bjdlzx

The problem with Howard County being one of the more profitable places to run an oil company is that too many people find out and issues crop up. For Laredo Petroleum, Inc. (NYSE:LPI), the fast payback of its wells there is an attraction because it is sky-high with breakeven times in months rather than years. But now that great return is threatened by competitive activity, causing production decreases due to fracking nearby and of course followed by a normal return to production. But the time value of money means the return gets lowered to still-decent levels and interrupts the progress towards more free cash flow.

Management noted in the latest December Corporate Presentation that production is above guidance right now. But competitive activity as not all that predictable in specific spots.

This is a version of the old psychological story that people in a class can get credit for the extra credit question. But only if two people answer the question. In the case of Howard County, we are getting “way past two people.” Returns are still good for wells drilled. But cash flow timing is different now.

Still, management also has acquired some acreage that is probably not as good as Howard County but is still more profitable than the legacy acreage. So, there will be options in case operating conditions change expected profitability outcomes.

Small Company Concentration

One of the problems with any of the smaller industry players, including this one, is the lack of diversification. Larger companies operating in Howard County have enough diversification that well interactions are unlikely to be a material issue. But Laredo is not big enough yet to be able to be in the same league. Therefore, any local issues are likely to be material and cause doubts with Mr. Market.

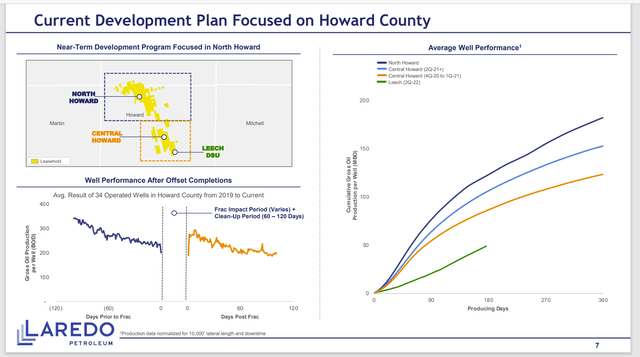

Laredo Petroleum Howard County Well Performance And Cleanup (Laredo Petroleum December 2022, Corporate Presentation)

On the one hand, wells drilled have a tremendously positive production curve shown on the right-hand side of the slide. On the other hand, the lower left-hand slide accounts for the actions of neighboring operators. So, on the right-hand side, what is really happening is a big drop in production at various times, followed by a cleanup, and then a resumption of production.

Once it pretty much becomes predictable due to the sky-high activity of a very profitable location, then company forecasting will improve. But the initial news and adjustment causes a lot of market consternation. That doubt is now reflected in the Laredo Petroleum stock price.

Ironically, the Leech group of wells, which caused a lot of worries initially, now appears to be on track for adequate if not spectacular profitability. The performance is worse than expected. That particular area is likely going to have the least possibility for interference because the more profitable locations are in the other direction (more gas to the right and down while more oil is to the left).

Free Cash Flow Should Matter More

Mr. Market frequently sees disasters around many corners. That has been the case with Laredo Petroleum ever since new management took over. Yet this management keeps reporting improvements. Now certainly the increase in commodity prices has helped. But good management finds ways to be in a position to benefit from upcoming developments. Prior management was really not in tune with that strategy.

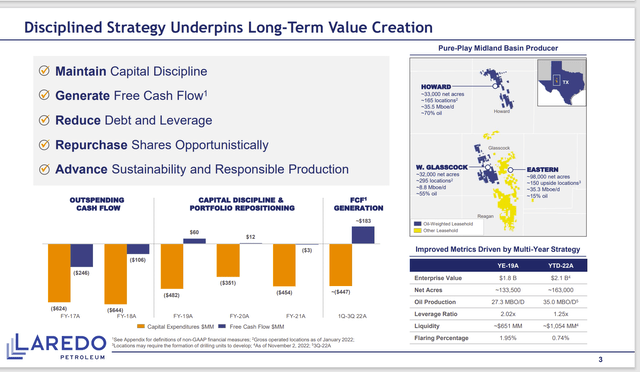

Laredo Petroleum Cash Flow Progress Due To Acreage Acquired Recently (Laredo Petroleum Third Quarter 2022, Conference Call Slides)

Since this management took over, the cash flow overspending has ground to a halt. It ground to a halt for the first time in years (and maybe the first time ever). The reason that cash flow is likely to continue to improve even if commodity prices decline is that the acquired acreage has a great oil production percentage than does the legacy acreage.

The Permian has often had excess natural gas production that has led to cheaper pricing or even price crashes that do not exist elsewhere. Decisions were often made to develop acreage based upon the price and profitability of the oil produced. Anything else was “icing on the cake.” Things like natural gas and natural gas liquids either were not that important or were not even in the profit calculation at all. The way industry conditions turned out, it may have been a good idea to do things that way.

This also explains the move that management made to produce more oil as a percentage of production. The increasing export ability could alter that equation in the future. But that is clearly not yet the case. So, the legacy acreage is worth keeping. But it is not worth drilling on any more than necessary to keep it.

Leverage

Obviously, the progress towards less leverage has slowed due to the issues encountered. But the major point is that the progress has not stopped. In many ways, management came up with a plan that would progress “no matter what happened.” Then everything happened and still the plan is moving forward.

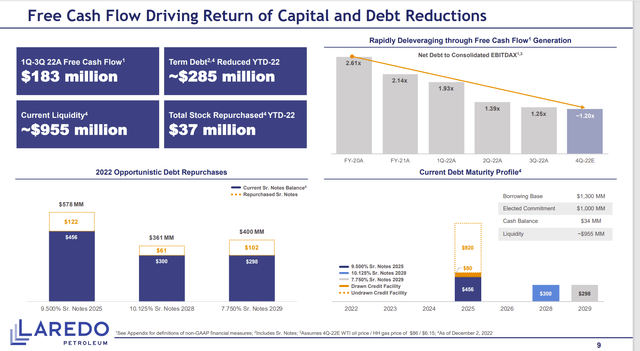

Laredo Petroleum Free Cash Flow Priorities And Debt Due Graph (Laredo Petroleum December 2022, Corporate Presentation)

Despite all the issues that concern the market, the leverage is coming down and it will be better should another cyclical downturn happen tomorrow. More importantly, free cash flow is rising, and it will continue to rise as long as oil production is emphasized. Total production does not have to grow. But oil production very much needs to increase.

Management has been repurchasing notes on the market. This has resulted in a little bit of gains for the shareholders. It is probably a wise strategy because management reported that they repaid the entire bank balance so that the bank line is open starting now. That means any debt due can be handled by the bank line if it comes to that. Every penny counts in this business. So, it is important to go after pennies as this management is doing.

The Future

Despite everything that has happened, this management has made forward progress under conditions where a lot of managements I followed would have failed. Right now, it appears that management is positioned to move forward despite all the Howard County activity that is causing production interference.

The market always demands a record before assigning a proper valuation. This management is earning that record. But some days, the shareholders just have to be more patient than was originally expected. This one has taken much longer than I expected due to “one thing after another.”

Management does appear to want to leave the company past behind by rebranding the company Vital Energy in January.

Yet it appears that the next fiscal year will show solid progress “no matter what” Finding “bulletproof” strategies in a commodity industry is very hard. Yet Laredo Petroleum management appears to have come as close as any to doing just that.

So, it’s probably time to “hang in there” and allow this whole thing to work out. Cash flow progress is clearly there for Laredo Petroleum. Just not at the originally guided progress. This happens with small companies like Laredo Petroleum. But the bright future is still in place. It just got pushed back a little.

Be the first to comment