studio-fi

Introduction

When last discussing CVR Energy (NYSE:CVI) earlier in the year, it seemed that 2022 was looking bright after another tough year during 2021, as my previous article highlighted. To the enjoyment of their shareholders, this proved timely with their quarterly dividends reinstated soon after, thereby now providing a moderate yield of 5.00%, even before counting their massive special dividend. Thanks to the booming operating conditions the refining industry is enjoying, their recovery is now complete with them already back to where they were before the COVID-19 pandemic.

Executive Summary & Ratings

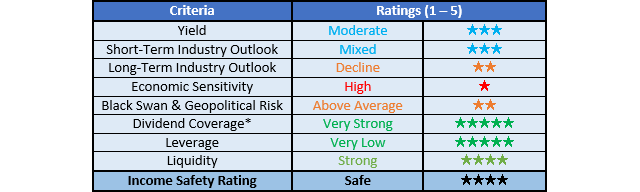

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

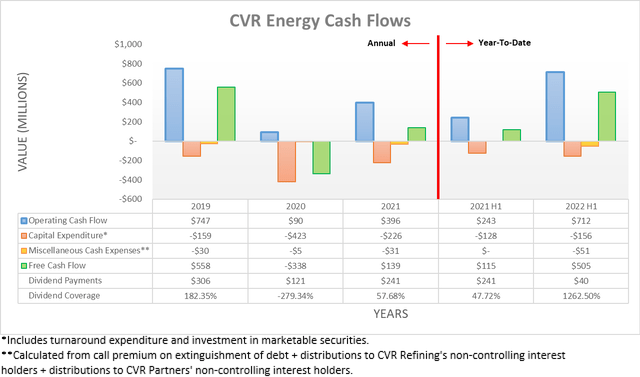

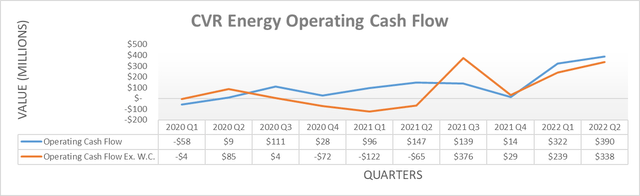

Even though they saw a rather disappointing end to 2021 with very little cash generated during the fourth quarter, the booming operating conditions across the energy sector saw this turn on a dime during the first half of 2022. In fact, their operating cash flow of $712m was so strong that it almost matched their full-year result of $747m during 2019 before the COVID-19 pandemic sent their industry into a tailspin, despite obviously being only half the length of time. Thankfully this was not merely on the back of temporary working capital movements with their underlying results posting similar performance, as the graph included below displays.

If removing their working capital movements, their respective underlying operating cash flow of $239m and $338m for the first and second quarters of 2022 remain close to their respective surface-level results of $322m and $390m. Thanks to their routine modest capital expenditure of only $156m during the first half of 2022, they also saw their free cash flow booming with a result of $505m, after subtracting their further $51m of miscellaneous cash expenses as listed beneath the first graph included above.

Following this very impressive turnaround, it was no surprise to not only see their quarterly dividends reinstated to $0.40 per share but most recently, accompanied by a massive $2.60 per share special dividend that even by itself amounts to a circa 8% yield on their current share price of $32.06. Whilst this is not the first time they have declared a special dividend, the only other time was in 2021 and related to the sale of their Delek US Holdings (DK) shares, whereas this one stems from their cash windfall. Naturally, this leaves investors pondering whether this marks a new approach to shareholder returns with more special dividends to follow, although unfortunately, they did not provide any firm guidance when asked during their second quarter of 2022 results conference call, as per the commentary from management included below.

“And I don’t know that the Board will continue to select special dividend as the mechanism or increase the regular, but it will be revisited every quarter and decisions will be made around that as we go forward. But bottom line is our commitment is to return cash to shareholders.”

-CVR Energy Q2 2022 Conference Call.

Even though it would have been helpful for the board to detail their shareholder returns policy, as commonly done by most companies, if nothing else, thankfully they at least seemingly view returning cash to their shareholders as a high priority. Whilst their free cash flow will always fluctuate given the inherent volatility of their industry, they should have no issues funding their dividend payments with their quarterly rate of $0.40 per share only costing $160.8m per annum given their latest outstanding share count of 100,530,599. This should consistently see very strong coverage given they generated $558m of free cash flow during 2019, despite seeing operating conditions that were merely business-as-usual. Unless operating conditions plunge back to the distressing levels seen during 2020, which seems unlikely recession or not given the global energy shortage, they should keep producing far more free cash flow than required and thus have scope to fund bonus shareholder returns even once these booming operating conditions inevitably subside.

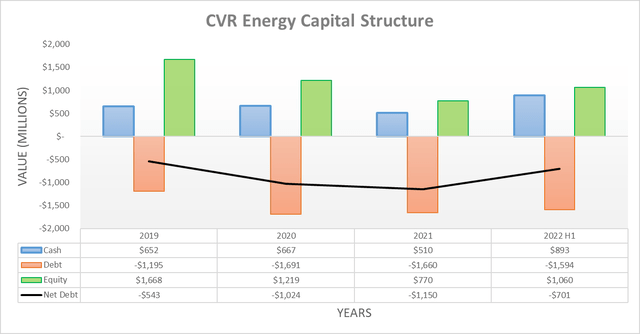

After seeing their net debt growth begin slowing during 2021 as the recovery started, the first half of 2022 saw it plummet on the back of their booming free cash flow with a drop to $701m versus its previous level of $1.15b at the end of 2021. This is now almost back to its level of $543m at the end of 2019 before the COVID-19 pandemic, which was a much faster recovery than anyone would have reasonably expected one year ago. When looking ahead, the extent their net debt continues to drop is unclear given the inherent volatility of their financial performance and the uncertainty surrounding their future shareholder returns. Although their willingness to reward shareholders quickly with a special dividend implies they intend to return a large portion of their free cash flow, which if continued would keep net debt broadly around its current level.

Quite unsurprisingly, their leverage is also now essentially back to where it was before the COVID-19 pandemic with their respective net debt-to-EBITDA and net debt-to-operating cash flow at 0.46 and 0.61, which are similar to their previous respective results of 0.63 and 0.73 at the end of 2019. This is a remarkable transformation for such a short length of time that sees their results now back beneath the threshold of 1.00 for very low territory, which significantly lifts the prospects for their shareholders to receive more special dividends or share buybacks.

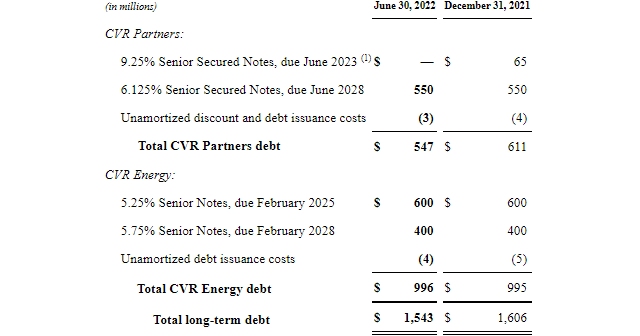

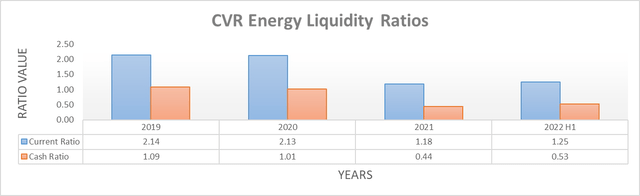

Following the analysis thus far, it should not be surprising to see their booming free cash flow also improved their already strong liquidity, thereby now seeing their respective current and cash ratios at 1.25 and 0.53, which are both higher than their previous respective results of 1.18 and 0.44 following the end of 2021. Meanwhile, their continued debt structure optimization sees ample breathing room to reward shareholders with no maturities until 2025 at the earliest, as the table included below displays.

CVR Energy Q2 2022 10-Q

Conclusion

Thanks to the booming operating conditions of 2022, they already closed the chapter on the COVID-19 era with their financial position essentially back to where it was before the pandemic and shareholders enjoying routine cash returns via quarterly dividends. Whilst it remains to be seen whether more special dividends will follow, at least management seemingly views rewarding their shareholders as a high priority. Even though this is very positive, it should also be considered that their share price is also now back to around where it was in late 2019 and thus I believe that downgrading my buy rating to a hold rating is now appropriate as their recovery is now complete.

Notes: Unless specified otherwise, all figures in this article were taken from CVR Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment