Fotokot197/iStock Editorial via Getty Images

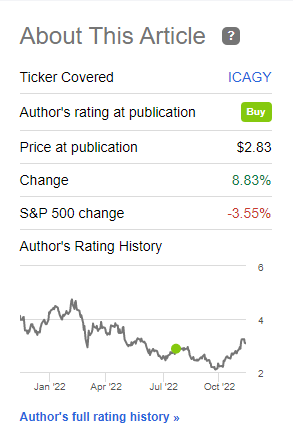

In my previous report discussing the Q2 2022 results of International Consolidated Airlines Group S.A. (OTCPK:ICAGY), I highlighted the buy opportunity for the company not solely based on the general upbeat sentiment on air travel demand, but also some particular drivers for the airline group such as capacity cap removals at Heathrow and strength in Spain.

Seeking Alpha

So far, the call for investment in International Airlines Group has performed quite well, with shares of International Airlines Group appreciating by nearly 9% compared to a 3.6% low for the broader markets. In this report, I will be analyzing the Q3 2022 results and the guidance for Q4.

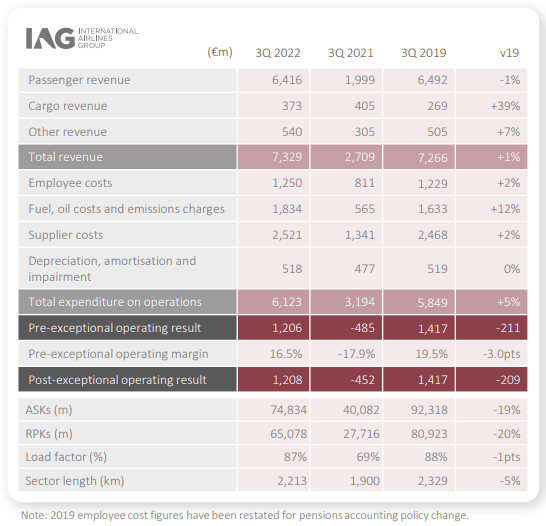

IAG

Compared to the third quarter of 2019 (pre-pandemic levels), ICAGY capacity was down 20%. However, the revenues did not reflect this one would think. With increased focus and better pricing on cargo, cargo revenues were up nearly 40% while passenger revenues were 1% higher driven by strong unit revenues. Operating results before adjustments showed a €211 million decline, which can largely be attributed to the €201 million increase in fuel costs. Viewing it slightly differently, the capacity reduction in some way was reflected inversely as lower supply led to higher unit revenues, which are baked into the topline results.

After aligning the accounting principles between 2019 and 2022, Aer Lingus revenues were 3% above 2019 levels, with capacity levels being 90% recovered and 102% recovered in the North Atlantic market. Profitability was 82% recovered, showing there is room for improvement.

British Airways is the airline where things are lagging behind. Capacity was 74% recovered, which is caused by capacity caps at London Heathrow Airport and that resulted in passenger revenues being 89% recovered instead of what likely would be a full recovery and profitability was only 65% back to pre-pandemic levels and the pre-pandemic results for the third quarter did include bottom line pressures from a pilot strike. The Q3 2022 results were also dampened by forex pressure of £87 million.

Where we are seeing significant strength is Spain in the form of Iberia and low-cost carrier Vueling. Iberia’s total revenues were 3% above pre-pandemic levels and passenger revenues were 5% above pre-pandemic levels, with profitability 90% recovered and capacity 84% recovered. Vueling’s revenues were 15% above pre-pandemic levels, and profits exceeded pre-pandemic levels by 11% on 3% capacity expansion. So, we do see some variance in the results per airline, but overall Q3 2022 results were good and exceeded the consensus by €400 million.

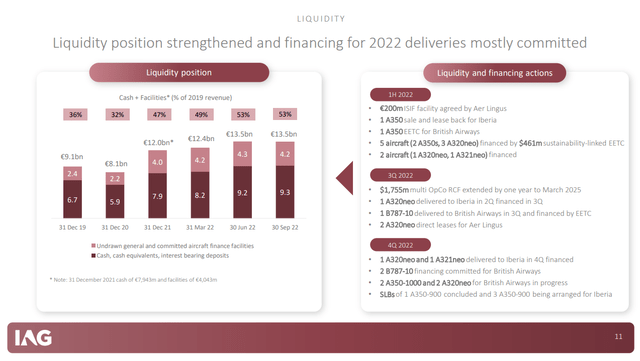

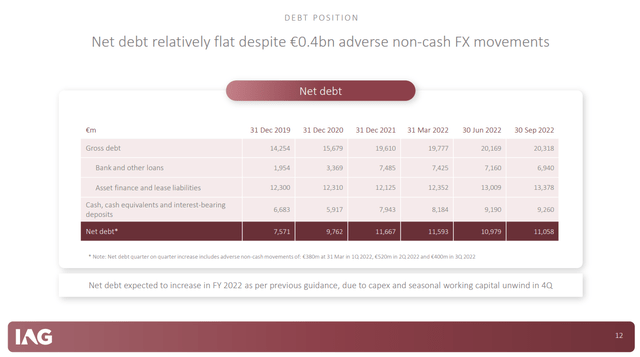

Liquidity Plateaus And Debt Increases

The liquidity position remains strong. Quarter-over-quarter, we see that cash and equivalent increased only slightly despite strong performance, but this is driven by initial cash build-up in the first half of the year unwinding in the second half of the year. Furthermore, ICAGY is focusing on regrowing its fleet and capacity to pre-pandemic levels, which puts some pressure on its liquidity increases but for good reason.

The net debt increased slightly quarter-over-quarter, but is down year-to-date despite a €400 million revaluation pressure. Net debt not showing stronger reductions also reflects the aim to increase the fleet and operations to pre-pandemic levels for which financing is required and cash is spent. I would like to see the debt coming down a bit faster, but the fact that this is not happening at this point is no point of concern.

More Color To Outlook For International Consolidated Airlines Group

With one quarter ahead this year, ICAGY felt comfortable setting a Euro target on profits before adjustment, and that target has been set at €1.1 billion. With a €1.2 billion profit in Q3 2022 and €739 million in the nine months ended September, I would say that the €1.1 billion target seems a bit soft, but nonetheless, the company is expecting solid performance for the year. Q4 2022 capacity is expected to be 87% of 2019 and 78% for the full year and 95% of 2019 in Q1 2023.

Compared to the FY 2022 capacity guidance, we see a slight contraction in the guidance for all airlines except British Airways. Looking at where the growth opportunities are for ICAGY, it is also with a strong focus on British Airways. On the 30th of October, the capacity cap at Heathrow has been removed which should start benefiting British Airways going forward and with re-openings in the Asia-Pacific regions there also are opportunities there, though the conditions remain subject to how COVID-19 infection numbers develop.

Furthermore, the Spanish market is expected to continue showing strong performance while and business travel is 70% recovered by volume, giving it significant runway ahead for ICAGY to capitalize on. Premium leisure revenues also have some room for improvement at British Airways, and hybrid travel could also further support demand for air travel. So, there are a lot of growth drivers for ICAGY to continue showing strong performance for at least a quarter or two ahead.

Conclusion: Opportunities Ahead For International Consolidated Airlines Group Stock

The ICAGY Q3 2022 results were good and significantly above expectations. While I do expect continued strength in performance despite inflationary pressures and recession and recession risk that will soften demand for cargo and potentially passenger travel, the full year guidance points at a somewhat weak fourth quarter which likely embeds continued high fuel costs and possibly some off-peak yet high unit revenues. So, I am interested to see how that pans out. However, I also do believe that with the capacity cap removed from Heathrow we should see stronger performance at British Airways in the quarters to come amplified by re-openings in the Asia-Pacific regions which should help British Airways in its long-haul network revenues.

So, while there are challenges, and I am somewhat puzzled by the guidance and the implications for Q4 2022, I do believe that there is significant room ahead for International Consolidated Airlines Group to continue its strong performance. The big unknown, however, is how strong unit revenues will be heading into next year.

Be the first to comment