Oli Scarff

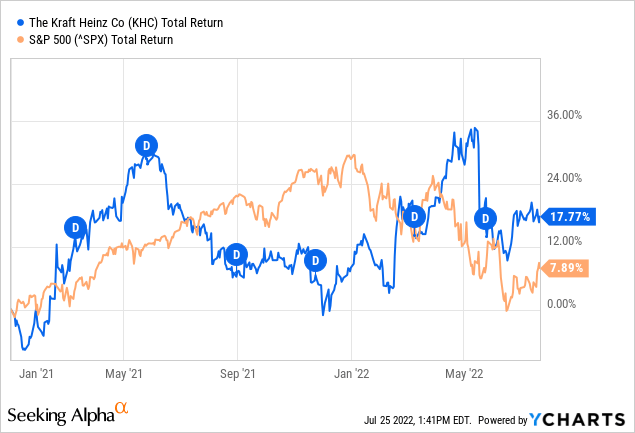

Kraft Heinz (NASDAQ:KHC) has been nearly a perfect hedge for S&P 500 since our last article Kraft Heinz: Renovation Comes Before Innovation. On top of outperforming S&P 500, KHC paid dividends, so that total return for 1.5 years comprised 17.8%, compared to 7.9% at S&P 500. Not too bad, in our view.

Now as some investors are getting buckled up for a possible recession, KHC as a Consumer Staple stock, could be a good investment idea.

Seeking Alpha

Kraft Heinz Has Not Been Investors’ Darling In The Past

Historically, Kraft Heinz has not been investors’ darling ever since Kraft Heinz $63bn mega-merger in 2015. The first restructuring program under the supervision of Brazilian private equity firm 3G Capital failed to bring the desired results. It led to more than 40% share price drop alone in 2018-2019. The share price has not recovered up to this day. After that, a new generation of management with Miguel Patricio has been appointed in July 2019 and the turnaround efforts look much better this time.

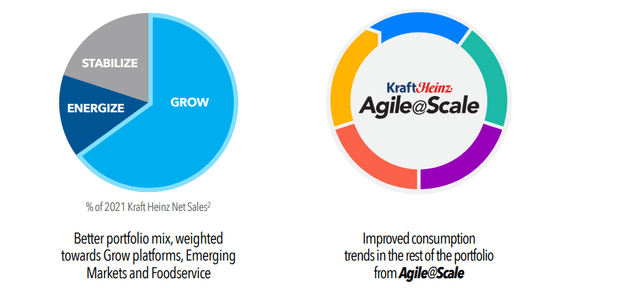

Kraft Heinz’s management structured the business into six product platforms and defined targets such as grow, energize or stabilize for each of them.

Most of the products (64%) are in Grow category, where the company targets both organic and inorganic growth. Portfolio structuring allowed company’s management to set clear targets for each category, while focusing its marketing efforts where it matters, thus avoiding spending empty marketing dollars. The management prides itself in making the hierarchy flatter and shortening the decision-making time, thus putting the giant company on agile tracks.

Kraft Heinz Declares Acceleration

Last year, KHC organic growth constituted 1.8%, driven mostly by international segment, where the organic growth constituted 3.1%.

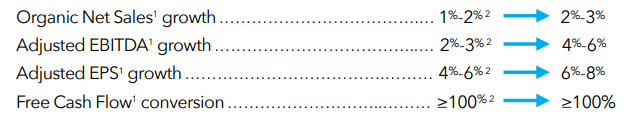

In its February 2022 CAGNY presentation, Kraft Heinz raised its long-term growth forecast, which we see as a sign of management’s confidence in the success of its acceleration plan.

Kraft Heinz

The company has been beating analysts’ expectations in the past year and is about to announce its Q2 results in a few days. One of the things to watch out for would be whether the management keeps its upbeat acceleration talk.

Kraft Heinz announced its Q2 results on July 27th, beating analysts’ expectations both on EPS and revenues and raised organic net sales for FY22 to high single digits on the back of higher prices that the company is able to pass on to the consumers.

Managing brand Portfolio via M&A

Apart from organic growth, Kraft Heinz manages its brand portfolio via M&A. With Miguel at the helm, Kraft Heinz divested two businesses – cheese and Planters nut in 2020 for $3.2bn and $3.35bn, respectively. At the end of 2021, the company acquired 85% of Just Spices for a rumored valuation of $300mln. This way, the company divested some of the slower-growing businesses while acquiring a fast-growing startup with the intention to roll out Just Spices as an international brand.

Cleaning Up Balance Sheet

The proceeds from two large divestments were partially used to pay off debt, which went down $7bn (or 25%) from $28bn at the end of 2020 to $21bn at the end of 2021. This way, Kraft Heinz kept its investment grade rating and decreased its net leverage to 3x Adjusted EBITDA.

Kraft Heinz Through Porter’s Five Forces Lenses

If you look at Kraft Heinz’s strategy from Porter’s Five Forces, being one of the largest packaged food producers in the world, the company has a relatively low bargaining power of suppliers: it procures huge quantities of raw materials and uses economies of scale. This is positive for KHC stock. In addition to that, Kraft Heinz hedged the prices for some of the commodities like grains, oils, energy until Q4, which gives the company some input price stability and time to adjust to an inflationary environment.

As evidenced by Kraft Heinz Q2 results, the company is successful in passing higher production costs on to buyers, suggesting that bargaining power of buyers is low. This is somewhat contradicted by the recent headlines, where Tesco (OTCQX:TSCDF) pulled KHC’s products like Heinz ketchup from their shelves in protest to price increases. The conflict has been solved since then, however, it shows that for Kraft Heinz, Tesco (and other supermarkets) is not only a rival with its private label products (threat of substitutes), but Tesco also enhances the bargaining power of buyers, which is negative for Kraft Heinz.

Packaged Consumer Goods Industry rivalry is quite high, which is showcased e.g. by KHC’s net profit margin of less 5%. At the same time, most of its competitors, such as General Mills (GIS) and Hormel Foods (HRL), post net profit margins above 10% mark. Kraft Heinz is aiming to achieve gross efficiencies of $2bn, which will serve margin improvement.

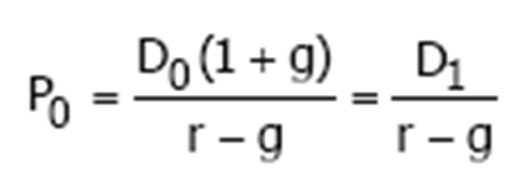

Dividend Discount Model

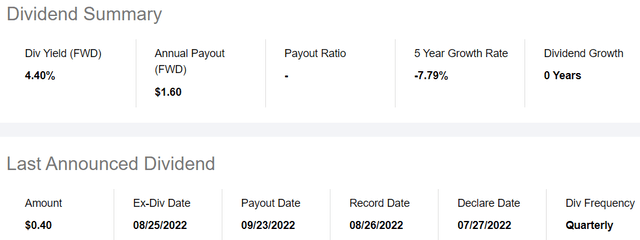

KHC has a long history of paying dividends. Current payout ratio is just below 60%. Therefore, we estimate the fair value of Kraft Heinz stock using the Dividend Discount Model (DDM).

Kraft Heinz has been paying $0.4 in quarterly dividends, or $1.6 p.a. for the past 4 years. Current dividend yield comprises 4.4%. Seeking Alpha analysts estimate that the dividends might grow at a moderate 2% growth rate in 2023 to $1.63. We use this assumption in our DDM.

Required return: We use risk-free interest rate of 2.77%, equity risk premium of 5.69% and a beta for the stock.

Choice of Beta: Usually, we take 5-year monthly beta for the stock. However, as we noted before, in the past 1.5-2 years, there has been essentially a very low correlation between KHC and S&P 500, resulting in beta of 0.08, whereas in the past five years, the monthly beta was 0.85. In our valuation of KHC stock using DDM, we decided to deviate from using 5-year beta and use a 3-year beta instead, since it’s the timeframe when company’s turnaround had been launched, new CEO appointed and COVID-19 hit among other things. We believe the beta over three years (0.46x) better represents KHC’s correlation with the market.

Having a beta of 1 means that the stock moves essentially as much as the market. Having a beta of less than one means that in the scenario when the equity markets are expected to go down due to a recession sell-off, the stock price of a low-beta stock will decrease less during the period.

The required rate of return for the KHC would be 2.77%+0.46*5.69% = 5.39%. You might wonder that the required rate of return is too low, however, this is due to the low beta and the diversification benefits of KHC stock.

Wikipedia

Assumptions:

D1 = $1.63 (expected dividends in 2023)

g = 2% (long-term growth rate)

r = 5.39% (required rate of return)

Result for Price: $1.63/0.0339 = $48 per share, 29% upside to the current share price.

Note on required return: You may notice that the required return that we use for KHC is just over half of the one used for PRU (10.6%) in our previous article. Even though both are mature, dividend-paying companies. The only reason behind it is that PRU’s beta is triple that of KHC’s.

Should you use 10% as the required rate of return, the fair value of KHC’s share will be reduced to $20.4/share. So, as you can see, the fair value per share estimate is highly dependent on your rate of required return.

Conclusion

In our view, Kraft Heinz went through a major transformation in the past several years.

It is in the right industry – Consumer Staples for the recessionary environment.

Management has increased both its FY22 guidance and long-term growth goals, which is quite a statement for a giant like Kraft Heinz.

The stock outperformed the market in the past 1.5 years since we’ve been following it and provided a great hedge to S&P 500.

We remain bullish on the stock and estimate KHC’s fair share value using DDM at $48, which suggests a 29% upside potential to the current share price.

Be the first to comment