LumiNola

Introduction

Inter Parfums (NASDAQ:IPAR) is a leading global fragrance producer and distributor that sells a set of iconic brands under license. Its owners and managers are industry veterans that have grown the company revenues at an 11% CAGR since 2016.

Its valuation of 20x EV/EBIT is right in the industry average, and major supply chain and sales growth risks could pressurize future EPS growth.

Consequently, I consider it fairly valued. It is a good stock to have in long the long run, but to be bought at a better price.

Market Overview And Competitive Environment

Market Overview

The global fragrances market is estimated to sum up to an annual size of USD 48+ billion in 2020, and 83% of that value is estimated to be distributed across North America, Europe, and APAC (Asia Pacific). While fragrances’ sales grew abnormally in the US between 2020 – 2021, I expect the growth rate to revert to the global mean of 5% p.a. (CAGR) in the future (2024 – 2025).

The market can be considered mature in developed economies, and the key growth driver for fragrances in the global environment is increasing consumer appetence in emerging markets such as China or Brazil.

Value Chain

The value chain consists of upstream and downstream players, with fragrance manufacturers at the heart. They interpret consumer needs and refine the final product and adapt it to market requirements. Upstream suppliers provide raw materials such as oils, flowers, or alcohol, while downstream distributors are responsible for filling, branding, marketing, and distributing to consumers. Fragrances are available through a wide array of distribution channels that make them available to consumers at nearly any moment in any location across the globe.

Product Categories

Fragrances are sub-divided into prestige and consumer segments, a differentiation that is based on product prices (and perceived brand value). In recent years, thanks to higher disposable income in developed markets such as the US or Europe, the market for fragrances experienced a significant trend towards premiumization, making the Prestige segment the primary growth driver.

Competitive Environment

The market for fragrances is highly competitive and dominated by large public players. Among them are reputable names such as L’Oréal (OTCPK:LRLCF), Louis Vuitton Moët Hennessy (OTCPK:LVMHF), Estee Lauder (EL) , Coty (COTY) or Inter Parfums Inc (IPAR). Nevertheless, it is worth mentioning that two private players (PUIG and Chanel) also compete fiercely and cannot be neglected. Fragrance manufacturers primarily compete on the perceived value of their products which is built through extensive marketing efforts and product adaptation to shifting consumer preferences. Thus, manufacturers rely on brand reputation to capture market share and grow, and any shift in brand value directly affects their sales.

Company Overview & Operating Segments

Inter Parfums Inc. was founded in 1982, by Jean Madar and Philippe Benacin. They met in Business School and have been business partners ever since. Inter Parfums consists of two main entities: Inter Parfums Inc. (IPAR) and Inter Parfums SA (EPA: ITP). Inc owns 72% of its European subsidiary and the remaining 28% of the shares float on the secondary market. Inter Parfums Inc. is responsible for the US operations and Inter Parfums SA operates in the European market.

Inter Parfums Inc. operates in two segments, the United States and Europe. Within each segment, products are divided between prestige and consumer products.

It is important to note that these segments refer to the location of the company’s operations, and not to the geographic markets that products address. Consequently, sales in the United States segment are also generated in Europe, and sales in the Europe segment are also generated in the United States. Combined, they sell in 120+ countries worldwide.

The company does not own production facilities and claims to be a CAPEX-light company that relies on third-party contractors to create its fragrances (10-K, p.2).

If you want to know more about the fragrances market, its trends, sales growth per company or who owns which brands, feel free to check out my market study on the fragrances industry.

Financials & Balance Sheet

Historical Performance

Inter Parfums has a fortress Balance Sheet at the end of FY2021, with total assets of USD 1.145 billion, negative net debt (excess cash) of USD 171 million and a D/E ratio of 0.55. PPE merely accounts for 13% of total assets.

The company grew sales at an outstanding CAGR of 11% since 2016. This suggests that its expansion is a lasting trend and not only due to a post-COVID recovery effect. It generated USD 880 million of rev

enue in 2021 and managed to increase its gross margin to 63.3%, up from 61.4% in 2020. Through the first 9-months of 2022, the gross profit margin slightly increased up to 63.7%. SG&A represents the major cost center, totaling 46.2% of revenue (USD 406 million) in 2021. Operating Income (EBIT) increased to 16.8% compared to 13% in 2020.

Free cashflows were negative in 2021 because Inter Parfums invested in its European segment’s new headquarters in Paris. Parallelly, cash from operations increased a whopping 84% to reach USD 120 million in 2021.

2022 YTD & Outlook

Inter Parfums faces uncertainties at the end of 2022 going into 2023. Major ones include:

Topline

- Its ability to continue growing sales in the US due to reduced consumer spending in the current macroeconomic environment

- Its ability to expand into the Chinese market because of a slower than expected return to growth, continued lockdowns, and the real estate sector’s implosion

- An appreciation of the Euro relative to the dollar which would trigger an adverse impact on revenues

- Decreased revenue growth potential through the withdrawal from the Russian market

Bottom Line

- Sustained gross margin pressures from suppliers (especially glass) that need to be either absorbed by COGS or passed on to consumers

- Increases in A&P spending which increases SG&A

- An appreciation of the Euro relative to the dollar which would have a positive impact on earnings

Inter Parfums declares that FX-rate fluctuations (primarily EUR-USD) have a material impact on sales and EPS. A strong dollar adversely impacts revenue but increases earnings because most costs are incurred in euros. A weak dollar yields the opposite effects (10-K, p.38). A comparison of YoY changes (2022 vs 2021) shows that the relationship holds, and that revenue and FX-rate changes have a correlation factor of 0.87.

|

Changes of Items YoY 2022 vs 2021 |

Q1 |

Q2 |

Q3 |

|

Total Revenue change |

26.3% |

17.9% |

6.8% |

|

Change EUR/USD |

-2.7% |

-5.5% |

-5.8% |

|

Correlation EUR/USD and Inter Parfums Inc. Revenue |

0.87 |

Management Action

Management is prudent and conservative in its outlook for 2023. It expects sales to reach USD 1.025 billion FY 2022, up 16.54% from 2021. The guidance was raised compared to previous estimates. In consideration of the uncertainties outlined above, it expects sales of USD 1.11 billion for FY 2023, slashing the expected growth rate in half, down to 8.29%. In fact, when looking at sales growth numbers YoY per quarter, a growth slowdown is already visible compared to 2021.

|

Revenue per Segment |

Change Q1-YoY |

Change Q2 YoY |

Change Q3 YoY |

|

United States |

74.8% |

68.7% |

45.8% |

|

Europe |

14.0% |

3.2% |

-3.8% |

|

Total revenues |

26.3% |

17.9% |

6.8% |

Valuation

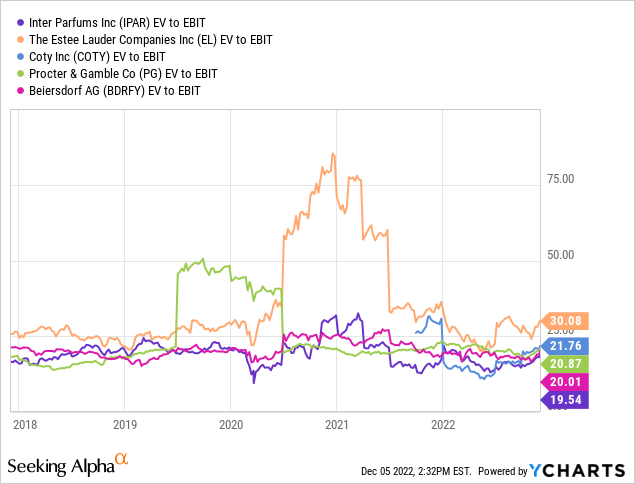

EV/EBIT multiples within fragrances have been historically comparable around 20x, except for Estee Lauder’s outbreak in Q2-2020 and P&G’s in 2019. We will thus take this metric for the valuation of Inter Parfums in the future.

Valuation Assumptions

I will assume the following for valuing Inter Parfums:

- Management guidance holds for revenue growth in 2022 and 2023, I assume 7%, 6%, and 5% for 2024, 2025, 2026, respectively

- SG&A remains a constant percentage of sales

- Gross margins remain steady at 63.3% of sales

- Net debt is constant (USD -171 million)

- EV/EBIT multiple is at the historic industry average of 20x EBIT until 2026

- CAPEX averages USD 20 million p.a., D&A increases 10% p.a. to reach USD 29 million in 2026 compared to USD 14 million in 2021. This is based on the assumption that the company will need to continue investing as it aims to increase global reach

- Working capital increases by USD 50 million in 2022, and decreases by USD 25 million each year until 2026 then after

Valuation Calculation

Below is the pro forma income statement based on the above assumptions. revenue grows at a 6.57% CAGR until 2026 which increases operating income (EBIT) to USD 215 million.

| Pro Forma Income Statement(all numbers in USD million) | 2022e | 2023e | 2024e | 2025e | 2026e |

| Revenue | 1,025 | 1,110 | 1,188 | 1,259 | 1,322 |

| growth % | 16.54% | 8.29% | 7% | 6% | 5% |

| Gross Profit | 649 | 703 | 752 | 797 | 837 |

| Selling, general and administrative | 482 | 522 | 558 | 592 | 621 |

| Operating income | 166 | 180 | 193 | 204 | 215 |

| Income before taxes | 160 | 174 | 187 | 199 | 209 |

| Provision for income taxes | 42 | 45 | 49 | 52 | 54 |

| Net Income | 119 | 129 | 138 | 147 | 155 |

For valuation, I use a multiple approach with a bear, base, and bull case. The respective EV/EBIT multiples are 15x, 20x, 25x. Deducting net debt and dividing by shares outstanding would thus yield a target share price range between USD 101.04 and USD 168.41, which represents 6.4% and 77.3% upside, respectively.

| Valuation (All numbers in USD million) | Bear Case | Base Case | Bull Case |

| Operating Income 2026 | 215 | ||

| EBIT multiple | 15.0x | 20.0x | 25.0x |

| EV | 3,220.87 | 4,294.49 | 5,368.11 |

| Net debt | (171) | ||

| Shares outstanding (million) | 32 | ||

| Value per share | 101.04 | 134.73 | 168.41 |

| Upside (base 95) | 6.4% | 41.8% | 77.3% |

Conclusion

Inter Parfums is an outstanding company that historically showed strong growth (11% CAGR). Revenue grew exceptionally in 2021 and 2022, primarily driven by a post-COVID recovery effect and increased consumer spending. However, growth in the fragrances market is forecast to slow down in the next years.

Inter Parfums’ founders remain in office as CEO and Chairman, and they communicate conservative assumptions in their guidance and are fully aware of the uncertainties ahead.

With competent management, a flexible and sustainable business model, strong financials, and plenty of opportunities to grow in the long run, I believe Inter Parfums is a good stock to have. Nevertheless, with the bear case being close to the current share price, it seems fairly valued, and I will wait for a better price to integrate it into my portfolio.

Be the first to comment