gorodenkoff/iStock via Getty Images

REIT Rankings: Industrial

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on September 21st.

Hoya Capital

A perennial performance leader in recent years, industrial REITs have been slammed this year despite delivering stellar operating performance with demand for well-located logistics space continuing to outstrip supply. Just as valuations were recovering from the plunge in the wake of Amazon’s (AMZN) late-April earnings report in which it announced that it was pumping the brakes on its pandemic-fueled logistics expansion plans, the sector has taken a fresh leg lower after FedEx (FDX) announced a similar “cost management” move last week, citing weakening global demand. The 30% plunge since April comes despite an otherwise strong slate of industrial REIT earnings reports highlighted by incredible 30% rent growth and record-low reported vacancy rates. In the Hoya Capital Industrial REIT Index, we track the twelve industrial REITs which total nearly $150 billion in market value.

Hoya Capital

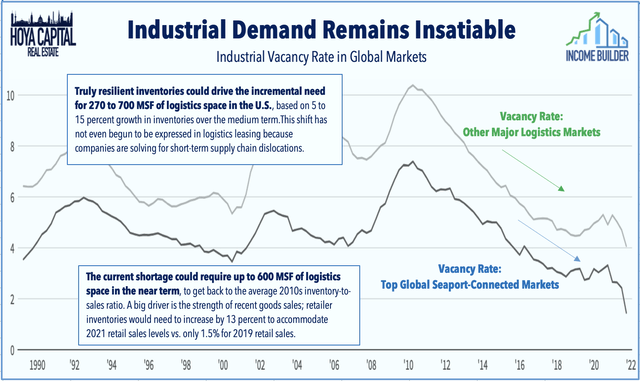

Robust demand for logistics space has been driven by dueling trends of the “need for speed” in both business-to-consumer and business-to-business goods delivery and, more recently, by the critical need for enhanced supply chain resiliency. Brokerage firms CBRE (CBRE) and JLL (JLL) each reported last month that industrial vacancy rates declined to record-lows below 4% in Q2 2022 even as the early effects of the global economic cooldown become more visible. CBRE reported in August that the overall industrial vacancy rate fell by 5 basis points quarter-over-quarter in Q2 and 70 bps year-over-year to a record low 2.9% in Q2. Separately, JLL reported that it also sees vacancy rates at record lows while y/y rent growth surpassed 21% in Q2, commenting: “while non-economic factors, such as the pandemic and war, have sparked uncertainty, the industrial market continues to remain strong and stable.”

Hoya Capital

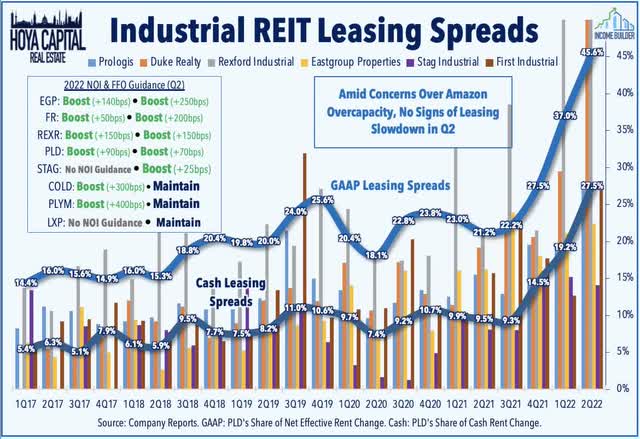

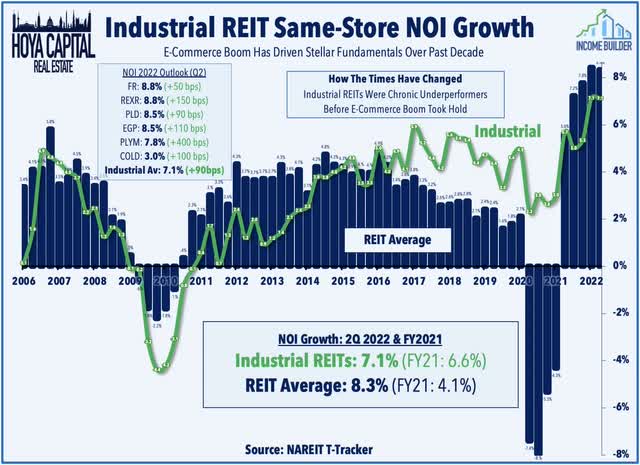

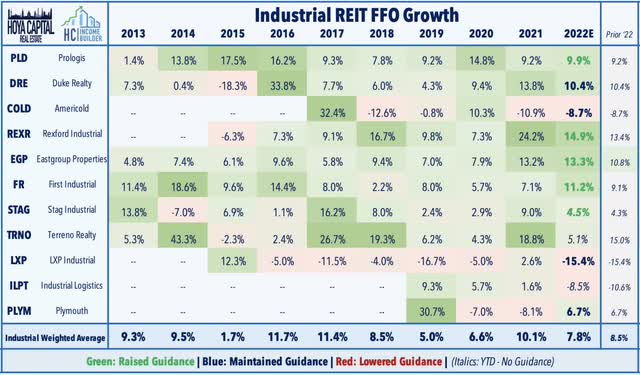

The still-favorable fundamental conditions were quite apparent throughout industrial REIT earnings season as well. As analyzed in our REIT Earnings Recap, all six industrial REITs that provide NOI guidance raised their full-year growth outlook while five of the eight that provide FFO guidance raised their growth targets. Upside standouts included First Industrial (FR), which significantly raised its full-year outlook citing strong leasing trends and record-high occupancy rates. Prologis’ (PLD) results were also impressive, boosting its outlook while recording an acceleration in renewal rates with a record-high 45.6% increase in effective rents. Rexford Industrial (REXR), meanwhile, reported incredible leasing spreads of 83% GAAP and 62% cash while maintaining a 99% occupancy rate. STAG Industrial (STAG) also delivered impressive results with rent growth on new leases of over 25%.

Hoya Capital

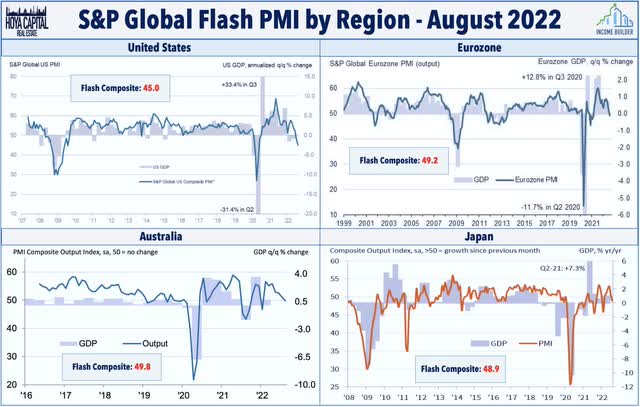

Storm clouds have gathered over the sector in recent months as strategy shifts and profit warnings from Amazon (AMZN) and FedEx (FDX) – each on the ‘front-lines’ of consumer spending and last-mile distribution – have confirmed that the global economic outlook has weakened more substantially than policymakers and Fed officials have so far been willing to acknowledge. FedEx warned last week that it will likely miss its full-year profit target, citing weakness in Asia and challenges in Europe, and expects conditions to weaken further in the quarter ahead amid weaker global volume. The warning follows data showing a rather sharp slowdown in economic activity since Q1 that has prompted downward revisions to several GDP forecasts which now project a third-straight quarter of GDP contraction for just the second time since 1975.

Hoya Capital

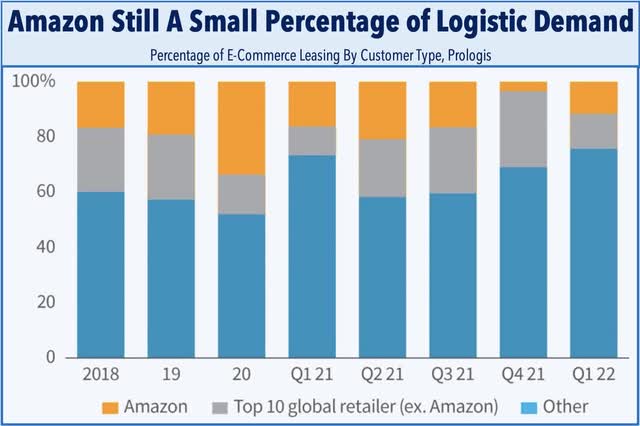

While major distribution and e-commerce giants Amazon and FedEx are indeed among the largest industrial REIT tenants – and are decent bellwethers for the overall direction of incremental demand trends – these two companies combined still comprise roughly 5% of total occupied space. For industry insiders, Amazon’s plans to scale back its expansion was not unexpected. Supply chain consulting firm MWPVL estimates that Amazon increased its square footage by nearly 400% between 2016-2021. The recent announcement from FedEx – which announced that it’s “going fully into cost-management mode” – was a bit more surprising given its relatively slower pace of expansion in recent years, but unlike with Amazon, its industrial real estate portfolio isn’t in the crosshairs of this cost cutting. FedEx noted that it is “reducing flights, temporarily parking aircraft, trimming hours for its staff, delaying hiring plans, and closing 90 FedEx Office locations.”

Hoya Capital

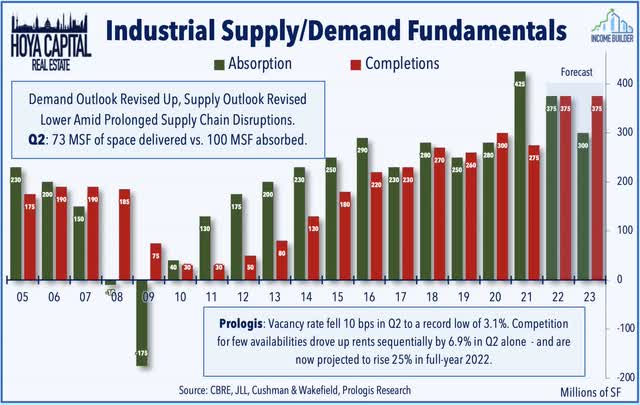

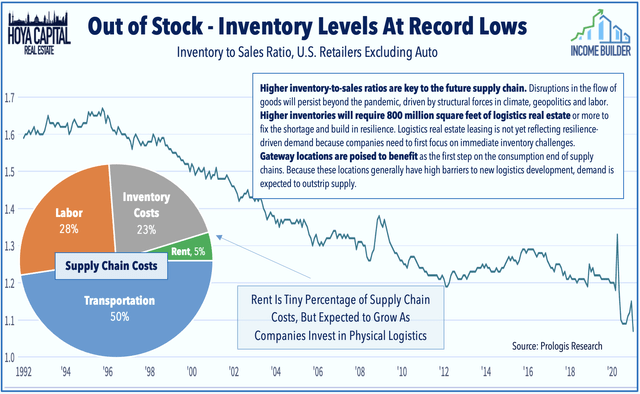

Pushing back on slowdown concerns in its Q2 earnings call, Prologis CFO Tim Arndt remarked, “there’s frankly a stark difference between what one reads in headlines versus what is actually happening in our business.” Prologis actually increased its full-year demand outlook in July and now expects rent growth of over 25% and record-low year-end vacancy rates of 3.3% this year, citing “clear constraint on supply.” PLD also noted that “logistics market conditions are still defined by historic low vacancy, constraints on new deliveries, and pent-up demand.” Prologis did concede that “economic uncertainty could slow urgency of expansion” but the firm still estimates that the market is experiencing more than 800 million square feet of pent-up incremental demand even with this pullback.

Hoya Capital

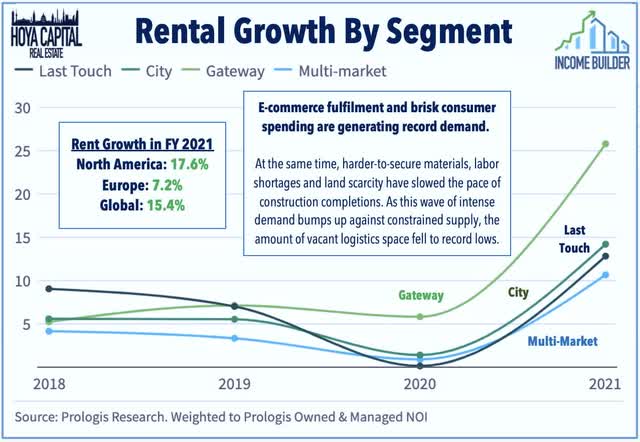

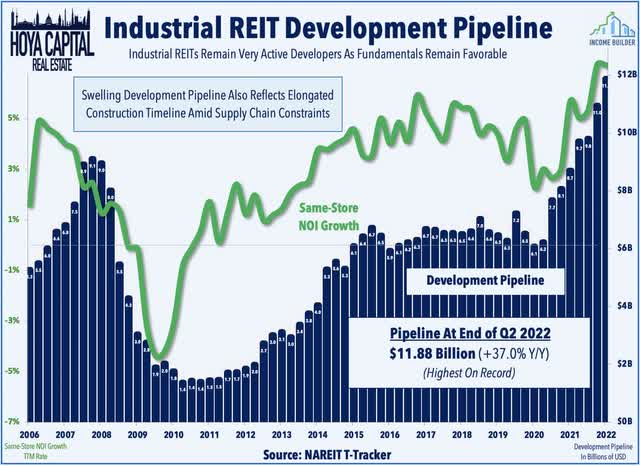

Prologis recorded effective annual rent growth of 17.6% in 2021 in North America and 15.4% globally, each the highest rates on record, and now sees rent growth of 25% in the U.S. for full-year 2022, up from the “high single digits” forecast earlier this year. Prologis noted that activity in U.S. warehouses “grew at a strong pace in Q2” while warehouse utilization increased to 85.6%, “indicating no excess space within facilities.” Prologis highlighted that potential new supply remains stuck in the construction pipeline – or awaiting ground-breaking – due to elongated development timelines and higher construction costs as only 73 million square feet (“MSF”) of new logistics space was delivered vs. 100 MSF absorbed.

Hoya Capital

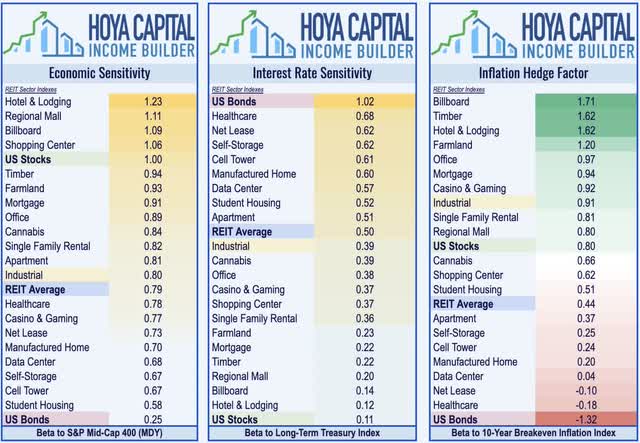

The magnitude of the selloff this year appears overdone as industrial real estate demand is fundamentally less ‘economically sensitive’ than implied with the majority of demand coming from tenants further up the supply chain that is still investing heavily in their Business-to-Business and internal logistics networks. As illustrated below in our Income Builder REIT Factor Model, industrial REITs have historically exhibited investment characteristics that are roughly in line with the REIT sector average when it comes to economic sensitivity (Beta to the Mid-Cap Index) and interest rate sensitivity (Beta to the 10-Year Yield) while serving as superior inflation hedges, as measured by the sensitivity to changes in 10-year inflation expectations.

Hoya Capital

Deeper Dive: Industrial REIT Earnings

Industrial REIT earnings results were quite impressive last quarter and showed that demand for logistics space continues to significantly outpace supply. Across the industrial sector, same-store Net Operating Income (“NOI”) growth averaged more than 7% in Q2 and since the end of 2019, NOI has risen by nearly 20%, trailing only the residential REIT sectors for the strongest NOI growth since the start of the pandemic. First Industrial leads the way with NOI growth of 8.8% projected for full-year 2022 after raising its outlook by 50 basis points from last quarter. Net lease-focused STAG Industrial is also slowly but surely starting to see positive mark-to-market rent growth effects as its long-duration leases come up for renewal, recording same-store NOI growth of nearly 5% through the first half of 2022, on pace to eclipse its prior record-high full-year NOI growth of 3.8% set last year.

Hoya Capital

Cold storage operator Americold (COLD), however, continues to struggle with ongoing margin pressure in its services-heavy business due to tight labor markets and ongoing supply chain difficulties. COLD maintained its full-year outlook which calls for a nearly 9% decline in its FFO as occupancy improvement has partially offset margin headwinds. Unlike other industrial REITs that simply rent the space, COLD feels the supply chain disruptions directly and noted that it continues to face “very challenged” conditions across the global food supply chain. Other industrial REITs are also figuring out how to get out of their own way including LXP Industrial (LXP), which still expects a decline in full-year FFO growth of nearly 15% as it seeks to sell its last remaining office assets as part of its transition to become a pure-play industrial REIT. Another smaller industrial REIT, Industrial Logistics (ILPT) reported disappointingly slow progress in its plan to reduce its debt by selling assets from its recently-acquired Monmouth portfolio and an FFO drag from its bridge loan being used to finance the deal.

Hoya Capital

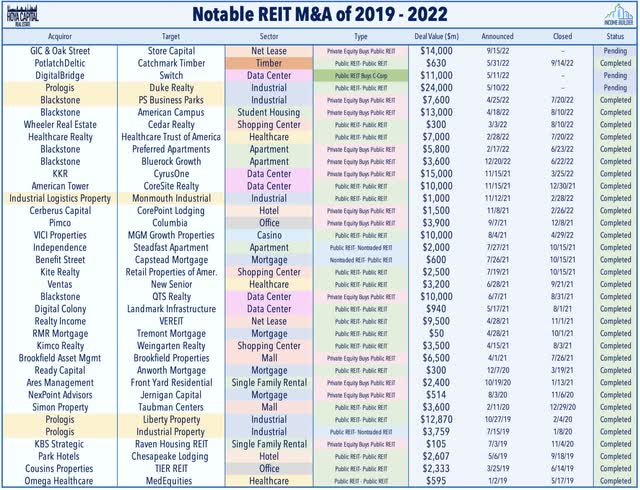

While some smaller industrial REITs are facing challenges with portfolio repositioning, several mid-cap REITs are enjoying a fertile and active M&A environment. In June, Duke Realty (DRE) agreed to be acquired by logistics giant Prologis in a $26B all-stock deal expected to close in the fourth quarter. Following months of pursuit and several rejected offers, the deal adds another 160 million square feet of space to Prologis’ portfolio of over a billion square feet of logistics and industrial space. Duke shareholders will receive 0.475x of a Prologis share for each Duke share. Expected to generate immediate accretion through significant synergies, the transaction is expected to be accretive to Core FFO by roughly 5% in year one.

Hoya Capital

Prologis has been far and away the most active acquirer over the past half-decade with major acquisitions of DCT Industrial in 2018 for roughly $8B, Industrial Property Trust in 2019 for $4B, and Liberty Property Trust in 2020 for $13B. Earlier this year, Blackstone (BX) – scooped up PS Business Parks (PSB) at $187.50 – a 12% premium to its prior closing price. For Blackstone – which oversees a massive conglomerate of real estate investment vehicles including the largest non-traded REIT – the deal was the fifth since last June following acquisitions of residential REITs American Campus, Preferred Apartment (APTS), Bluerock Residential Growth REIT (BRG), and data center REIT QTS Realty Trust (QTS).

Hoya Capital

Industrial REITs continue to see more significant value-add opportunities in ground-up development with development yields averaging 6-8% compared to cap rates between 4% and 6%. While the surge in interest rates has pressured real estate valuations this year, private market industrial cap rates have moved only modestly higher – far less than the magnitude of the rise in the 10 Year Treasury Yield. While industrial supply growth is averaging roughly 2-3% per year and trends over the past three years lead us to believe that there are mounting barriers to entry and supply constraints. Industrial REITs have built up a sizable land bank over the last decade and are now responsible for a significant percentage of total industrial real estate development.

Hoya Capital

Industrial REIT Stock Price Performance

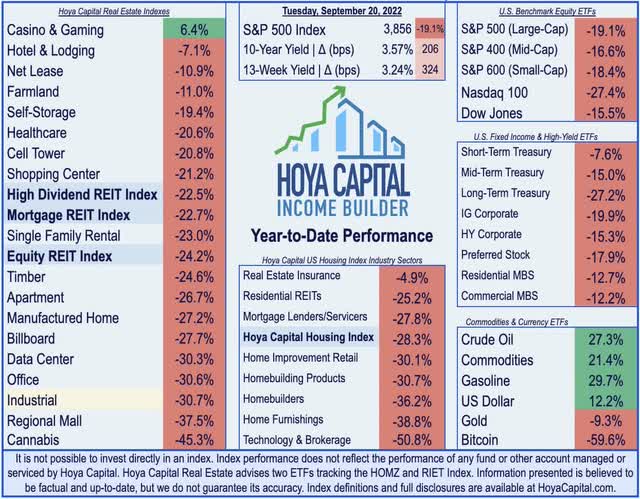

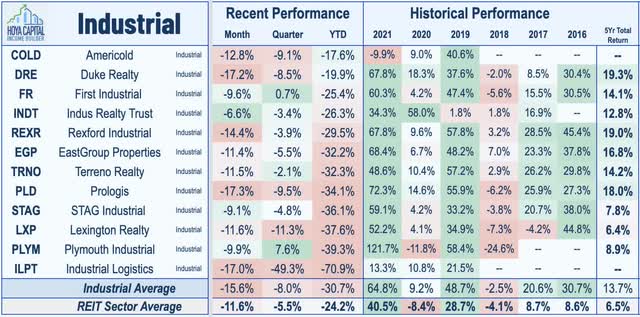

Industrial REITs are now lower by more than 30% so far on the year, trailing the 24.7% decline from the broad-based Vanguard Real Estate ETF (VNQ) and the 19.1% decline from the S&P 500 ETF (SPY). These declines, however, come after recording a remarkable sixth straight year of outperformance in 2021, a streak that trails only the manufactured housing sector, which has delivered an unprecedented nine-straight years of outperformance. Since the start of 2015, industrial REITs have been the second-best performing property sector, producing average annual total returns of 23.0%, the best in the REIT sector, edging out the 22.5% average annual returns delivered by manufactured housing REITs over this period.

Hoya Capital

The carnage this year has been widespread across the sector with every industrial REIT lower by more than 15% YTD. Small-cap REITs have been slammed particularly hard with Industrial Logistics dipping roughly 70% this year after slashing its dividend while Plymouth Industrial and Lexington Realty are each lower by nearly 40% – a sharp reversal from last year in which several of these smaller-cap names were among the sector leaders. As noted, however, the brutal year follows one of the strongest for industrial REITs as twelve of the twelve industrial REITs delivered positive total returns in 2021 with Americold as the lone exception.

Hoya Capital

Deeper Dive Into The Industrial Sector

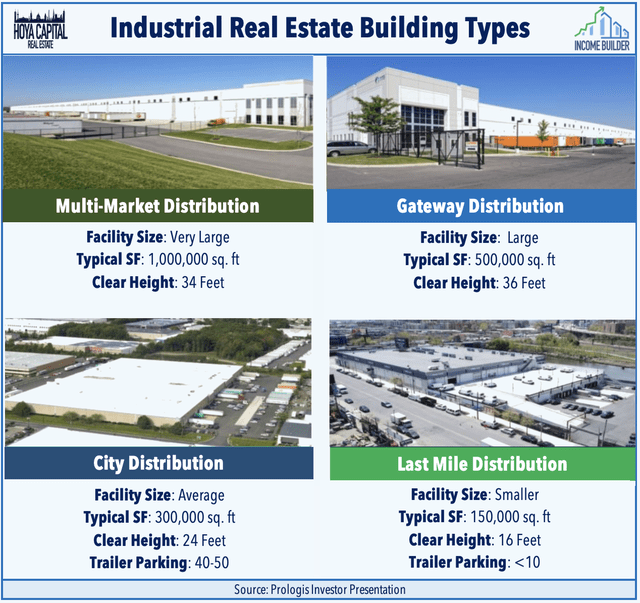

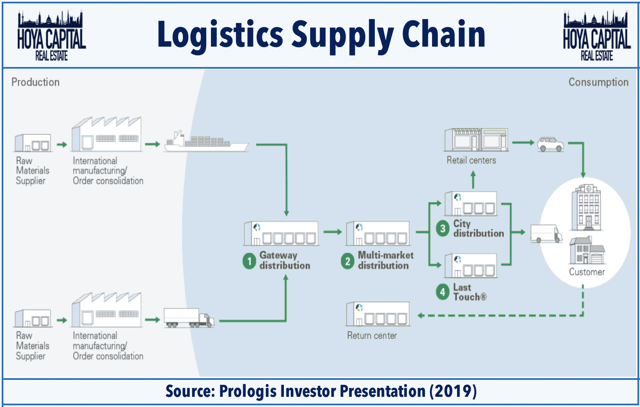

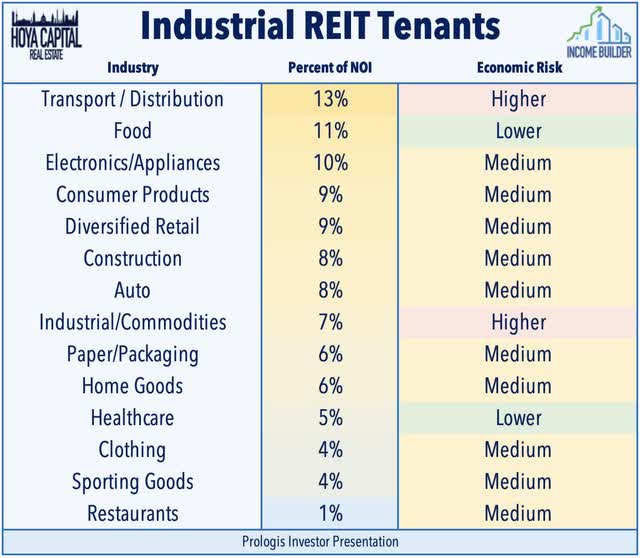

Industrial REITs own roughly 5-10% of total industrial real estate assets in the United States but own a higher relative percentage of higher-value distribution-focused assets with building sizes averaging around 200,000 square feet, which have seen significant rent growth and more favorable supply/demand conditions due to tangible constraints on land availability. Robust demand for space over the past decade has been driven by a relentless “need for speed” arms race as retailers and logistics providers have invested heavily in supply chain densification and physical distribution networks.

Hoya Capital

Prologis segments industrial real estate assets into four major segments: Multi-Market Distribution, Gateway Distribution, City Distribution, and Last-Touch Centers. Along that continuum towards the end-consumer, the relative value of these properties (on a per square foot basis) increases, as do the underlying barriers to entry due to scarcity of permittable land. Rent growth has been most robust over the last half-decade in the segments closer to the end-consumer – typically occupied by distributors like UPS (UPS), and FedEx – a trend that has been further accelerated by the pandemic.

Hoya Capital

Supply chain disruptions came as inventory levels were already historically lean amid a shift towards “just-in-time” inventory management. Resilient supply chains will require substantial investments in logistics space with Prologis pegging the number at 800 million extra square feet just to reach equilibrium. These “just-in-case” trends are additive to the pre-existing “need for speed” trends which continue to be driven most prominently by e-commerce giant Amazon and increasingly by Walmart (WMT), Target (TGT), Home Depot (HD), and Lowe’s (LOW). The pandemic significantly accelerated the penetration rate of e-commerce, which requires up to three times more logistics space than sales through traditional brick and mortar sales. A potential double-edged sword for industrial REITs, the shortage of industrial space itself has driven investments into logistics technologies that could eventually lead to higher levels of space efficiency.

Hoya Capital

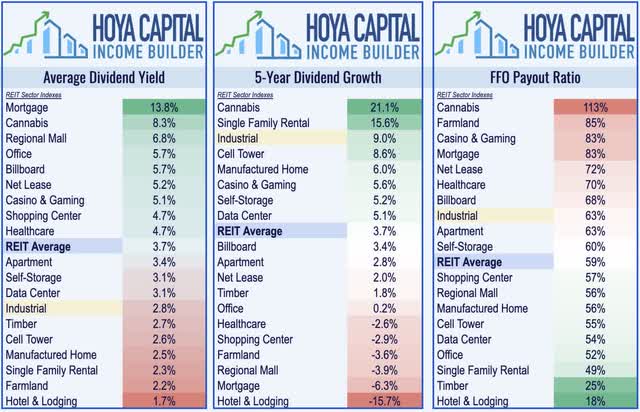

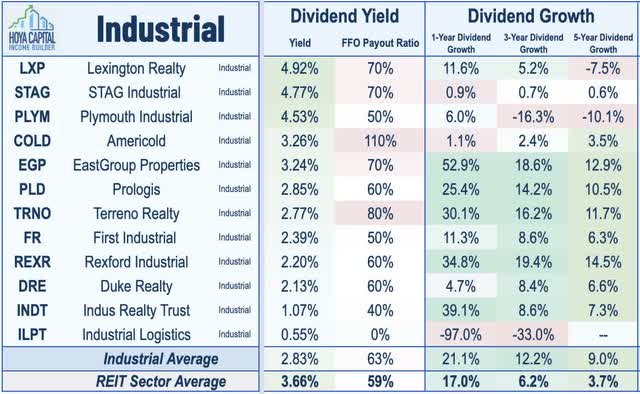

Industrial REIT Dividend Yields

Appreciated more for their dividend growth than their current yields, industrial REITs pay an average dividend yield of 2.8%, which is below the REIT average of roughly 3.7%. However, it’s important to note that Industrial REITs have grown both dividend distributions and FFO by nearly 10% per year since 2014, significantly higher than the REIT sector average of roughly 4%. Industrial REITs pay out roughly 60% of their available free cash flow, leaving an ample cushion for development-fueled growth and future dividend increases.

Hoya Capital

Within the sector, we note the varying strategies of the twelve industrial REITs where the “tradeoff” between high current yield and long-term dividend growth becomes quite apparent. The three “Yield REITs” at the top of the chart pay an average current yield between 4.5% and 4.9% but have seen their dividends grow at slower rates. On the other hand, the eight “Growth REITs” pay an average dividend yield of around 2.3% but have seen their dividends grow by an average of 10% per year over the past five years.

Hoya Capital

Takeaways: Headlines Worse Than Reality

Industrial REITs – a perennial performance leader in recent years – have been slammed this year despite delivering stellar operating performance with demand for well-located logistics space continuing to outstrip supply. Just as valuations were recovering from the Amazon-related dip, the sector has taken a fresh leg lower after FedEx announced a similar “cost management” move last week, citing weakening global demand. While we’ve been vocal in recent months that the global economic outlook has weakened more substantially than policymakers and Fed officials have been willing to acknowledge so far, the magnitude of the selloff in industrial REITs appears quite a bit overdone. Industrial demand is fundamentally less ‘economically sensitive’ than many presume and while consumer-facing distributors are important tenants, the vast majority of activity comes from tenants further up the supply chain that are still investing heavily in their B-to-B and internal logistics networks.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Be the first to comment