Presley Ann

On August 4th, after the market closes, the management team at Warner Bros. Discovery (NASDAQ:WBD) is due to report financial performance covering the second quarter of the company’s 2022 fiscal year. This is a particularly noteworthy time because it will represent the first time that both WarnerMedia and Discovery will report together as a consolidated entity. Though it will fall a bit short of being a full fiscal quarter of the two together. Even so, there are some important things that investors should be keeping an eye out on. These are particular metrics that will go a long way to determining what kind of upside potential, if any, the combined company will have moving forward. In a normal market, this would be a pivotal moment for the enterprise. But given the pessimism that has faced the business since the merger was completed, with shares down 37% in all, clearing up uncertainty is that much more important.

Look to streaming

In my opinion, the most important thing that investors should keep an eye on is the health of the combined entities’ streaming services. for the past couple of years, streaming has been viewed as an opportunity for almost perpetual growth. But with a number of competitors coming into the space and the price of streaming increasing, particularly during a time of broader economic inflation and hardship, real concerns have come up about the more marginal players in the market. HBO and HBO Max, which fall under the WarnerMedia banner, is certainly viewed as a second-tier streaming platform, despite how large it is. Meanwhile, discovery+ is still quite small by comparison. Compared to industry leader Netflix (NFLX), which has experienced weakness in subscriber numbers over the past two quarters now, and industry darling The Walt Disney Company (DIS), with Disney+, ESPN+, and Hulu under its belt, Warner Bros. Discovery is most definitely not a contender for leadership over the space.

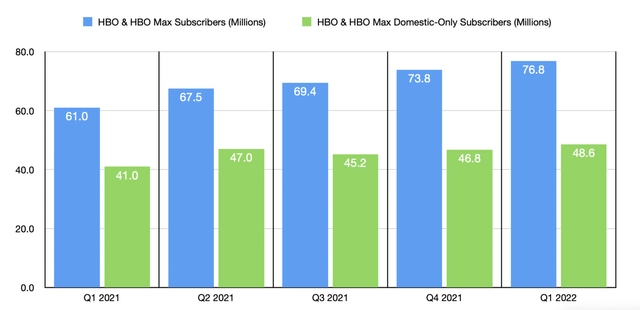

If there are problems that start to rise up regarding streaming outside of what we have already seen with Netflix, a company like Warner Bros. Discovery is certain to be more vulnerable. This is why investors should pay careful attention to what data the company reports for its second-quarter earnings release. Remember that, in the final quarter in which WarnerMedia belonged to telecommunications giant AT&T (T), the HBO and HBO Max platform had done pretty well. The company ended the latest quarter with 76.8 million subscribers, 48.6 million of which were in the domestic market. These numbers compared to the 73.8 million and 46.8 million, respectively, reported just one quarter earlier. They also compare favorably to the 61 million and 41 million, respectively, reported for the first quarter of 2021. Continued growth on this front will go a long way to proving the bears wrong about Warner Bros. Discovery.

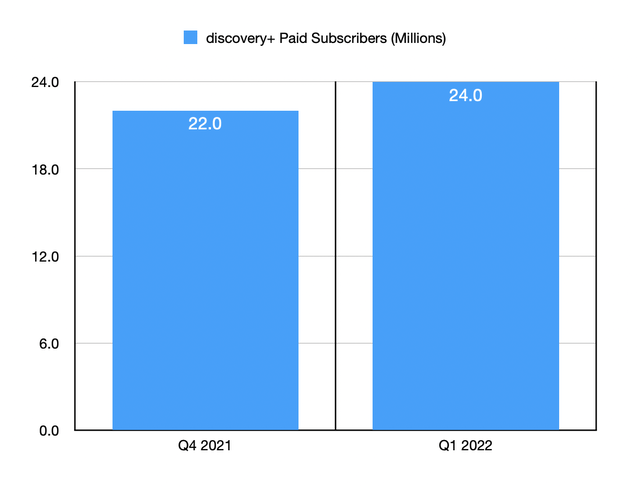

Of course, we should also pay attention to discovery+. The management team at Warner Bros. Discovery has not been very vocal about subscriber numbers over time. However, they did say that in the first quarter of the year, the platform boasted 24 million paid subscribers. That was up from the 22 million reported for the end of its 2021 fiscal year. Related to this, we should also be cognizant about the possibility that management might try and merge HBO Max with discovery+. I covered the details of this in a prior article, including my own concern that this might be a bad decision for multiple reasons. Instead, an option to bundle the two might make more sense. Either way, investors should keep an eye out on what could be a transformative change.

Watch out for Warner Bros. Discovery’s targets

Large corporate transactions that involve the acquisition, merger, or divestiture, of another large enterprise can be messy and they create a tremendous amount of confusion for shareholders. But what we do know so far is that management has some high hopes for the combined business. For starters, Warner Bros. Discovery is aiming to capture at least $3 billion in annual cost savings over the next three years. In what was perhaps the first salvo along this vein, the company did announce the closure of CNN+ just a short time after it was launched. It will be interesting and important to see to what extent the company might already be making progress and whether or not guidance on that front has changed. Much of the early savings will come from consolidating duplicative positions within the combined business, such as corporate jobs and content generation. But beyond that, it’s unclear what to expect.

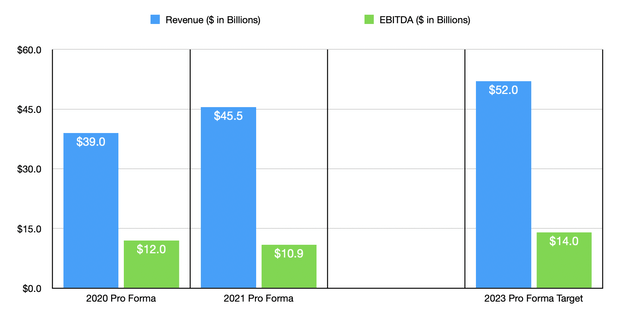

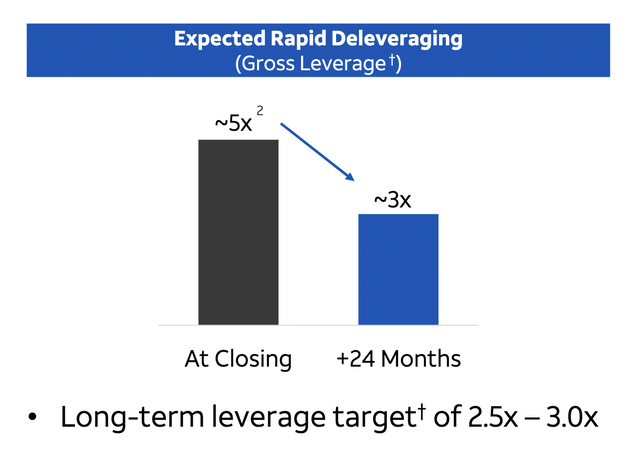

We should also pay attention to top line and bottom line expectations. Using pro forma numbers for the 2020 fiscal year, the combined business would have had revenue of $39 billion with EBITDA of $12 billion. In its initial presentation to shareholders regarding the merger of WarnerMedia and Discovery, management said that they were targeting revenue of $52 billion in 2023 and EBITDA of $14 billion for that same year. This compares to 2021 figures of $45.5 billion and nearly $10.9 billion, respectively. Along the way, management is also hoping to reduce leverage rather considerably. The gross leverage multiple as of the close of the merger was 5, with management forecasting that this would drop to just 3 within 24 months of the deal being completed. They also said that their long-term target is for a multiple of between 2.5 and 3. So what the company does when it comes to debt will be incredibly important as well. In the short term, I don’t expect too much on this front. Mainly because I think the company will be more focused on spending in order to generate cost savings and in order to ramp up content in the competitive streaming space.

Takeaway

Right now, Warner Bros. Discovery seems to be in a pretty interesting position. The market is clearly pessimistic about the firm as I fully suspected it would be. That was why I immediately sold my shares in Warner Bros. Discovery once I receive them, opting instead to purchase more of AT&T. Having said that, shares of the streaming giant are now cheaper and clarity will start to come in regarding what the fundamental position of the company looks like. If all goes well, it is entirely possible that the company could go on to create attractive value for its investors. But either way, there is a decent amount of risk heading into earnings and I would advise any investors who are averse to it to tread cautiously.

Be the first to comment