ollo/iStock Unreleased via Getty Images

Dear readers,

I get a lot of requests – but Porsche (OTCPK:POAHY) is a recurring wish from many of my readers that I look at time and time again to make sure the thesis of this premium automotive manufacturer is still intact.

The yield is up – the valuation is down – and the way it looks is that the company is in a significantly better position with a great upside.

Let’s find out if this is actually the case

Porsche – More undervalued at this point?

In my last article on Porsche, I shifted my stance from Neutral to a “BUY” stance for the first time. Since that time, the company has more or less doubled the decline we see from the S&P500, turning the company even cheaper than at the time of the piece on April 14th 2022.

It’s not that we have a massive amount of new data to justify, or not justify the company’s valuation here. In my latest article I went into how the potential IPO of Porsche as a car brand can influence things.

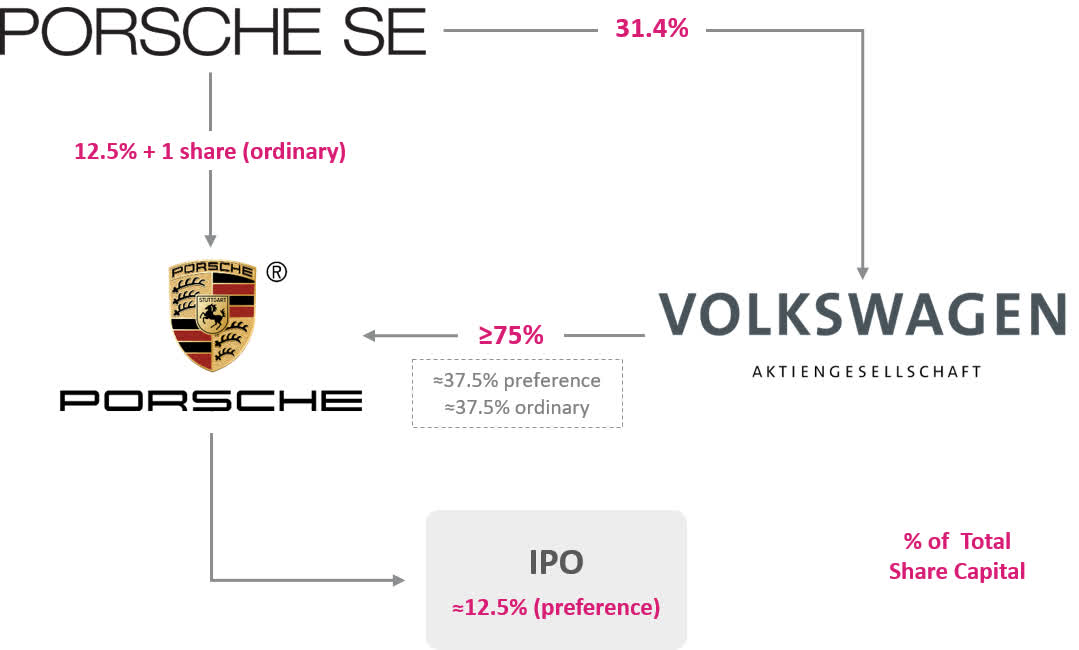

A framework agreement has been signed by the VW Group and Porsche SE to cover the current talks that have been done, as well as the preliminary agreements of a listing of Porsche. Porsche AG’s share capital would be divided into 50% preference and 50% ordinary shares. Porsche SE would purchase 25% + 1 of the ordinary shares (around 12.5% of the total share capital), while Volkswagen would hold 75% ownership of the automaker, with 25% of the preference listed publicly.

For existing Volkswagen shareholders, a special dividend of 49% of the pre-tax proceeds would be proposed.

This is what we currently have, and this is the current, planned post-IPO structure of the company.

Porsche IR (Porsche IR)

Porsche remains a fundamentally sound business, despite the recent crash in the company of more than 20%. There is no doubt that Porsche can be seen as one of the most attractive sports car brands on earth. It’s every bit as premium as Ferrari (RACE), Lamborghini, and others. As I mentioned, Porsche is no more than 3% of the actual sales volume of the VW group – but at the same time, it has the best operating margins in the entire group – one of the best margins, in fact, of the entire car industry, at over 16%. That’s more than 5-9X next to peers.

Because of this, how Porsche is currently structured, makes little sense, because it has the potential to be valued in line with some of these other premium brands. VW hopes to enable the market to view Porsche in the same light as other luxury automakers like Ferrari, where multiples would be closer to luxury businesses – closer to 25-40x P/E.

What this means in raw numbers is that the current stand-alone EBIT is around €4-€4.5B, assuming around €28B in revenues at a 16-16.5% operating margin. Also, as I mentioned in my previous article, the company already proved in 2021 its ability to generate impressive amounts of earnings. As a result of a solid annual result, the proposed dividend for the coming year is up 15.9% YoY for the preference and for the ordinary share, and the next liquidity for the company is up to close to €650M for the year.

For 2022, the forecast includes a result of between €4-€6B for the Holdco, as well as improving net liquidity to over a billion euros at the end of the year. This is even prior to any investment activity, including the Porsche IPO. This is unchanged as of the publishing of this article – no new data or forecast considerations have come.

We have 1Q22 since my last article. The quarter was strong, due to increased profitability from VW, which derived from higher sales, cost control, and more EV sales. Porsche also saw sales figures that turned green, with a €2.1B net result in a single quarter.

What’s more important, and as I mentioned above, despite the uncertainty, the company retained its 2022E forecast. With a net result that’s more than double that of 1Q21. Porsche also pushed deeper into VW, buying €400M in shares up to almost 32% of the company.

The company’s positives were, at the same time, impacted by several not-insignificant headwinds, due to raw material increases, COVID-19, and Russia/Ukraine. Despite this, and the Russian declines, the company fully expects to see upwards of a €6.1B net result for the entire year, and that’s still excluding the M&A of the preference shares and the possible IPO of Porsche.

Overall, the upside for Porsche at this juncture is significant. The impact on valuation based on these results is only minor. I’m rolling forward my estimates for Porsche to 2024, with the clear understanding that the company’s upside changes significantly if and when the company IPO’s it’s Porsche stake.

If and when that happens, I’m probably going to be investing heavily in the business – because of the upside that I’m going to show you in the next segment.

Porsche Valuation

The best way to calculate Porsche’s valuation remains the NAV/SOTP. Porsche’s stake in VW is worth billions. I pull 20% from the company’s valuation in discount because the preference shares of VW owned by Porsche do not come with voting rights.

The dividend is the other important factor for Porsche when looking at this company. The historical average yield is nothing superb, but as of the recent drop, it’s well above 3.5%, and for the time being, it seems covered. So long as the Porsche/Piech families do their own best to protect their investments, which it is very likely that they will, free-float shareholders like us, will continue to be well off.

I also want to add that added to the NAV, the company’s R&D businesses are very exciting ventures, even if on a book valuation/NAV level, they currently offer nothing exciting to us (but may in the future).

For NAV, we use the company’s listed ownership of Volkswagen and value it at around €28.6B. Assets net of cash come to €20B, which at 306M shares net of treasury comes to an average NAV of €66.5, which means that the current share price is actually at a discount – very rare for this company, as usually the upside is found in DCF and peers.

Porsche isn’t compared to most automotive, because it’s more of a holding company – but it should be closer-considered given that the company’s actual holdings, which are only automotives. In terms of actual P/E, the company is at a significant, triple-digit undervaluation to most holding business peers, and this includes businesses across a multitude of segments. To other automotive, the company doesn’t have much of an undervaluation.

For DCF, we assume that Porsche will be able to capitalize on the continued interest in its cars, boosted by its EV ambitions. With a 4-8% sales growth estimate range, and a 4-6% EBITDA growth range, the company reaches an implied EV/Share of around €95/share based on a WACC of 8.3% (risk-free of 3.5%, adjusted for rate increases).

The overall picture that I’m sticking with is that the company, at this time, is quite significantly undervalued here. Looking at the native ticker, the company has lost just north of 30% in less than a year. The average target for this company, based on S&P Global averages, is no less than €105/share, €60/share as a low-range PT and €133/share on the high end. That makes the undervaluation to 63% for S&P Global here. Equity analysts give us a smaller upside, targeting a PT of around €80/share.

8 out of 12 analysts have the company at a “BUY” or “Outperform” here. That’s a significant increase from the last set of targets, even if the company has been sub-€100/share for over a year at this point. However, this is the first time for some time it’s been sub-€75/share.

At this point and this valuation, I’m sticking to my “BUY” target. I also think it’s high time that investors look over Porsche to see what it might offer you – because at this valuation, there’s a lot to like about the company.

Thesis

Here is the thesis for Porsche:

- Porsche is, to me, a more interesting investment than VW due to the corporate structure and holdings. With the recent information on the IPO and the dividend bump as well as improved results, the company’s portfolio is ready for improvement and higher returns.

- These changes justify a change in the price target, and I now consider Porsche to be a “BUY” with an upside to a PT of €85/share.

- Expect more exciting news for 2022 as details on the IPO come out.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you, however, want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Porsche is a “BUY” here with an upside to a price target of €85/share.

Thank you for reading.

Be the first to comment