wellesenterprises

Thesis

NVIDIA Corporation (NASDAQ:NVDA) stock has recovered remarkably from its October lows, posting a price gain of more than 57% to its recent November highs, as its valuation fell to its 10Y average. Notably, the gains are ahead of its 10Y total return CAGR of 50.3%. We also gleaned sellers have started to swamp NVDA’s buying upside, as astute buyers who picked October lows could be looking to cut some exposure.

However, the real test for the buyers from these levels will be whether they can muster enough momentum to retake August highs. Our analysis suggests that the recent sharp recovery looks ready for a further pullback.

Therefore, investors need to assess whether October lows would be supported for investors to be confident in buying the dips. Failing which, it could turn out to be a “falling knives” situation, given NVDA’s strong medium-term downtrend bias.

Management had attempted to assure investors of its forward outlook, suggesting the company expects sequential growth in its revenue segments (sans pro viz). The market had also correctly anticipated a better-than-feared Q3 release as it formed its October lows (pre-earnings).

We believe investors looking to add more positions need to be patient here. Given the sharp recovery from its October lows, a healthy pullback should provide investors more clues to assess buyers’ conviction as NVDA looks to consolidate above its October lows. Hence, we believe it’s not time to jump on board now after significant technical damage in NVDA’s price action.

With a valuation that has likely been de-rated, NVDA buyers still need to defend its 10Y average against further downside. Hence, we believe a potential successful re-test of NVDA’s October bottom should be capitalized by investors looking to add more to positions at its long-term lows.

Revising from Buy to Hold for now, as we await patiently for the re-test.

Management Needs Its China Segment To Turn Its Decline Around

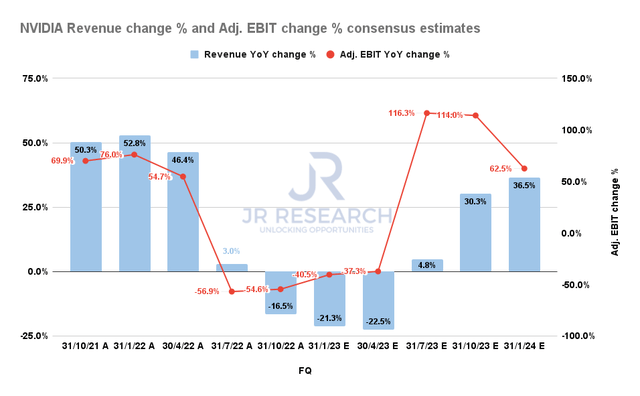

NVIDIA Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

Management’s guidance in its FQ3 release suggests that it sees revenue declines of -21.5% YoY (midpoint) but a slight uptick of 1.2% QoQ. However, the consensus estimates are slightly more bullish, indicating a revenue decline of -21.3% YoY.

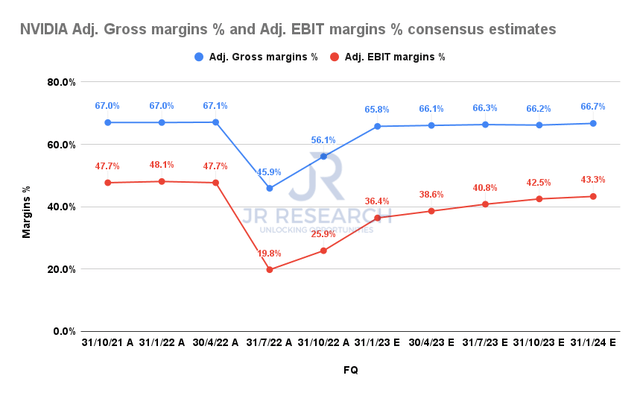

NVIDIA Adjusted Gross margins % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Also, Nvidia’s forward guidance indicates the worst of its inventory digestion is likely over, with a return to 66% in adjusted gross margins (midpoint) for FQ4.

Recent data from Tom’s Hardware also indicated that the pricing digestion of Nvidia’s RTX-30 series has slowed down, with a potential for inflection. It articulated:

Prices on the remaining Nvidia and AMD (AMD) cards mostly trended down again, which is nice to see, though the rate of decline has definitely slowed. We also noticed that retail prices on the RTX 30-series cards have started to head back up. Overall, Nvidia prices are down just 2.8% compared to [October], while AMD prices dropped 5.6%. – Tom’s Hardware

Also, the premium on its latest RTX-4090 premium GPU has held up well, seeing robust demand despite the discount seen in the RTX-30 series. Hence, we believe management’s outlook seems more credible after last quarter’s poor execution that affected investors’ confidence in CEO Jensen Huang and team.

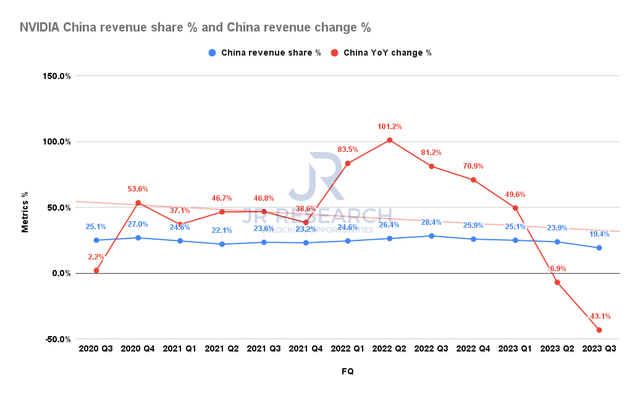

NVIDIA China revenue metrics (Company filings)

However, we postulate that unless China’s significant underperformance improves markedly from its current malaise, we assess it’s challenging to expect Nvidia to return to a high-growth mode to justify its premium valuation.

China accounted for 19.4% of Nvidia’s revenue in FQ3, down from last year’s 28.4% and also down from FQ2’s 23.9%.

Notably, its China revenue fell 43% YoY, collapsing from Q2’s 6.9% downtick. Therefore, it’s critical for NVIDIA to help relieve its data center customers from the US export restrictions that targeted its A100 and H100 AI-high-performance computing (HPC) chips.

Furthermore, Jensen Huang assured investors that it expects its A800 chips to fulfill the US export requirements to China and not be some unsustainable method to circumvent the rules. Hence, it should provide durability over the revenue visibility for its A800 chips.

Notwithstanding, China’s zero COVID restrictions have resurfaced after a recent move to refine its strategy. Therefore, we believe China remains a drag in lifting Nvidia’s growth impetus from its normalization. Without significant improvement from China, we think it’s highly challenging for Nvidia to recover its August highs.

Is NVDA Stock A Buy, Sell, Or Hold?

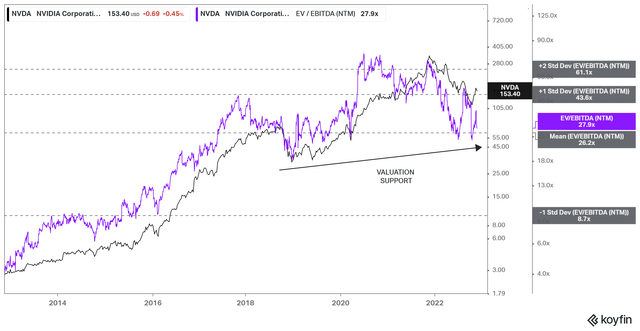

NVDA NTM EBITDA multiples valuation trend (koyfin)

As seen above, NVDA’s valuation has been supported above its 10Y EBITDA multiple averages since 2020. Hence, it’s critical for buyers to stanch further downside from its October lows.

Furthermore, if Nvidia’s forward estimates are not likely to be slashed further, we believe its valuation support has been de-risked appropriately.

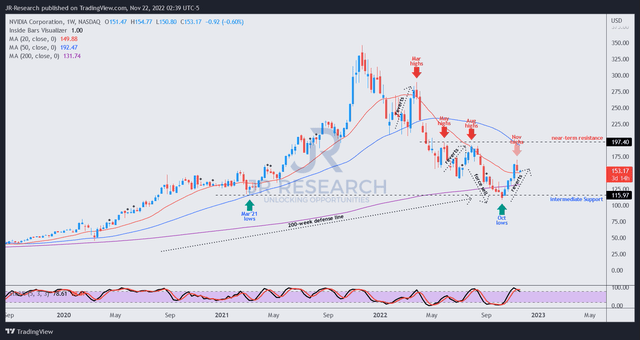

NVDA price chart (weekly) (TradingView)

The recovery of NVDA’s price action toward above its 200-week moving average (purple line) or 200-week MA is constructive, helping it to form its long-term bottom.

However, it remains in a medium-term downtrend, with its November highs likely facing selling pressure after a sharp mean-reversion rally from its October lows.

Hence, we postulate that NVDA buyers must demonstrate resolve in sustaining NVDA’s next pullback above its 200-week MA before a sustained bottom can be confirmed.

For now, we believe a pullback is imminent and suggest investors wait on the sidelines first.

Revising from Buy to Hold.

Be the first to comment