onurdongel

Investment Thesis: InterContinental Hotels Group (NYSE:IHG) has seen strong RevPAR growth, and could see further upside if earnings continue to increase and long-term debt declines.

In a previous article back in August, I made the argument that InterContinental Hotels Group could see further upside going forward, on account of U.S. RevPAR levels exceeding levels seen in 2019 along with a continued reduction in net debt.

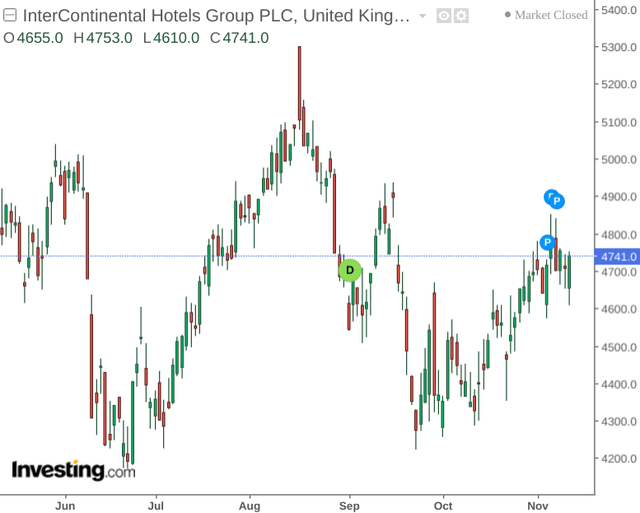

Since then, the stock is down by just over 5% since my last article:

The purpose of this article is to evaluate whether the stock could see a rebound in upside from here, particularly taking most recent quarterly performance into consideration.

Performance

In my last article, I made the point that growth across the US market had largely been driving growth for the company, as evidenced by that market having seen a higher RevPAR relative to EMEAA and Greater China.

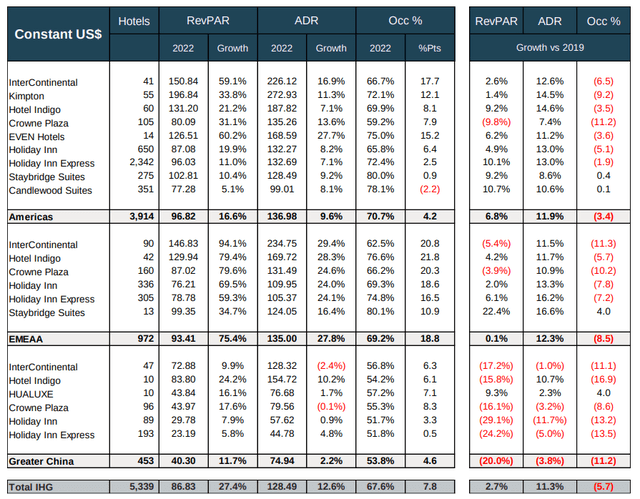

While this has continued in the most recent quarter – it is still notable that RevPAR growth across the EMEAA region has largely caught up with that of the Americas – growing by over 75% to $93.41. Additionally, RevPAR growth for Greater China also came back into positive territory, up by 11% as opposed to the last quarter when we saw RevPAR down by nearly 40%.

IHG Supplementary Information – Q3 2022

Additionally, it is also notable that with the Kimpton, InterContinental and Hotel Indigo brands having shown the highest ADR (average daily rate) for the Americas, EMEAA and Greater China respectively – all three of these brands showed impressive growth in RevPAR, from 24.2% for Hotel Indigo to 94.1% for InterContinental.

When looking at the company’s latest balance sheet, it is interesting to note that the company’s long-term debt to total assets ratio was at a very similar level to that of 2019 last year – indicating that the company’s debt load relative to assets has not had to increase significantly in order to finance the recovery that we have been seeing in RevPAR.

| 2019 | 2021 | |

| Non-current loans and other borrowings | 2,078 | 2,553 |

| Total assets | 3,976 | 4,716 |

| Long-term debt to total assets ratio | 0.52 | 0.54 |

Source: Figures sourced from InterContinental Hotels Group 2019 and 2021 Annual Report (except long-term debt to total assets ratio). Figures provided in USD millions. Long-term debt to total assets ratio calculated by author.

Looking Forward

Going forward, while RevPAR growth has been impressive – I take the view that investors will be increasingly looking to see if the revenue growth we have been seeing provides a significant boost to earnings and whether the company can also significantly reduce its long-term debt load as a result.

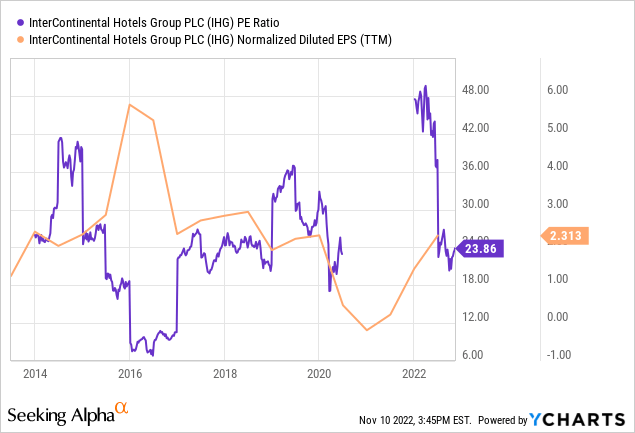

When looking at the company’s historical P/E ratio, we can see that the ratio is back down to levels seen between 2018 to 2020, but earnings per share still remains below the peak seen in 2016.

ycharts.com

In this regard, the next two quarters will likely be a good indicator as to whether earnings can rebound to the higher end of the range that we have seen over the past ten years.

Given that the EMEAA market is strongly rebounding – there could still be significant growth potential for earnings in this regard.

In my view, the main risks for InterContinental Hotels Group at this time are potential COVID restrictions across Greater China having the potential to lower RevPAR growth once again, along with an eventual plateau of RevPAR growth across the Americas.

However, inflation does not seem to have hindered revenue growth to date, and further growth in earnings and a reduction in long-term debt will be encouraging signs that revenue growth is in turn translating to bottom-line growth.

Conclusion

To conclude, InterContinental Hotels Group has continued to see strong growth in RevPAR. Should this translate to further earnings growth and a reduction in long-term debt going forward, then I take the view that the stock could rise further from here.

Be the first to comment