Anchiy

When it comes to companies that are undergoing meaningful transitions, analysis can become rather challenging. Throw into this the fact that the past few years, broadly speaking, have been defined by tremendous economic and stock market volatility, and you definitely end up with some uncertainties that must be contended with when rendering an assessment of a company’s prospects. One firm in question that seems to be chugging along nicely after a lot of changes itself is Allscripts Healthcare Solutions (NASDAQ:MDRX). This business, which delivers information technology solutions and services to healthcare organizations across the globe, is starting to resume growth again and has shares that seem to be trading at rather cheap levels. Naturally, investors should still remain cautious about this firm, especially as economic issues become more precarious. But as a whole, I am starting to become a bit more bullish on the enterprise.

A quick note

All of the financial metrics mentioned in this article, unless otherwise mentioned, refer to results from continuing operations for the company. I make this disclosure because it has substantial discontinued operations data that still falls on its books as it deals with the legacy of old parts of the company.

Signs of stability and growth

The last time I wrote an article about Allscripts Healthcare Solutions was back in late February of this year. At that time, I talked about how the company was finally showing some robust fundamental results following a few difficult years that it went through. I also felt as though shares were cheap enough to perhaps warrant some nice upside for investors. At the same time, however, I still felt as though the lack of consistency in the company’s financial performance warranted some concerns from investors. And it was that primary feeling that led me to keep the company rated a ‘hold’ to reflect my belief that shares would likely generate upside or downside that would more or less match the market for the foreseeable future. So far, this call has proven to be pretty solid. While the S&P 500 is down by 8.9%, shares of Allscripts Healthcare Solutions have dropped about 6.9%.

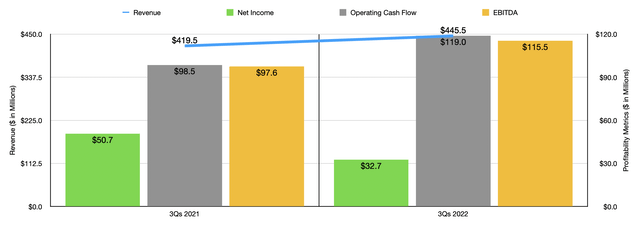

Fundamentally speaking, Allscripts Healthcare Solutions seems to be doing pretty well for itself. For the first three quarters of the 2022 fiscal year as a whole, the company generated revenue of $445.5 million. That’s 6.2% higher than the $419.5 million generated one year earlier. According to management, increases in transaction-related, subscription, and upfront software revenues helped to push provider revenue for the enterprise up by 4.4% year over year from $345.3 million to $360.4 million. The greatest growth from a percentage basis though came from the payer and life sciences operations of the enterprise. Revenue here shot up by 14.5%, climbing from $74.3 million to $85.1 million. According to the company, this was thanks to an increase in subscription revenues and transaction-related revenues under that category. To be clear, the real driver for the company these days is its Veradigm business. So far this year, it has accounted for 95.7% of the company’s overall sales. While the other parts of the company are shrinking, this particular piece of the pie is rising, with revenue in the year-to-date period up by 7.4% compared to where it was in the first nine months of 2021. For those who may be new to the company or who might be a bit rusty on the details, Veradigm provides health plans and payers, health care providers, network partners, patients, and other related parties, data collection and analytics services, online personal health records, prescription price transparency solutions, and more, for their customers.

Although revenue for the company rose nicely year over year, net income did take a step back. Profits fell from $50.7 million in the first three quarters of 2021 to $32.7 million the same time this year. Most of this decline came from a rise in selling, general, and administrative expenses. Though the company did also see research and development costs increase as well. When it comes to the former metric, the increase from $87.7 million to $133.7 million can be attributed to a couple of different factors. First, stock-based compensation dedicated to these activities jumped from $7 million to $17.6 million. In addition to this though, the company also dealt with higher legal costs and certain corporate expenses that ended up remaining following some of the company’s disposition activities. Fortunately, other profitability metrics fared much better. Operating cash flow, for instance, rose from $98.5 million to $119 million, while EBITDA grew from $97.6 million to $115.5 million.

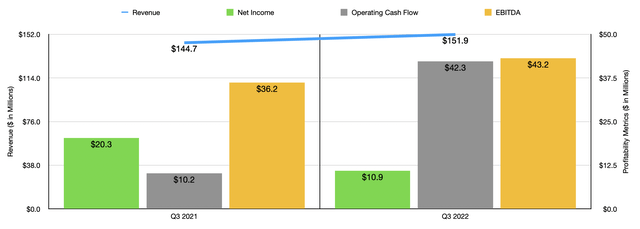

Even when you fast forward to the most recent quarter, which would be the third quarter of the company’s 2022 fiscal year, results are looking up. Revenue of $151.9 million beats out the $144.7 million reported the same time last year. Once again, net income is lower, having fallen from $20.3 million to $10.9 million. But operating cash flow has grown from $10.2 million to $42.3 million, while EBITDA has risen from $36.2 million to $43.2 million. Truly, these results are robust for the most part. Management has used this opportunity to buy back a great deal of stock. In the third quarter alone, the firm repurchased $34 million worth of shares. This is not to say that everything for the company is great. For instance, bookings for the company’s offerings in the latest quarter came in at $58 million. That’s down marginally from the $61.6 million reported the same time last year. Even that being the case though, bookings for the first three quarters of the year in their entirety are still up by 5.6%. This does give some reason to celebrate.

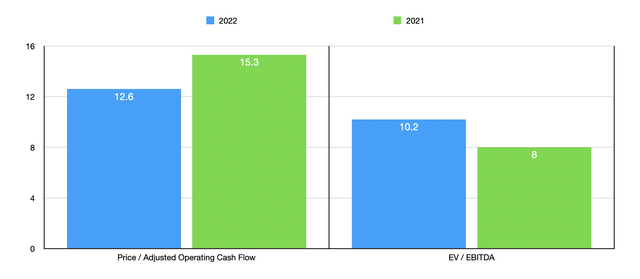

When it comes to the 2022 fiscal year in its entirety, we don’t really know what to expect. Management has said that revenue associated with Veradigm should rise by between 6% and 7%, while EBITDA should grow by between 10% and 15%. Seeing as how Veradigm comprises most of the company’s operations, using that kind of growth rate when it comes to EBITDA as a whole would not be unrealistic. This would imply a reading for 2022 of $175.4 million. The picture gets a bit trickier when considering operating cash flow. Management said that free cash flow from continuing operations this year should be between $110 million and $120 million. But they haven’t really guided any capital expenditure data. If we take the capital expenditure figures used last year, that would imply operating cash flow this year of $193.6 million. That’s down from the $248.3 million reported last year even though results so far in 2022 are looking up. But to be safe, I’m going with this more conservative figure.

Based on these estimates, the company is trading at a forward price to operating cash flow multiple of 10.2 and at a forward EV to EBITDA multiple of 9.6. If, instead, we were to use the data from 2021, these multiples would be 8 and 10.8, respectively. As part of my analysis, I compared the company to four similar firms. On a price to operating cash flow basis, these companies ranged from a low of 11.6 to a high of 128.8. And when it comes to the EV to EBITDA approach, the range is between 28.3 and 93.5. In both scenarios, Allscripts Healthcare Solutions was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Allscripts Healthcare Solutions | 10.2 | 9.6 |

| GoodRx Holdings (GDRX) | 11.6 | 29.2 |

| Definitive Healthcare Corp. (DH) | 32.4 | 93.5 |

| Evolent Health (EVH) | 128.8 | 92.6 |

| Certara (CERT) | 29.7 | 28.3 |

Takeaway

What we know about Allscripts Healthcare Solutions at this moment is that the company is showing some nice signs of recovery. It has only recently really made the shift away from its old business model to what it has today. Moving forward, I suspect that the future for the enterprise will be rather bright. I don’t like seeing net income drop like what we experienced so far this year. But when you look at things from a cash flow perspective, the situation does look promising. Add on top of this how cheap shares are, both on an absolute basis and relative to similar firms, and I do think the company now warrants a soft ‘buy’ rating.

Be the first to comment