Metkalova

Published on the Value Lab 19/09/22

Our coverage on Mowi (OTCPK:MHGVY) seems to have hit home. Feed prices are indeed up, but salmon demand has been fantastic in the context of rather contracted supply. Prices had been extremely high at quarter’s close and we are looking at superb income growth. The problem is that is a peak result. Prices seem to have come down substantially and the markets seem to know it. While the economics are good and the markets around Mowi rational, we don’t see a particularly compelling case for salmon given the valuations. In spite of the structural support to the commodity, we think it’s a pass for now.

Comments on Mowi

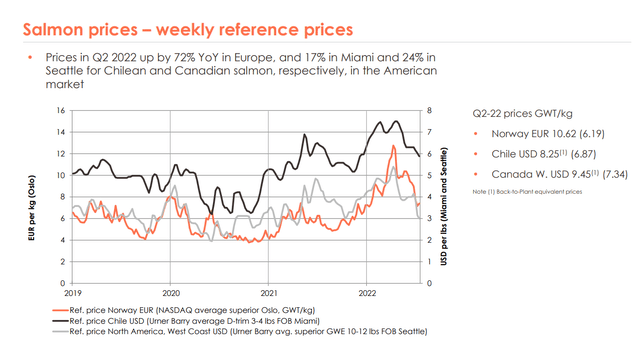

The EBITDA grew monstrously by over 100% particularly on growth in salmon prices of around 50% depending on the market.

Besides a solid demand environment, likely supported by our theory on shifted consumption away from grain-fed protein made more costly by rising grain prices on Ukraine supply fallout, the supply situation directly for salmon was good. Waters were cold, and the zealous slaughtering in 2021 to bring forward profits but the industry slightly behind in supply for 2022. Mowi delivered volume growth despite the broader industry having engaged in a major 2021 slaughter, but there is no doubt that price of salmon drove the company’s results. What’s more is that contract share, while lower than average, was still 27%, meaning that the high spot prices weren’t fully realized, and the contracts that did rollover did so at a high.

40% of the company’s costs are from feed. Fish feed prices have been coming up quite a lot by about 15-20% driving overall cost per kilo, but those appear to have peaked and the industry is managing to reduce feed intensity a little to tackle the issue.

The problem is not only have the costs peaked, salmon prices fell precipitously. The NASDAQ salmon index has shown about 30% price declines. Some of that is to do with seasonality but it’s also just to do with the reversal in commodities generally related to macroeconomic concerns. Waters have warmed as well which has supported supply. The good thing is that a 30% contract share, if not higher as the company stated they foresaw seasonal supply increases, reduces the cyclicality of results. Some new contracts would have rolled over at these higher prices meaning that they are locked in, for at least a portion of their volumes, and can support revenues and profits in the quarters to come.

Conclusions

The company is trading at about 7.8x EV/EBITDA on forecast EBITDA that will more or less double relative to the FY 2021. While some durable trends remain on the demand side, we are unsure about whether the business can actually deliver quite that profit increase for the FY. Indeed, markets seem to have their worries as well, thus the quite low multiple and the contraction in price of 31% over the last 6 months. The levels in salmon price now aren’t different from lows experienced in 2020, so the reversal has been very substantial.

Overall, the markets seem to be pricing the environment into Mowi, but it wasn’t a screaming buy before. Is it one now? Salmon farming economics are good in general, and it’s a nice, high return business that you might want your claws in for the long-term. On a broader basis, the company is back to trading at about 2020 levels. Not quite march lows, but only 20% above those nightmare levels. I think many would want to get a bite now. It probably wouldn’t be a bad idea in our opinion. But we have very high standards nowadays. We want things that are cheap, but will also incrementally improve despite worst case scenarios. Right now, Mowi doesn’t have that latter criterion – no catalyst. We’ll pass, but we recognize that particularly on the Ukraine issue, salmon as a protein still has durable market share wins ahead of it. While we are seeing peak fundamentals now, 2022 is unlikely to evolve into a disaster for salmon.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment