PonyWang/E+ via Getty Images

Investment summary

Here at HBI, we continue to bring you unique thematic plays that can be built into a basket of portfolios with similar exposure to broaden alpha potential and hedge downside risk. We’re here today to review a potential position in Sight Sciences, Inc. (NASDAQ:SGHT) because we’re looking to bulk out our ophthalmology and eye treatment market exposure and have been met with only one out of three successful candidates thus far, including SGHT itself. We believe there could be uncorrelated alpha obtained in this stock should it deliver on its glaucoma growth initiatives. For a deep dive into the company, you’re best to check out Donovan Jones’ deep dive on the stock here on Seeking Alpha, after it IPO’d.

Overall, we believe the glaucoma treatment market presents a compelling investment opportunity, with a strong and growing demand for effective treatments, a diverse range of products and technologies, and significant potential for growth in key global markets. As such, we believe we should be searching to allocate portions of our equity risk to companies operating in this sector.

You can see our review of the sector thus far in:

- Cooper Companies: Questions On Viability Of Future Earnings Upside

- Iveric bio: Building Momentum Around Zimura, Rate Buy

Turning to SGHT, we see it was a record third quarter in revenues of $18.7mm, representing a 43% growth YoY and 8.4% growth sequentially. This strong performance was driven by growth in both the MIGS and dry eye treatment markets, with Surgical Glaucoma revenues of $17.1mm, up 37% YoY and 7.4% sequentially.

However, turning to additional data, it suggests we may just be best waiting on the sidelines with an allocation at a more appropriate time. Net-net, we rate SGHT a hold, but are constructive on this name. We urge investors to keep active on the daily and weekly charts for the name too.

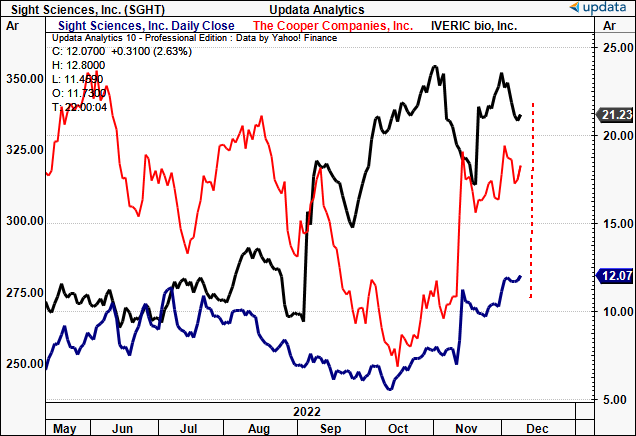

Exhibit 1. Performance of COO, ISEE and SGHT respectively.

Data: Updata

Market underpinning investment thesis – differentiated exposure to glaucoma

We see good growth of this market for SGHT looking ahead. IN Q3 FY22, its surgical glaucoma segment saw 37% year-over-year increase to $17.1mm as mentioned, and a 7.4% sequential increase, representing a nearly 400 basis point improvement over the previous quarter. Its growth as a company is also evidence of a market that will absorb newer players. This growth in Q3 for SGHT was attributed to an increase in retention and ordering facilities, as well as a notable increase in utilization.

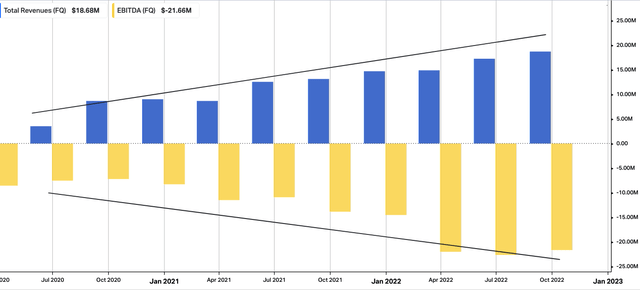

A look back at SGHT’s revenue and Core EBITDA prints. Top-line growth on good trend.

Data: HBI, Refinitiv Eikon, Koyfin

To really understand the differentiated positioning, one has to first have some realization of the underlying market, its fundamentals, growth trends, and future value.

Glaucoma is a group of eye conditions that lead to optic nerve damage and vision loss. It is often caused by increased pressure within the eye, known as intraocular pressure (“IOP”), which can damage the delicate structures of the optic nerve. The most common form of glaucoma is primary open-angle glaucoma, which occurs when the drainage canals of the eye become blocked, leading to a build-up of fluid and increased IOP. Glaucoma is a leading cause of blindness, and it is estimated that over 3mm people in the United States have glaucoma.

Treatment options may include medications, laser therapy, or surgery to improve the drainage of fluid from the eye and reduce IOP.

SGHT’s flagship product, the OMNI surgical system, is designed to reduce IOP and improve aqueous outflow, helping to slow the progression of glaucoma and preserve vision. Noteworthy, is that glaucoma is also present across the mammalian spectrum as well, in dogs as well, for instance.

The glaucoma treatment market is a rapidly growing sector within the overall ophthalmology market. With an estimated global prevalence of over 60mm cases and a projected increase to over 112mm by 2040, the demand for effective glaucoma treatments is expected to continue to rise.

Currently, the market is dominated by pharmaceutical interventions, such as prostaglandin analogues and beta blockers, which when combined account for over 60% of global glaucoma treatment sales.

However, the market is also seeing significant growth in the use of surgical interventions, such as trabeculectomy and glaucoma drainage devices, which are expected to account for over 20% of global glaucoma treatment sales by 2024.

In addition to this market opportunity, we also noted SGHT’s other divisional highlights last quarter.

For instance it’s also worthwhile noting that its Dry Eye segment turnover grew 145% YoY and 21% sequentially.

Turning to the OMNI and TearCare products, both segments beat consensus estimates. Management reported that its customer acquisition and retention efforts have resulted in a growing installed base and strong underlying growth fundamentals. As evidence of this, In Q3 2022, the company trained over 160 new OMNI surgeons in the US, bringing the total number of trained surgeons to nearly 2,200.

On this, the company’s gross margin for the quarter was 84%, consistent with the corresponding prior year period and the previous quarter. Looking to the segmented margin breakdown:

- Gross margin for Surgical Glaucoma was 89% in Q3 2022, compared to 87% in the prior year period

- For Dry Eye it was 38%, up from 33% in the prior year period.

In addition to its strong revenue growth, the company ended the quarter with $200mm in cash, which it expects will be sufficient to support its growth plan until it reaches cash flow breakeven in 2025. Management still expect annual revenue growth rates of ~43%- 47% over 2021, calling for $70mm-$72mm.

Technicals are supportive – and guided price visibility well

In the current market we simply cannot ignore the importance of blending good technical analysis with rigorous fundamental analysis for the best investment outcomes.

With the disconnect in fundamentals, price distribution at all-time highs in some portions of the market, it is wise to have additional data points to run by. You can see below that SGHT has just broken our from a double-bottom double base, setting new highs in doing so.

It has closed above the 50DMA for 7 weeks in a row now. So the question is, can the rally continue?

Looking at the volume into each impulse upward, accumulation was fairly week. Looking at the latest trends, it is a little stronger.

The next step is to check what upside targets we have without the noise of volume and time.

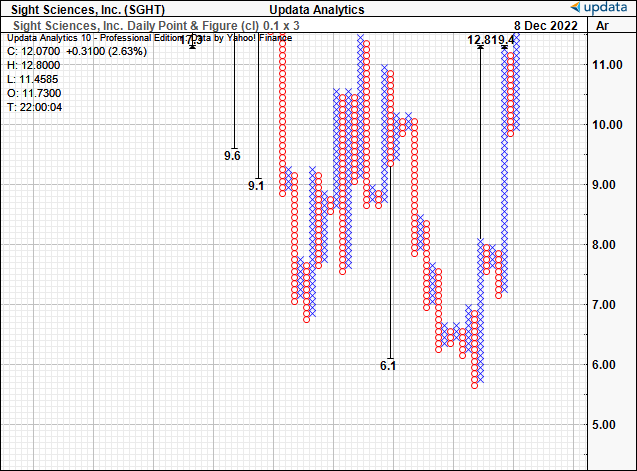

Exhibit 2. SGHT price evolution — double bottom double base, breakout to the upside. Setting new highs. Crossing above 50DMA for last 7 weeks.

You can see that we have upside targets to $12.80 and then $19.40 which implies there is buyers at the current levels in our estimation. There’s been a large price swing back to previous resistance as you can see. Could investors also be recognizing the future value of the glaucoma market? It might be, because the stock is catching a strong bid.

Next question, can it overturn the longer-term downtrend?

Exhibit 3. Upside targets to $12.80, $19.40 off sharp reversal

Data: Updata

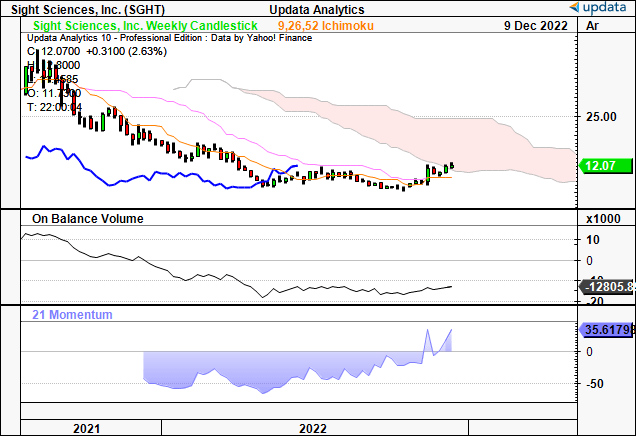

With respect to the trend, here is where the confluence of factors falls short. We have the SGHT share price just entering up into the cloud, with the lag line still positioned at some depth away. Meanwhile, despite more recent price action, on-balance volume has remained in continuation of its longer-term downtrend. We’re yet to see the momentum behind the move yet either.

Hence, this is a key risk moving forward. We’d need more data here to commit to a full position, and hence, are keeping the position size very small, ready for a quick exit if the stock slips more than 8-10% below our entry price. This will keep daily value at risk (“DVaR”) within our limits, by estimation. And whilst that is prudent, we’d want to see large upside with this kind of risk, and so capping the position size will be an inefficient use of capital.

Exhibit 4. Trend indicators not corroborating with the above findings. Can’t size in with large position, must keep DVaR small, ready for exit. Not appealing risk/reward therefore.

Data: Updata

Valuation and conclusion

We’d advise that consensus has the stock valued at 5.8x EV/Sales, and SGHT trades at 3.4x book value. Although, at a negative 40.7% trailing return on equity, we’re not so sure on the prospect of a value play here.

We believe that management’s expectations around revenue are fair and reasonable, and that paring them back for FY22 is a correctly conservative move.

Applying the 5.8x forward multiple to the $72mm at the upper range implies a valuation of $8.79, around 28% downside from the current market price.

Hence, this also supports our neutral view.

Be the first to comment