StefaNikolic/E+ via Getty Images

Introduction

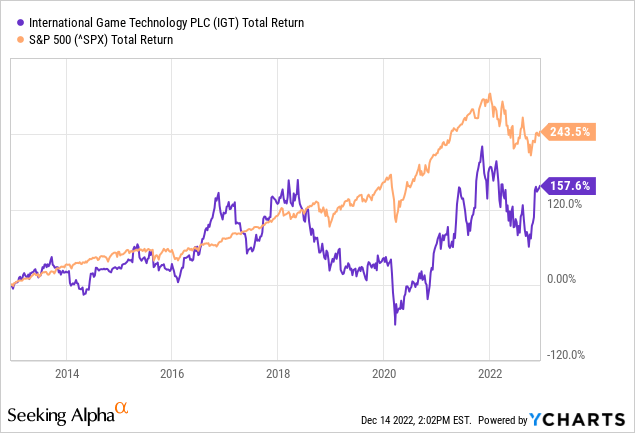

Investors who bought International Game Technology (NYSE:IGT) in the mid-2020s may be pleased with their amazing returns. The total return from the 2020 low to the present is 320%, well above the return of the S&P500.

Although the stock did not perform in line with the S&P500 over the past decade, the stock still offered a nice return. Quant rating rate the stock as a strong buy with an overall ranking of 121 out of 4759. The stock is definitely worth a look at. In addition to the high Quant rating, 6 analysts have revised earnings upward. However, the stock’s valuation is expensive compared to its historical valuation, and the company has posted widely fluctuating earnings in recent years. Therefore, the stock is a hold.

Company Overview

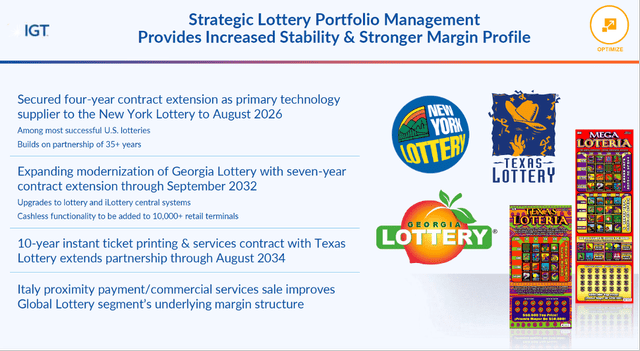

Lottery business segment performance (IGT 3Q22 investor presentation)

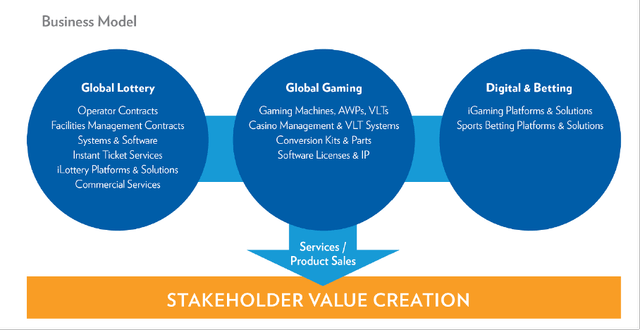

International Game Technology is a gaming company headquartered in London, United Kingdom. The company operates and provides gaming technology products and services internationally. The company is divided into three business segments:

- Global Lottery (69% of revenue)

- Global Gaming (27% of revenue)

- Digital & Betting (4% of revenue)

IGT derives its revenues primarily from its Lottery segment; the company has a broad global lottery footprint, with 36 of the 46 United States lotteries and is a dominant operator in Italy.

Global Gaming is the second largest segment; in this segment, the company derives revenue from casinos and government-sponsored Video Lottery Terminal customers. Its leadership in Global Gaming is known for its large portfolio of games and intellectual property, and best-in-class systems.

The last business segment is Digital & Betting, this segment deals with iGaming and sports betting, mainly in the United States.

Quoted from the company’s 2021 annual report:

The Company operates and provides an integrated portfolio of innovative gaming technology products and services, including: lottery management services, online and instant lottery systems, gaming systems, instant ticket printing, electronic gaming machines, sports betting, digital gaming, digital lottery, and commercial services.

Business Model (IGT 3Q22 Investor Presentation)

Third Quarter Earnings Were Strong

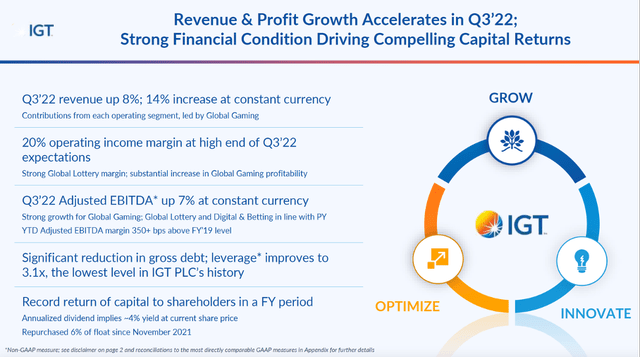

Third Quarter highlights (3Q22 IGT investor presentation)

Third-quarter earnings were strong, with revenue up 8% year over year, led by the Global Gaming business segment. Operating profit margin came at the upper end of analysts’ expectations, and the company reduced gross debt to a leverage of 3.1x.

The Global Lottery business segment showed strong growth as multi-year same store sales were 30+% higher than 2019 level in North America. Cleopatra Clusters Jackpot is IGT’s most successful eInstant game launch ever. The business segment showed a 500 basis point improvement in operating profit margin over fiscal 2019.

The Global Gaming business segment also showed strong growth, as revenue growth of more than 30% drove operating income and unit shipments reached record levels.

Structural cost savings increased operating margin by 370 basis points in the third quarter compared to fiscal 2019. The company acquired iSoftBet, increasing the business segment’s revenue by more than 30%.

Although the earnings report stated that the company reduced net debt, IGT still has net debt of $5.1B, which is a pretty big number compared to free cash flow of only $740M for fiscal year 2021. The company should reduce net debt further to improve margins and gain financial stability. Instead, the company resumed dividend payments and launched a share buyback program.

Dividend Payments Are Resumed, Repurchasing Shares

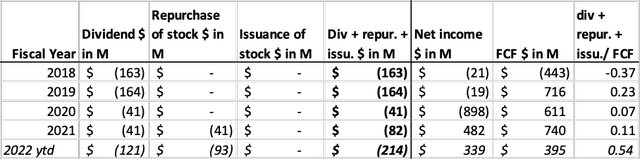

IGT isn’t a company that consistently pays dividends over the years. Net income and free cash flow also fluctuate widely over the years. Thus, the stock should be considered a high-risk opportunity.

The company showed strong results in 2021, net income is positive and free cash flow came to $740M. Management returns money to shareholders through dividends and share repurchases. Year to date, the company paid $121M as dividends to shareholders, representing a dividend rate of $0.80 (forward dividend yield = 3.2%).

In addition to the dividend payment, the company repurchased $93M worth of shares year to date, reducing the number of outstanding shares by 1.8%.

And as of September 2022, the company has ~$156M of share repurchase authorization outstanding, representing a repurchase yield of 3.2%. Share repurchases should increase the share price as supply decreases while demand increases. It is a tax-efficient way to return cash to shareholders.

IGT cash flow highlights (SEC and author’s own calculation)

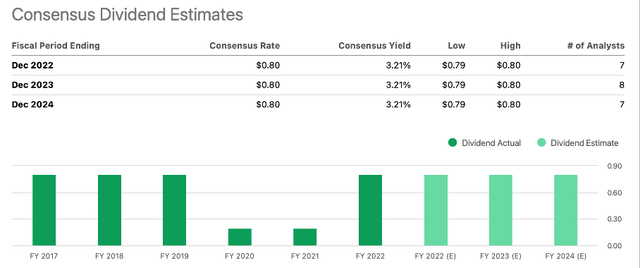

Income investors are interested in dividend payments. From the Seeking Alpha IGT ticker page, 8 analysts expect the dividend for 2024 to be $0.80, representing a yield of 3.2%.

IGT dividend estimates (Seeking Alpha IGT ticker page)

Valuation Is Expensive

From a valuation perspective, the P/E ratio is a well-known ratio to understand the company’s valuation. The current P/E ratio is 14, indicating that the company is undervalued compared to the S&P500 (S&P500 P/E ratio is 21). Analysts on the Seeking Alpha IGT Ticker Page expect earnings per share of $2.10 for fiscal 2022. If we multiply this number by the average PE ratio of 10, we arrive at a price of $21 per share. This indicates that the company is slightly overvalued relative to its historical valuation. Since earnings per share have fluctuated widely in recent years, the stock is a high risk. And with the Fed raising interest rates to 5%, a recession is looming, which could hurt casino and gambling companies like IGT.

Key Takeaway

- Investors who bought International Game Technology in the mid-2020s should be proud of their amazing returns. The total return from the 2020 low to the present is 320%, well above the return of the S&P500.

- Quant rating rate the stock as a strong buy with an overall ranking of 121 out of 4759.

- Third-quarter earnings were strong, with revenue up 8% year over year, led by the Global Gaming business segment. Operating profit margin came at the upper end of analysts’ expectations, and the company reduced gross debt to a leverage of 3.1x.

- Although the earnings report stated that the company reduced net debt, IGT still has net debt of $5.1B, which is a pretty big number compared to free cash flow of only $740M for fiscal year 2021.

- Year to date, the company paid $121M as dividends to shareholders, representing a dividend rate of $0.80 (forward dividend yield = 3.2%).

- In addition to the dividend payment, the company repurchased $93M worth of shares year to date, reducing the number of outstanding shares by 1.8%.

- If we multiply the fiscal 2022 EPS number by the average P/E ratio of 10, we arrive at a price of $21 per share. This indicates that the company is slightly overvalued relative to its historical valuation.

Be the first to comment