Sundry Photography/iStock Editorial via Getty Images

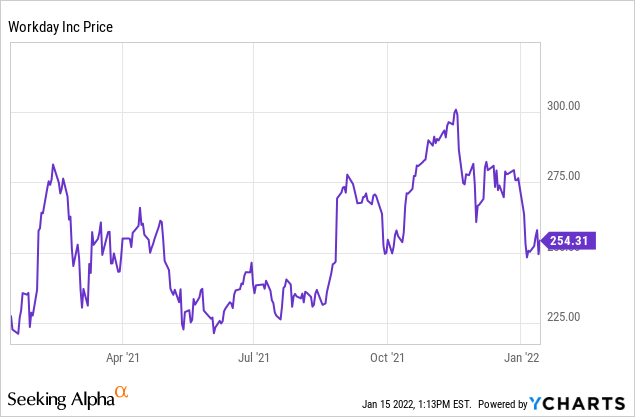

Though most technology stocks have taken huge beatings since the beginning of November, a select few have been spared the carnage. Workday (NASDAQ:WDAY) is one of these stocks. This HCM (human capital management) cloud software giant has been relatively unscathed in the recent correction, shedding barely 15% of its value since the start of November.

It’s curious, actually, why Workday has been able to avoid much of the recent pain. Fundamentally, the company leaves a lot to be desired: growth is slowing down, margin progress is there but meager, and Workday still retains a hefty valuation. Perhaps investors are taking comfort in the size and appeal of the Workday brand, which is by far the most dominant name in HR software (Workday’s relative resilience, however, isn’t standard across the industry, as sales software titan Salesforce.com (NYSE:CRM) has lost about 25% of its value since November).

In my view, while I don’t see Workday substantially declining from here, neither do I see Workday materially outperforming the broader markets.

In light of the company’s recent valuation drop on top of steady, if unexciting results, I’m slightly bumping my view on Workday to neutral, versus the bearish position I had taken on the stock back in September. Workday is fine – it’s a large-cap, stable, unsurprising SaaS stock that won’t disappoint you, but I do see the stock underperforming the broader markets by several points this year (considering how sharply small and mid-cap tech stocks have fallen over the past few months, I think there’s substantially more opportunity in those names).

There’s a number of fundamental factors why I think Workday is bound to disappoint:

- Growth has slowed. In its prime, pre-pandemic, Workday had been able to cling to 30-40% y/y revenue growth. That has steadily declined since the pandemic began, especially as companies began shedding headcount. Workday’s growth rates are now clinging to the ~20% y/y range, which is a growth trajectory that should no longer command a large valuation premium.

- Profitability doesn’t balance out the growth slowdown. Workday has just notched approximately breakeven on a GAAP operating margins basis. Despite the company’s scale, it’s still impossible to rationalize Workday’s valuation from an earnings basis (its forward P/E is still north of 70x).

- Crowded market and saturation. While Workday remains the dominant name in HCM and a powerful player in financial software as well, a whole new crop of competitors has popped up, and I think over time that these smaller and faster-growing players will eat into Workday’s market share. Workday broke apart from Oracle (NYSE:ORCL) in its origins to be the disruptor in the HCM space; but now, it has gotten the point of being so large as to be the one being disrupted.

And of course, Workday’s valuation is no longer quite attractive either. At current share prices near $255, Workday trades at a market cap of $63.58 billion. After we net off the $3.56 billion of cash and $1.85 billion of debt on Workday’s most recent balance sheet, the company’s resulting enterprise value is $61.87 billion.

Meanwhile, for FY23 (the year ending for Workday in January 2023), Wall Street analysts have a consensus revenue target of $6.12 billion for the company, representing 19% y/y growth (approximately flat to Workday’s pace of growth over the past two quarters, which to me is a growth target with quite a bit of risk in it considering recent decelerating trends). At this revenue estimate, Workday trades at a 10.1x EV/FY23 revenue multiple. It may seem like a long time ago, but pre-pandemic in 2018-2019, when Workday was growing closer to ~30% y/y, the stock had commanded only a high single-digit revenue multiple.

The bottom line here: I’m not so enthused on Workday’s prospects. I don’t see many fundamental catalysts that can re-ignite investors’ interest in this stock again; though I don’t necessarily see any catalysts that can drag it down, either. Workday has become a “ho-hum”, boring stock – but amid the recent carnage in small/mid-cap stocks, including in attractive categories like e-commerce, I believe far better rebound investments exist elsewhere.

Q3 download

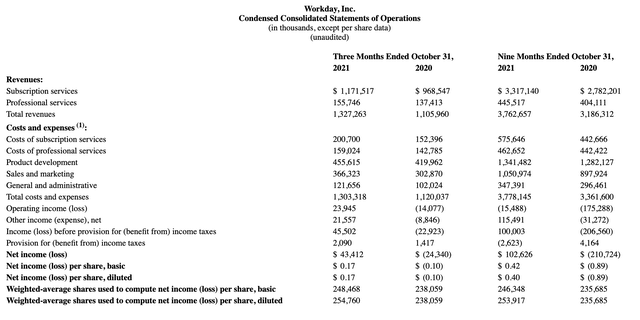

Let’s now cover Workday’s latest third-quarter results in greater detail. Overall, while the company managed to beat consensus expectations by its usual small margin, there was nothing in the quarter that inspired or justified the company’s current valuation.

The Q3 earnings summary is shown below:

Workday Q3 results Workday Q3 earnings release

Workday’s revenue grew at a 20% y/y pace to $1.33 billion in the quarter, only slightly edging past Wall Street’s expectations of $1.32 billion (+19% y/y). Revenue growth kept a fairly constant pace versus Q2’s 19% y/y growth pace.

Note that Workday has an ambitious plan of accelerating revenue growth over the next few years, and hitting a revenue target of $10 billion annually. The company’s chief lever here is by expanding its product portfolio, as commented on by CEO Aneel Bhusri on the Q3 earnings call:

As we highlighted at our Analyst Day in September, we continue to expand our addressable market with a broadening product portfolio and multiple go-to-market levers to drive sustainable growth on our path to $10 billion and beyond. As we’ve discussed throughout this year, our expectation has been for accelerating growth. While not every expectation comes to fruition, this one certainly has even faster than we expected. And we are optimistic on the momentum we see as we head into our all-important Q4 and prepare for a great year in fiscal year ’23.”

Though product expansion sounds like a nice goal, not all of this growth is organic. Workday has been turning more and more to the tried-and-true solution for software companies that are becoming too large to maintain organic growth at its historical pace: M&A. One of the company’s most recent conquests is a company called Pecan Employee Voice, which is a platform for capturing worker feedback.

The company plans to “aggressively” invest in sales capacity in 2022, as well as doubling down on “key brand marketing initiatives.” The company’s current goal for FY22 is to retain 20% y/y growth in subscription revenue (versus 21% y/y subscription growth in Q3).

On a margin basis, Workday’s pro forma operating margins hit 25.0% this quarter, up 90bps versus 24.1% in the year-ago quarter. However, investors should be prepared for margins to head south: with the investments that Workday is making into sales capacity and revenue growth, the company’s CFO Robynne Sisco has warned investors that pro forma operating margins will drop to the ~18% range in FY23. The company expects to return to a ~25% pro forma operating margin profile only when it hits its stated goal of a $10 billion revenue scale.

Even though the market is being forewarned of the incoming margin drop, I do fear that the risk-averse market will not take kindly to Workday shedding margins only to maintain the ~20% subscription revenue growth it’s currently delivering.

Key takeaways

In my view, there are few reasons to remain bullish on Workday. Though brand name, consistent performance, and a massive recurring revenue base will continue to keep Workday afloat, I don’t see the company materially outperforming its peers over the next year. Steer clear here and invest elsewhere.

Be the first to comment