deepblue4you/iStock Unreleased via Getty Images

Published on the Value Lab 30/10/22

Mazda Motor Corporation (OTCPK:MZDAY) sells millions of units of its cars on international markets. In addition to difficulties in semiconductor procurement, the company has been dealing with a severe production slowdown due to major factories in Shanghai going into lockdown that supply key parts. In interaction with the appreciation of the dollar and the extraordinary depreciation of the Yen, the quarter has been painful. Management believes that it can recover the 50 million unit shortfall from this quarter in future quarters. While this may not be possible, we do acknowledge how cheap the company is thanks to large holdings of non-operating assets. With the Yen potentially being a Fed pivot play as well, the effective 40% decline in the Mazda stock in dollar terms represents a possible opportunity.

Q1 Look

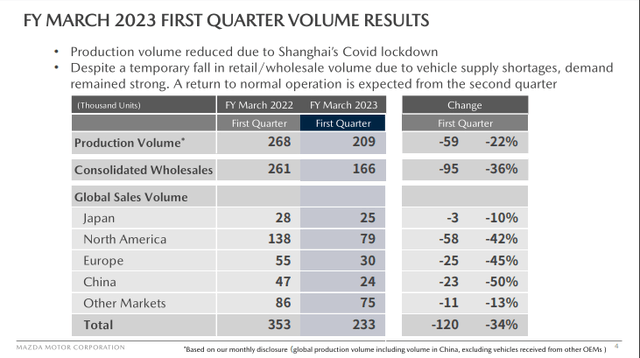

Mazda’s Q1 from August is heavily affected by declines in volumes.

Japanese volumes were relatively strong, and this is because while there were supply shortages of parts from China they were less severe and the concentration of the supply chain in the Far East made it more possible to supply the market. To be precise, the main issue was actually logistics with large inventories being stocked in China. In addition to stops in production, logistic halts related to lockdowns made it impossible to export these parts to the US for example and of course to be used in China for production of vehicles in those markets. Because assembly for Japanese markets happens primarily in Japan, they stock inventory there for the Japanese market but not others, therefore the bifurcation.

At any rate, orders continued to be ahead of volumes thanks to strong local demand and strong sales in key models like the Roadster whose special editions came out recently. Pent-up demand is present in the car market still despite pressures from rates.

China was severely affected both on the demand side due to lockdowns, but also because suppliers in Shanghai were on lockdown and the typical plan to assemble models in China for the Chinese and European markets. Europe suffered entirely due to difficulties in assembly in China. Both semiconductor and auto part suppliers from China were to blame for the almost 50% declines in volumes in Europe and China, and also in America. Key inputs were just not coming despite several factories being present on US soil.

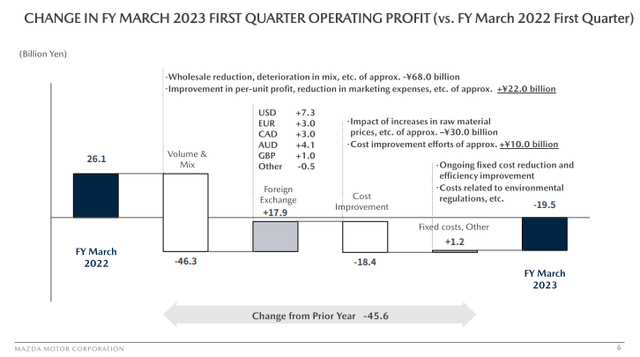

The other issue was plain inflation. YoY declines into negative territory could already be explained by just variable cost increases. Pricing efforts on offset these cost increases by 66% as of now due to difficulties with new deliveries. But declines in volumes were the primary problem by far in the profit situation, which saw substantial declines.

Operating Profit (Q1 2023 Pres)

FX was actually a positive in this quarter because the majority of Mazda sales happen to foreign markets whose currencies have all appreciated with respect to a dismal yen. The problem is the relatively slower declines in Japan mean that the FX impact is not as good as it could have been.

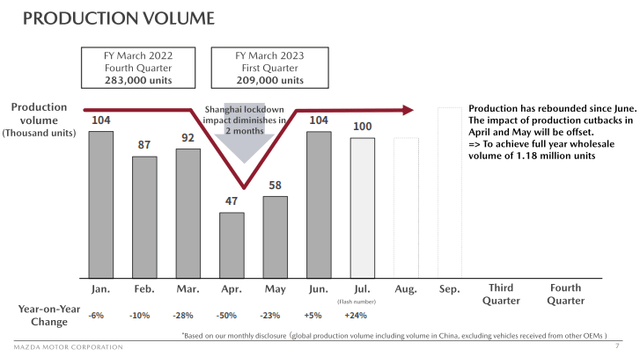

Management insists that production on track and that the shortfall of about 50 million units this quarter, which is 5% of the volume target, can be recuperated. In fact, management guides to a 8% increase for the full year.

Volumes (Monthly) (Q1 2023 Pres)

While we believe this is possible as volumes have evidently come back on track since the June ended quarter, the COVID-zero policy is a major problem for any manufacturer depending on China. Mazda is resolved to shoring up inventories, but this of course will strain working capital to a large degree. Operating cash flows are as negative as they were positive this quarter. This will be structurally worse for the medium term future to shore up supply chains.

Bottom Line

We still like Mazda. While we think further lockdowns in China are possible, production has recovered and Mazda is taking measures to avoid quite the same supply shortfalls again.

The primary reason we like Mazda is on valuation. The Yen has declined and so has the stock, so in terms of dollars the Mazda stock is severely discounted by a total of almost 40% from historical prices, despite 90% of sales in Q1 are accounted for by foreign markets, where foreign markets were substantially less present than usual.

Yen YTD Declines (Seeking Alpha) Mazda YTD Declines (Seeking Alpha)

The other thing is that Mazda has millions of dollars in Toyota (TM) stock. About 18% of Mazda’s market cap is accounted for by Toyota stock. This has driven down the EV of the company to a very attractive level. EV/EBITDA is 1.96x based on 2023 forecasts. The PE is also quite low at just 5.5x, but the EV multiple really accentuates the safe balance sheet.

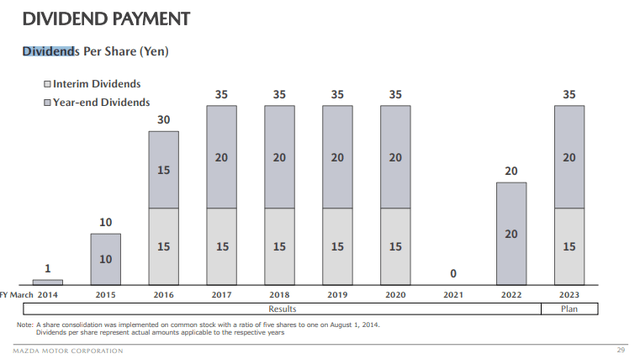

If you are beginning to suspect inflation might be peaking, then the Yen’s decline may be troughing. Moreover, consumer durables will see a recovery. Both play in Mazda’s favour. If the Yen continues to decline, it does not matter fundamentally to Mazda much, and the low multiple offers a margin of safety. Moreover, pent-up demand in cars is proving out for now, while risks of course remain on the macro drop. On balance, Mazda seems to be a buy – yield isn’t bad either at 3.7%. Mazda still plan on maintaining the dividend this year.

Be the first to comment