tum3123

Emerging Markets vs. Developed Markets Equity Quant Model Has Turned More Positive

Suggests Considering an Overweight to Emerging Market Equities

Historical and current analyses do not guarantee future results. As of October 31, 2022 (AllianceBernstein)

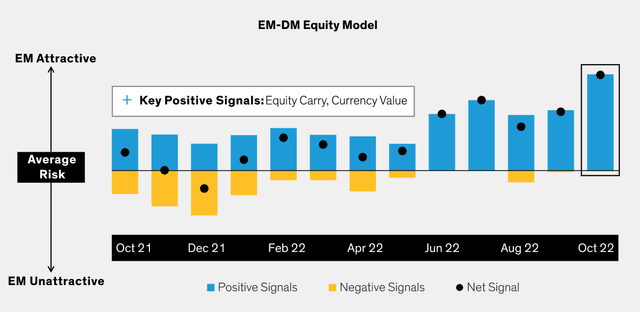

Emerging market (EM) equities have underperformed this year. But recently, an upturn in key quant signals supported a fundamental view that EM equities could be starting to look attractive relative to developed markets (DM) (Display).

Through October, our multi-asset quant models were sending increasingly positive signals in favor of EM equities relative to DM equities. EM equities have lagged DM, with many EM countries badly hurt by the impact of COVID, the global economic slowdown and a strengthening US dollar.

Across our wide range of quant signals, two positives for EM equities stood out: equity carry, a relative valuation measure; and currency value, which compares currencies’ competitiveness. On both measures, EM was rated attractive against DM equities.

Combining Quantitative and Fundamental Signals

These signals, used in conjunction with our fundamental analysis, led us to the view that EM looks to be offering good value and that an improvement in fundamentals could trigger outperformance versus DM. Recently we have seen early signs of positive change for EM, notably in China: some relaxation of the tough COVID quarantine rules that have weighed on economic activity; further policy measures to address the property crisis; and a potential thawing of US/China relations. These steps are widely viewed as supportive of economic growth both in China and for EM economies that are linked to Chinese consumer demand.

Risks to EM still remain, notably in terms of continuing high inflation, together with geopolitical tensions and slowing growth across much of the region. So the weight of an EM equity position should be carefully considered in the broader context of a multi-asset portfolio.

While we still feel underweight to risk assets makes sense for multi-asset investors, we think tactical positions can improve overall risk-adjusted returns. By using a dynamic approach to asset allocation, as well as a combination of quantitative and fundamental signals, investors can effectively tap the widest possible opportunity set to reduce risk and enhance return potential.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment