imaginima

The energy sector is incredibly complex and requires a number of working parts in order to operate. You have companies that extract raw materials for the purpose of creating energy. You also have companies dedicated to producing it or refining it. You have others that are focused on other activities such as actually delivering that energy to customers. One firm that does this in the regulated energy space and that also happens to focus on the production and sale of construction materials like crushed stone, sand, gravel, asphalt mix, and more, is MDU Resources Group (NYSE:MDU). So far this year, financial performance achieved by the company has been really robust. This, combined with the company’s low share price, has been instrumental in keeping investors more enthusiastic about it than about the economy more broadly. As a result, shares of the company have outperformed the broader market for much of this year. And based on the data currently available, I do think that trend is likely to continue for the foreseeable future, leading me to keep the ‘buy’ rating I had on the company previously.

Great results so far

Back in early January of this year, I wrote a bullish article about MDU Resources. In that article, I talked about how the company had grown consistently over the prior few years, including through the pandemic. That growth was continuing at the time that I wrote about the business, serving to further increase my optimism about its prospects. Add on top of this growth record the fact that shares of the company were trading at fundamentally attractive levels, and I could not help but to rate the business a ‘buy’. So far, my call has played out quite well. While the S&P 500 is down by 15% since the publication of that article, shares of MDU Resources have declined by only 0.3%.

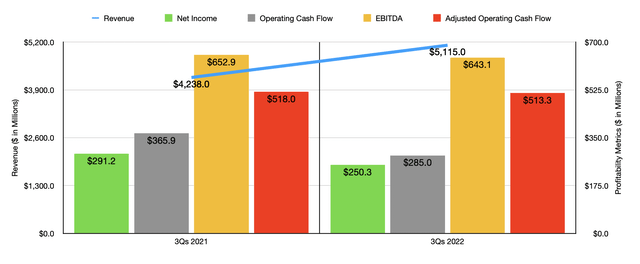

Author – SEC EDGAR Data

This return disparity is certainly no fluke. To see what I mean, I would like to point you to the financial performance achieved by the business. For the first three quarters of the 2022 fiscal year, sales of the company came in strong at $5.12 billion. That’s 20.7% higher than the $4.24 billion generated the same time last year. This increase in sales was driven by strength across the company’s segments. For instance, the Electric segment of the enterprise reported revenue of $278.6 million in the first nine months of the year. That’s 4.1% above the $267.7 million generated one year earlier. This came at a time when actual volume was lower year over year to the tune of 2.2%. Instead, the company made up for it with an increase in the average cost of electric fuel purchase of 30%. A combination of a 12% increase in production volumes and a 34.9% increase in pricing, somewhat offset by a 7.3% decline in transportation sales, was instrumental in pushing up revenue under the Natural Gas Distribution segment of the company by 29% from $614.8 million to $793.3 million.

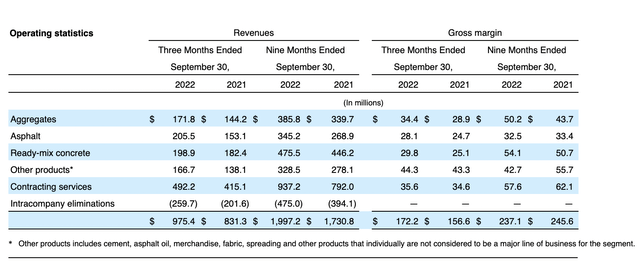

MDU Resources

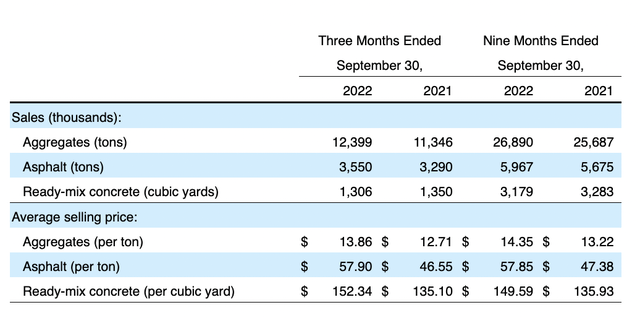

MDU Resources

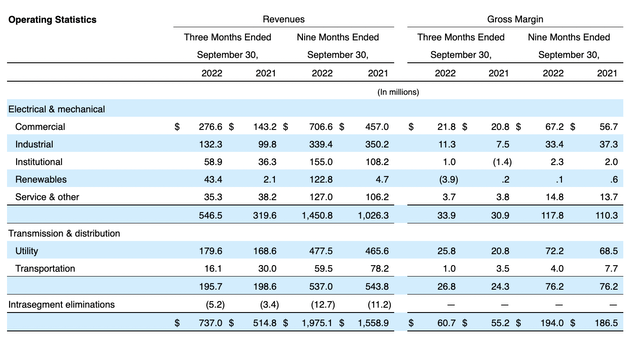

The much smaller Pipeline segment of the company reported a 7.1% increase in sales. Growth for the company came from the Construction Materials and Contracting segment of the firm. Revenue here jumped by 15.4%, climbing from $1.73 billion to nearly $2 billion. Growth here occurred across pretty much every category as the image above illustrates. And as you can see in the second image above, higher average pricing for the products the company sold (excluding ready-mix concrete), combined with an increase in amounts sold (excluding ready-mix concrete), proved useful in achieving this upside. Under the Construction Services segment, sales shot up by 26.7%, climbing from $1.59 billion to $1.98 billion. This increase was driven mostly by greater demand for the company’s electrical and mechanical services in the commercial category. Management attributed this to a variety of factors, including $97.5 million of additional workload in the hospitality sector, a $30 million increase in data center work, and an increase in the general commercial sector.

MDU Resources

Although revenue for the company increased for the first nine months of the year, profits took a step back. Net income fell from $291.2 million to $250.3 million. Given how large and complicated MDU Resources is from an operational perspective, we could spend an entire article dissecting exactly why this decline in profitability occurred. The short answer is that the company experienced margin contraction largely due to inflationary pressures like increased fuel and material costs, higher labor costs, and efficiency issues in some parts of the firm. Naturally, this led to weakness in other measures of profitability. Operating cash flow, for instance, fell from $365.9 million last year to $285 million this year. If we adjust for changes in working capital, we still would have seen a decline from $518 million to $513.3 million. And over that same window of time, EBITDA for the company dropped from $652.9 million to $643.1 million.

Author – SEC EDGAR Data

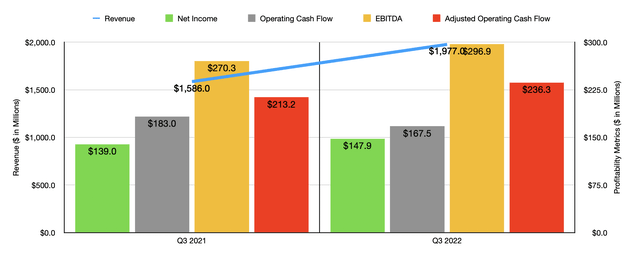

If it seems odd that shares would hold steady at a time when profits are declining, I would urge you to look at financial results covering the third quarter of 2022. For that quarter alone, revenue surged from $1.59 billion last year to $1.98 billion this year. This was an impressive 24.7% rise year over year. With it, net income rose from $139 million to $147.9 million. Operating cash flow still was lower year over year, dropping from $183 million to $167.5 million. But if we adjust for changes in working capital, it would have risen from $213.2 million to $236.3 million. And over that same window of time, we also saw an improvement in EBITDA, with the metric rising from $270.3 million to $296.9 million.

Author – SEC EDGAR Data

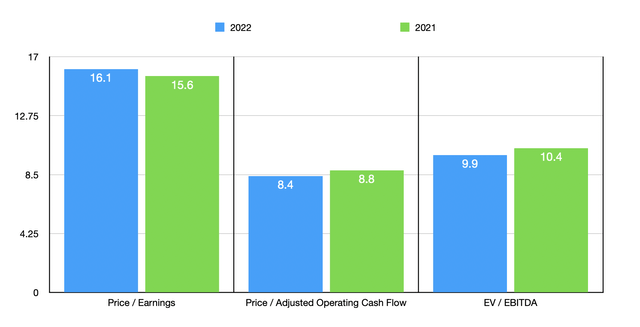

When it comes to the 2022 fiscal year and its entirety, management believes the net income from continuing operations should be between $350 million and $385 million. At the midpoint, that would translate to profits of $367.5 million. Meanwhile, EBITDA is forecasted to be between $875 million and $925 million. Using the midpoint there of $900 million, we should get adjusted operating cash flow of around $704.3 million. Given these figures, we end up with a forward price to earnings multiple of 16.1, a forward price to adjusted operating cash flow multiple of 8.4, and a forward EV to EBITDA multiple of 9.9. In two of these three cases, the company looks cheaper year over year than if we were to use the data from 2021. As part of my analysis, I also compared the company to five similar businesses. As you can see in the table below though, using each of the three valuation metrics, MDU Resources ends up being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| MDU Resources Group | 16.1 | 8.4 | 9.9 |

| Stantec (STN) | 36.7 | N/A | 14.8 |

| Valmont Industries (VMI) | 29.1 | 36.8 | 16.2 |

| MasTec (MTZ) | 67.8 | 17.5 | 14.3 |

| EMCOR Group (EME) | 20.4 | 17.7 | 11.3 |

| Fluor Corp. (FLR) | N/A | 108.2 | 15.7 |

Takeaway

Although I would have preferred for shares of MDU Resources to actually rise over the past several months, I find myself pleasantly surprised by how well the company has held up in a very difficult and uncertain environment. Overall, the financial performance of the company looks very robust and I have no doubt that its future should be bright. Add on top of this how cheap shares are on both an absolute basis and relative to similar firms, and I do believe that a ‘buy’ rating is still appropriate for it at this time.

Be the first to comment