Nikada/iStock Unreleased via Getty Images

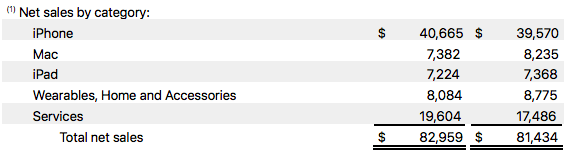

Apple (NASDAQ:AAPL) has reported earnings which were able to meet expectations in several key metrics including revenue, EPS, and iPhone sales. However, the company reported only 12% YoY Services revenue growth and this segment is now facing severe challenges. The Services segment reported revenue of $19.60 billion against an estimate of $19.70 billion.

In the last few years, the core investment thesis around Apple stock was that it was transforming from a Products company to a Services oriented business. The recurring revenue base and better moat in the Services business allowed Apple stock to gain a better valuation multiple and helped the bullish momentum. However, there has been a slowdown in Services growth rate. The company reported YoY Services segment growth rates of 12%, 17%, 24%, and 26% in the last four quarters.

A bulk of Services revenue base comes from the App Store and the licensing deal with Google (GOOG). Both these revenue streams are very lucrative and help deliver good margins. However, Apple has started feeling regulatory pushbacks in the App Store in several key international regions including European Union, South Korea, U.K., and others. The licensing business is also coming under the regulatory scanner as it boosts monopolistic practices between Apple and Google. At the same time, Apple’s new Services businesses of Music streaming, TV+, and subscriptions are not showing good progress.

We could see low single-digit or even negative YoY growth rates in the Services segment in the next few quarters which could create significant bearish sentiment towards Apple stock. The headwinds faced by Apple’s Services segment make it a poor bet for long-term investment.

Importance of Services segment

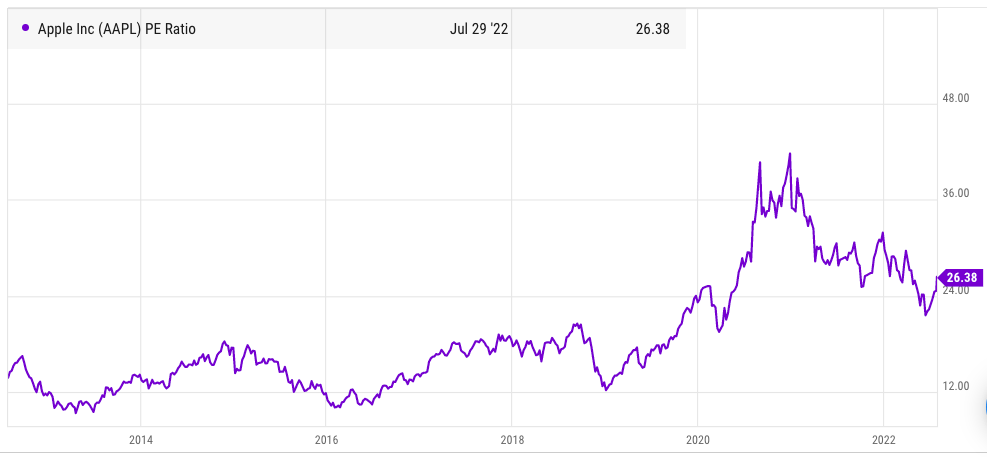

The importance of Services business for Apple cannot be overstated. We can easily see the transformation in the PE multiple of Apple once the Services business took off.

Ycharts

Figure 1: Apple’s PE ratio in the past few years.

Apple had an average valuation multiple of 15 for most of the last decade. However, faster growth in App Store revenue gave a strong bullish momentum to the stock. Its PE ratio has been averaging over 25 for the past few quarters which is due to the growth in the recurring revenue business of Services segment.

We can see a steady fall in Services segment’s YoY revenue growth numbers in the last few quarters. In the recent quarter of Q3 2022, Services segment had revenue of $19.6 billion compared to $17.4 billion in year-ago quarter which is equal to 12% YoY growth. In Q2 2022, Services segment had revenue of $19.8 billion compared to $16.9 billion in year-ago quarter which is equal to 17% YoY growth. In Q1 2022, Services segment had revenue of $19.5 billion compared to $15.7 billion in year-ago quarter which is equal to 24% YoY growth. In Q4 2022, Services segment had revenue of $18.2 billion compared to $14.5 billion in year-ago quarter which is equal to 26% YoY growth.

Company Filings

Figure 2: Apple’s Services segment revenue showed 12% YoY growth in recent quarter.

Low single-digit Services segment growth

Apple is facing massive headwinds in the two most lucrative revenue streams within Services segment. The App Store is coming under regulatory pressure due to the massive commissions charged by Apple and the monopolistic payment options used by the company. This challenge is not limited to a single region but can be seen across different geographies. Apple has recently allowed third-party payments options in South Korea but will still be charging additional commissions. In the dispute with Dutch regulators, Apple is following a similar pattern of allowing third-party payments but charging additional commissions for those payments.

At the core of this issue is the “Apple Tax” which developers have to pay for using Apple’s “walled garden”. This is generally viewed as a monopolistic practice by most regulators and we could see a substantial change in the App Store business model. This will obviously hurt the highly lucrative revenue from this business.

Apple is also seeing pressure from regulators due to its licensing agreement with Google which rakes in over $10 billion annually. This would be pure profits for Apple because it is essentially selling the real estate on its platform to Google. Both the European and the domestic U.S. regulators would be looking at ways to limit the scope of this licensing deal which prevents new search engine options for customers.

If the current slowdown in YoY growth of Services segment continues, we could see a low single-digit YoY growth or even a negative growth rate in Services revenue. This would change the entire investment thesis around Apple stock and can lead to a big bearish correction.

Apple Music and TV+ are not helping

Apple has launched new services to gain additional growth options within this segment. The company does not reveal the exact numbers of paid subscribers within the music streaming and TV+ business. But third party estimates show that the company is facing growth challenges within these businesses. Spotify (SPOT) has retained its market leadership in music streaming. Amazon (AMZN) and Google are quickly ramping up their music streaming business with the help of their leadership in smart speaker segment. Amazon also has an advantage due to Prime membership while Google is using YouTube Premium membership to attract customers to music streaming.

Apple has not announced paid subscribers in Apple Music for over three years. This alone shows that the company might be facing tougher than expected competition. In the previous announcement in 2019, Apple Music had over 50 million paid subscribers. If Apple has increased this number to 80 million, this segment would be contributing over $8 billion to Services segment which is close to 10% of the revenue base in this segment. Hence, any slowdown in music streaming alone can cause headwinds for Services growth.

The TV+ business is also facing massive challenges due to the investment scale of other competitors. Amazon, Netflix (NFLX), and Disney (DIS) are ramping up their streaming budgets. There might not be a lot of customers willing to pay for a fourth or fifth video streaming subscription. A report in Verge mentioned that Apple’s management has announced a subscriber base of less than 20 million in TV+. Unless Apple can massively ramp up the subscriber numbers in this business, it will become a money pit for the company due to high investment and low sales.

Impact on Apple stock

Long-term investors hoping for good returns should carefully look at the growth trajectory of the Services segment. If Apple’s management is not able to add a highly successful business to its Services segment, we could see a massive slowdown in Services growth and possibly even a decline in the revenue base. The iPhone and other products are still dependent on the upgrade cycle and show a lot of fluctuations in their sales.

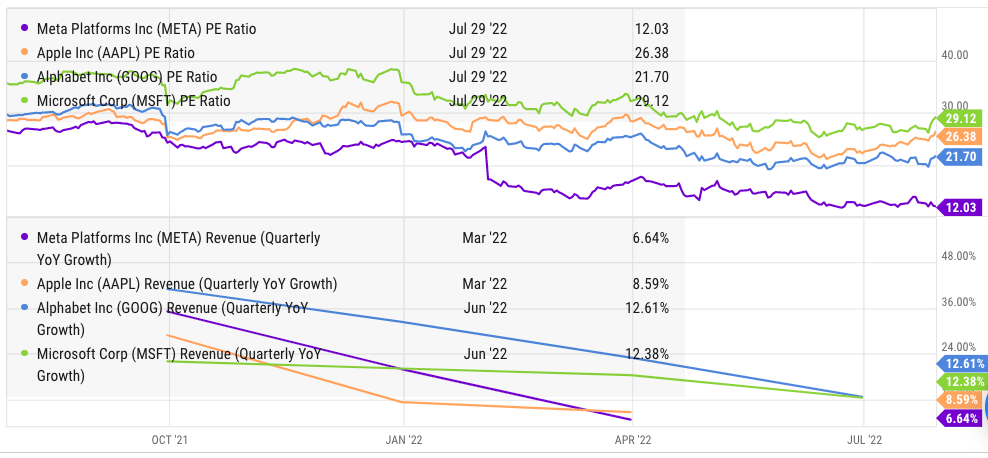

Ycharts

Figure 3: PE ratio and YoY revenue growth of Apple and other Big Tech companies.

Apple’s PE ratio is one of the highest among Big Tech companies. At the same time, the revenue growth is lower than these competitors. Only Meta (META) reported a lower YoY growth rate of negative 1% in this quarter. On the other hand, Meta is trading at less than half the PE multiple of Apple.

It is highly likely that Wall Street will not be happy with a low single-digit growth or negative growth in Apple’s Services segment. It is certain that Apple will not be trading at a PE multiple of over 26 if Services slowdown materializes. Due to the bearish sentiment of Wall Street towards the broader tech space, we could see the PE multiple of Apple fall to below 20 or even close to 15 if challenges for Services business persist.

Investor Takeaway

Apple reported YoY Services growth rate of 12%, 17%, 24%, and 26% in the previous four quarters. This segment was supposed to be a major growth contributor and also deliver a recurring revenue stream. The Services segment is facing challenges within the App Store and licensing deals. The growth trajectory of Apple Music, TV+ and subscriptions has also been below expectations. The future decline in Services business can cause Wall Street to take a bearish view of Apple stock.

Apple is trading at one of the highest PE multiples among Big Tech companies while showing lower YoY revenue growth rates. Apple stock is too expensive at the current price considering the headwinds faced by Services segment.

Be the first to comment