Iván Jesús Cruz Civieta/iStock via Getty Images

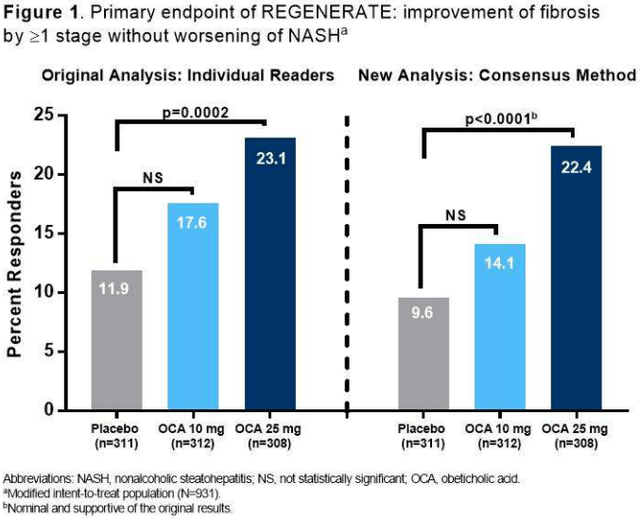

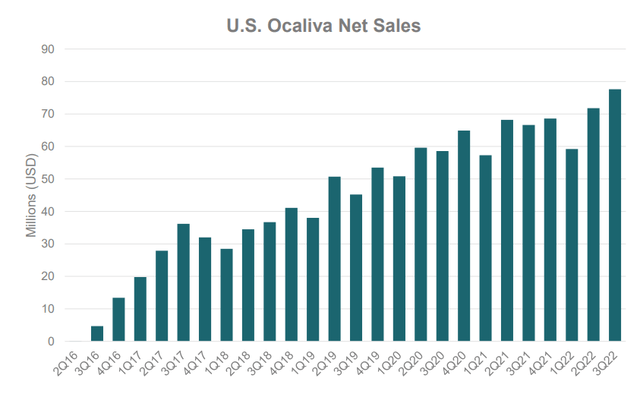

Intercept (NASDAQ:ICPT) is a small ($570 million market cap) biopharmaceutical company focused on therapeutics for non-viral liver diseases, and was the long-time front-runner for the NASH market, until their OCA NDA was derailed by a Complete Response Letter (or CRL) from the FDA. The company reported U.S. Ocaliva net sales of $77.6 million, and upped their guidance, leaving a very doable $73-83 million for Q4. Because they haven’t reached profitability, a new indication is necessary. The NASH data combines the newer 3-pathologist consensus panel analysis of topline results (Figure 1) for the 931 patients included in the original 2019 NDA, and more importantly, of additional patients biopsied since then. Investors should probably wait for more details, mainly on safety, from the annual meeting of the American Association for the Study of Liver Diseases (AASLD).

REGENERATE topline results (The Liver Meeting)

Some background on NASH is in the recent Madrigal (MDGL) article. According to the FDA’s “Noncirrhotic Nonalcoholic Steatohepatitis With Liver Fibrosis” 2018 draft guidance, accelerated approval may be secured by demonstrating improvements with ANY ONE of the following liver histological endpoints:

-

Resolution of steatohepatitis on overall histopathological reading and no worsening of liver fibrosis on NASH Clinical Research Network (or CRN) fibrosis score. Resolution of steatohepatitis is defined as absent fatty liver disease or isolated or simple steatosis without steatohepatitis and a NASH CRN activity score (NAS) score of 0-1 for inflammation, 0 for ballooning, and any value for steatosis [NASH-EP]

-

Improvement in liver fibrosis greater than or equal to one stage (NASH CRN fibrosis score) and no worsening of steatohepatitis (defined as no increase in NAS for ballooning, inflammation, or steatosis) [Fibrosis-EP]

-

Both resolution of steatohepatitis and improvement in fibrosis (as defined above)

Unlike Madrigal’s resmetirom, OCA, the first-in-class farnesoid X receptor (or FXR) agonist, demonstrated efficacy as an antifibrotic agent (Table 1) in REGENERATE, an ongoing Phase 3, randomized, double-blind, placebo-controlled, multicenter, international study. A pre-specified interim analysis was conducted comparing Month 18 biopsies to those at baseline. A panel redid the biopsies which were initially done by single pathologists at the respective trial sites.

Table 1. New REGENERATE interim analysis on 931 subjects

|

Percent of patients with: |

Placebo |

OCA 25 mg |

p-value |

|

≥1 stage of fibrosis improvement without worsening of NASH [Fibrosis-EP] |

9.6 |

22.4 |

<0.0001 |

|

NASH Resolution (without fibrosis increase) [NASH-EP] |

3.5 |

6.5 |

Not significant |

The original six-month NDA review which is accorded to a designated Breakthrough Therapy such as OCA, was supposed to include a twice-postponed FDA advisory committee meeting that was never convened due to disruptions by COVID-19. Three days after the Prescription Drug User Fee Act (PDUFA) target action date of June 26, 2020, the Agency handed down the CRL, stating that “the predicted benefit of OCA based on a surrogate histopathologic endpoint remains uncertain and does not sufficiently outweigh the potential risks.” The FDA then recommended “additional post-interim analysis efficacy and safety data” from REGENERATE.

And so Intercept has gathered safety data from 2477 subjects who received ≥1 OCA dose, representing 8,000 patient years. Of course, pruritus was the most common treatment-emergent adverse event (TEAE), as has been known since the beginning. But since OCA has been sold as Ocaliva since 2016 (Figure 2) and patients stay on it long-term, the itching concern is probably overblown and managed adequately in the real world. Similarly, the more modest cholesterol issues were found to return to near baseline by month 12. Thus, all seems ready for Intercept to resubmit the NDA by the end of the year.

Figure 2.

Intercept Corporate Presentation

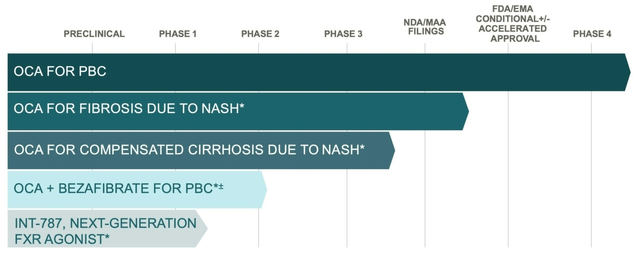

Also on The Liver Meeting calendar is Phase 1 data for the company’s next-generation FXR agonist. From Abstract #4758, one case of moderate TEAE (migraine) was observed in a low dose. Intercept is expected to announce INT-787’s lead indication and updates on its Proof-of-Concept study, FRESH. Management has given indication that 787’s FXR targeting is more likely to affect the gut than the liver. The Phase 2 on a fixed-dose OCA + bezafibrate combo was instigated in Europe.

Figure 3. Intercept Pipeline

*Investigational. ± Intercept has a license to develop and commercialize in the U.S. only.

Ocaliva and is indicated for the treatment of adult patients with primary biliary cholangitis (or PBC). Its sales growth has been steady (Table 2). However, after 3 straight revenue misses, analysts anticipate only $317.45 million for the year, although the high target is $349.61 million which is in line with the company’s updated guidance of $340 million to $350 million. Operating loss narrowed to $10 million, while Intercept’s cash position is close to $500 million, so they are fine as long as approval for NASH is secured. Otherwise, convertible notes in the amount totaling $336 million may become a problem.

Table 2. Ocaliva quarterly U.S. net product sales ($ thousands)

To conclude, investors can have confidence that there is a likelihood of a favorable response on the new NDA. At the very least, the FDA should make good on previous promises to hold an Adcom. Any remarkable developments from The Liver Meeting will be posted in the Comments section; oral presentations are usually reserved for matters of importance; the Intercept sessions are scheduled on November 7 and 8.

Be the first to comment