Drazen_/E+ via Getty Images

Broader markets have been on a downturn for the better part of the last two quarters as 2022 proves a troublesome year for investors. Issues surrounding surging inflation, an ongoing supply chain distribution, and upcoming rate hikes had many investors already worried, with the Russian invasion of Ukraine only serving to cause further chaos in the markets. As a result, money is being pulled out of stocks and moved into safer havens, including bonds, gold, silver, or simply the U.S. dollar.

On the back of the largest bull run in history which lasted almost thirteen years and saw the market return more than 400%, many investors have turned away from value stocks proclaiming the investment philosophy made famous by the likes of Ben Graham and Warren Buffet dead. However, 2022 revealed once more that in troublesome times like these, investors always seem to go back to the only thing that really matters, fundamentals. Today we are highlighting four companies coming out of different sectors of the market that have one thing in common, strong fundamentals. The following companies are worthy of further research as we believe that their pure value proposition remains strong while several turnaround catalysts are slowly building up.

Turnaround Play 1: Discovery (DISCA) (DISCK) (DISCB)

In March of last year, a $10 billion family office called “Archegos Capital Management,” led by the now infamous investor Bill Hwang, imploded after failing to provide collateral to cover the fund’s extreme exposure on swaps. Archegos failure to meet its margin calls prompted a massive $20 billion fire stock sale as the prime brokers rushed to sell off the fund’s positions thereby creating havoc in the markets.

This is the story of how Discovery, one of the major positions held by the fund, lost more than 60% of its value in a matter of days. The stock has been trading sideways ever since. However, the stage has been set for a turnaround by a surprise announcement of AT&T (T) deciding to spin off its Warner Media assets and have them merge with Discovery, creating a new streaming and media giant in the process. The most anticipated deal of the year has now passed all regulatory hurdles and is expected to close in the following couple of weeks.

Discovery Share Price (TradingView)

Warner Bros. Discovery’s content library can be easily compared to its main competitors in both quality and quantity. In fact, it brings so much to the table that some of them might grow increasingly displeased with this merger over time. The merger itself creates a worthy competitor that is designed to trade blows with the likes of Netflix (NFLX), Disney (DIS), and Amazon (AMZN).

It is not difficult to see how a company with such a deep content portfolio as WBD would be becoming more successful as the years progress. The portfolio covers a very wide selection of content, ranging from some of the greatest cinematic achievements on one end (LoTR, HP, GoT, etc.) to some of the “low intensity” content suitable for your average Sunday family gathering (TLC, Food Network, Discovery, etc.). Quantitatively speaking, WBD’s portfolio will consist of about 200,000 hours of programming, which would already cement it at the very top of the pyramid of streaming wars.

This upcoming merger is creating a true giant in the media and streaming space that will start trading blows with the likes of Netflix or Disney, seemingly overnight. The unique combination of great long-term prospects and unjustified short-term valuations can make Warner Bros. Discovery one of the best investment opportunities of the year. It is a brilliant example of deep value being hidden in plain sight; many investors might look back upon this point asking themselves how the painstakingly obvious was missed.

Turnaround Play 2: Facebook / Meta (FB)

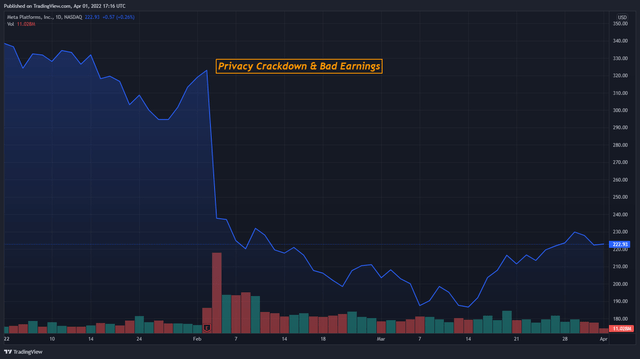

The biggest loss of value in stock-market history has been recorded earlier this year, as the newly renamed Meta released its disappointing fourth-quarter results. The troublesome Q4 results highlighted several weaknesses with Meta’s business model and shed light on not-so-bright expected growth numbers. The subsequent crash that followed has seen the $900 billion tech empire lose more than $200 billion in value in just a matter of an hour, and more than $300 billion over the course of the next two months.

Meta Share Price (TradingView)

Over the past couple of years, the relationship between the social media powerhouse and Apple (AAPL) has been increasingly deteriorating. The latest result of the growing rivalry was the decision from the latter to impose several major privacy changes to its iOS 14 operating system which were designed in part to limit the ability of the former to generate targeted ads for its clients.

Apple’s proposed changes couldn’t possibly come at a worse time for Meta Platforms, considering it went through numerous issues and scandals related to privacy concerns during the past couple of years. In a Bloomberg article, it was reported that roughly 75% of iOS users have decided to opt out of tracking as a result of the “App Tracking Transparency” feature. Due to this fact, the company’s ability to provide targeted ads to clients was severely limited which could produce serious harm to Meta’s top and bottom lines in the future.

The company does to a certain extent remain subservient to both Apple’s and Alphabet’s (GOOG)(GOOGL) interests, meaning that the two tech companies exert a great amount of control over the social media giant. Another big takeaway from the earnings was the now already consistent and noticeable top and bottom lines growth slowdown.

However, many would argue that the market’s fears are overblown and that the sell-off of this magnitude was largely unwarranted. In a world where social media is becoming more relevant by the day, Meta remains the undisputed king and the largest social media company with more than 3 billion monthly active users across its platforms. It is estimated that the world’s current population is set somewhere around 7.9 billion people. That means that the social media giant has managed to create a 45% penetration and that one out of two people in the world use at least one of Meta’s apps on a monthly basis.

Meta’s Facebook app, along with Instagram, Messenger, and WhatsApp, remains the world’s most widely used apps on both Android and iPhone smartphones. The family of apps continues to dominate the social media space as there are no meaningful alternatives left to provide the same service to the users. Even though platforms such as Tik Tok or Snap (SNAP) are gaining ground, the newcomers cater to completely different urges and are thereby not a meaningful replacement.

The truth is, even though the market is going to have to price in the recently observed vulnerabilities in Meta’s business model, the company remains a free cash flow machine that is yet to encounter its first actual competitor. In other words, Meta remains in a league of its own, and the unprecedented sell-off has created a great value proposition that many would be wise to exploit.

Turnaround Play 3: Intel (INTC)

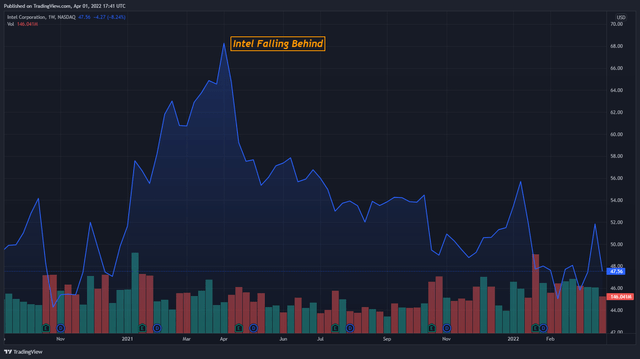

On the back of a two-decade-long market share domination, the extraordinary results that were achieved have allowed Intel’s management to carefully carve out one of the most attractive-looking balance sheets in the business. The previous management’s almost isolated focus on shareholder returns allowed their competition to step up their game and deal a serious blow to the US chip giant. The company has fallen behind on innovation, having serious issues with its 10-nanometer process in recent years, and the subsequent announcement that its 7-nm process will be delayed until 2023, creating an opportunity for competitors such as AMD (AMD) to gain share.

Intel Share Price (TradingView)

Still, not everything is looking so bleak for Intel. If the previous management group did anything good, it at least allowed Intel to enter this period of downturn from a position of financial strength. Several important catalysts are playing themselves out at the same time as the new CEO Pat Gelsinger seems to be playing all the right moves.

After years of teasing and speculation, the company is seemingly finally ready to join competitors such as AMD and NVIDIA (NVDA) in the struggle for supremacy in the GPU market. On the CPU side, Intel seems to have also caught a break as well as their Alder Lake CPU lineup is reported to be able to trade blows with Ryzen. Macroeconomics trends are playing into Intel’s strengths as well as the ongoing supply chip shortage and the ever-increasing demand for semiconductors might prove as an important catalyst.

Another rather unexpected growth catalyst seems to be coming from the US government itself, with the introduction of the “chip bill“. Intel stands to greatly benefit from the US government recognizing chip manufacturing as a sector of strategic importance to national security, with the company being the most prominent American chip maker. Even though it remains a question of, will all of this be enough to shoot the company stock back into the high 60s, it is becoming more difficult to overlook the steady value generation that is being built at Intel’s side.

Turnaround Play 4: Corsair Gaming (CRSR)

After going through its IPO during the pandemic at the end of 2020, Corsair Gaming stock has been picked up by the meme investor community. It was subsequently pumped into the high 40s, going significantly beyond the fair value of the company. However, macroeconomic headwinds combined with issues surrounding EagleTree Capital’s ownership stake in the company have created a significant down-pressure on the stock as Corsair remains one of the highest shorted companies in the US, with more than 30% of the shares being sold short.

Corsair Share Price (TradingView)

Things seem to be finally changing for the better as Corsair beating fourth-quarter earnings is foretelling of better days for the company. Managing to beat earnings and delivering a 12% YoY revenue growth in a horrible macroeconomic environment is a sign of strength. The growth came despite being restrained by supply chain challenges, including the lack of availability in the retail channel of reasonably priced GPUs which curtailed the demand for new PC builds and their components, ultimately having to downgrade guidance. Recently announced management growth expectations place the company’s revenues in 2026 at $3.6 billion, thereby almost doubling revenues and marking a 16.5% CAGR from today. Catalysts are slowly building up for a slow turnaround.

It remains likely that Corsair will trade sideways at least until the temporary headwinds start clearing up later this year. Then, the pure value proposition combined with the likelihood of short-sellers covering their shorts can only serve to further magnify returns.

Summary

As chaos and uncertainty rule the markets, the investment philosophy made famous by the likes of Graham and Buffett comes back in style once more. Each of the stocks in question had legitimate reasons behind the down pressure they have experienced during the course of the past couple of months or years. This was especially true on the back of an extravagant bull market that caused investors to care little for the importance of things such as fundamentals, moats, free cash flow, or earnings.

Without wanting to perform a deep dive underneath the hood, we wanted to highlight several depressed value stocks that have a good chance to outperform as market expectations slowly realign back with the fundamentals. In the end, it always comes back to fundamentals. We strongly believe that the companies in question are worthy of further research as their value proposition remains strong while several turnaround catalysts are slowly building up.

Be the first to comment