Melena-Nsk/iStock via Getty Images

Published on the Value Lab 1/4/2022

We think that US housing is actually a really strong and relatively rational market. While this year’s economics woes are supply side and not monetary in nature, as we’ve always maintained, housing is also the marquee theatre for stagflation in action. Prices are rising across chemicals and materials for construction, and prices of homes also continue to rise, while actual homebuilding falls! Unproductivity being the cause of price increases is the definition of stagflation, but with such a clear marker that demand is outpacing supply, we can also be more sure about the financial outlooks for companies that provide essential materials for the industry. We look at Interfor (OTCPK:IFSPF) and explain why we think this could be the essential pick for the next leg of the market.

Comment on US Housing

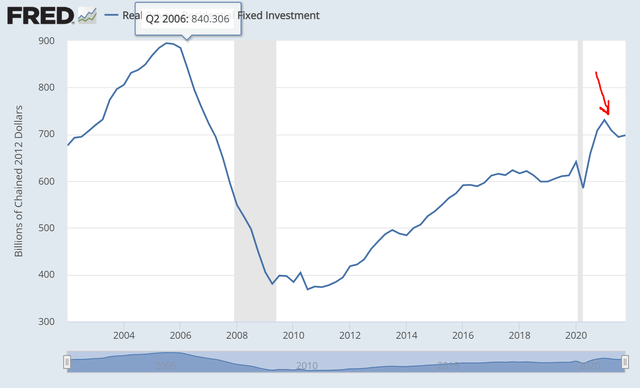

Why are we confident in US housing? Prices are rising by as much as 20% across US markets in 2021, but investment by developers/private buyers and homebuilding has actually fallen since Q1 2021, so we are not afraid of rate hikes opening a hole below the housing prices. Companies are actually trying to put homes together, but supply side issues are posing a very real barrier to being able to do that.

Real Private Residential Investment (St. Louis Fed)

Things like cabinets and doors, and a lot of other lumber based products, are definitely part of the shortages that are causing issues. But together with other products like chemicals also being short, the whole development segment is simply needing to bring down the velocity to be able to cope, so lumber prices, while higher than pre-pandemic, have come back down.

Lumber Prices (tradingeconomics.com)

The Beauty of Sawmills

We were majorly invested in Suzano (SUZ), another business much like lumber production that takes in trees as an input. While fiber is less particular to source for pulp production, one of the beauties of sawmills is similar to the reason we invested in Suzano in the first place. Trees are abundant, but the facilities that process trees into products are not. Pulp factories, just like sawmills, are simply not very abundant, and this bottleneck was the reason for the massive increase in lumber prices that we saw in early 2021.

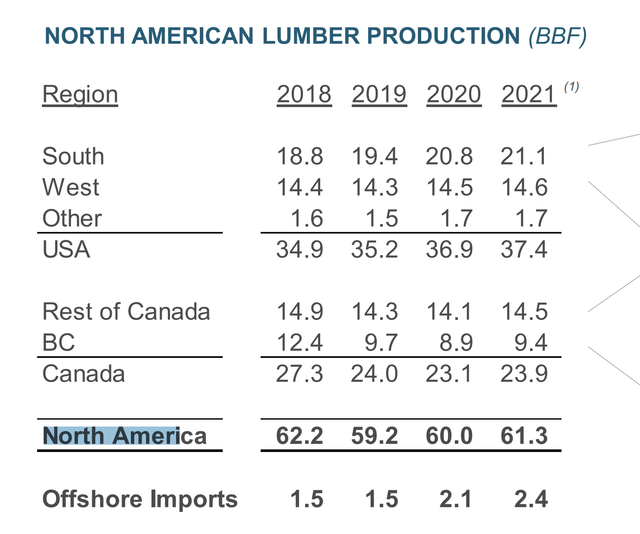

There’s also more factors that favor lumber producers right now. Sawmills in British Columbia are suffering with beetle infestations that have now become a perennial problem for that region’s timber, reducing Interfor capacity there by 24% since 2018. Moreover, Russia which is a major landmass with lots of timber is also at risk of coming off the market, with those sawmills effectively less productive for export to western markets, even without explicit trade bans. Sawmills in NA have become more valuable, but it’ll take some time before those mills are constructed, and even when they are, it’ll coincide with releasing pressure on the supply chain, and the housing end-market should become unblocked to compensate for the increasing supply.

The Interfor Play

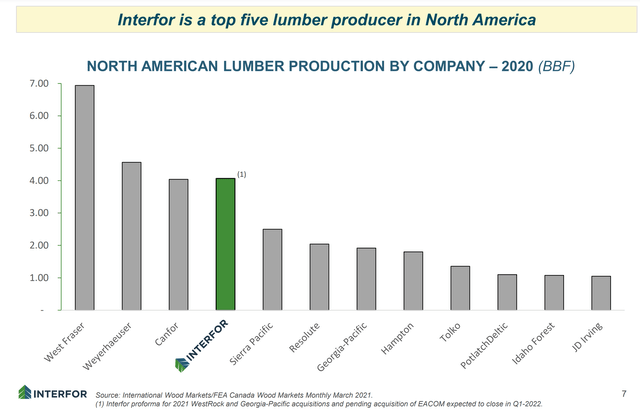

Interfor is one of the major pureplay lumber players, and it has been repositioning itself to have more assets in the US rather than Canada.

Market Position (Investor Presentation Interfor)

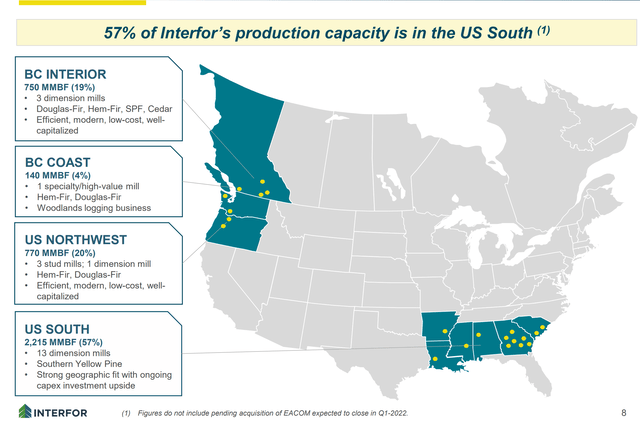

While it used to be much more focused with assets in BC, most of its productive capacity is now in the US south financed in part by the extraordinary windfall from lumber prices in 2020 and early 2021.

BC vs South US (Investor Presentation Interfor)

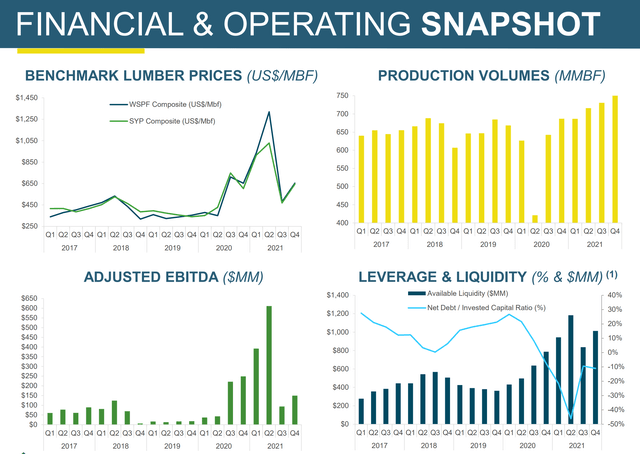

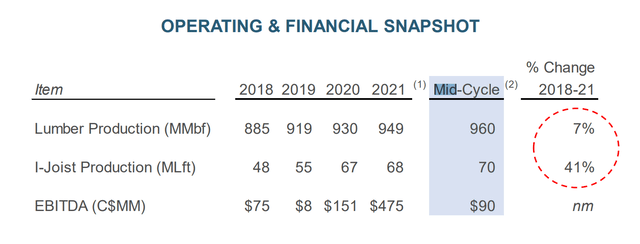

They’ve spent almost C$500 million in acquisitions to grow their capacity, with the latest transaction bringing them up 25% once it closes. Now they’re on track to produce around C$700 million in EBITDA based on current lumber prices with an EV of C$2.3 billion, so a 3.1x multiple. The growth in production has been trending relentlessly upward, with BC assets only having a slight reprieve from an overall decline.

Financial Highlights (Investor Presentation Interfor) Production By Region (Investor Presentation Interfor)

Return Opportunities and Risk

The risks are quite clear, the company is very levered to the price of lumber. Looking at their EACOM target announced in November 2021, if 2021 was the blockbuster year, then there could be as much as a 80% decline in the profits if we enter a less fervent and more normalized environment. We are already in an environment that can be represented by the mid-cycle figures.

EACOM Assets Snapshot (Investor Presentation Interfor)

However, we think there is enduring strength and enough pent up demand in the US housing market that things can’t go too wrong. We believe that a 3.1x multiple is sustainable over the next couple of years, with the possibility of lumber prices even seeing a recovery and driving those profits much higher, meaning the multiple could be even lower on forward EBITDA. Given the market fundamentals, we are not too worried about a payback period of 3 years. That’s a horizon we can entirely expect sawmills to be resilient over. We rate Interfor a buy.

Be the first to comment