Michael Ciaglo/Getty Images News

After some delays and changes in plans, Ethereum’s (ETH-USD) Mainnet looks to merge with its Beacon Chain proof-of-stake consensus mechanism in the coming months. With final tests occurring, the consensus from crypto media sources who talk with developers, operators, and other participants is that The Merge will likely occur in the second quarter or possibly the third quarter. The Merge will be the end of proof-of-work for Ethereum and the platform will be fully proof-of-stake.

From a price perspective, The Merge is important because the changes in the issuance rate could lead to a supply peak in the total number of Ethereum. Also, I believe there will be somewhat of a staking revolution that will both increase demand for Ethereum as well increase the tendency of Ethereum to be kept from the immediate supply. Lastly, the move to proof-of-stake consensus adds a second layer to Ethereum’s regulatory moat as lawmakers and regulators look to ESG concerns with proof-of-work mechanisms. These three factors are explored in the article below.

In the past, post-Merge Ethereum has been called Eth2 and Ethereum 2.0, or sometimes The Merge along with other upgrades like sharding have been called Ethereum 2.0. In any case, there is a move to change the terminology in order to remove some misconceptions the current usage of “Eth2” causes. For those interested consider looking at The great renaming: what happened to Eth2?

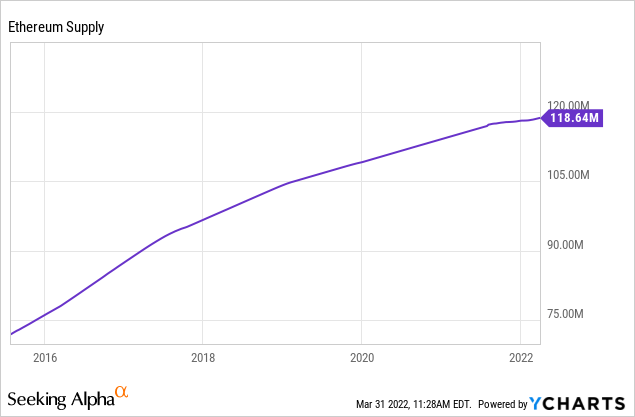

Peak Supply

Under Ethereum’s current proof-of-work regime the miner who wins the trial and error race receives two freshly minted ETH. This is inflationary to the system. They also receive the tip portions of the transaction fees paid by the “payers” of the transactions placed in the block. However, the base fees paid by the payers of the transactions are burned or destroyed. This is deflationary to the system.

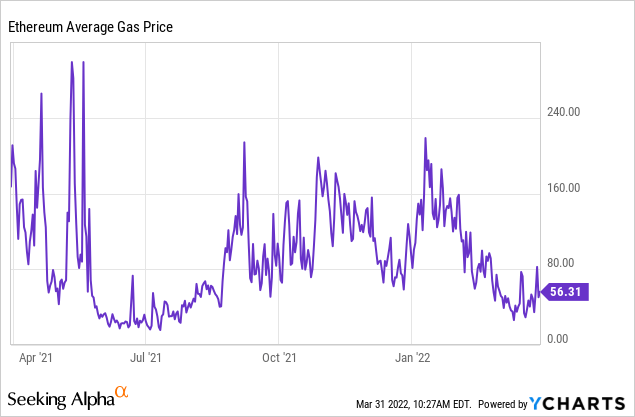

The dynamic gets a bit more complicated because the base fee is variable and dependent on the volatile gas price, which itself is dependent on network congestion. At current average gas prices, the two ETH issuance is about four times higher than the burned base transaction fees. And the supply of ETH is growing by over 3% per year.

However, the balance is set to change with The Merge. There will no longer be the two ETH issuance to the miners of the proof-of-work regime. Instead, those choosing to stake their coins will receive rewards for securing the platform. The new rewards will total only a small fraction of the proof-of-work issuance. And the upshot is that the base fee burns at current gas prices would be larger than these staking rewards and the system would be slightly deflationary.

The likely improved tokenomics and peaking of the Ethereum supply from The Merge will be welcomed by the sound money proponents in the digital asset space and therefore constructive for the price.

Staking Revolution

Though still basically in a test, Ethereum staking “on” the Beacon Chain now holds about 10-11 million ETH. Of note, this staked ETH is locked and can not be withdrawn. In a cleanup upgrade “very soon after” The Merge, the ability to withdraw staked ETH will be implemented.

Obviously once the cleanup upgrade is live, there will technically be more available tradable supply. However, once staked ETH won’t be subject to the long, somewhat unknown length of lock up, more holders will look to stake. So the immediately available tradeable supply should decrease.

There is uncertainty, but at a minimum, staking yield percentages look to be in the high single digits following The Merge. In the current low or negative real rate environment, tens of billions of dollars in search of yield may flow into Ethereum staking.

Once the upheaval of The Merge settles and the cleanup upgrade is implemented, it seems reasonable that the amount of staked ETH doubles or triples, going from 9% to between 20-25% of the total market cap. For reference, Ethereum’s market cap is approaching $400 billion. And of note, other popular mid-cap, staking coins generally have 40%-70% of their total value staking; in fact, Cardano (ADA-USD) has consistently had over 70% of its market cap staking.

Demand for Ethereum may increase in the coming months in recognition of, or put differently, in anticipation of this staking revolution.

New Regulatory Moat

Outside of any considerations with The Merge, Ethereum has a relatively wider than average moat from regulatory effects because of its status as a commodity. But with The Merge, it will also enjoy the growing benefits of having what is becoming the preferred consensus mechanism among ESG advocates.

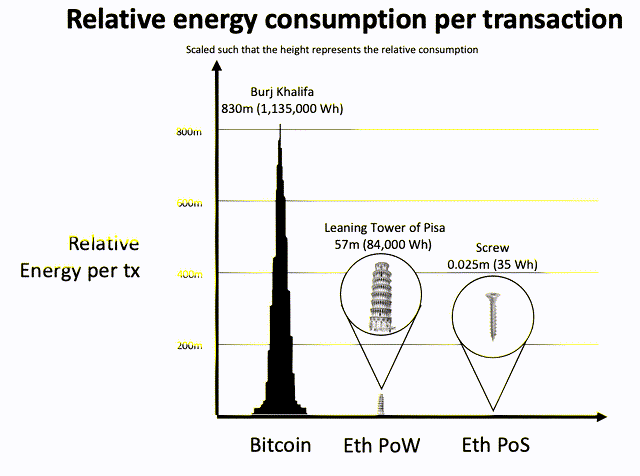

A recent estimate suggested that The Merge to proof-of-stake could result in a 99.95% reduction in total energy use, with proof-of-stake being ~2000x more energy-efficient than proof-of-work. The energy expenditure of Ethereum will be roughly equal to the cost of running a home computer for each node on the network.

ETHEREUM ENERGY CONSUMPTION, ethereum.org, updated 3/29/22

Ethereum Energy Usage (ethereum.org)

Likely with the Bitcoin (BTC-USD) network in mind, the European Parliament’s economic and monetary affairs committee recently considered a proposal to place limits on digital assets using energy-intensive proof-of-work consensus mechanisms. While the particular provision did not pass, the vote against was a relatively tight 30 to 23 with 6 abstaining. A full account of the story from CoinDesk can be found here.

In the U.S. there are also somewhat similar rumblings. Biden’s Executive Order on Ensuring Responsible Development of Digital Assets broached the issue, but in a more balanced way. It asked relevant agencies to prepare a report which addresses the following:

…the effect of cryptocurrencies’ consensus mechanisms on energy usage, including research into potential mitigating measures and alternative mechanisms of consensus and the design tradeoffs those may entail.

…implications for energy policy, including as it relates to grid management and reliability, energy efficiency incentives and standards, and sources of energy supply.

Taken as a whole, the inherent higher energy efficiency of the proof-of-stake consensus mechanism under The Merge will be appreciated by ESG activists in the digital asset space. And importantly, the switch likely increases adoption among institutional investors with heightened ESG concerns.

Grayscale’s Ethereum Trust

How should one gain exposure to Ethereum as a play on the three factors discussed above? Consider the Grayscale Ethereum Trust (OTCQX:ETHE) and its direct holdings of ETH. The Trust has done reasonable job tracking the moves of the underlying coin over the past year.

The Trust also provides benefits over direct personal ownership of ETH. Investors do not need to create wallets or keys and have the assurance that the Trust’s Ethereum is in cold storage with Coinbase (COIN). The Trust’s fee is relatively high at 2.5%, but that is comparable to funding and trading fees on digital asset marketplaces.

Most interestingly, the Trust is trading at a 20% discount to the net asset value of its holdings. And this spread has been somewhat stable over the past two months. It is my belief that this discount closes if and when Grayscale is able to convert their large Bitcoin Trust (OTC:GBTC) to an exchange trade fund. For my reasoning on why this could occur, consider reading Grayscale Corners SEC On Converting Bitcoin Trust To ETF, Sets Up 2022 Crypto Catalyst.

Assuming Ethereum maintains above $3,100 and the Nasdaq Composite above 13,500, I am targeting a price between $3,875 and $4,125 near the date of The Merge.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment