JasonDoiy

Intel (NASDAQ:INTC) submitted a nightmarish earnings report for the second quarter on Thursday that included a giant EPS miss, weak key metrics from top to bottom and a hugely disappointing outlook for FY 2022. Due to weakness in the PC market – which is cooling off after the pandemic drove record demand for PCs, laptops and tablets in FY 2021 – Intel’s problems are growing. The earnings report resulted in Intel’s shares revaluing sharply lower last week and estimates are likely to trend down sharply going forward. With continual softness in the PC industry and possibly weaker than expected shipments in the second half of the year, the risk profile for Intel is highly unfavorable!

Huge EPS miss, but Intel’s problems go much deeper

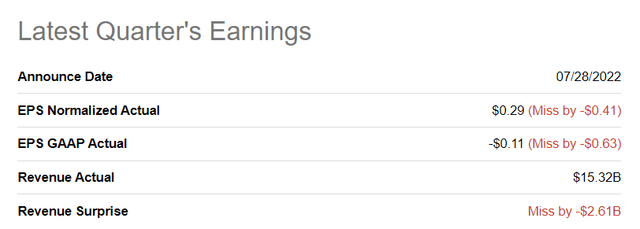

Intel missed predictions for Q2’22 EPS by a huge margin: the chip maker reported non-GAAP EPS of $0.29, falling short of predictions of $0.70. Revenues for Q2’22 were 15% below consensus figures and it was the biggest revenue miss for Intel since 1999.

Seeking Alpha – Intel Q2’22 Results

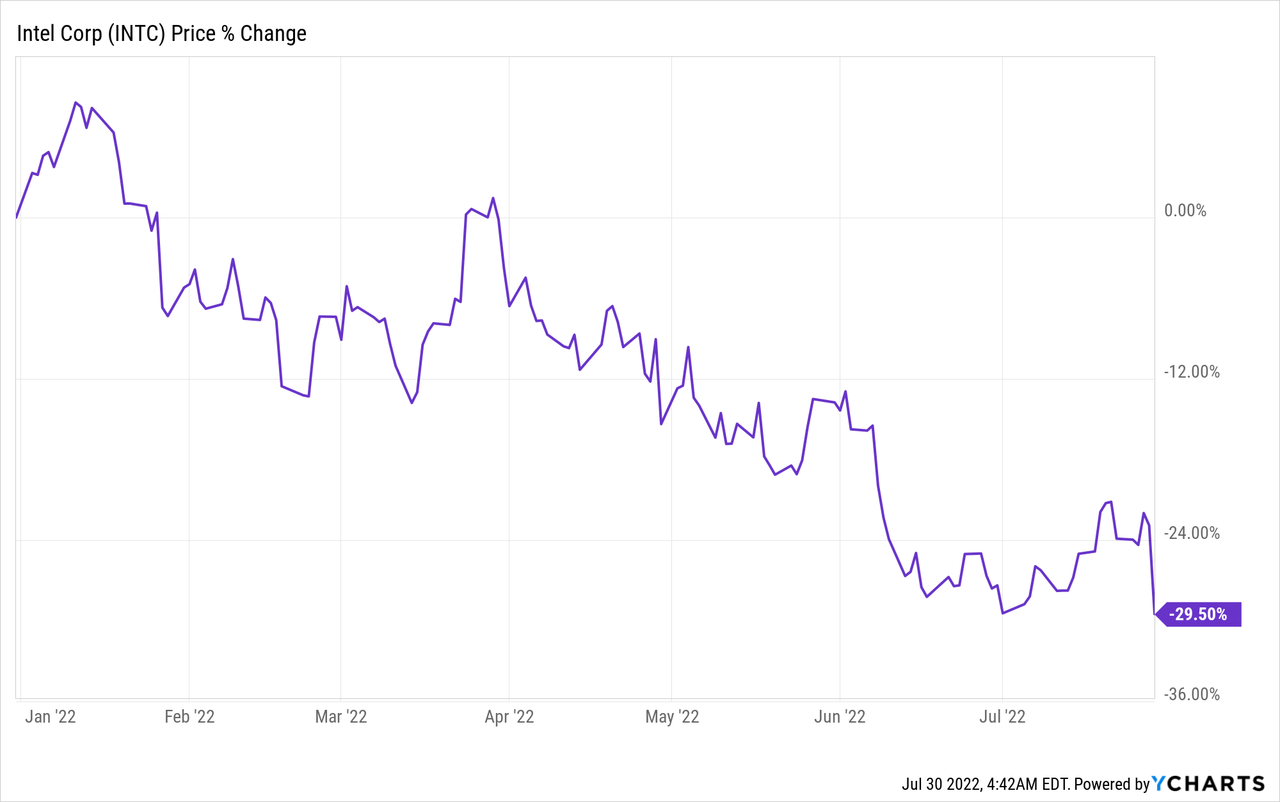

This was clearly not your average earnings report. It doesn’t happen every day that a company misses estimates by such large margins and it indicates that the market as well as Intel itself have fundamentally misjudged the company’s capacity for growth. Shares of Intel skidded 9% yesterday to a new 1-year low as investors reevaluated their Intel positions.

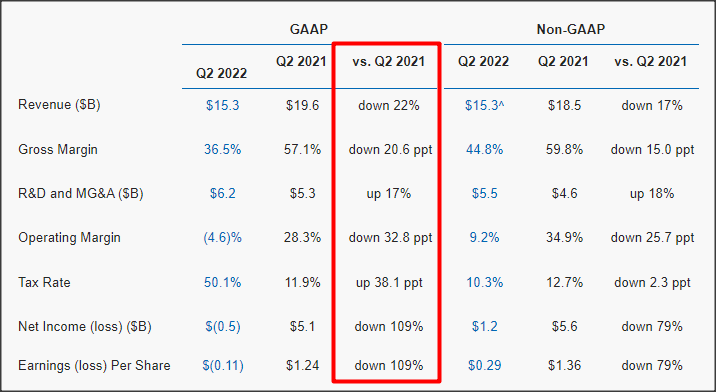

Intel’s Q2’22 earnings report was a nightmare report through and through. The firm’s top line growth declined 22% year over year to $15.3B and operating margins collapsed a massive 32.8% year over year, largely due to Intel’s escalating problems in the Client Computing Group/CCG.

The Client Computing Group serves the personal computing market with Intel’s processors and other technologies including AI-based smart home technologies. Due to the post-pandemic down-turn in PC shipments, no other business is as vulnerable to continual PC market softness than Intel’s Client Computing Group: the business has a 50% revenue share, so whatever plays out within CCG will seriously affect Intel’s results.

Intel: Q2’22 Segment Results

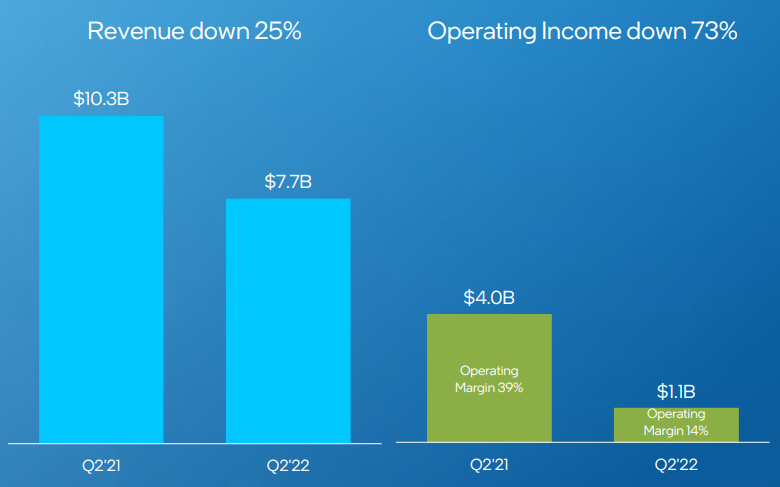

The Client Computing Group is a problem for Intel because it is most affected by declining PC shipments and the business saw the sharpest correction in revenues in the second quarter. In Q2’22, the Client Computing Group saw a revenue decline of 25% year over year which translates to 2.6B lower revenues than in Q2’21. It was the largest percentage and dollar decline in Intel’s core businesses in the second quarter.

Especially concerning is the speed with which Intel’s operating margins in CCG have declined in Q2’22, indicating that the down-turn is proceeding at a much faster pace than expected. In the second quarter, CCG’s operating income margins declined a massive 25 PP compared to the year-earlier period. Due to lower revenues and higher costs, the segment’s operating margin declined 2.9B compared to last year.

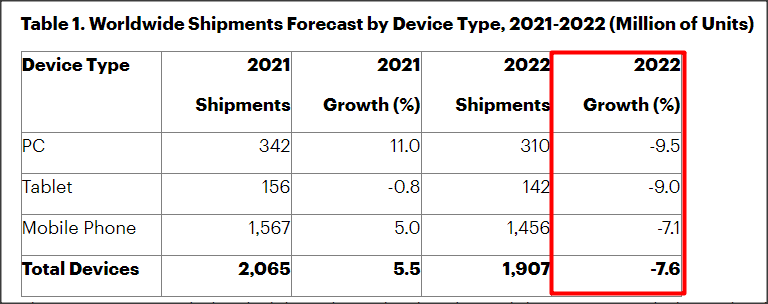

Intel – CCG Segment Q2’22

The business outlook for Intel’s CCG is highly negative. According to Gartner, total device shipments – including PCs, tablets and mobile phones – are expected to drop off 7.6% year over year in FY 2022, in part because many companies and consumers upgraded their devices during the pandemic to work and study remotely. The biggest drop off in growth is expected to occur in the PC category – Intel’s core business – which is projected to contract 9.5% this year. With pandemic effects wearing off, the short term revenue outlook for Intel in general, and the Client Computing Group especially, is not very bright.

Gartner – Estimated Device Shipments 2022

Gartner’s prediction for device shipments in 2022 was made at the end of June and therefore before markets got confirmation that the US economy is in a recession. For that reason, I believe drop-off rates in device shipments could actually be much worse than Gartner’s earlier forecast implies, especially if the US economy slows down further in the second half of the year.

The outlook is a real shocker

If you thought earnings were bad, you haven’t seen Intel’s outlook for FY 2022 which shows a broad-based deterioration of fundamentals. For FY 2022, Intel projects a 9-13% year over year decline in revenues to $65-68B. Intel previously expected to be able to generate revenues of $76B in FY 2022. Margins and EPS are also expected to decline rapidly while free cash flow is projected to be $(1)-(2)B.

Intel: New Outlook FY 2022

What worries me enormously is how large the downgrades are relative to the previous projections which indicates to me that Intel is facing a very serious downturn in the industry.

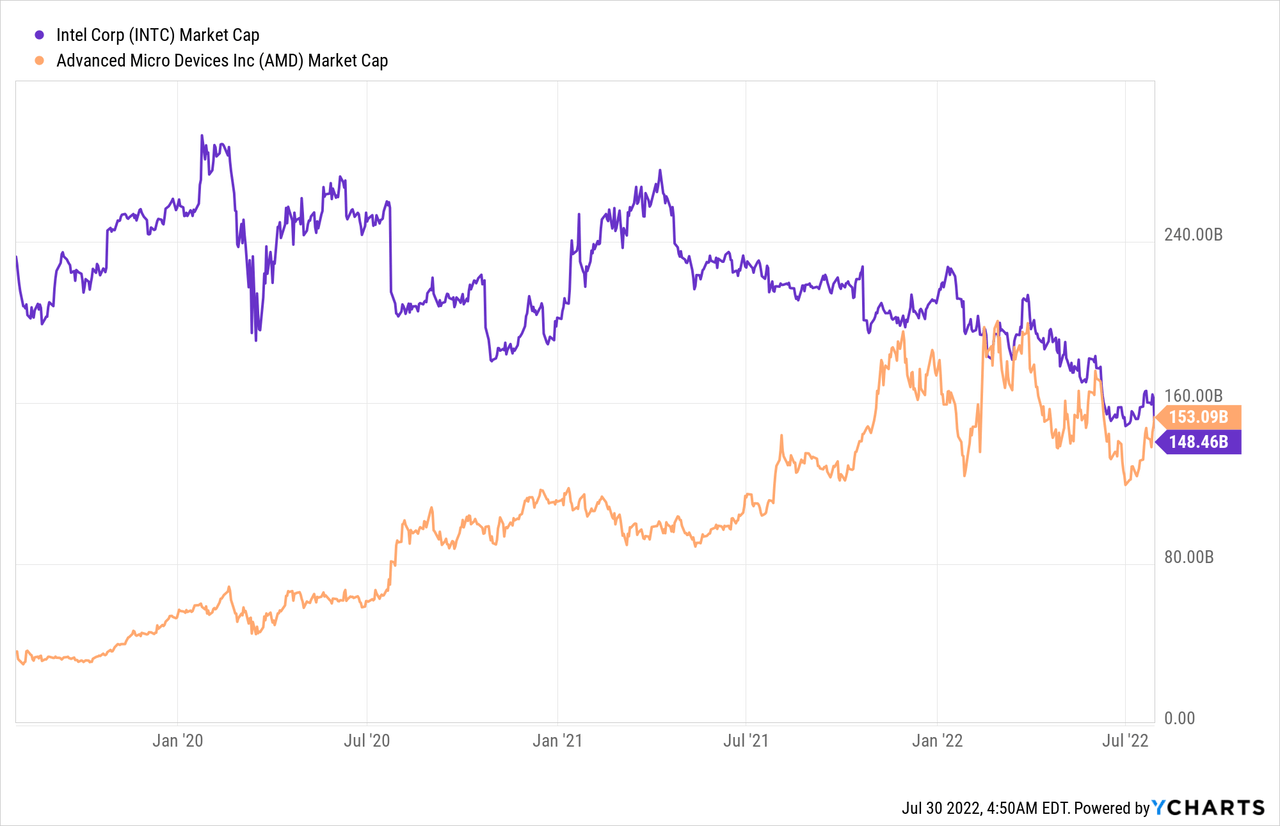

Besides market weakness, Intel also has other problems. Intel has delayed the market introduction of the Sapphire Rapids data center processor multiple times with which the company seeks to compete against AMD (AMD)’s super-successful EPYC server processors. Because of delays, volume shipments can be expected to take place only at the end of the year. AMD has made big inroads into the server market lately with its EPYC processors and those gains have largely come at the expense of Intel.

Because of Intel’s share price drop on Friday, AMD’s market cap now exceeds Intel’s market cap.

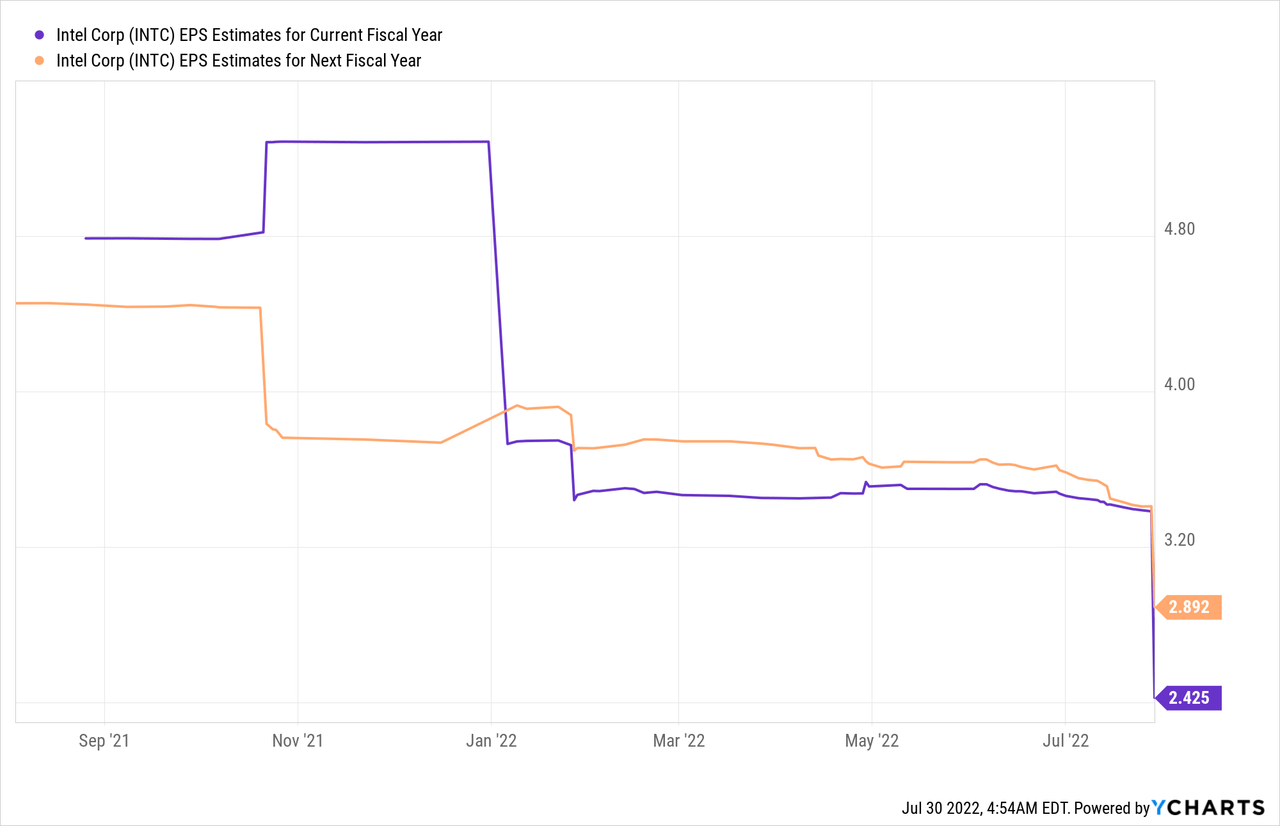

Estimates are set to see major downgrades

With EPS and revenues missing big and with Intel guiding for much slower top line growth in FY 2022, a significant overhang has been created for Intel’s EPS predictions. Because Intel’s Q2 and FY 2022 outlook have introduced so much uncertainty, estimates are set to be refreshed to the down-side, exposing shares of Intel to continual selling pressure. EPS estimates have already begun to fall sharply and the trend is likely going to remain negative for the foreseeable future.

Unattractive risk profile

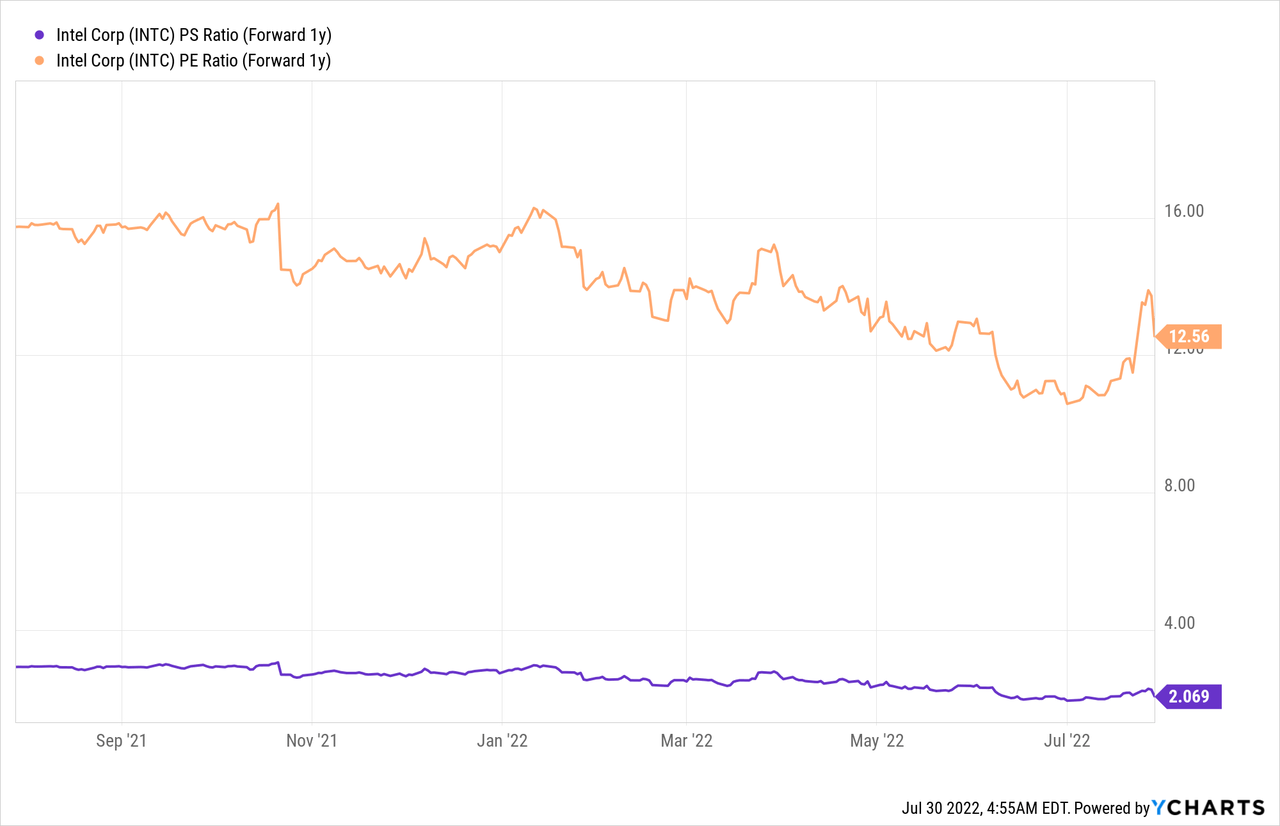

Intel’s core problems – sluggish PC sales, delayed Sapphire Rapids introduction – are weighing heavily on Intel’s valuation and there is very little reason to believe that things will improve in the short term. Intel is valued at 2.1 X sales and 12.6 X earnings, but declining earnings estimates would make shares of Intel more expensive.

Risks with Intel

The biggest risk, as I see it, is that Intel’s management is misjudging the severity and length of the post-pandemic downturn in the PC market and although management has expressed its opinion that it will get better from here, commercial risks are high.

The holiday season at the end of the year may lead to an increase in PC sales, but hoping for a strong holiday quarter to turn results around is not a good strategy. However, a volume ramp for Sapphire processor sales toward the end of the year may give Intel’s business some upside momentum. If the economy is (remains) in a deep recession by the end of the year and consumers cut back spending, a weak holiday quarter may only compound Intel’s problems.

Final thoughts

Intel’s earnings report, the size of bottom and top line misses, and the outlook for FY 2022 were all of nightmarish proportions and indicate that Intel is facing a broad-based, cyclical down-trend in PC shipments that could get worse in the second half of the year, especially if a deepening recession puts PC buyers further on the defensive. The outlook especially is a total game-changer and fundamentally resets expectations about Intel’s business growth.

The EPS estimate trend is highly negative and more down-grades could add pressure on Intel’s valuation. Since Intel is so heavily relying on the Client Computing Group for revenue and operating income growth, I believe the risk profile is heavily skewed to the downside!

Be the first to comment