JasonDoiy

Intel (NASDAQ:INTC) has struggled more than investors in any large company ever should. The company’s share price has dropped by almost 50% over the past 16 months as the company has dealt with node delays, increasing capital requirements, and companies that’d rather cut out the middle man.

Despite this, as we’ll see throughout this article, we highly recommend investing at this time.

Intel Recent Performance

Intel had a debilitating quarter, as the company was hit by numerous macroeconomic factors.

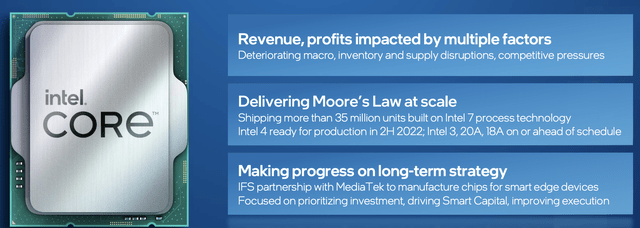

Intel Recent Performance – Intel Investor Presentation

Intel had an incredibly weak quarter as a result of a changing macroeconomic quarter. However, the company has continued to perform where it matters. The company has shipped more than 35 million units on Intel 7 and Intel 4 is expected to be ready for production in the second half of the year. The company’s next 3 nodes are on or ahead of schedule.

The continued success of those 3 nodes is essential to the company’s continued performance in the markets. The company expects a cyclical slowdown to cause a 10% decline in 2022 PC TAM with prolonged supply chain problems directly affecting the company. The company will recover afterwards, but we expect it to be a slowdown.

Intel 2Q 2022 Performance

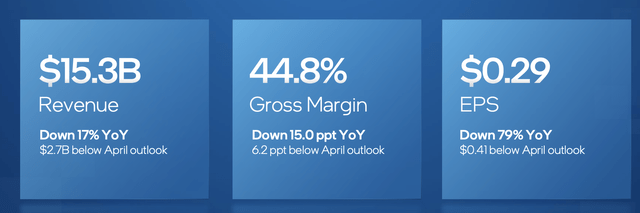

The company had an incredibly weak 2Q 2022.

Intel earned $15.3 billion in revenue for the quarter, showing the market weakness, as its revenue dropped 17% YoY That was a massive $2.7 billion decline versus the company’s April outlook. The company also had a 44.8% gross margin down a massive 15% YoY as its EPS of $0.29 was down a massive 79% YoY and well below the company’s outlook.

The macroeconomic environment and investments have clearly changed for the company. The company has been impacted by inventory reductions, an ASP decline, and lower demand from the industry. The one brightness in the company’s assets were its emerging businesses like Mobileye and its Network and Edge computing growth.

Intel Market Downturn Outlook

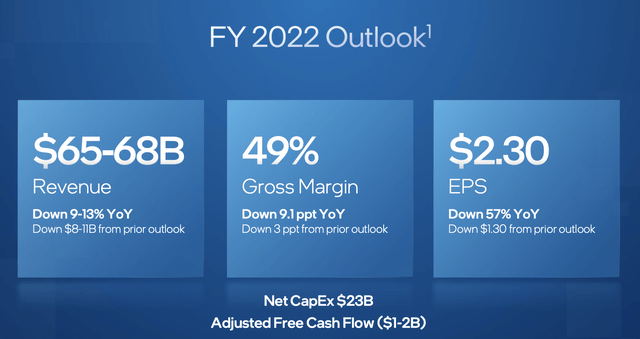

The company’s new outlook is for strong market weakness.

The company’s forecast for revenue is roughly $67 billion, down from a prior outlook of almost $80 billion. That revenue decline came with an almost 10% decline in margin, because high capital spending means that margins drop much faster than revenue. The company’s net EPS is expected to be $2.3 / share or a P/E of ~15, down a massive 57% YoY.

The company is investing a massive $23 billion in capital expenditures as it chases its capital growth goals. The company’s adjusted FCF is expected to be -$1.5 billion, however, as it continues to develop, we can expect that to change and move positive. The recent Chips Act could add billions in cash flow while covering growth.

Our View

Intel is a stalwart in the industry. The company has a unique portfolio of assets and its one of the last major fab operators in the U.S.. The company is working to build up how competitive it is with other companies, especially international ones, while taking advantage of the recent chip act.

The company’s financials have had a tough time recently and as long as the company continues spending more than $20 billion in annualized capital, we expect that to continue. However, as long as the company remains on track with its nodes, and the markets recover, we expect the company’s FCF to recover in upcoming years.

Intel is currently in a transition period where it’s spending massive capital. The company has cut its capex spending as a result of its financial weakness, however, we still expect it to recover and outperform.

Thesis Risk

The largest risk to the thesis is that Intel needs to continue executing. The company has failed to properly develop nodes before, and it needs to change that and execute. It’s had an incredibly tough year, which will continue, and until there’s a sign of a turnaround we expect the company’s share price to underperform.

Conclusion

Intel had a tough 2nd quarter, as a result of a changing market. PC demand is a set of demands that’s easily postponed. especially with the largest and most consistent customers moving towards designing their own silicon to avoid needing to directly contract with Intel and instead enabling them to capture more of the spread. That’s why Intel is building up its own fab business.

Intel continues to offer investors a dividend of roughly 4%. The company will have strong support from the U.S. with the Chip Act as the largest home-grown fab company. It’s in the midst of a capitally heavy transition phase, however, after that, we expect the company to generate increasing FCF, making it a valuable investment.

Be the first to comment