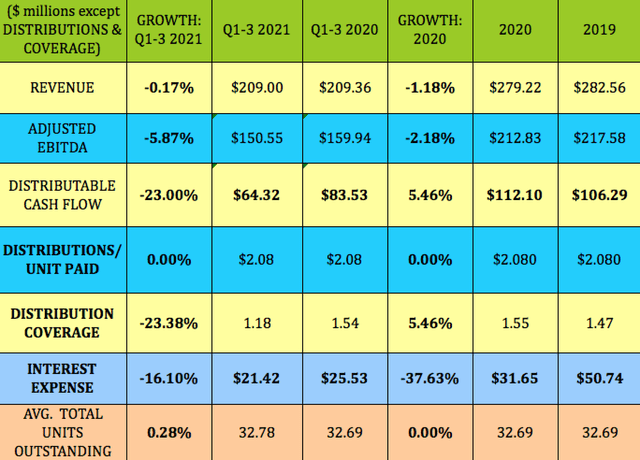

While Revenue was flat in Q1-3 2021, EBITDA and DCF have both seen declines due to the off-hire and technical issues in the fleet. One bright spot has been Interest Expense, which decreased by -37.6% in 2020, and also fell -16% in Q1-3 ’21.

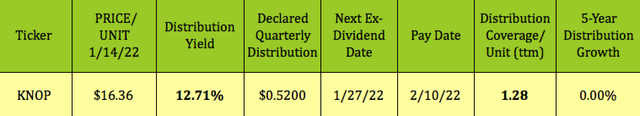

Distributions:

In the Q3 ’21 presentation, KNOP’s management reiterated its intention to maintain the $.52 quarterly distribution. They made good on this priority this week by announcing another $.52 distribution, which goes ex-dividend on 1/27/22.

At its 1/14/22 $16.36 intraday price, KNOP yielded 12.71%. That marks the 26th consecutive $.52 payout.

Distribution coverage has averaged 1.28X over the past 4 quarters, but the 1.03X coverage has made investors a bit jittery, and, along with “cut” speculation, pushed KNOP’s price/unit from ~$20.00 to below $13.00 from late October into late December.

Management commented on the Q3 ’21 call, that, “Although this ratio is lower than we have traditionally reported it remains at one despite several vessels experiencing temporary technical issues and others transitioning between charters.”

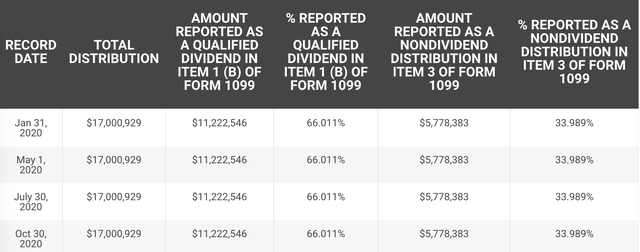

Taxes:

KNOP has elected to be treated as a C-Corporation for tax purposes – investors receive the standard 1099 form and not a K-1 form. There was a 66%/34% split between Qualified and Non-Dividend Distributions in 2020.

Performance:

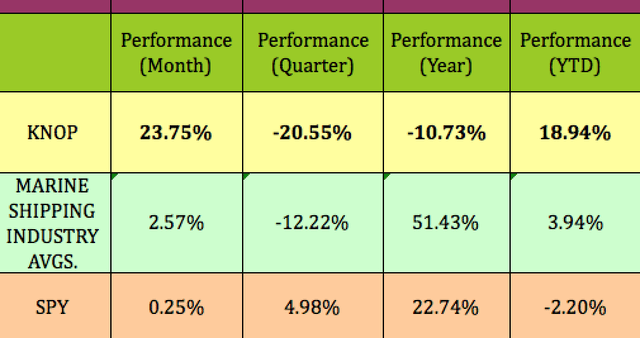

However, KNOP has begun bouncing back from those December ’21 lows – it’s up ~24% over the past month, ~19% so far in 2022, having risen ~9.75% over the past week, due to management maintaining the $.52 quarterly distribution.

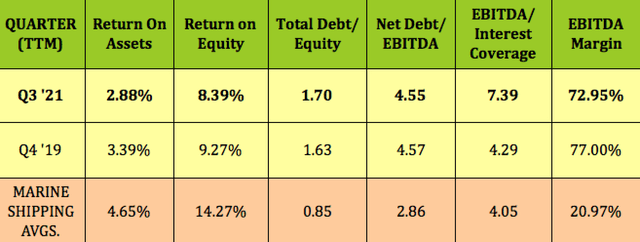

Profitability & Leverage:

KNOP’s ROA, ROE and EBITDA Margin are down somewhat from their pre-pandemic figures, while its debt leverage is stable, and its Interest Coverage has much improved.

Debt & Liquidity:

Management closed a $345 million refinancing in September, via a new senior secured credit facility for the Tordis, Vigdis, Lena, Anna and the Brazil Knutsen. The credit facility bears interest at a rate per annum equal to LIBOR plus a margin of 2.05%. With that done, KNOP has no further refinancings due until the third quarter of 2023.

KNOP also entered into a sales agreement with B. Riley Securities for an ATM equity program, whereby the partnership may offer and sell up to $100M of common units from time-to-time.

KNOP had $121.6 million of available liquidity as of 9/30/21, which included cash and cash equivalents of $66.6M, up from $52.6M at the end of Q2 ’21.

IDR Swap:

On September 7, 2021, KNOP entered into an exchange agreement with its general partner and Knutsen NYK whereby Knutsen NYK contributed to the Partnership all of Knutsen NYK’s IDRs in exchange for the issuance by the Partnership to Knutsen NYK of 673,080 common units and 673,080 Class B Units, whereupon the IDRs were cancelled.

The Class B Units are a new class of limited partner interests which won’t be entitled to receive cash distributions in any quarter unless common unitholders receive a distribution of at least $0.52 for the quarter. For each quarter (starting with Q3 ’21) that KNOP pays distributions on the common units that are at or above the $.52/unit Distribution Threshold, one-eighth of the Class B Units will be converted to common units on a 1-for-1 basis until no further Class B Units exist. After the payment of the Partnership’s quarterly cash distribution in November 2021, 84,135 of the Class B Units converted to common units on a one-to-one basis.

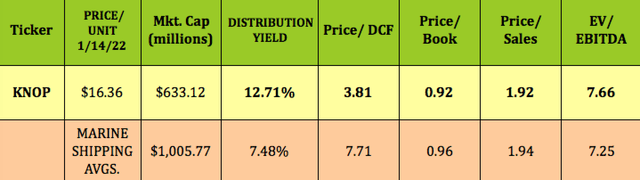

Valuations:

At the currently lower price level, KNOP looks undervalued on a Price/DCF basis, in addition to having a much higher yield.

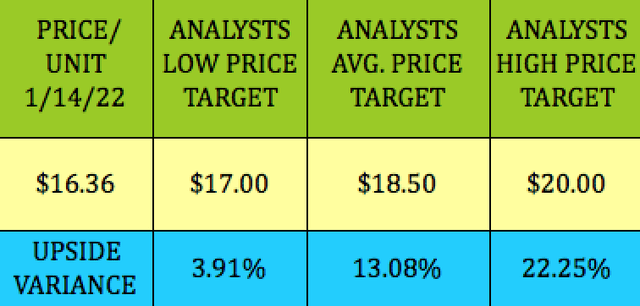

Analysts’ Price Targets:

At $16.36, KNOP is ~4% below analysts’ low price target of $17.00, and 13% below the $18.50 average price target. Two caveats, though, these targets from just 2 research firms, B. Riley and Barclays, are the newest ones we could find, from January 2021. KNOP probably won’t report Q4 ’21 earnings until March – maybe there will be some target updates at that point.

Parting Thoughts:

With offshore oilfield volume expected to bounce back and grow vs. pre-pandemic levels, KNOP’s management should be able to recharter its vessels. The big question remains, though, of how high a level of charter rates they’ll receive. Q3 ’21 looked to be an outlier in terms of the technical issues with its vessels, but it would appear that Q4 may have looked better, with management maintaining the $.52 payout.

“As we move into 2022 and beyond, the key things we will be looking to do are to secure employment for our vessels that are currently open in 2022 and 2023, maintain high operational utilization, plan, prepare and execute the drydocking at the Tordis Knutsen and other vessels, assess attractive growth capital options for future accretive acquisitions (that) may be in 2022, prepare for the expected growth in the shuttle tanker demand in Brazil and the North Sea, and continue ongoing close dialogue with our customers concerning operations and chartering and re- chartering to ensure we can respond flexibly to demand opportunities as they arise.” (Q3 call)

All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

Be the first to comment