Maksim Safaniuk/iStock Editorial via Getty Images

Introduction

Two months ago, I published a mini-series of articles on the main truck manufacturers, starting from the three most recent spin-offs among the European players.

The first article dealt with Daimler Truck Holding (OTCPK:DTGHF, OTCPK:DTRUY) and pointed out how the company has the great advantage of being the market leader in North America, but that, overall, it is behind both Volvo Group (OTCPK:VOLAF) and Paccar (PCAR) in terms of margins. This is why I suggested to wait a bit more before initiating a position, because in one or two quarters we will be able to understand better if Daimler Truck has undertaken the right path towards low-double digit margins.

I then gave my view of Iveco Group (OTCPK:IVCGF) and warned that, though the company holds a leading position in Europe, its revenue depends for almost 75% from this continent, thus making it weaker than its peers in terms of geographical diversification. In addition, the company really needs to work on improving its margins, since its EBIT margin was just 2.4%. I rated it a sell, but I said that, in my view, Iveco is the most likely candidate among the industry major peers to be acquired by a competitor seeking to consolidate the industry. If this scenario happens, investors would see at least a 30% premium paid for their shares.

Traton Group (OTCPK:TRATF) was the object of my third article. Here, the main topic showed that the company has a profitable brand – Scania – and an unprofitable one – MAN – that needs to be put back on track. Moreover, the recent acquisition of Navistar should add revenue, margins and value to the group and it could be an interesting driver of increasingly good results. I advised to remain on the sidelines for some time in order to see how Traton would address this issue.

In this article, I would like to focus mainly on Daimler Truck, since I think it released the most interesting results in Q2. In the meantime, I will give a quick update about Iveco and Traton too, in order to keep track of all the three companies that were recent spin-offs.

Daimler Truck Results

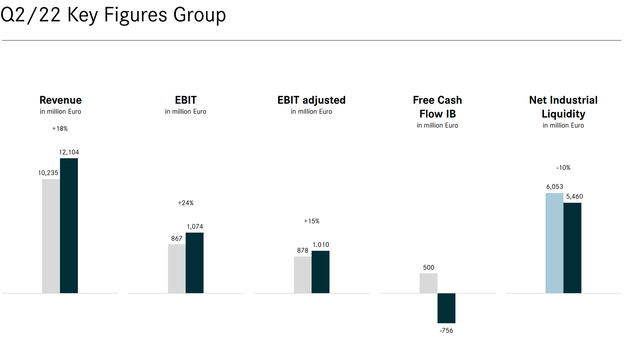

In its earnings report, Daimler Truck stated that it was able to increase its unit sales to 120,961 units in Q2 2022 (+ 4 % YoY). The revenue grew by 18% to €12.1 billion, supported by increased sales and improved net pricing. The order backlog remains high even though the company, as all its peers have done, is restricting order intake in order to control prices more effectively. Daimler Truck is actually the most strict regarding future order books, since it still hasn’t opened them up for 2023. This strategy is leading to a decreasing book to bill ratio that is currently at 92% vs. 111% a year ago. Clearly, we are still before a very high ratio that reassures investors about how strong demand for trucks is. The only segment that saw the ratio increase is Daimler Buses with a 191% ratio compared to 113% in Q2 2021. This has a simple explanation: the buses business is still in recovery mode since for almost two years it was basically reduced to zero.

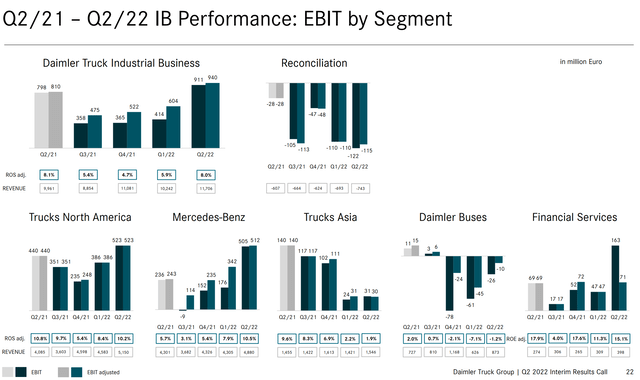

The company’s EBIT (adj.) increased by 15% to €1 billion. In the Industrial Business, EBIT (adj.) of €940 million was 15% higher YoY, as shown from the slide below taken from the results presentation.

Daimler Q2 2022 Results Presentation

The adjusted return on sales was 8%, slightly down from the 8.1% YoY. Among the three manufacturers we are considering, Daimler was the one that preserved the most its margins. The free cash flow was negative due to the impact of a change in working capital which we can see in many manufacturers as inventories built up due to supply chain bottlenecks. Moreover, the company reported that there was a problem linked to finished inventory especially in Europe, because its customers are unable to pick up finished trucks due to driver shortage.

Secondly, the negative free cash flow result was also linked to a €250 million contribution to the pension fund, which was already planned as part of the spin-off; last, Daimler Truck had to pay significant cash taxes in the quarter. This led to a decrease in net industrial liquidity from €6.1 billion in Q1 to €5.5 billion in Q2. Even though this is not the direction investors want to see for free cash flow, I think it is very easy to understand that the result was not linked to any major problem within the business and how it is managed, but that it is rather linked to external factors. In fact, the company confirmed its guidance of mid-three-digit positive free cash flow in Q3 and a strong fiscal free cash flow in Q4 supported by the reduction of finished and unfinished goods to more ordinary levels.

Keeping in mind that in Q2, Daimler Truck could not deliver as many vehicles as it could have delivered without bottlenecks and that the company increased net pricing offsetting inflationary cost increases, with an obvious benefit to the bottom line, I think the report is fairly good and encouraging.

Daimler Truck market shares

Let’s look at Daimler Truck’ market shares around the world. In North America, the company is the clear leader and it holds 41% of the Class 8 market which enables it to keep margins up. The company is also number 2 in Brazil for medium and heavy duty trucks and it is the leader in Europe for the same classes with a 19.7% market share, as shown in the 2022 Capital Markets Presentation that was just released. Daimler Buses is also the global market leader with a 27.5% market share in Europe, a 53.8% market share in Brazil and a37.8% market share in Mexico.

Daimler Truck is confident that it will keep its leadership in many markets although it is very strict on book orders. As Martin Daum, Daimler Truck’s CEO, explained during the earnings call:

Today, the limiting factor of our business still is not demand. The limiting factor is supply and our ability to produce and deliver. We are sold out especially in Europe and North America 2022. That means there is no room for any more orders for the third and fourth quarter. What you see in orders in those two regions are strictly for 2023. And as I stated in the US, we have – we are not taking any order for 2023. And in Europe we are only taking very selected, very well monitored orders.

Daimler Truck margins

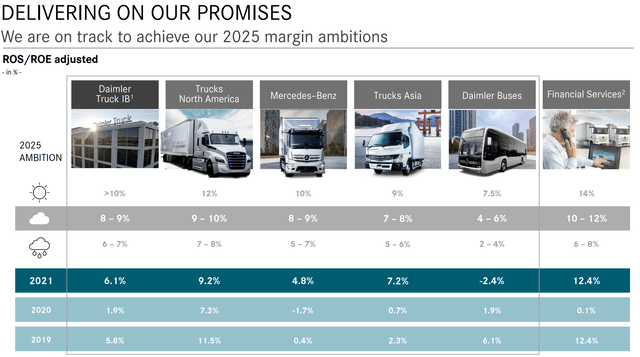

Before diving into this quarter margins, let’s recap the guidance and the goals the company has given in terms of margins. As we can see from the slide below, Daimler Truck reached overall a 6.1% margin last year that by 2025 would be accepted only in case of really adverse economic conditions. Trucks North America is leading the company with a 9.2% margin that should increase by 2025 to 12%. Mercedes-Benz has the goal to return to satisfying profitability by reaching the high single digits or even 10% in case of a favorable environment. Trucks Asia gave good results in 2021 with a 7.2% margin that could slightly improve to 9% by 2025.

Daimler Truck Roadshow Q2 Presentation

Let’s keep these numbers in mind and let’s compare them to the results at the end of Q2 2022. In the slide below, one of the most important for our analysis, we can see that in North America, the company is back to where it was a year ago in terms of margins after some difficult quarters where the return on sales decreased. The 10.2% return on sales already exceeds the 2025 goal in case of normal conditions. I think Daimler Truck will easily reach its 12% goal in 3 years, with the chance that it will reach it in a shorter period of time.

Daimler Truck Q2 2022 Results Presentation

Mercedes-Benz, which operates mainly in Europe, is well above last year’s results, with a surprising 10.5% return on sales. Why was Mercedes-Benz able to reach double digit EBIT margins of 10.5%? In the earnings call, Jochen Goetz, Daimler Truck’s CFO, explained the reasons behind the result:

Important to understand, earlier than originally expected, we recorded a positive non-cash EBIT impact of around €160 million from license income for the localization of Mercedes-Benz Truck in China. To give you some background on the license income, Daimler Truck entered into a technology license agreement with our joint venture Beijing Foton Daimler Automotive in the context of localization, localizing Mercedes-Benz trucks for the Chinese market produced by the BFDA in China. The license agreement includes the use of defined intellectual property for Mercedes-Benz Trucks Research & Development by the BFDA for the localization of Mercedes-Benz Truck. DTG transferred the final technical documentation in the second quarter, fulfilling its obligations under the license agreement. Revenue recognition and the positive EBIT effect was triggered by the acceptance of the documentation by the Chinese authorities. To be clear and open, the recording of the income was expected for 2022 and was included in the guidance, but the timing was depending on the final approval by the Chinese authorities. We received the required approvals in Q2 and therefore could record the positive impact earlier in the year than initially expected. In addition to the license income, increased interest rates have resulted in mid double digit million positive impact because of higher discounting of non-current liabilities. Even without these two items, we are exactly on track to achieve our targets.

Without these two tailwinds, margins should have been around 6% which, in any case, is a big improvement compared to the 4.8% in 2021.

Trucks Asia is finding a difficult environment to operate, given the Chinese lockdowns that keep on hindering travel and freight. Furthermore, the company shifted intentionally semiconductors from this market to higher margin ones in order to maximize its returns. As a consequence, the Asian market is taking a hit.

Daimler Buses, which was the segment most hurt by the pandemic, is almost returning to profitability and we will probably see its return on sales positive in the next two quarters. The company also took an important step to improve its competitiveness in buses: it will reduce its production cost in Germany by €100 million annually with a clear impact on margins.

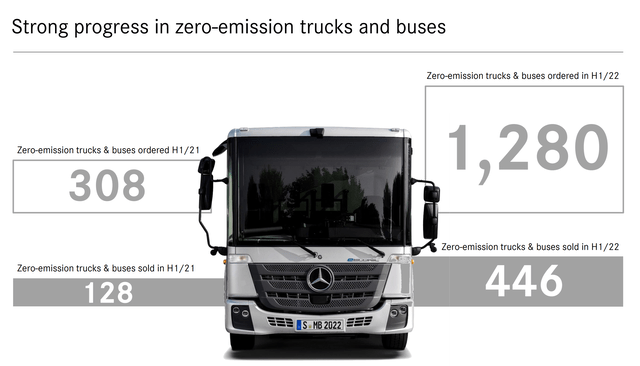

One last one, the electric and zero emission vehicles business of the company is growing, as shown from the slide below and we can count on the fact that it is picking up speed. In the U.S., the Freightliner eCascadia will enter serious production in 2022 and Daimler Truck has already got the first major order of 800 units.

Daimler Truck Q2 2022 Investor Presentations

More in general, the company was able to pass the increased costs on to customers, keeping itself on track towards a profitability that aims at the low double digits in a few years. Although I like this report, I still see some issues that need to be addressed before considering the company at the same level of the two industry leaders. First of all, the situation in Europe could affect more than expected the company’s results in the next quarters; secondly, Mercedes-Benz needs to prove itself capable of increasing its return on sales without damaging its volumes. However, Daimler Truck has a strong position, as we have seen, in North America which should protect it more than its other two peers. In addition, an improving contributor was the continued strong performance of the aftersales business, which could really help the company achieve its profitability goals.

Daimler Truck Outlook

Daimler Truck stuck to its previous guidance of a return on sales between 7% and 9 %. The full year 2022 outlook for the segments Mercedes-Benz, Trucks North America and Daimler Buses remain unchanged compared to Q1. However, given the shift in strategy we have talked about, for the Trucks Asia segment the full-year guidance is lowered to 1-3% compared to the 3-5% range given before. On the other hand, the segment Daimler Truck Financial Services is now expecting a higher margin between 9-11% compared to the previous guidance of 5-7%.

Daimler Truck’ peers

Iveco

Iveco Group reported these results for the second quarter:

- Consolidated revenues of €3,371 million, up 1.5% YoY.

- Net revenues of Industrial Activities of €3,329 million, up 1.1% YoY.

- Adjusted EBIT of €118 million (vs. €126 million a year ago), with a 3.5% margin vs. (3.8% margin last year).

- Adjusted EBIT of Industrial Activities of €91 million (vs. €110 million a year ago).

- Adjusted net income of €60 million (vs. €77 million in Q2 2021)

- Adjusted diluted EPS of €0.20 (vs. EPS of €0.26 in Q2 2021).

- Free cash flow of Industrial Activities was negative €111 million, €293 million lower compared to Q2 2021. This was due to working capital absorption because of component shortages.

These results are somewhat mixed. While the company is showing some slight top line growth, margins are shrinking and this leads to a 23% decrease in the EPS, which is quite a drop.

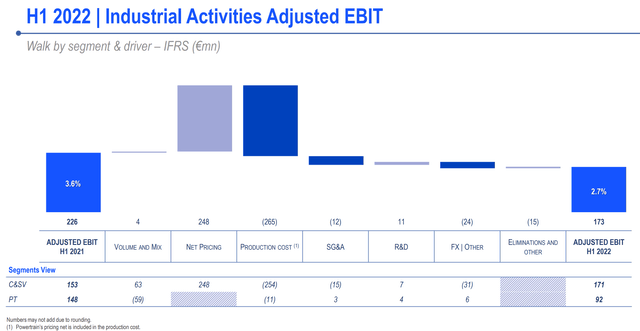

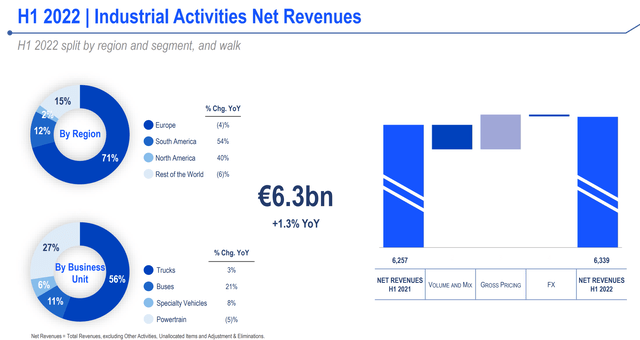

The company wasn’t able to offset completely the increased production costs and this has had an impact on margins, as shown from the graph below, taken from the results presentation.

Iveco 1H 2022 Results Presentation

The company also saw its order intake down by 10% YoY, with light duty trucks down 12%, and medium & heavy duty trucks down 7%. However, this should not worry investors since many companies, and Iveco is among them, are restricting the order slotting to manage the quality in the order books and the cost of inflation. At the end of the quarter, Iveco’s truck book-to-bill in Europe is at 1.29.

Iveco should in any case be able to reach at the end of the year a revenue close to €13 billion, around 4% higher than in 2021. In fact, total revenues for the first six months of the year are already at €6.4 billion and, usually, the second half of the year performs better than the first one. Over the first six months of the year, the EBIT margin decreased from 4% in 2021 to 2% this year. The consequence is not pleasant for investors: EPS for the first half in 2021 were €0.46, this year they are €0.05 (-89% YoY). This can’t be explained just by saying that inventories are up 31% YoY.

Finally, the company is still very linked to Europe, which may be a market that will see a slowdown in the next quarters as the war in Ukraine and the energy crisis keep on going on. True, South America is growing, but it still is only 12% of regional revenues, which is not enough to provide a true geographical diversification for the company.

Iveco 1H 2022 Results Presentation

Overall, I wasn’t particularly impressed by these results and I am actually a little concerned that the company not addressing more thoroughly its margin problem. The company states that it is controlling its order book in order to control inflation, but these results show that, so far, the strategy hasn’t worked well. I keep on believing that the company is too small to compete with the other major players of the industry and that it may be the object of an acquisition by a competitor.

Other than that, I don’t see Iveco as a convincing company and this is why I will stick to my sell rating, given in my previous article.

Traton Group

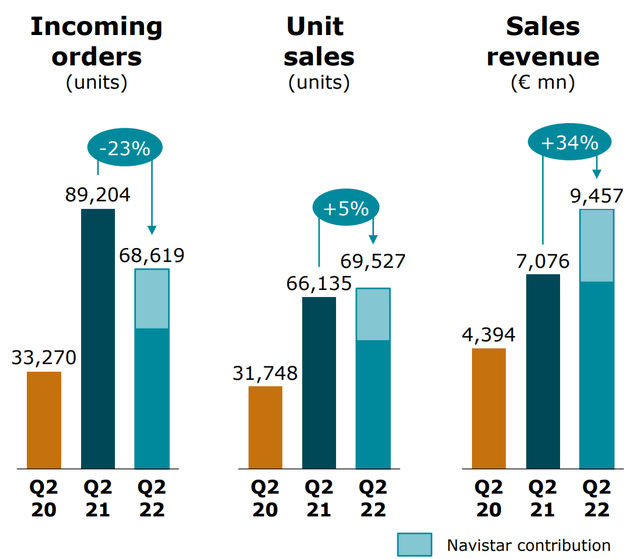

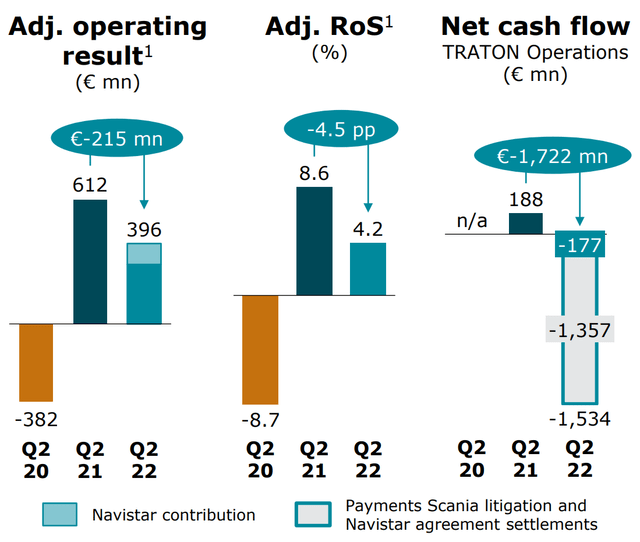

Traton Group didn’t perform much different from Iveco and it seems to be headed, too, towards decreasing orders and decreasing margins. In its report, the company showed that while sales revenue rose by 32% to €18 billion and unit sales were 9% higher at 137,294 vehicles, orders were down by 4% and, most important, the operating return on sales decreased to 4.4%, compared to 8.3% achieved in the first half of 2021. Net cash flow for industrial operations was negative €1.4 billion, compared to positive €941 million last year. As we will see, both Scania and, especially, Man are going through some hard times. It is actually the acquisition of Navistar that is enabling Traton to post decent results, as shown from the graph below:

Traton 1H 2022 Results Presentation

During Q2, it is thanks to Navistar that the group as a whole sees increasing unit sales and sales revenue. The operating result, the return on sales and the net cash flow, as we have seen from the results, are also show in these graphs that help us visualize the path of the company’s results in the past years. They are not going in the right direction and they show a company that is struggling with passing its top line growth down to the bottom line.

Traton 1H 2022 Results Presentation

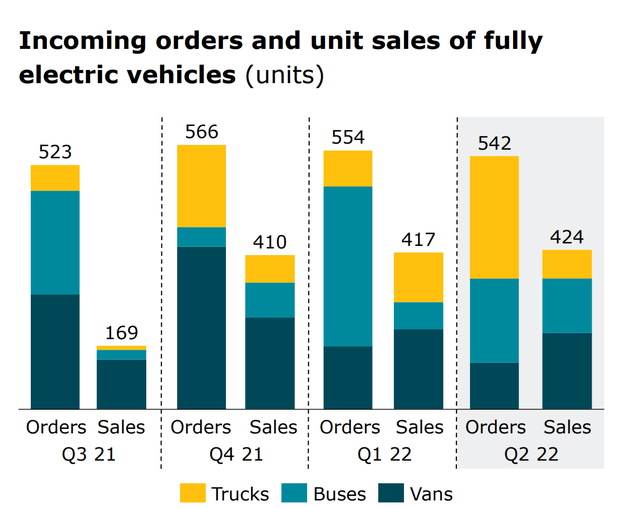

Even the electric vehicle business saw orders a bit down compared to Q1 and sales barely up compared to the previous quarter, as shown in the slide below taken from the Results Presentation:

Traton 1H 2022 Results Presentation

Keep in mind that other competitors are seeing this business grow at a very fast pace, as I just outlined in an article about Volvo Group.

Overall, I am not pleased by these results and I would have expected the company to implement better its strategy to reduce its order intake in order to keep control of costs and pricing power. Furthermore, I don’t like the fact that the electric vehicle business is growing slowly. I am not going to downgrade the company from a hold to a sell, since I believe it still needs one more quarter to make it clearer before investors what it plans on doing to push margins upwards once again. I believe the acquisition of Navistar is proving a right move and it might actually pave the way for Scania and Man to achieve better profitability.

Daimler Truck Valuation

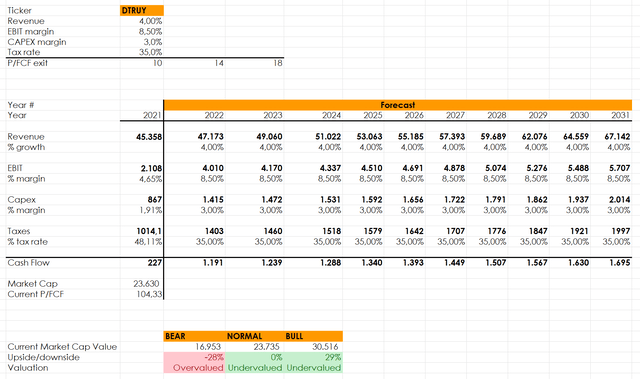

At the moment, I confirm my hold valuation. Though the company seems to be stronger than its two other peers, it still has to improve to reach results comparable to the industry leaders. In the attempt to give a fair valuation, I used this simple discounted cash flow model with the following assumptions for the next decade:

- Average revenue growth of 4%

- Average EBIT margin of 8.5%

- Capex at 3%

- Three possible price/free cash flow exit multiples: a conservative 10 and a bullish 18, with an intermediate 14.

Author, with data from Seeking Alpha

As shown, the company is actually fairly valued in case of a normal scenario, with an equal downside and upside in case of bear or bull scenario. At the moment, though I am pleased with some of the results the company reported, I still don’t see enough margin of safety to establish a full position. Bullish investors could start building a position at current valuations, but before pulling big the trigger I would wait or I would turn to other options within the industry.

Conclusion

The three manufacturers, although operating in the same industry, are on different stages of their path towards good profits. While Daimler Truck is ahead of the other two, it still needs to reassure investors about its Asian division and it needs to prove it can keep up its good results in Europe even if this continent may face a difficult winter. On the other side, Iveco and Traton are being damaged by the current economic environment and seem lagging behind the main industry players in terms of profitability. I rate Daimler and Traton as two holds, with the former getting closer to being upgrade to a buy. I keep thinking that Iveco is too weak to play globally and this is why I rate it a sell.

Be the first to comment